- TRUMP has consolidated within a certain range over the past twelve hours.

- The subdued volume and bearish momentum kept traders waiting to go long.

Official Trump [TRUMP] has settled into a short-term range that stretched from $40 to $31.3. The mid-level at $35.7 acted as resistance earlier today, but turned into support in recent hours.

Trading volume has decreased over the past 12 hours. The Fibonacci retracement levels will likely act as resistance if TRUMP breaks outside the short-term range. Will it?

Short-term range formation hinders TRUMP bulls

Source: TRUMP/USDT on TradingView

The price action on the hourly chart has been bearish over the past 24 hours. When launching Official Melania (MELANIA), TRUMP experienced a 39.9% loss within an hour. Since then, the memecoin has been in a downward trend.

The range formation over the past 12 hours has been around the 78.6% Fibonacci retracement. This was a good sign for the holders and gave hope of recovery.

However, the technical indicators on the hourly chart were bearish. The CMF was at -0.05 and had been below -0.05 a few hours ago. This showed that capital outflows were dominant, making a bullish breakout unlikely.

Similarly, the DMI showed a dominant downward trend, with the -DI and ADX both above 20.

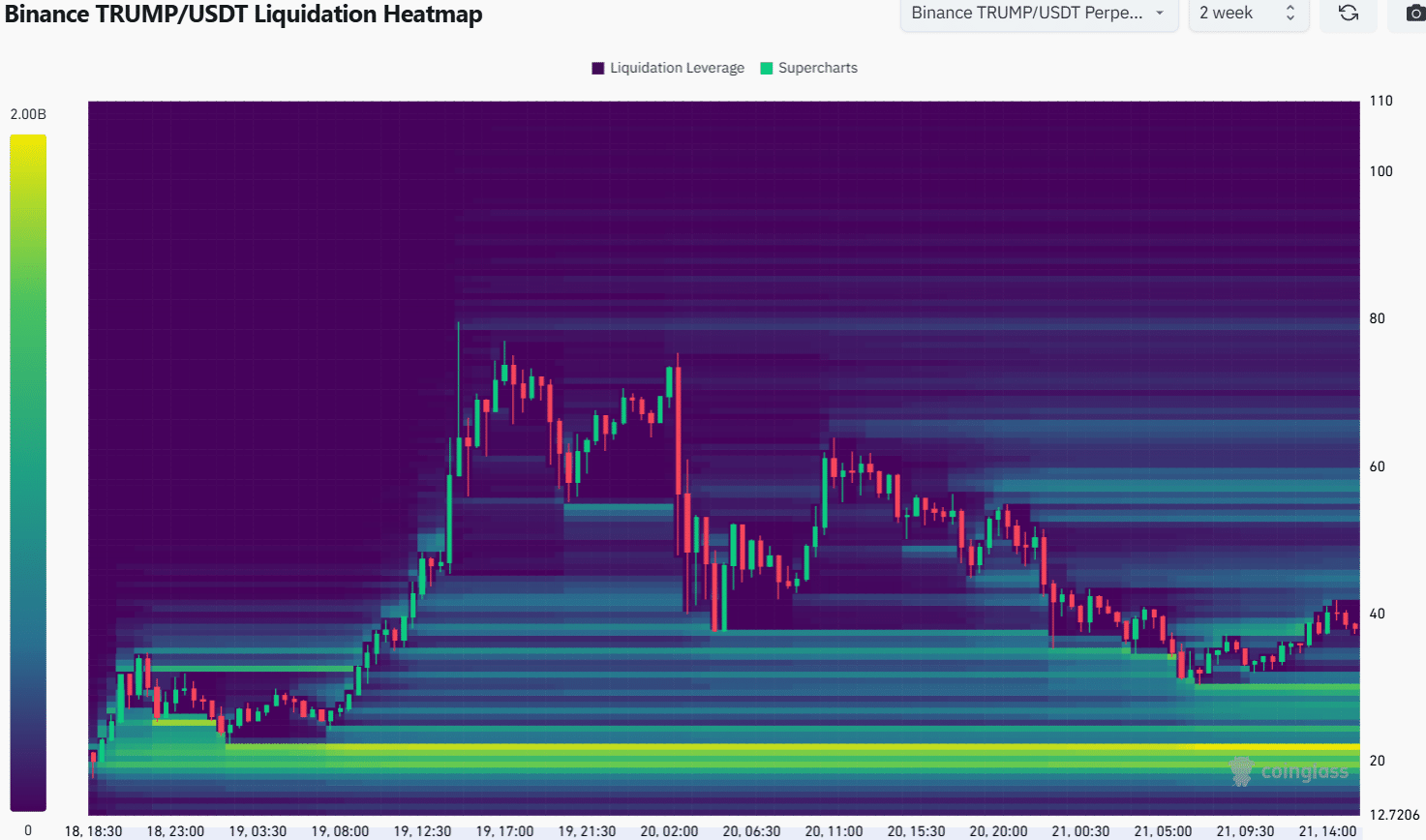

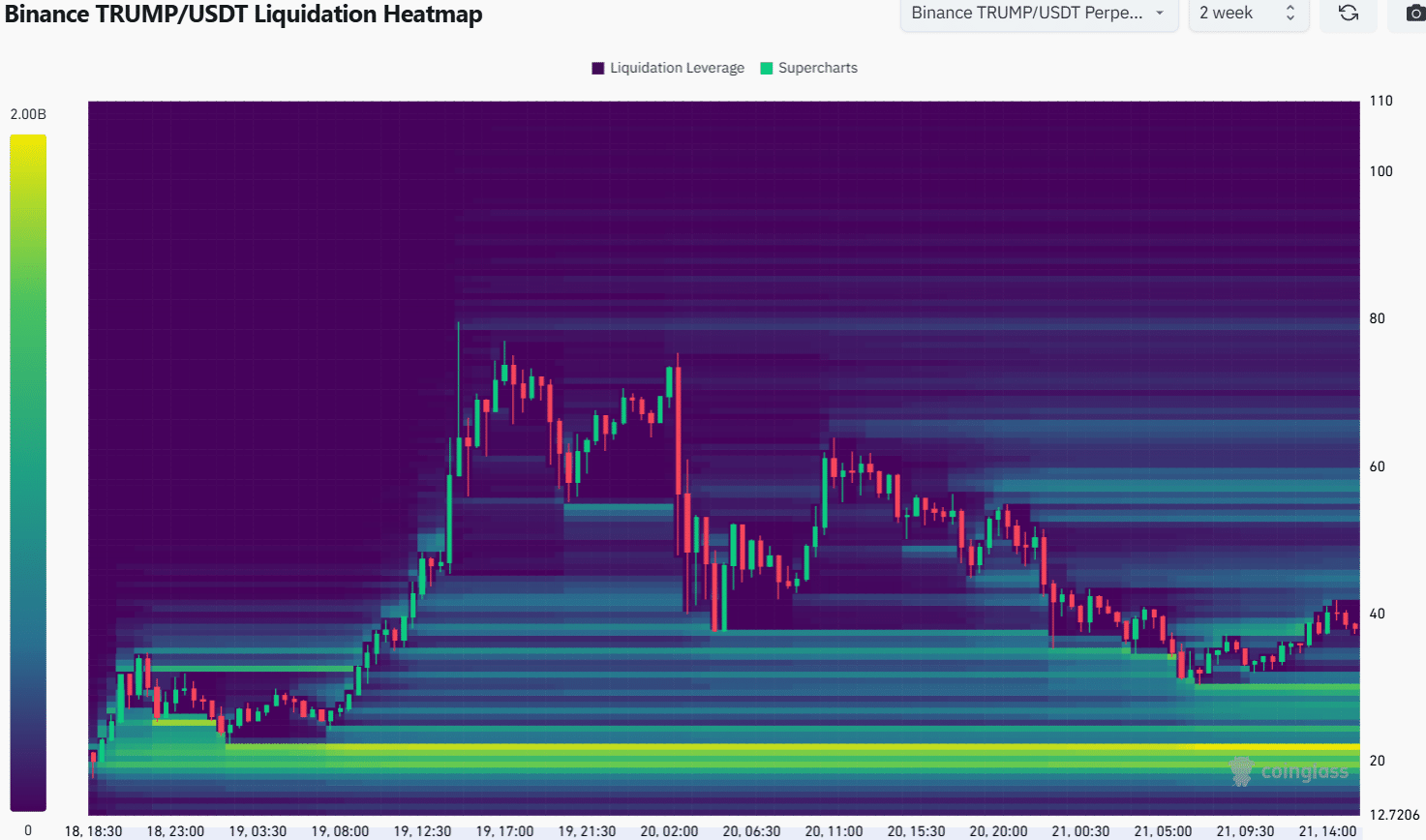

Source: Coinglass

The liquidation data shows that the $20 region is a strong magnetic zone that could pull prices south.

