- Uncertainty over US BTC reserves has limited BTC’s recent rebound.

- The options market suggested prolonged price swings over the next 48 hours.

Bitcoin [BTC] recorded erratic moves during inauguration day, reaching a new high of $109.5K before returning to $100K.

The market seemed cautiously optimistic after the inauguration, with BTC Options analyst Tony Stewart mark expected volatility for the January 21 expiration date. He stated,

“BTC expires in 12 hours on January 21 and is still 100% priced. Indicates that the inauguration speech was not the focus. The market is still cautious about/expecting volatility.”

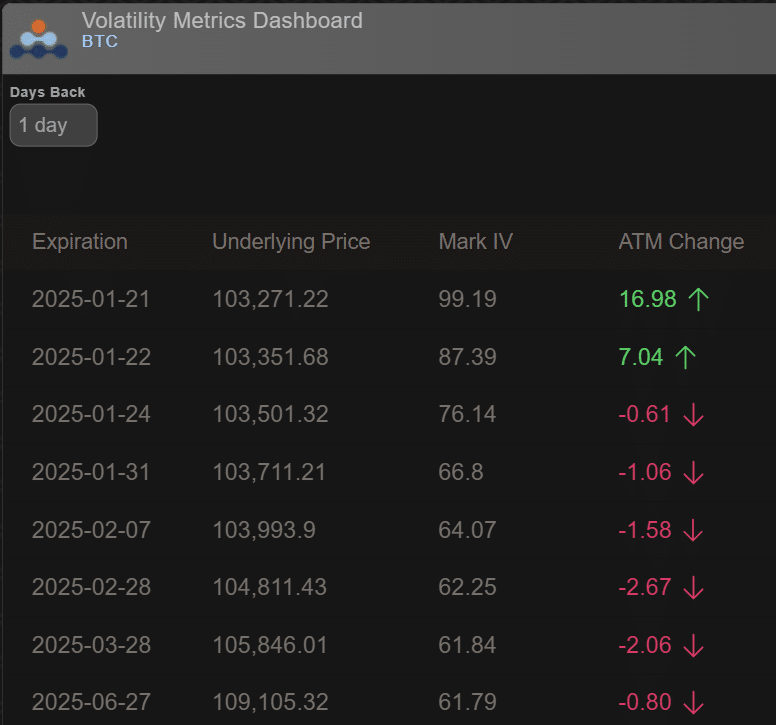

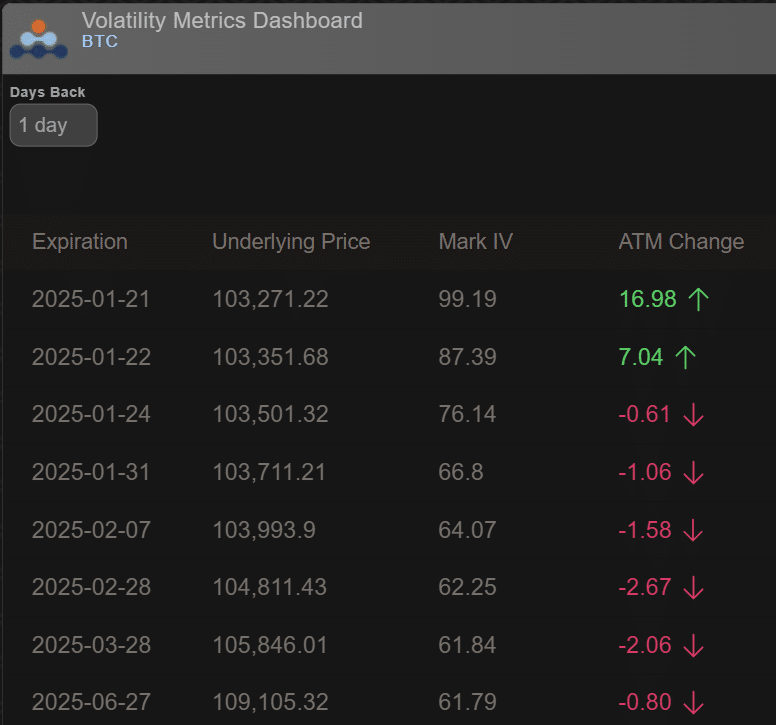

Source: Amberdata

The attached chart indicated that the Mark IV (Implied Volatility) was close to 100% before the option’s expiration date on January 21st. This showed that uncertainty and potential price fluctuations had increased after the inauguration.

