- Charting Bitcoin’s price prediction as BTC consolidated between $100,000 and $105,000 after Trump’s inauguration.

- Option traders were considering $90K and $96K as likely levels for possible declines.

After shaking off early ‘disappointment’ after Trump’s inauguration, Bitcoin [BTC] has defended the $100,000 level. Over the past two days, the king coin has fluctuated between $100,000 and $105,000.

With key on-chain metrics pointing to a possible outbreak What is the near-term future for BTC given its general price range?

BTC Expands Price Range

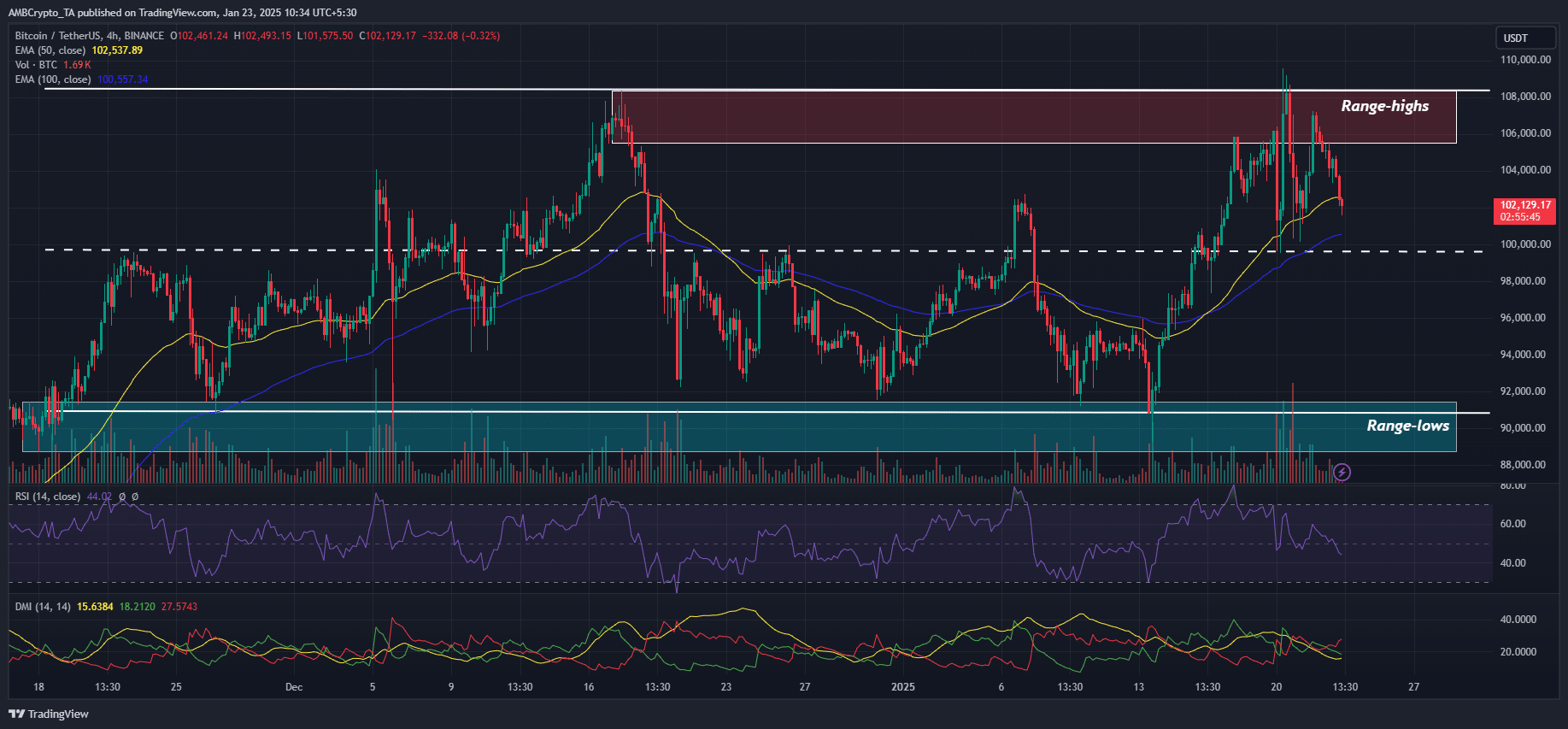

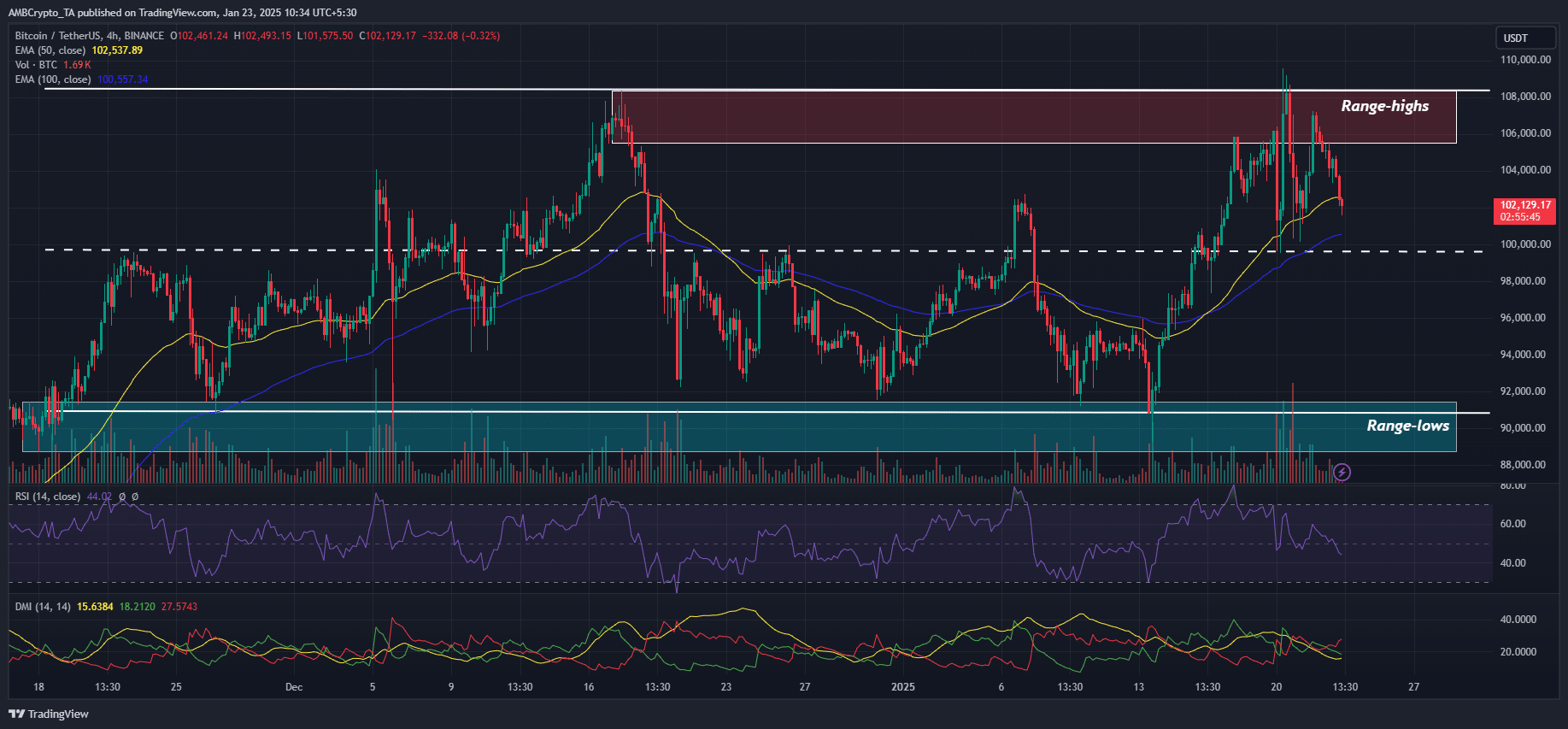

Source: BTC/USDT, TradingView

The recent price action has been stuck in the upper $90,000-$108,000 range. Although bulls previously used the 50-EMA (yellow) on the 4-hour chart for a short-term re-entry, key chart indicators pointed to increased weakening.

For example, the Directional Movement Index (DMI) showed that short-term momentum has weakened significantly (red line above green) and this could encourage short sellers.

