- Bitcoin cycle inducators (IBCI) have crossed a critical point on the graph, which suggests that a fall could be on the horizon.

- BTC has developed strong support levels that can influence a price jump if a price correction takes place.

Bitcoin [BTC]In the last 24 hours, a slight decrease has seen, with only 1.08%. However, it still acts above the $ 100,000 region.

Despite the bullish market sentiment, corrective phases are inevitable and are part of the wider market cycle.

The analysis of Ambcrypto showed that a corrective phase could approach and identified important regions that can support a price-back in price.

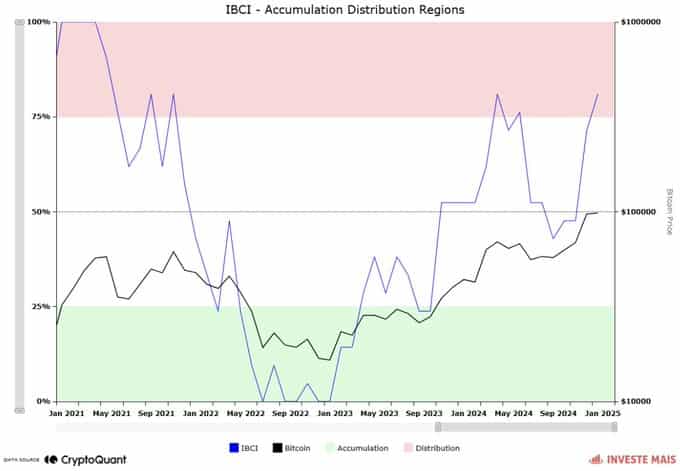

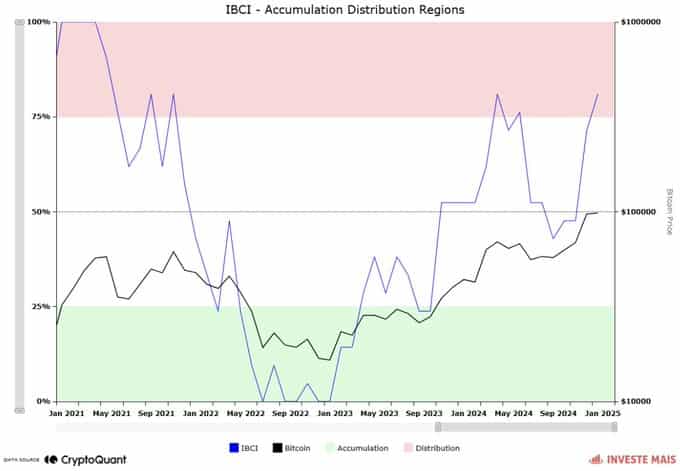

Distribution phase threatens BTC

The Index of Bitcoin cycle indicators (IBCI) on Cryptoquant showed that it was actively introduced a distribution zone, a level that was last reached eight months ago, in May 2024.

IBCI is a combination of different market indicators – in total – including Puell Multiple, MVRV, NUPL and Sopr.

A distribution is indicated when the IBCI inserts the red region into the graph, starting at 75%, which means that there is still growth potential for BTC; However, sales activities have started.

Source: Cryptuquant

As soon as IBCI touches the 100% zone – which occurs when all seven indicators start their distribution phase – BTC would reach a market top, with its price, lower highlights and lows.

IBCI above 50%, where BTC is currently located, suggests that a corrective phase is expected before BTC resumes its upward process.

Further analysis of Ambcrypto identified a potentially bounced-back level if a correction takes place before the market top is reached.

A drop to mid-$ 90k for rally

With the help of the in/out of money around the price, an on-chain-metdic to determine potential support and resistance zones on the map, certain Ambcrypto where a potential BTC decline would be paid by the demand for a continuous movement up.

This demand zone is between $ 94,800 and $ 97,000, with a central range of $ 96,500. About 1.36 million BTC Buy orders of 1.4 million addresses support this reach.

Source: Intotheblock

A corrective phase in this region would be followed by a price die back to the $ 100,000 region, with the possibility that BTC will set a new high from there.

Other observed market activities could also play in favor of BTC for a move, one is to create a stock including BTC.

US Stockpile could stimulate BTC

The establishment of an American digital assets stock, as announced in the recent executive order on January 23 by President Donald Trump, could promote BTC.

Read Bitcoin’s [BTC] Price forecast 2025–2026

A digital stock including BTC implies that the US government can keep the cryptocurrency as part of its reserves.

According to Arkham, the US government already has around 198,000 BTC, with a value of $ 20.71 billion. If the government increases its participations, it could stimulate question and positively influence the BTC’s price process.