However, at the time of writing, the IV had dropped to 71%, while the Wednesday options expiration had the highest IV at 77%. This indicated expected potential price movements over the next 48 hours.

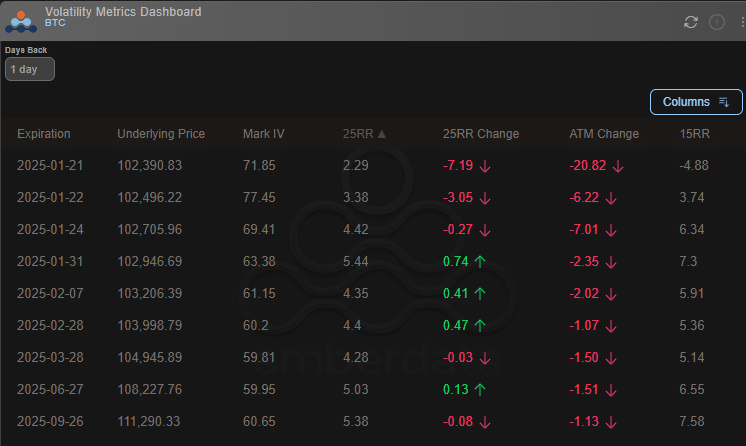

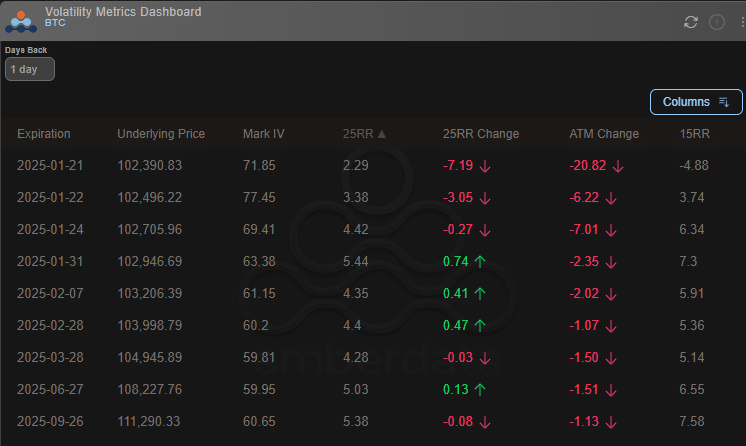

Source: Amberdata

It is worth pointing out that despite the uncertainty, there was a premium for call options (bullish bets), as evidenced by the positive 25-Delta Risk Reversal (25RR).

Uncertainty About US Bitcoin Reserves

Perhaps the market jitters were caused by crypto being missing from President Trump’s executive orders on day one.