Likewise, the 4-hour RSI dipped below 50 at the time of writing, indicating subdued demand, perhaps linked to post-inauguration caution.

The above bearish numbers could threaten the $100,000 support and the mid-range. If cracked, BTC could fall to $96K or the low of $92K.

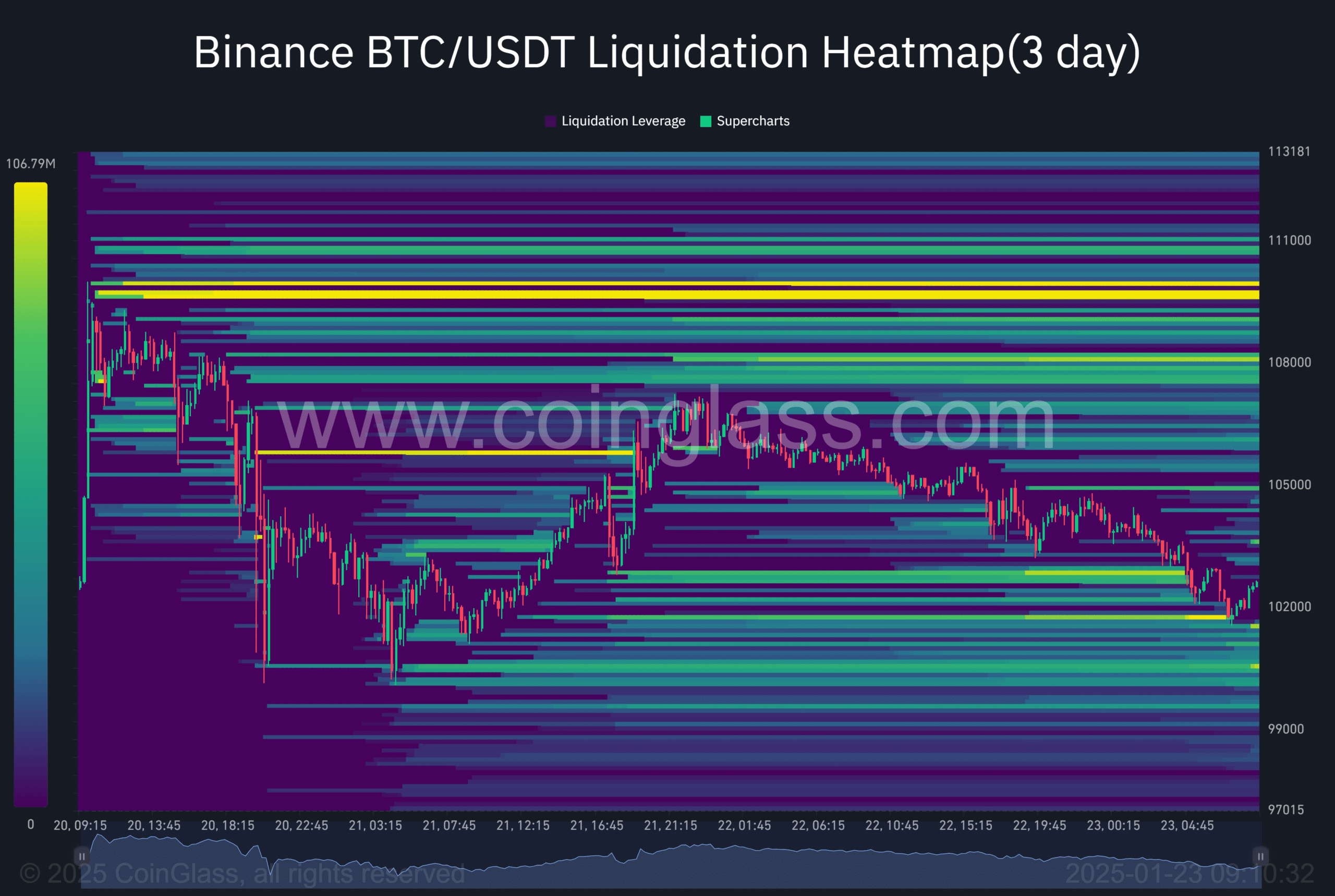

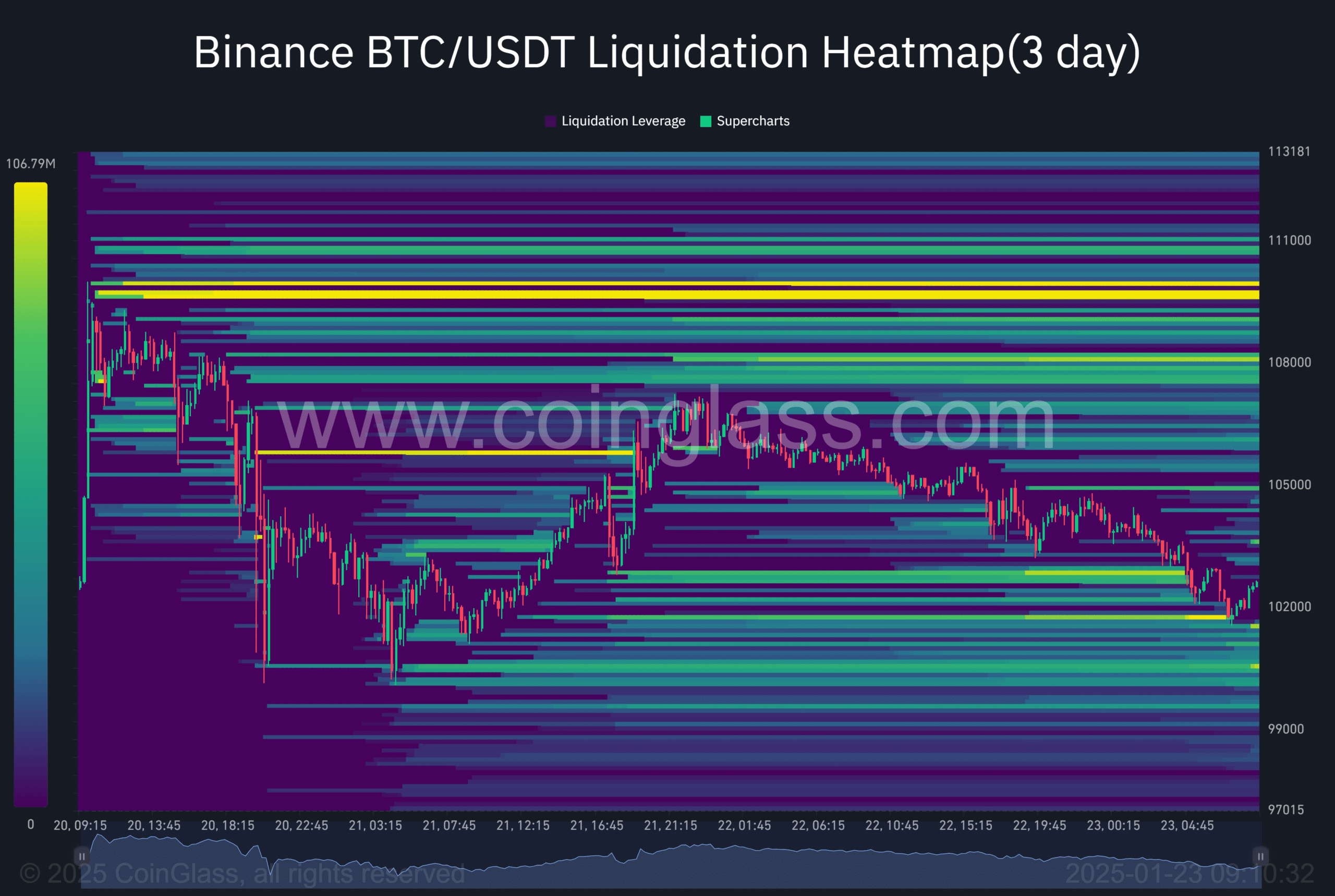

Key BTC Levels by Liquidity

However, the liquidation heatmap disagreed with the above outlook. At the time of writing, there was a huge amount of liquidity (bright yellow) of $109,000.

This meant several players shorted the asset at its recent all-time high. By extension, the massive liquidity could act as a price magnet and drive prices higher. If so, $100,000 could be defended again.

Source: Coinglass

That said, the futures market remained bullish despite cautious sentiment in spot markets.

According to options trading desk QCP Capital, there were more bullish bets than bearish bets on the Futures side. It declared,

“Meanwhile, BTC futures continue to trend higher, especially on the front end, as last week’s market net-long exposure remains solid. Bullish bets currently outnumber bearish bets by a ratio of approximately 20:1.”

