- The reactivated lost coins of Bitcoin suggest that the bullmarkt may take its final phase.

- A crucial support for $ 97,190 could determine Bitcoin’s following movements.

Bitcoin’s [BTC] Bull Market enters a critical moment, with signs that suggest that a big turning point could just be just around the corner.

In recent months we have seen a remarkable increase in activity, because once sleeping bitcoin addresses come back to life-an event that is often seen during strong bullish trends.

This reactivation of previously “lost” coins feeds speculation that Bitcoin is preparing for his next big move.

At the same time, important indicators emphasize a crucial level of support at $ 97,190 – one that must maintain Bitcoin if this rally has to continue.

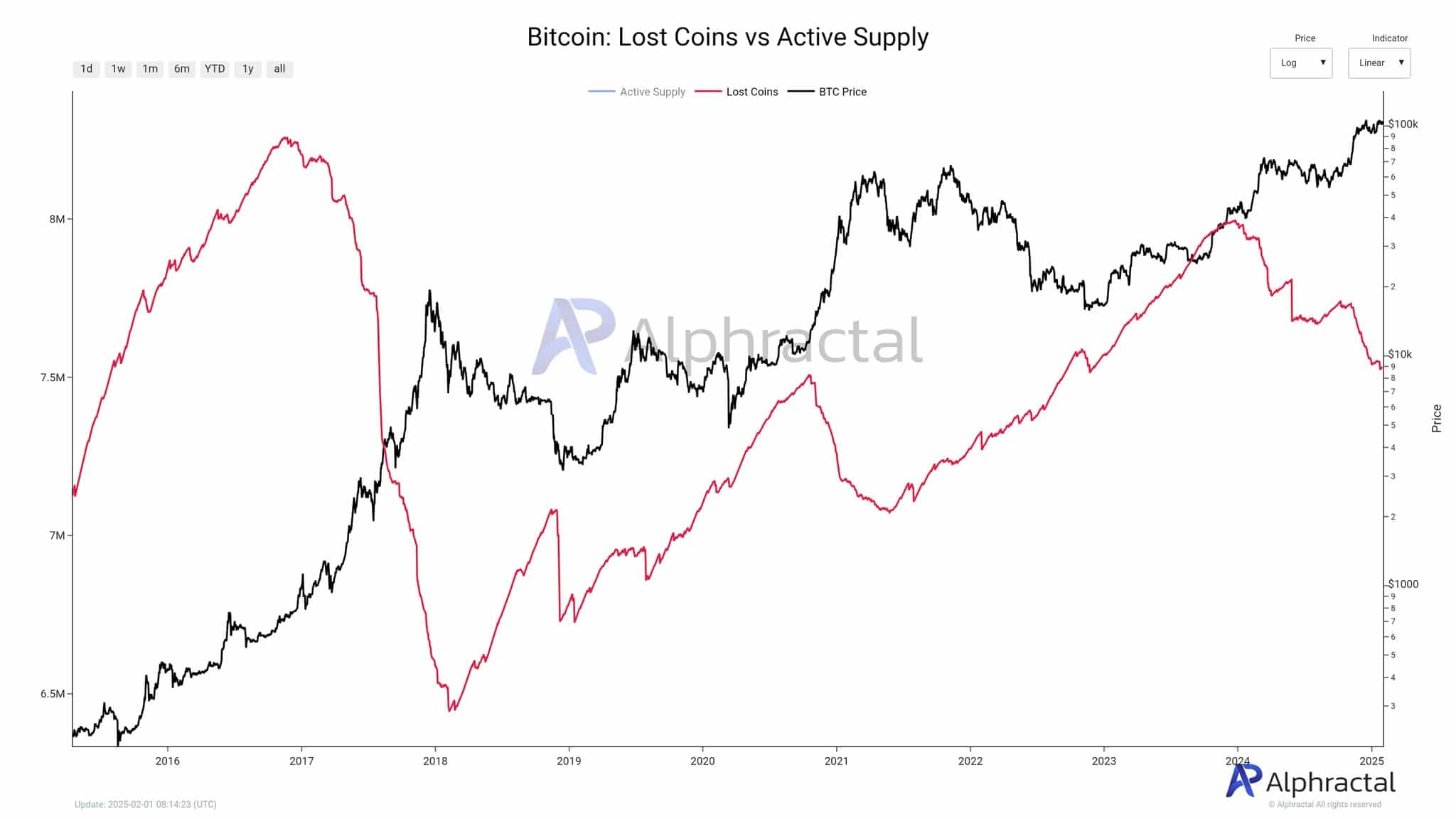

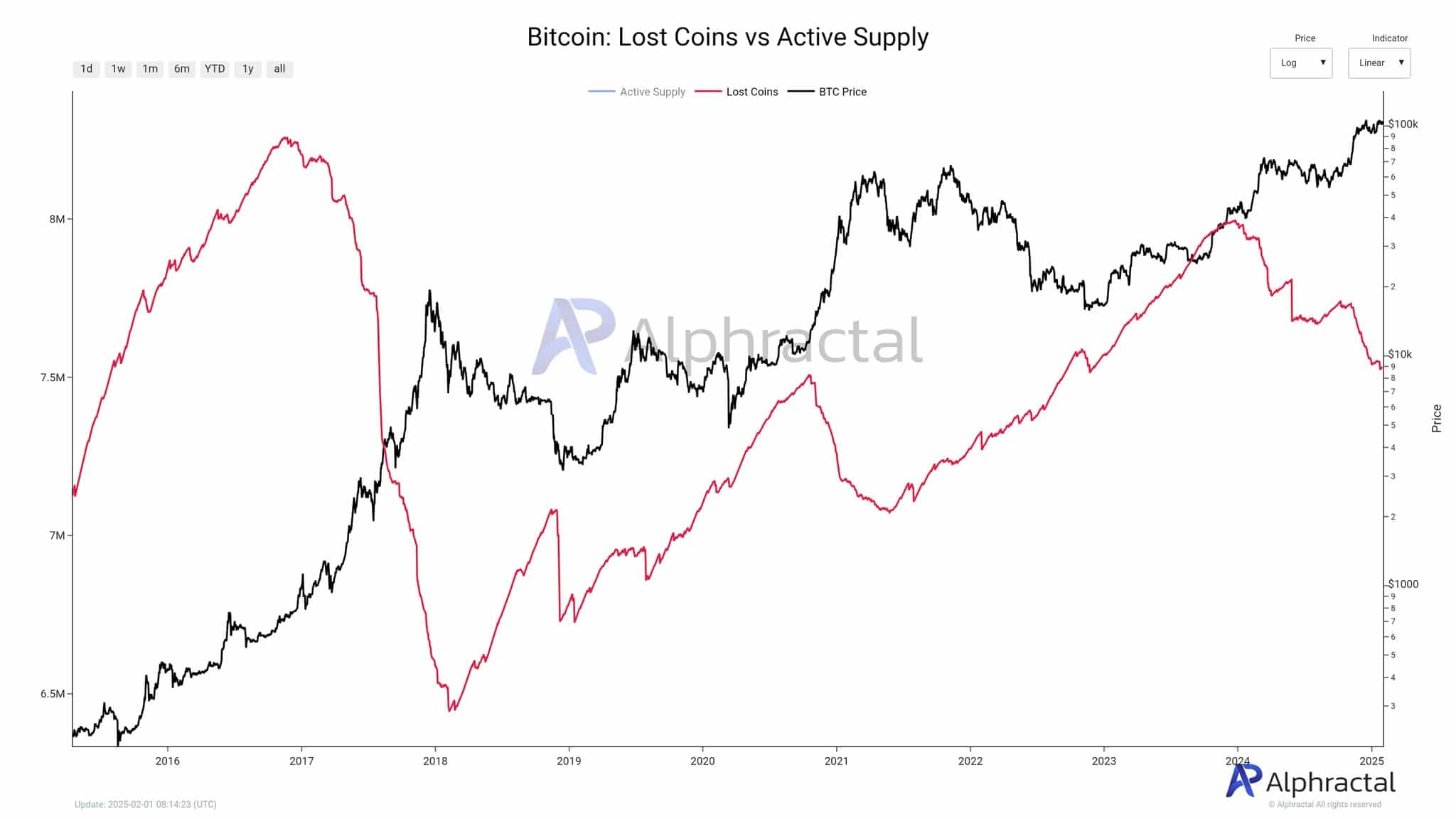

Lost coins return

Lost coins refer to BTC that has been dormant for years, often held by early investors or whales that forgot or chose not to move their assets.

