- Ethereum is seeing poor performance against Bitcoin, with the ETH/BTC pair hitting a four-year low.

- ETH is down 2.48% in the past 24 hours.

The past few months have Ethereum [ETH] has struggled to maintain upward momentum, while Bitcoin [BTC] has continually reached new heights.

As such, Ethereum has continued to battle against Bitcoin, while BTC.Dominance pushed the pair to recent lows.

At the time of writing, ETH/BTC was trading as high as $0.031, hitting a four-year low for the pair. This dip raises concerns about Ethereum’s future prospects and whether it can turn around its fortunes.

Ethereum continues to battle against Bitcoin

Over the past year, Bitcoin has made significant gains, rising 144.45%. This marked an increase from $40,000 to $101,000 at the time of writing, while BTC has reached an ATH of $109,000 over the same period.

Source: TradingView

By comparison, Ethereum has posted modest gains over the same period, up 30.27% to $3,219 at the time of writing. During this period, ETH remained approximately 33% below the ATH of $4891 recorded in 2021.

Now that the ETH/BTC ratio has fallen to 0.031, all the gains of the past four years have been wiped out. Historically, the pair peaked at 0.087 in 2021, when the market saw a surge in altcoins.

However, since reaching this level, the altcoin has experienced strong downward pressure.

Factors behind this decline

Several factors led to Ethereum’s underperformance against Bitcoin. In particular, the royal coin has received high preference from institutions and governments.

In this regard, many governments have considered creating Bitcoin reserves, which is why BTC is seeing higher preference and adoption rates compared to other crypto assets.

Source:

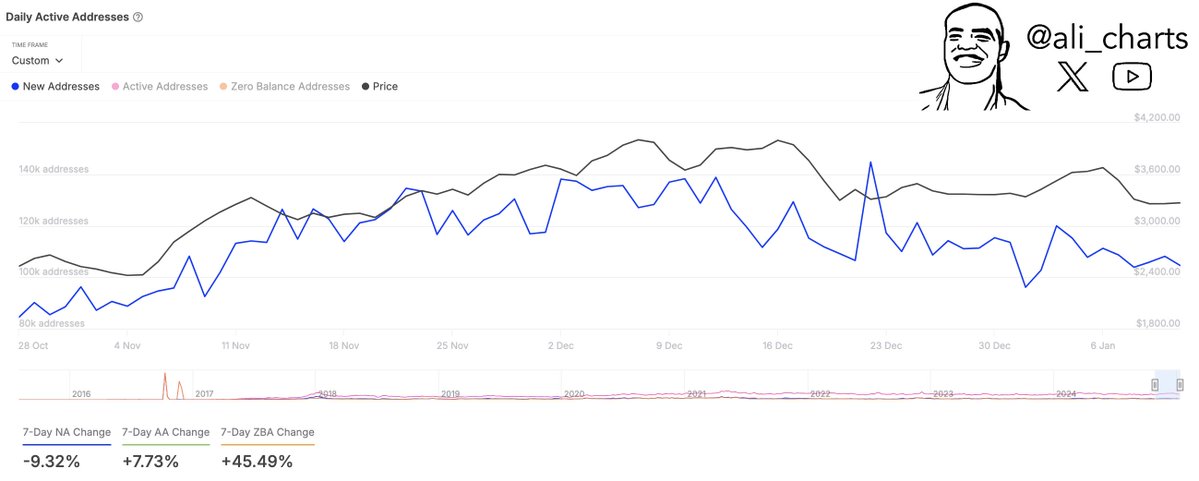

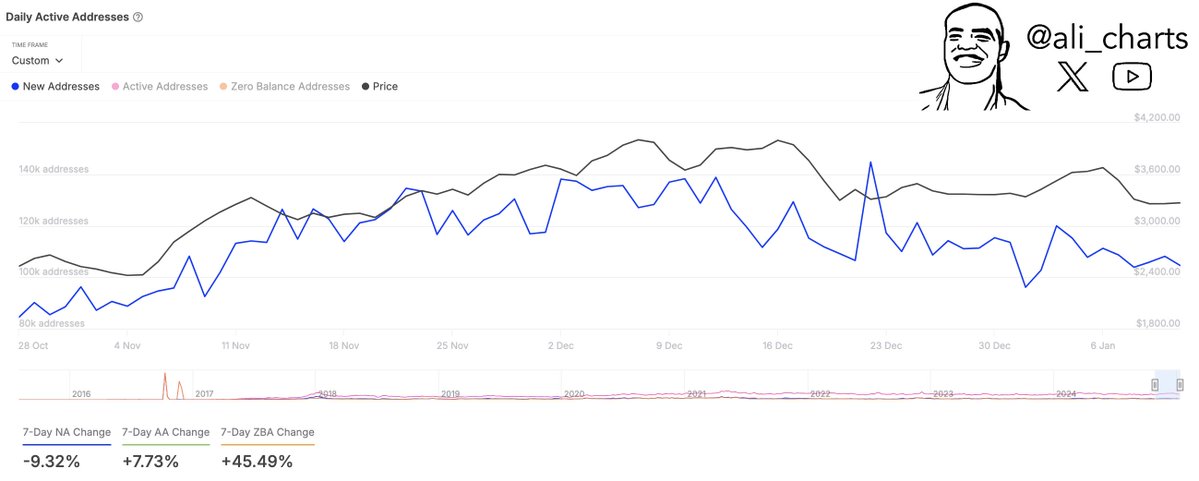

Ethereum, on the other hand, has experienced a decline in adoption rates, with the number of new addresses falling by 9.32%.