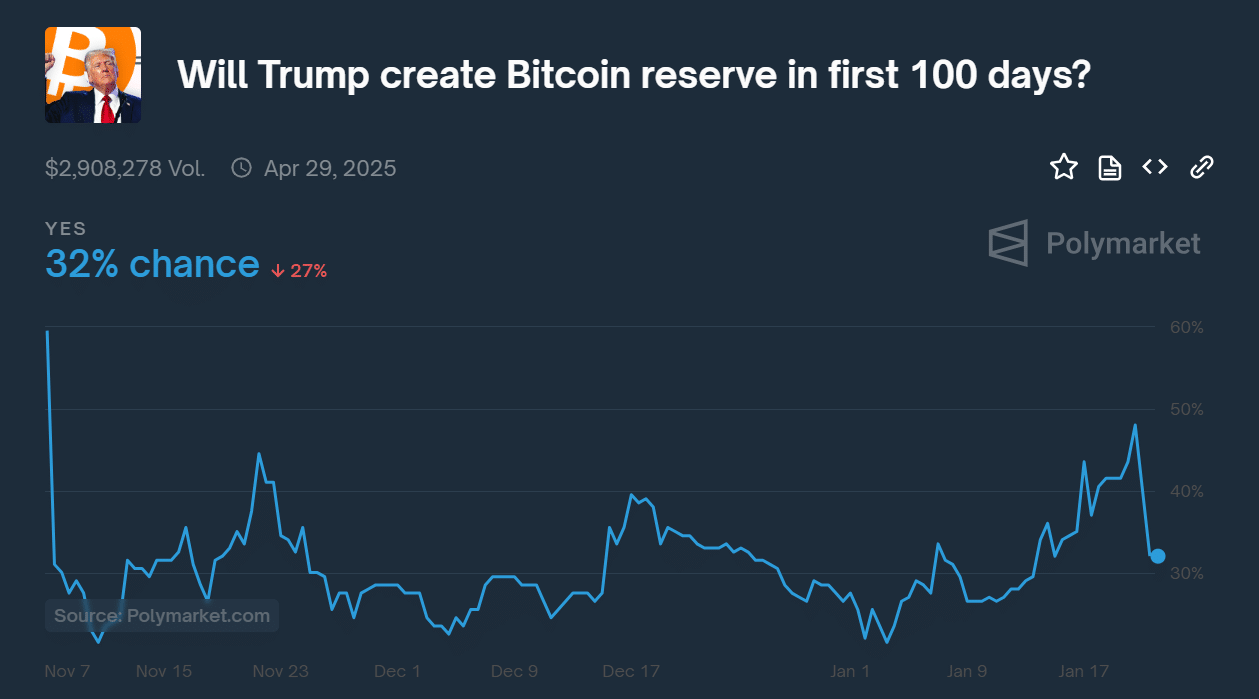

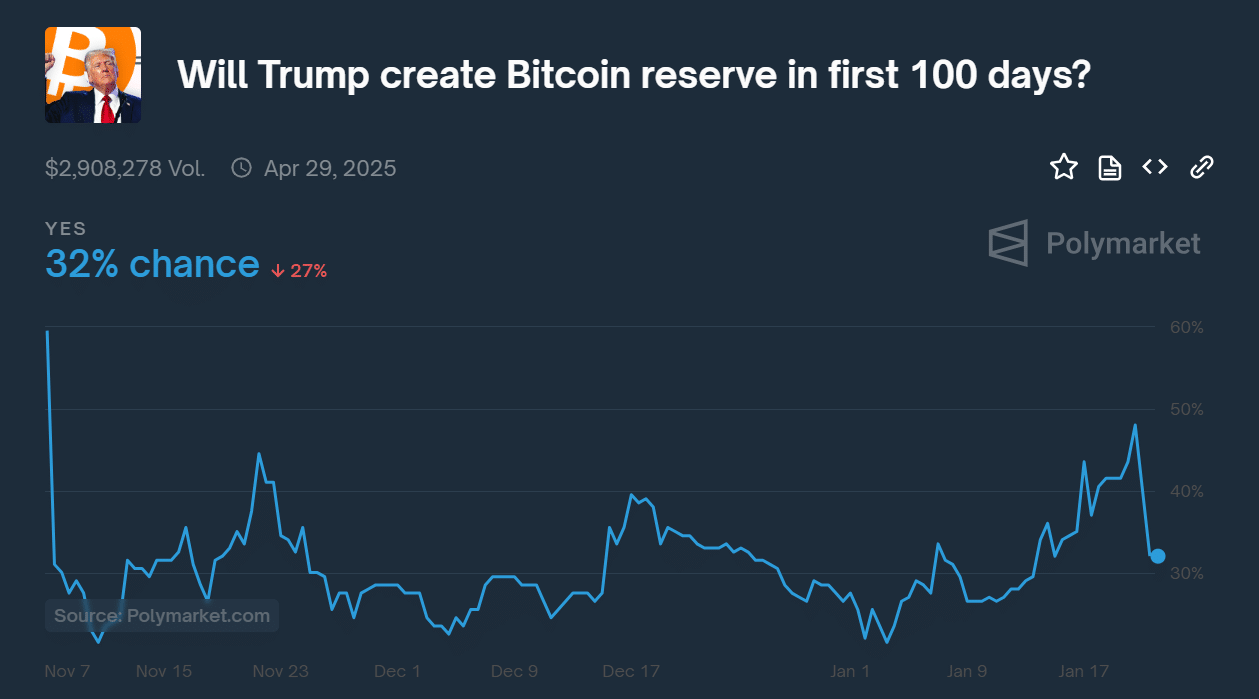

Just hours before the event, Polymarket’s odds on the US BTC reserve shot up to 48% in the first 100 days, sending the price of BTC soaring. record high of $109,000.

However, the odds then dropped to 32% when it became clear that crypto was not a priority, at least not on the first day of business.