When these coins start to move again, this indicates that holders can prepare themselves in the long term to take a profit or adjust their positions.

Historically, this reactivation is tailored to large bullish phases, which indicates a potential shift to the last leg of the bull run.

Source: Alfractaal

Illustrate the data This phenomenon, which shows how lost coins become active again. This behavior is consistently tailored to Bitcoin’s most explosive price runs.

In recent months, the price of Bitcoin has continued to climb and push to new all time. As can be seen in earlier cycles, the final phase of a bull market often comes with increased volatility.

If previously inactive BTC holders start selling in large volumes, this can introduce downward pressure in the short term before the market resumes its upward process.

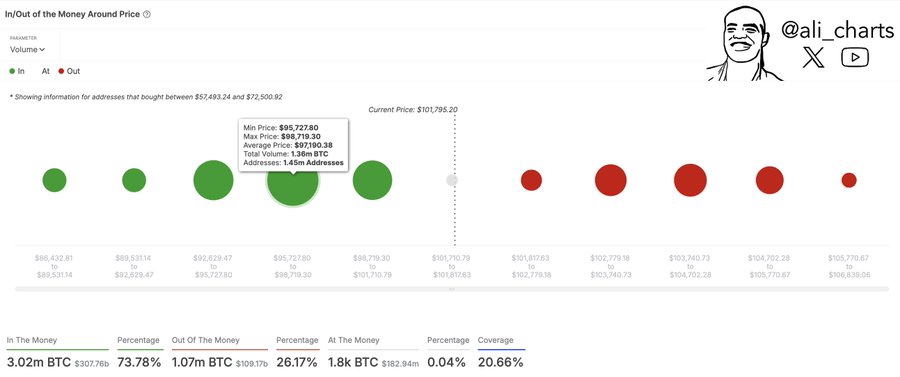

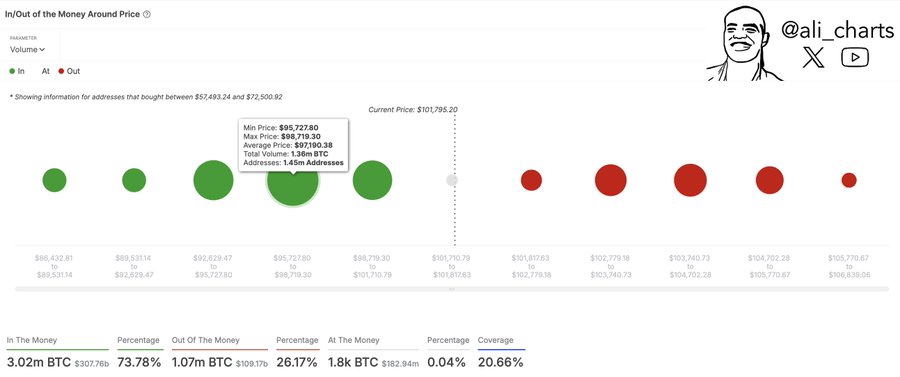

$ 97,190: De Lijn in the sand for Bitcoin’s Bull Market

Crypto analyst Ali Martinez has pointed out that $ 97,190 is a crucial level of support for Bitcoin. Data on chains shows that this level represents a significant cluster from BTC Holdings.

Source: X

About 1.45 million addresses acquired BTC between $ 95,772 and $ 98,719, with a total volume of 138k BTC.

If Bitcoin stays above this zone, the upward trend will probably continue, because these holders will probably not sell with losses.

However, if BTC breaks below this level, this can cause a wave of sales pressure of these investors, which leads to a steeper correction.

This makes $ 97,190 a psychological and technical level to view in the coming weeks.