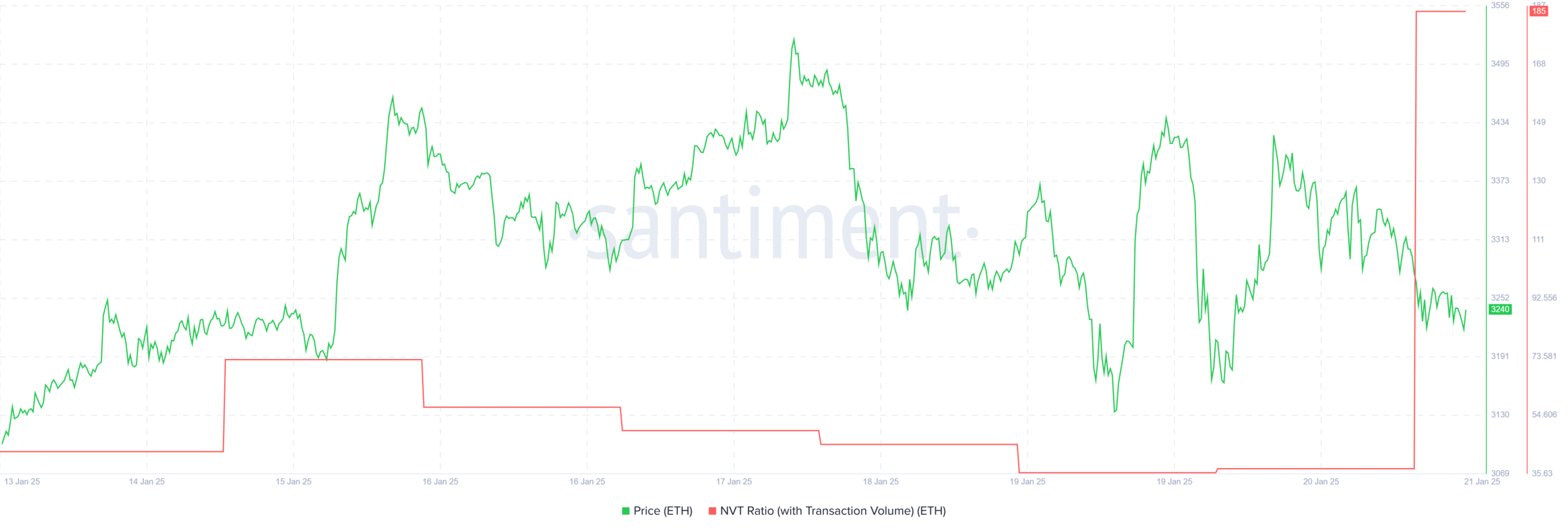

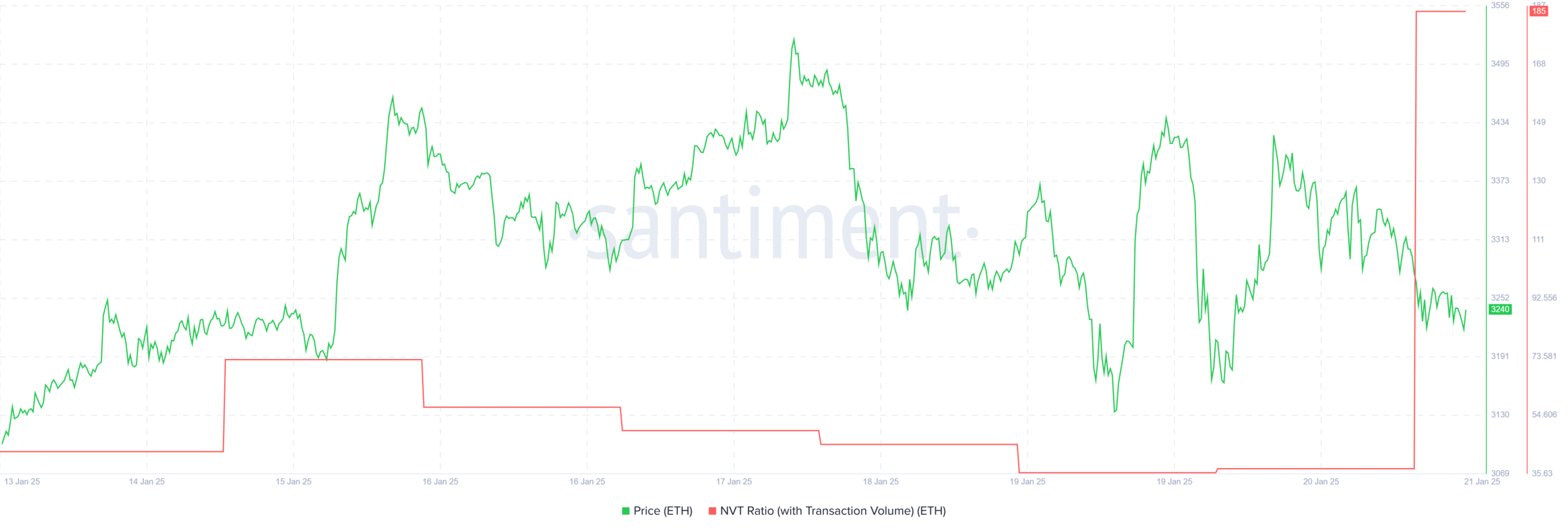

Source: Santiment

This drop in addresses is further evidenced by a rising NVT ratio, which has risen to 185.5, indicating reduced transaction activity. As such, transactions on the Ethereum network have continually decreased.

This drop in network activity raises concerns about overvaluation, exacerbating ETH’s poor performance.

What awaits us?

With reduced market preference, ETH could experience more losses, and its poor performance against Bitcoin could continue.