However, this would take the price below the range of the lows and the swing low that initiated the move to $81.2, which would be a strongly bearish outcome.

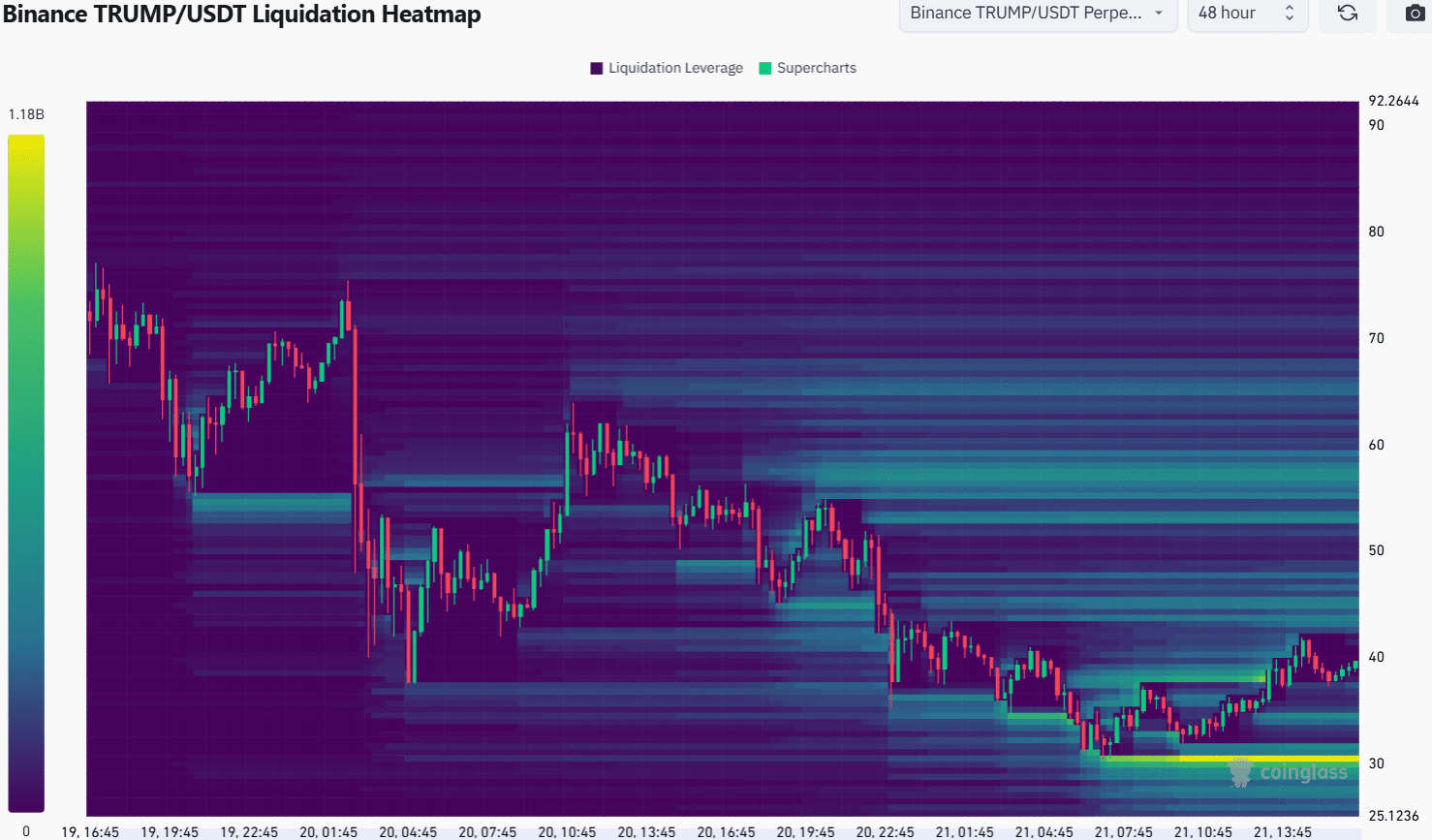

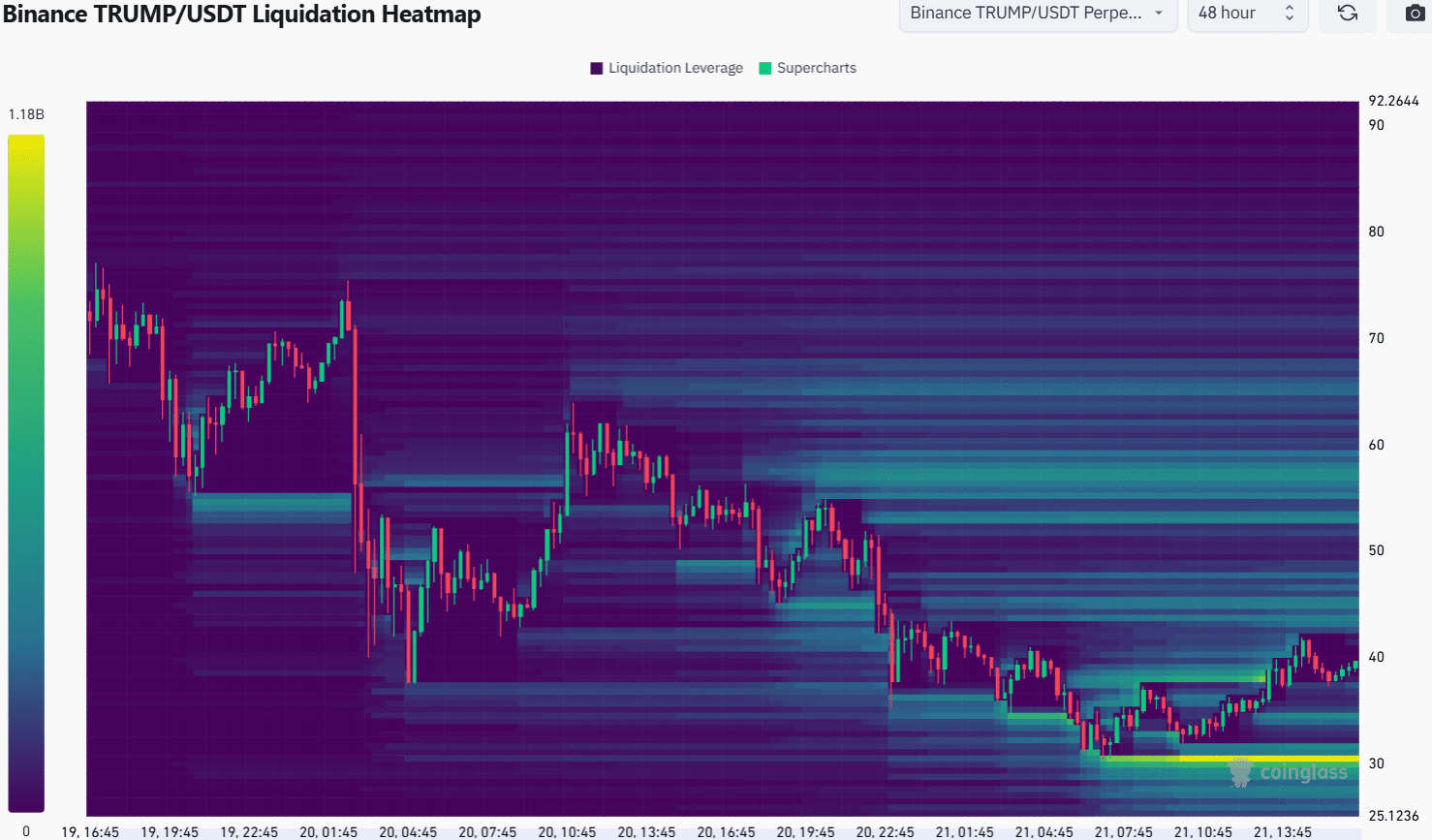

Source: Coinglass

The two-day lookback period highlighted $30.3 as the short-term target. To the north, the $43-$44 region was the next price target. It roughly coincided with the range highs around $40.

Realistic or not, here is TRUMP’s market cap in BTC terms

So there was a greater chance of a temporary setback once the range highs were tested.

Since the TRUMP memecoin tends to pump quickly, traders should be wary of increased volume in the event of a breakout and may want to go long if volume is high enough.

Disclaimer: The information presented does not constitute financial advice, investment advice, trading advice or any other form of advice and is solely the opinion of the writer