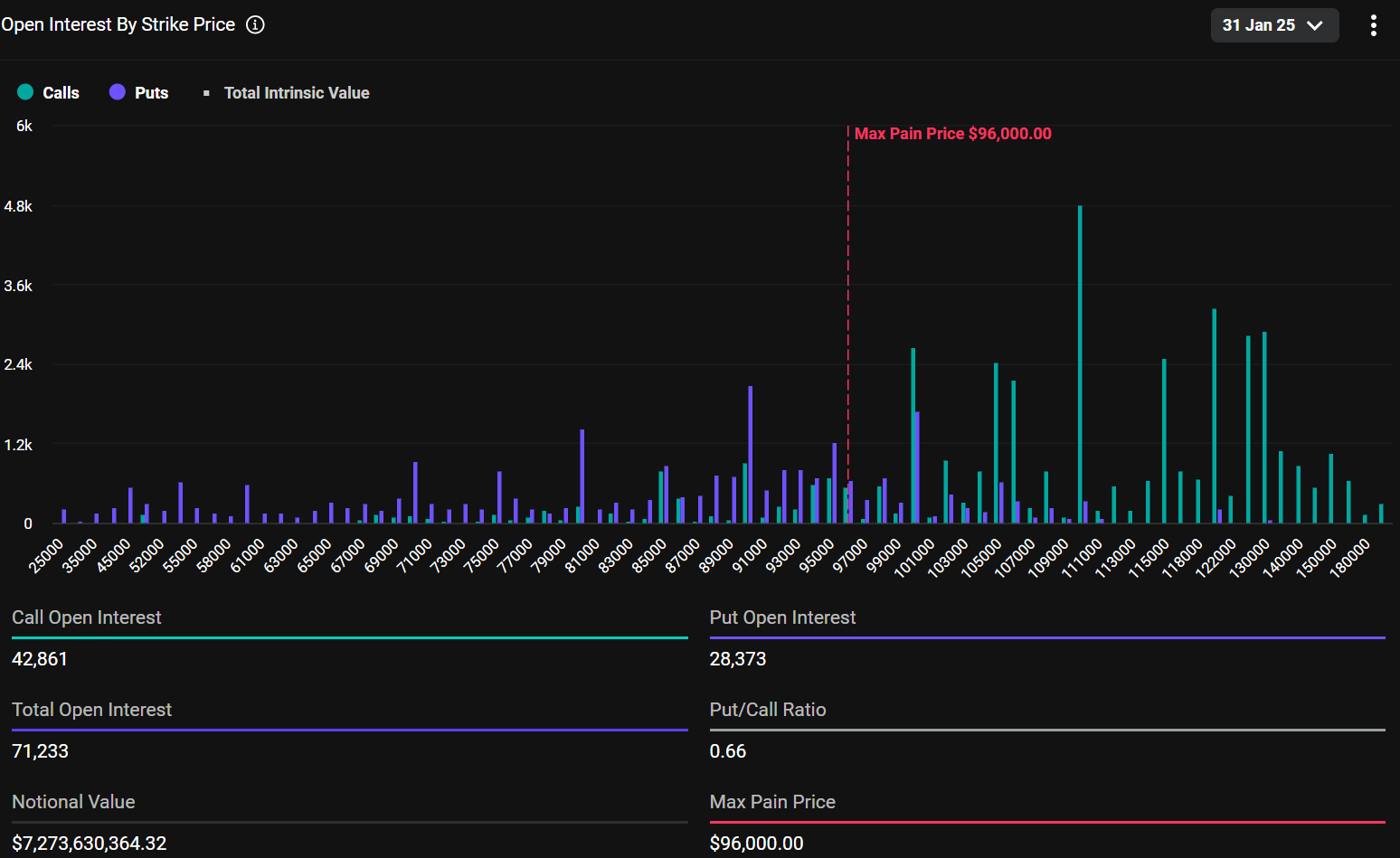

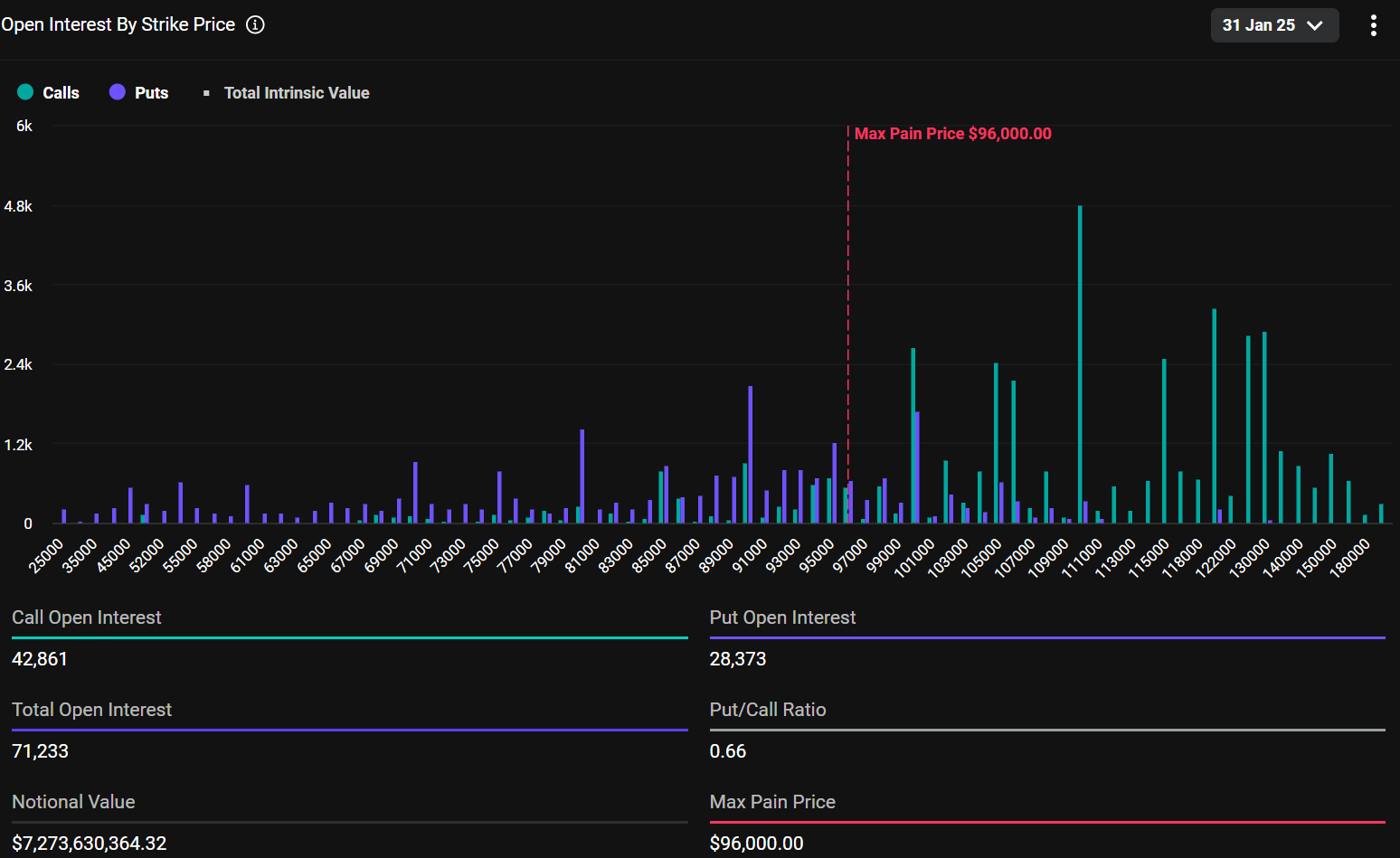

AMBCrypto checked the expiration date of Deribit’s next major options (January 31) for more insights. The $110K and $120K had the highest prices Open interest for calls (bullish bets), which are identified as important bullish targets at the end of January.

Source: Deribit

Read Bitcoin [BTC] Price forecast 2025-2026

On the other hand, $90,000 (highest puts, bearish bets) and the maximum pain point of $96,000 were the key levels expected by options traders for possible sharp declines.

Simply put, the market expects price fluctuations in the range of $90,000-108,000, with a possible deviation towards $110,000.

Disclaimer: The information presented does not constitute financial, investment, trading or other advice and is solely the opinion of the author.