- Cardano’s break above $1.065 highlighted the bullish momentum, targeting $1.77 with growing interest from traders

- Strong development activities and an increasing number of daily active addresses could strengthen its long-term growth potential

Cardano [ADA] recently confirmed a breakout after retesting key resistance levels, sparking optimism among traders. The cryptocurrency was trading at $1.07 at the time of writing, after rising slightly by 0.05%, and has seen some renewed strength on the charts lately.

This development has set the stage for ADA to potentially reach its next price target of $1.77. However, with technical indicators and market sentiment painting a mixed picture, can Cardano maintain its upward momentum and lead the crypto market to a broader rally?

How Does Price Action Signal a Bullish Trend?

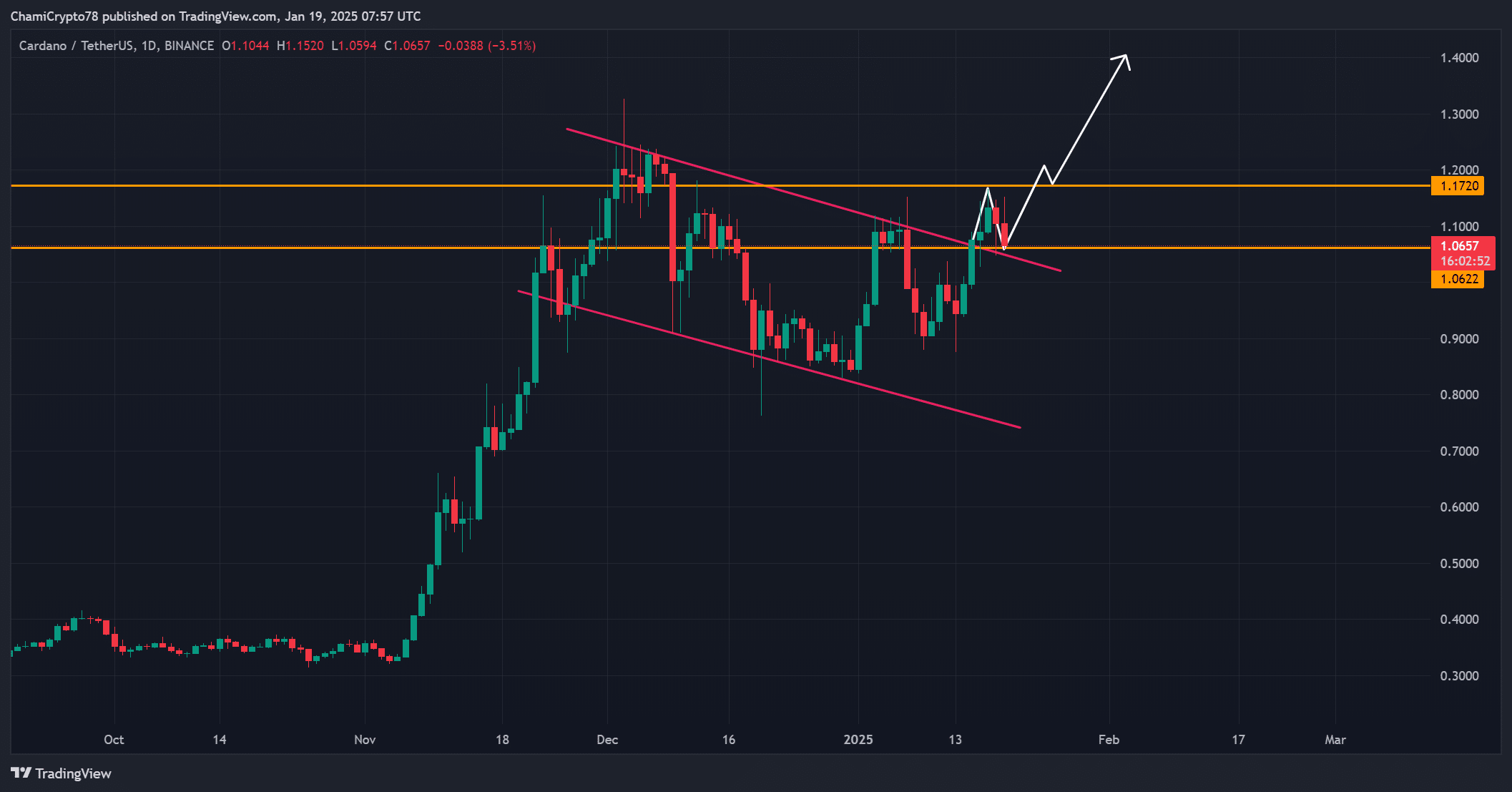

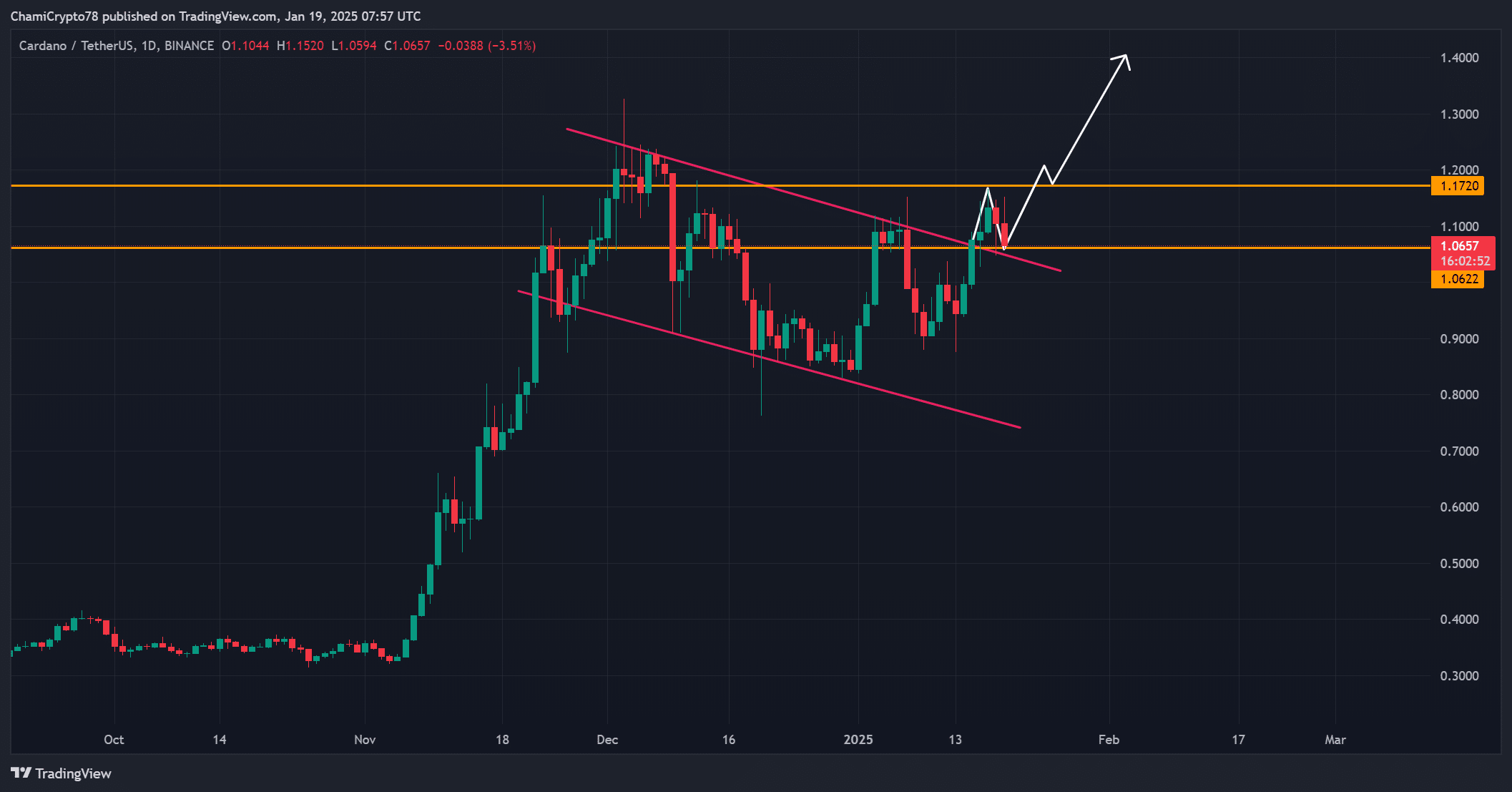

ADA’s price action showed a clear breakout from the falling wedge pattern – a bullish signal for traders. At the time of writing, the cryptocurrency remained even above the $1,065 support level, with $1,172 acting as the next critical resistance.