Source: Polymarkt

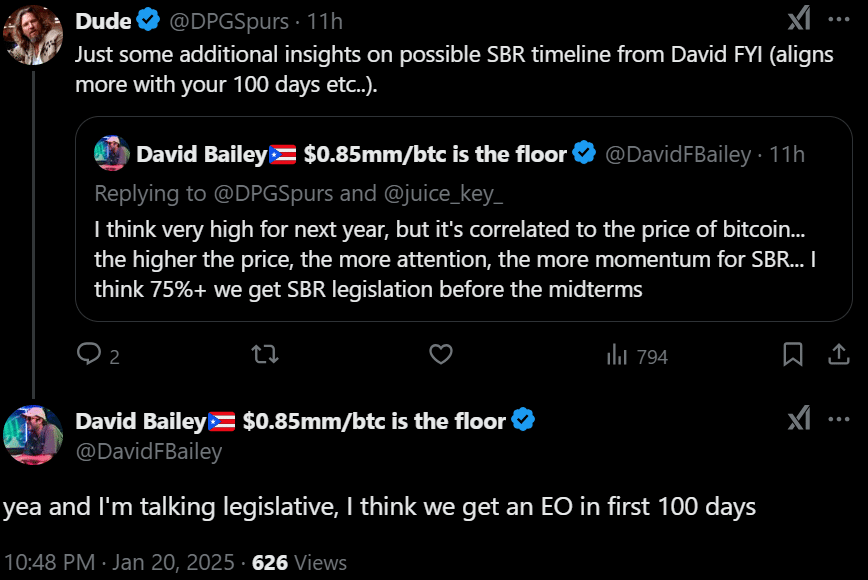

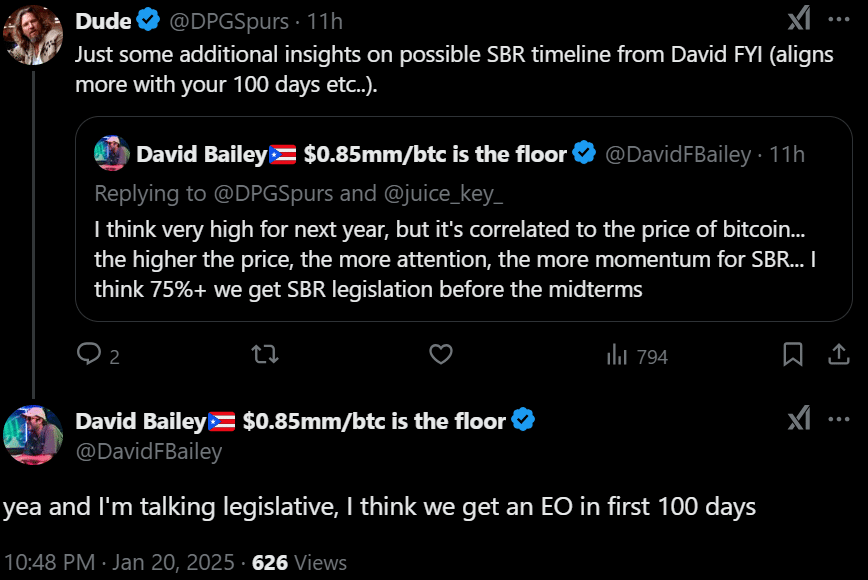

One of the insiders, Bitcoin Magazine’s David Bailey, speculated that an executive order for a Strategic Bitcoin Reserve (SBR) could likely be within 100 days. Still, he said, the legislative framework could continue until the midterm elections.

