- Trump reportedly would roll back accounting rule SAB 121

- Market expectations for a strategic BTC reserve in the United States have risen

The crypto market could score an early victory on the regulatory front. President-elect Donald Trump reportedly plans to repeal accounting rule SAB 121 on his first day in office.

According to a Washington Post reportTrump considers the de-banking agenda a “top priority.” The report went on to say that he will issue executive orders on day one to address this issue and repeal the accounting rule that has excluded traditional banks from the sector.

The SAB 121 directive required strict 1:1 accounting for banks involved in crypto and restricted most banks from participating in the sector.

Although Congress voted overwhelmingly to overturn the proposal, President Joe Biden vetoed and said he “would not put consumers and investors at risk.”

Is a Bitcoin Strategic Reserve Next?

The update from the Trump-Vance transition team resonates with their campaign promises to the sector. Brian Hughes, the spokesperson for the transition team, told the Washington Post that they want a space where crypto can thrive in the US. He said:

“President Trump and David Sacks will protect free speech online, move us away from big tech censorship, and build a legal framework so the crypto industry can thrive in the United States”

In addition to repealing most anti-crypto laws, the team has promised to create a strategy BTC reserve (SBR).

Industry insiders such as Strike’s Jack Mallers have claimed that SBR would be included in the president’s day one executive orders. Although the Washington Post didn’t mention SBR, market expectations have understandably risen since then.

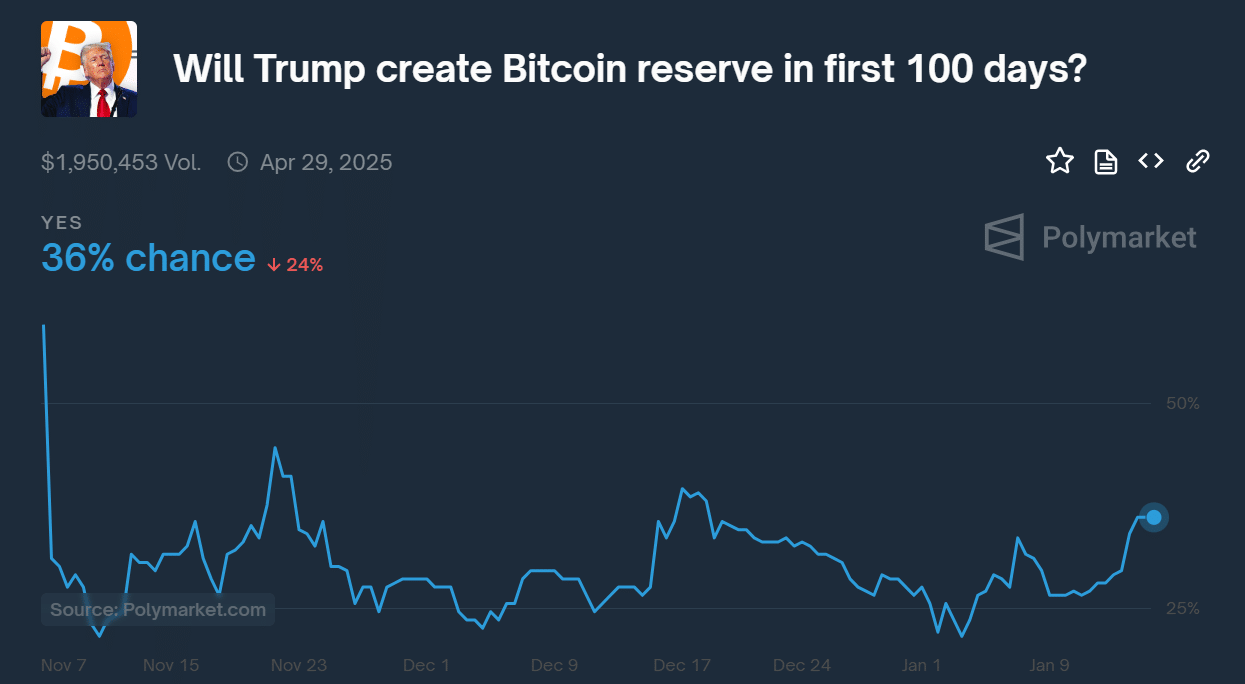

In the past two weeks alone, Polymarket’s chances of forming a US SBR within the first 100 days of the Trump administration have increased from 26% to 36%.

Interestingly, the price surge in the new year coincided with BTC’s recovery from $91,000 to $102,000, before the cryptocurrency reversed its gains.

Some market experts even believe that a US SBR would cause FOMO in other countries and potentially increase the value of BTC. It remains to be seen if this is the next step in Bitcoin’s adoption wave.