Moreover, a sustained rise above $1.172 could pave the way for a rally towards $1.77 – a major milestone. However, failure to maintain support at $1,065 could result in a pullback, creating opportunities for buyers to re-enter at lower levels.

Source: TradingView

What does the sharp increase in the NVT ratio indicate?

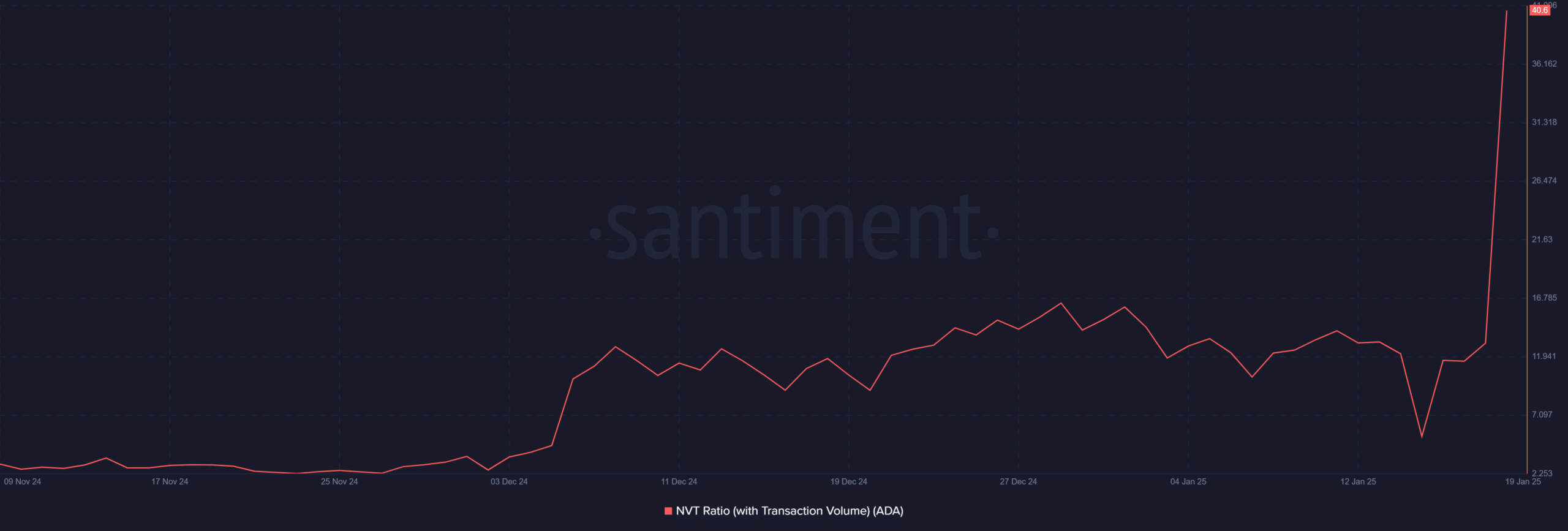

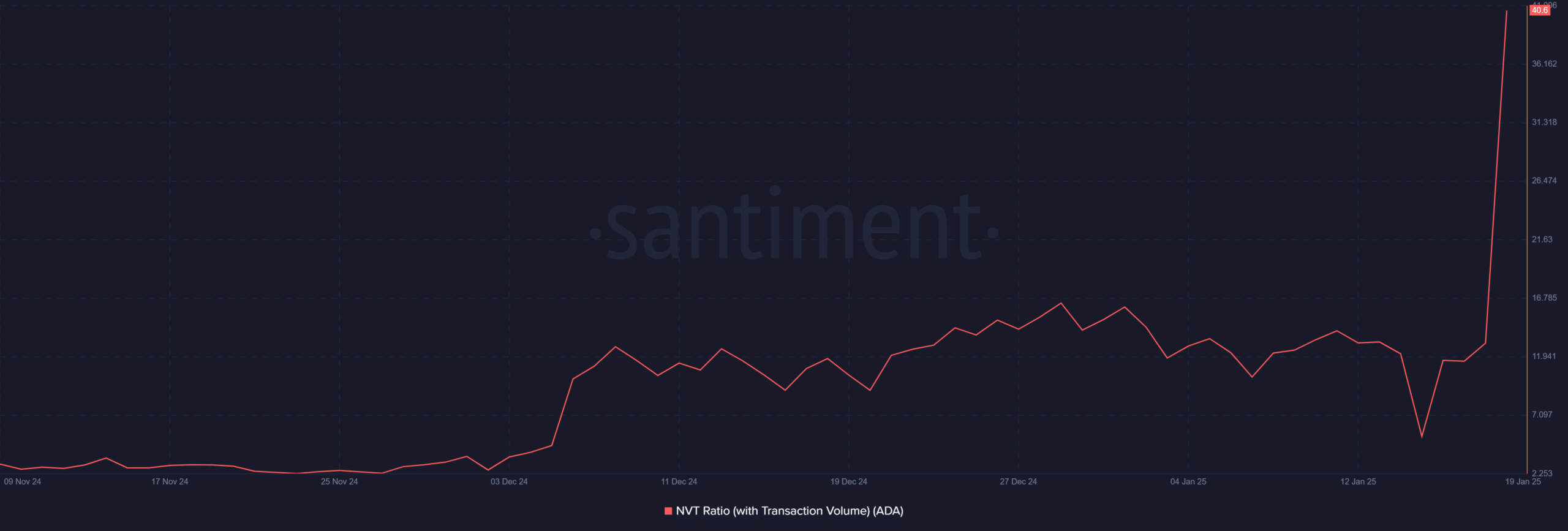

The NVT ratio for ADA increased to 40.6, reflecting an increase in valuation compared to transaction volume. This measure often indicates increased investor interest, which can drive the price higher in the short term.

However, such a rapid increase could also indicate overvaluation, which requires caution from traders. Therefore, keeping an eye on transaction activity will be critical to understanding the sustainability of this rally.

Source: Santiment

How do daily active addresses reflect network engagement?

The number of daily active addresses on Cardano’s network also increased to 40,591, highlighting growing user engagement. Simply put, there is an increase in activity within the ecosystem, further confirming its fundamental strength.

Furthermore, continued growth in the number of active addresses often supports price stability and strengthens investor confidence in the long term. However, maintaining this trend will be essential to ensure that ADA continues to attract new participants.

Source: Santiment

Do ADA’s technical indicators support the rally?

The stochastic RSI at 86.29 indicated that ADA is in the overbought zone, indicating strong bullish momentum. However, it also warned of a possible pullback if buying pressure eases.

Meanwhile, the ATR at 0.0920 underlined moderate volatility, suggesting traders should prepare for price swings. Therefore, carefully navigating these dynamics will be critical for market participants looking to profit from this rally.

Source: TradingView

How does ADA’s development activity drive growth?

Finally, Cardano’s development activity has recovered to 38.71, recovering from a December low of below 20. This recovery shows the blockchain’s commitment to innovation and ecosystem expansion.

Furthermore, the network continues to attract developers, thanks to its growing community projects and regular upgrades. Such progress strengthens ADA’s long-term growth story, aligning ecosystem improvements with rising market sentiment.

Source: Santiment

Read Cardanos [ADA] Price forecast 2023-24

Conclusion

The Cardano breakout was supported by strong fundamentals, increasing network activity and significant development progress.

However, traders should remain vigilant as overbought conditions can trigger short-term corrections. With its robust momentum, ADA is well positioned to continue its rally and possibly reach new highs, including the $1.77 target.