Market structure and important resistance levels

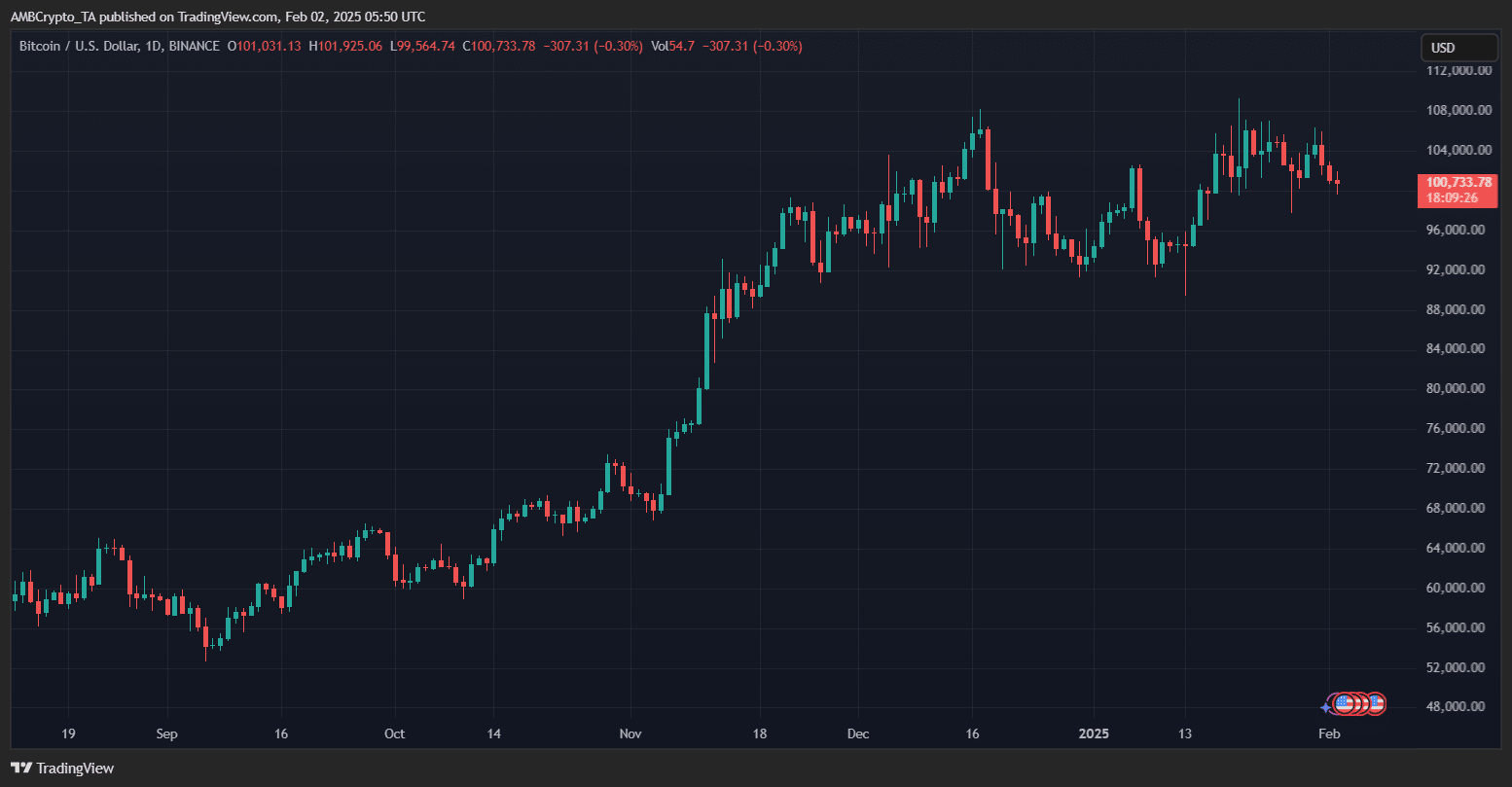

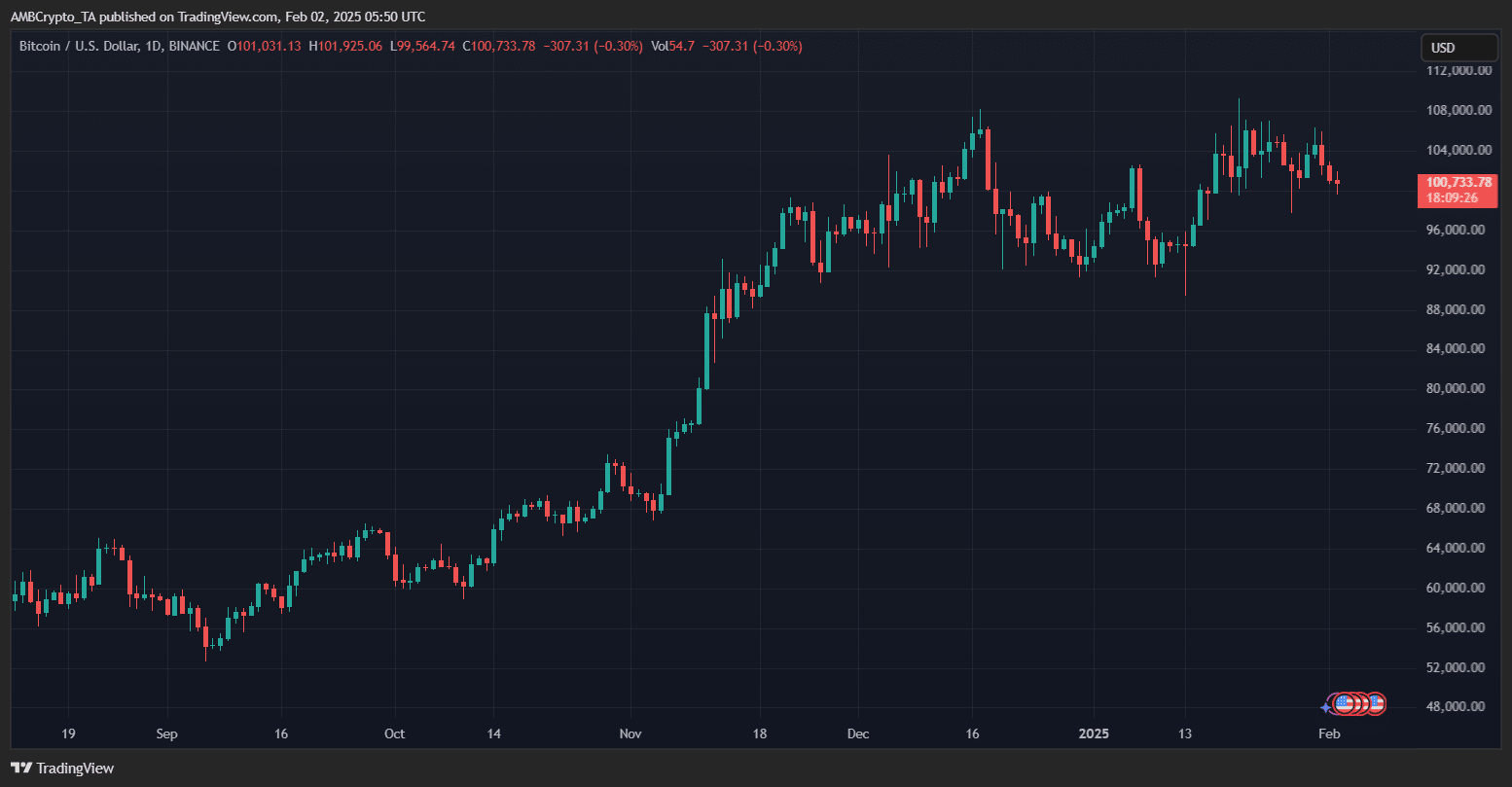

Looking at Bitcoin’s price diagram, we can see that BTC has been in a strong upward trend, with higher highlights and higher lows.

The King Coin traded on the $ 100,733 press and was confronted with small resistance in the range of $ 104,000 – $ 108,000.

A clean outbreak above these levels could open the door for a new price discovery phase, whereby BTC may focus on $ 120,000 and beyond.

Source: TradingView

On the other hand, if Bitcoin struggles to break resistance and loses Momentum, we could see a short-term retirement to $ 97,190.

Read Bitcoin’s [BTC] Price forecast 2025-26

A break below this level can test lower support zones around $ 92,000 and $ 88,000, where there is great purchase interest.

For now, all eyes are focused on the Bitcoin price action, because the market determines its next step.