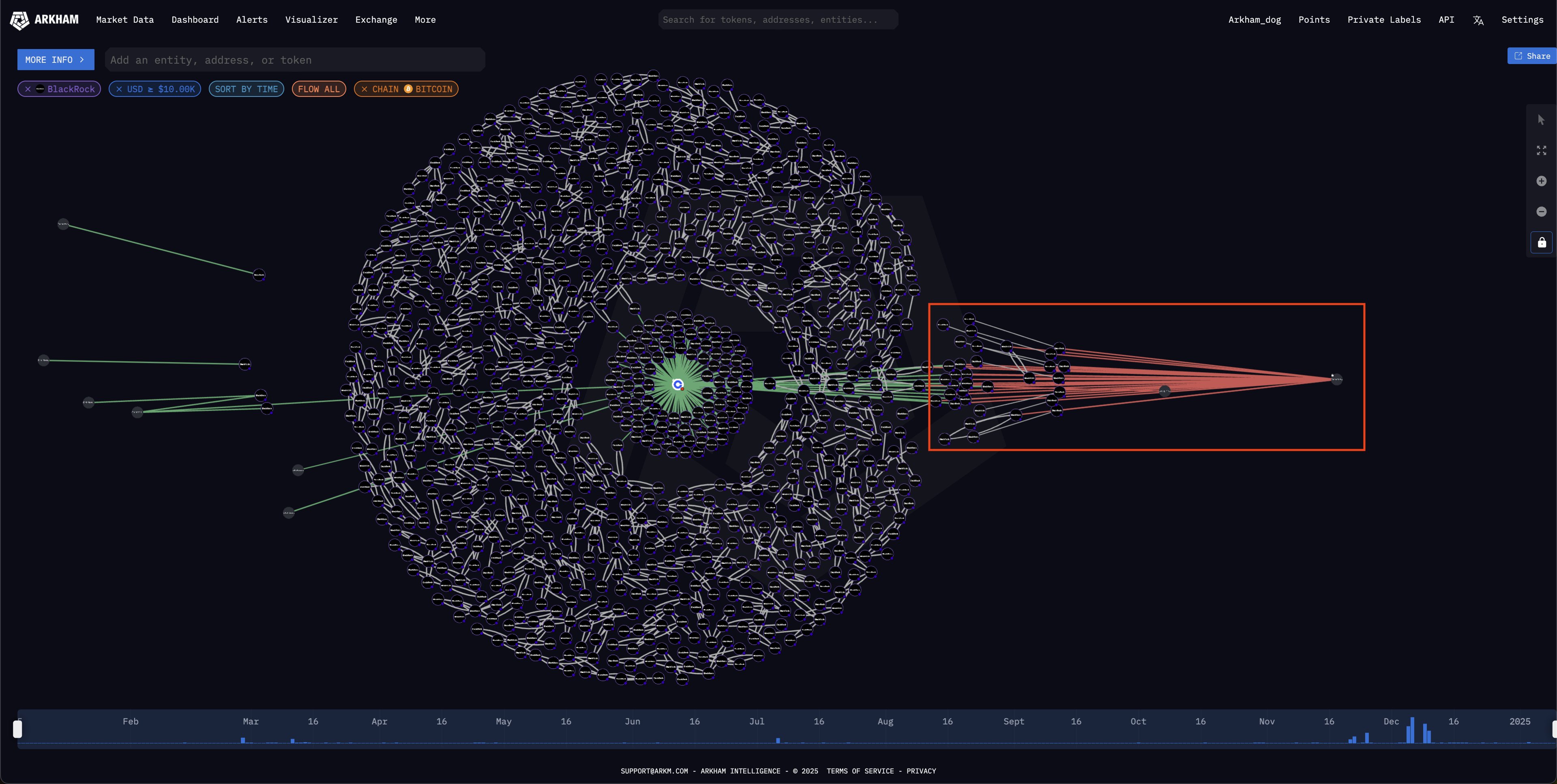

New data from market intelligence firm Arkham shows that asset management titan BlackRock will build a stock of Bitcoin (BTC) worth $50 billion by 2024.

The data too finds that software company MicroStrategy, founded by BTC maxi Michael Saylor, bought the crypto king for $24 billion last year, while financial services provider Fidelity collected $20 billion worth of BTC.

Other notable digital assets in BlackRock’s portfolio include $3.6 billion worth of top altcoin Ethereum (ETH) and $68.5 million worth of stablecoin USDC.

However, Arkham goes further remark that BlackRock – which has more than $10 trillion in assets under its management – no longer aggregates the top crypto assets by market capitalization. Instead, the price has reversed and BTC is unloading in the short term.

Earlier this month, it was reported that BlackRock’s spot market BTC exchange-traded fund (ETF) saw record outflows. At the time, it was noted that the company’s iShares Bitcoin Trust ETF (IBIT) witnessed an outflow worth $332.6 million on January 2, its biggest day ever.

In November, it was found that IBIT had surpassed BlackRock’s gold ETF (IAU) in terms of net assets – to over $33 billion – despite launching the gold ETF almost two decades earlier in 2005.

The top digital asset is trading at $94,201 at the time of writing, down 1.1% in the past 24 hours.

Don’t miss a beat – Subscribe to receive email alerts straight to your inbox

Check price action

Follow us further X, Facebook And Telegram

Surf to the Daily Hodl mix

Generated image: Midjourney