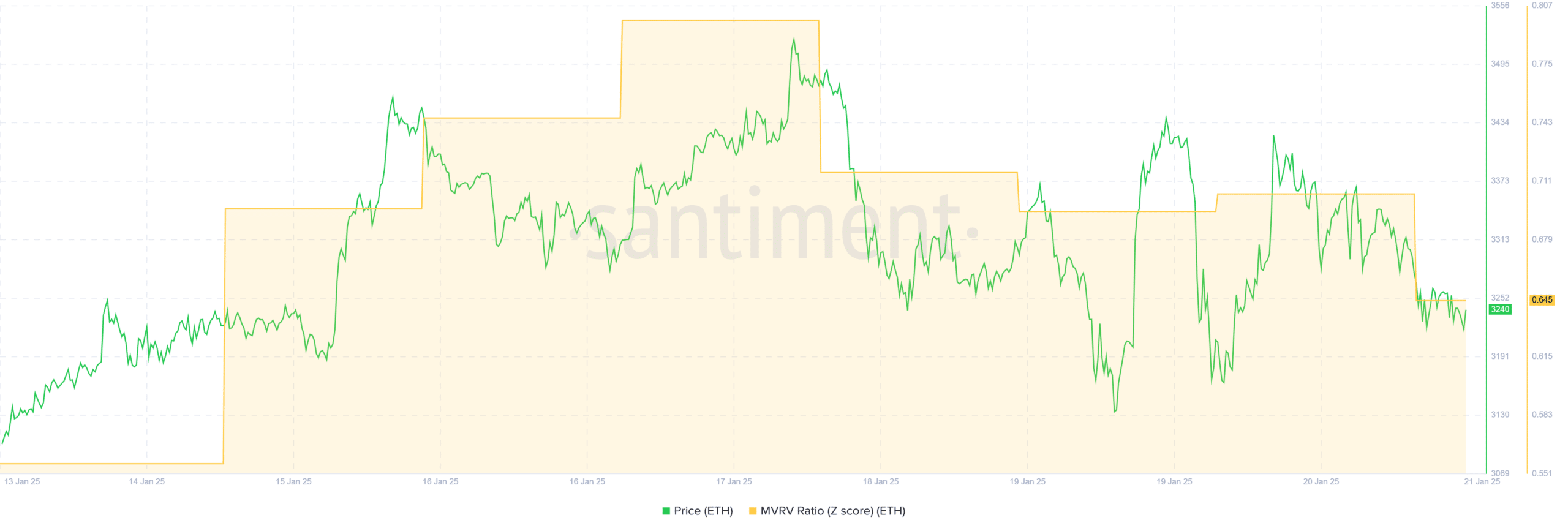

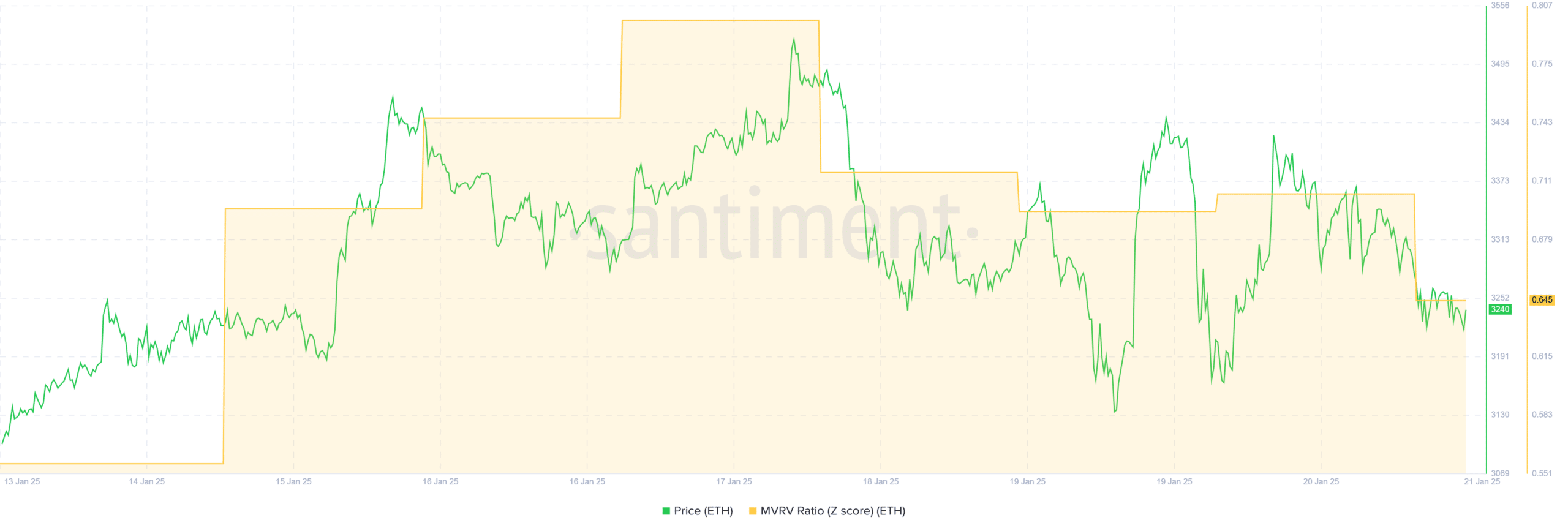

Source: Santiment

This potential decline is supported by the fact that the MVRV ratio has fallen to 0.64. Such a decline implies that investors are bearish and have little confidence in price recovery in the short term.

Realistic or not, here is the market cap of ETH in terms of BTC

Therefore, Ethereum is facing strong bearish sentiment in the short term, which could see ETH fall to $3160. However, if buyers view this drop as a buying opportunity, ETH will reclaim $3300 and attempt $4k.

This will strengthen the ETH/BTC pair and push it to regain $0.04.