Source:

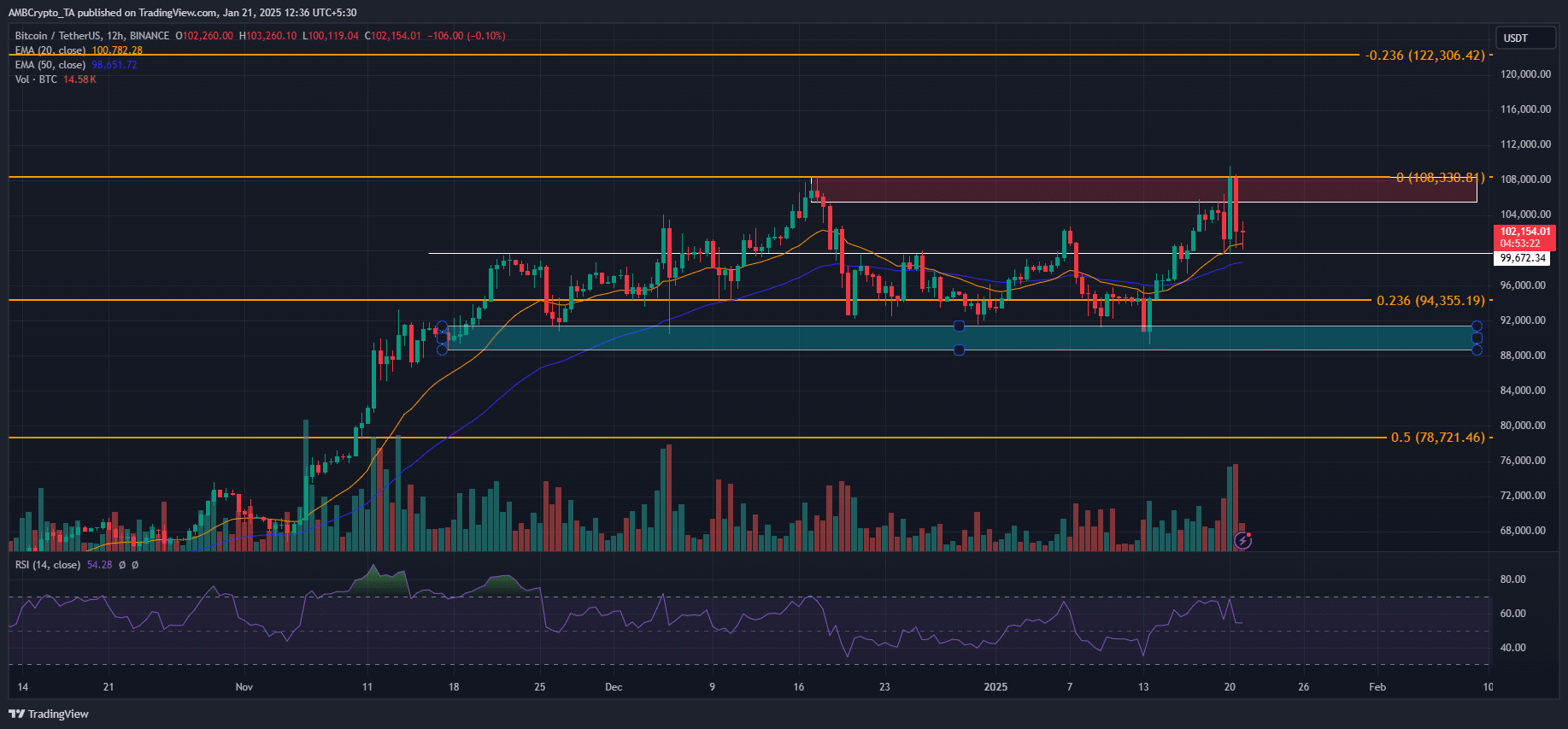

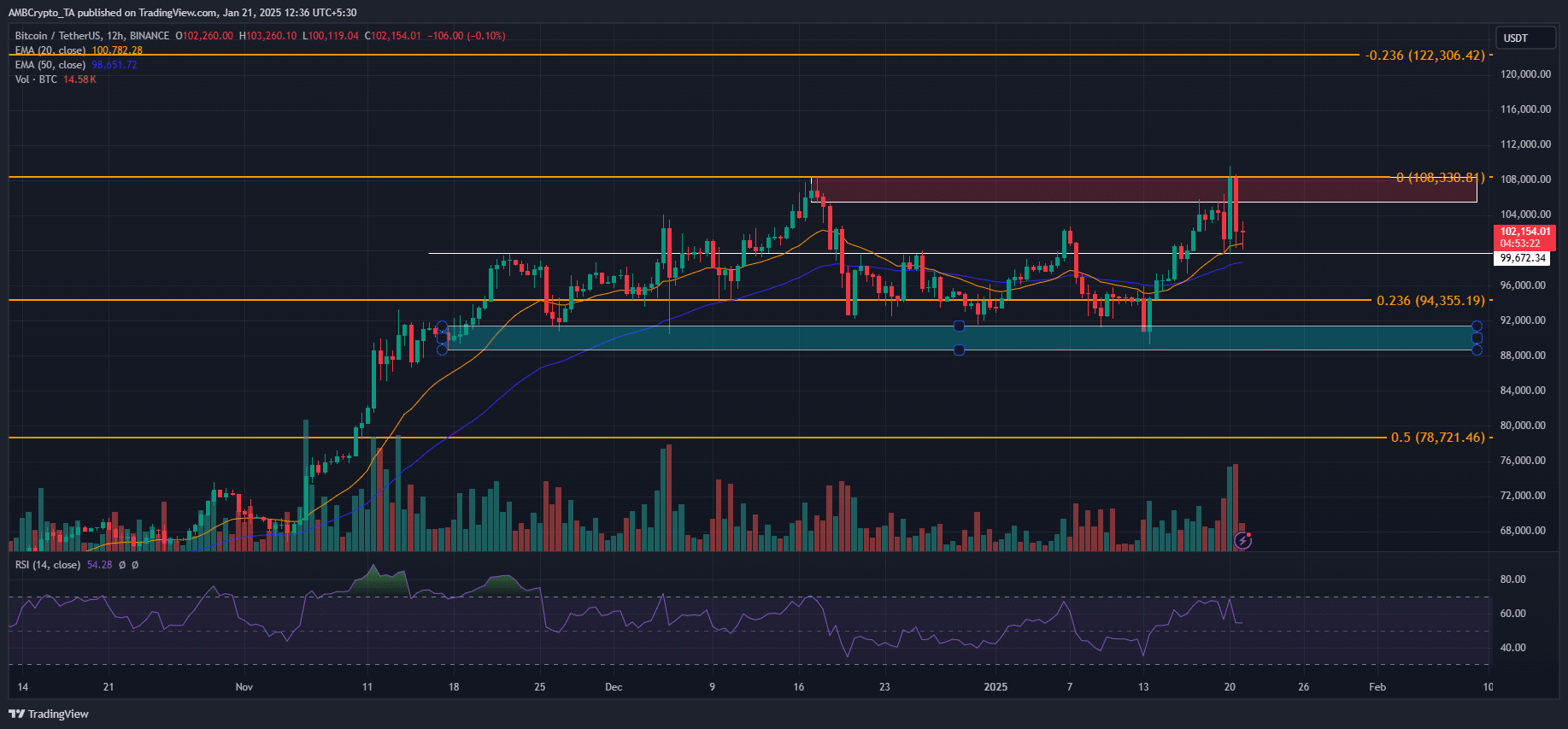

The BTC price fell below $108,000 but remained above the key moving averages near $100,000, indicating strength despite uncertainty over the US SBR. A break below the averages could drag BTC to $94K or a low of $90K.

However, a strong rebound could make $120,000 reachable, especially with positive updates on the US SBR outlook.

Source: BTC/USDT, TradingView