- Avalanche is celebrating healthy transaction growth, but liquidity has declined.

- AVAX demand is cooling, but can the bulls make a comeback as the price gains major support in the short term?

At the time of writing, Avalanche [AVAX] hovered at eleventh place in the crypto rankings by market capitalization. But can it leverage its growing number of transactions to climb into the top ten, or will market pressure push it down?

The next step for Avalanche will largely depend on network performance. A network analysis yielded mixed results.

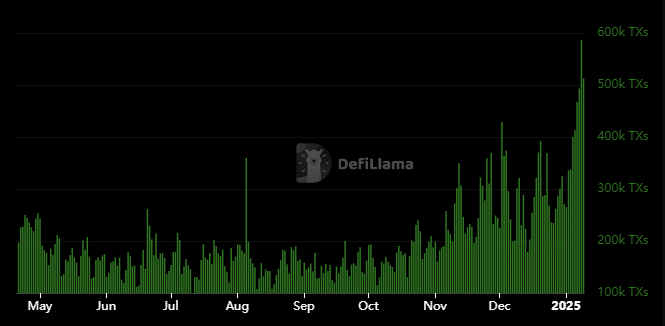

For example, the Avalanche blockchain has seen positive growth in terms of daily transactions.

The number of daily transactions rose to a ten-month high of 586,650 transactions on January 8, confirming healthy growth in terms of network utility.

source: DeFiLlama

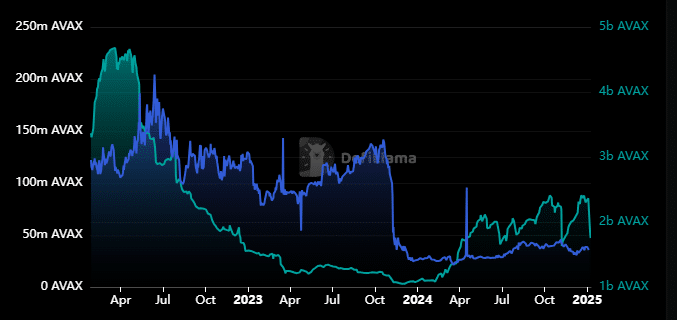

While healthy daily transactions may indicate that the network is on the right track, more is needed to fully realize the growth opportunities. That requires positive TVL growth and the number of stablecoins.

According to DeFiLlama, both TVL and the stablecoin market cap on the Avalanche network are struggling to maintain positive growth.

For context, Avalanche had a TVL of $1.375 billion, which was about 10% of the ATH achieved in December 2021.

Liquidity in the Avalanche network has also decreased. Stablecoin’s market capitalization rose to $4.68 billion in March 2022. At the end of November 2023, the market capitalization fell to $1.051 billion.

The economy then rebounded to as much as $2.43 billion in 2024, but only began seeing significant outflows this year.

Source: DeFiLlama

Avalanche’s stablecoin market cap has fallen by about $1 billion in the past ten days. TVL fell by about $140 million over the same period.

AVAX is approaching notable support after the recent dip

It was unclear whether the mixed network performance metrics (increasing transactions and declining stablecoins) will affect AVAX’s price.

The price action of the cryptocurrency moves in line with prevailing market conditions.

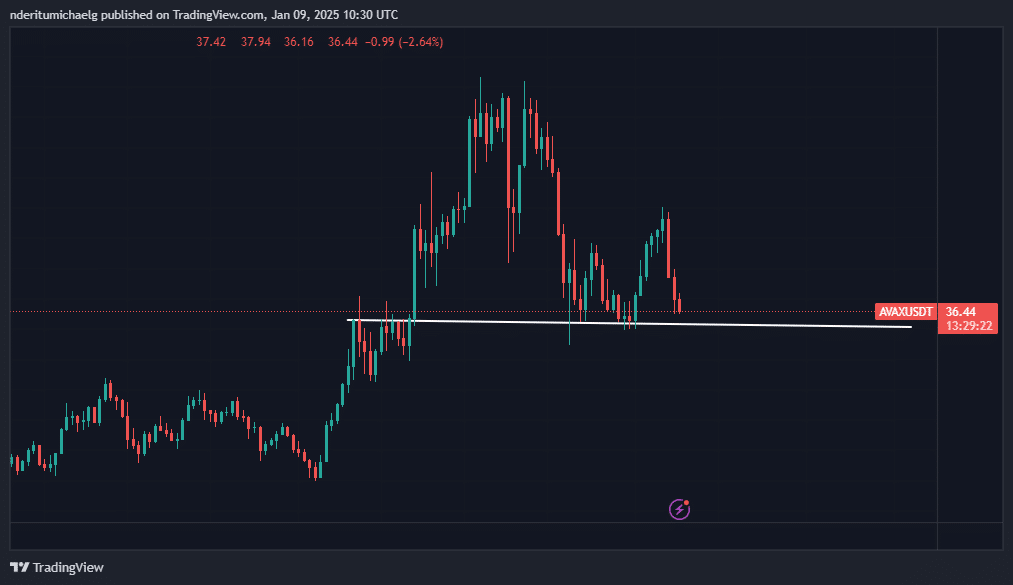

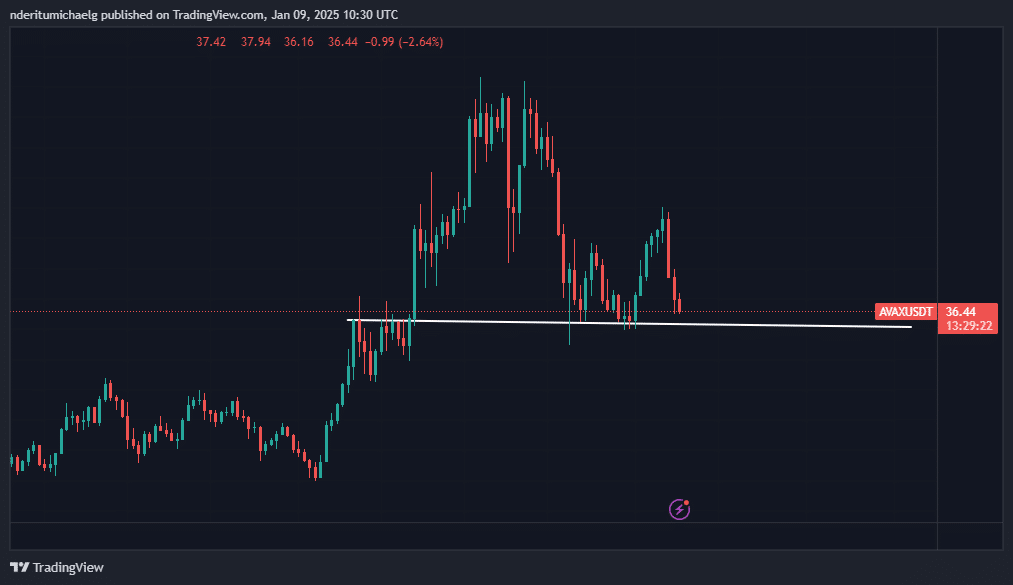

AVAX was trading at $36.46 at the time of writing, having fallen 18.7% since the start of the week.

Source: TradingView

AVAX was approaching a short-term support zone near the $35 price range. This zone could potentially pave the way for a near-term recovery. Historical concentration data can provide insight into the state of demand.

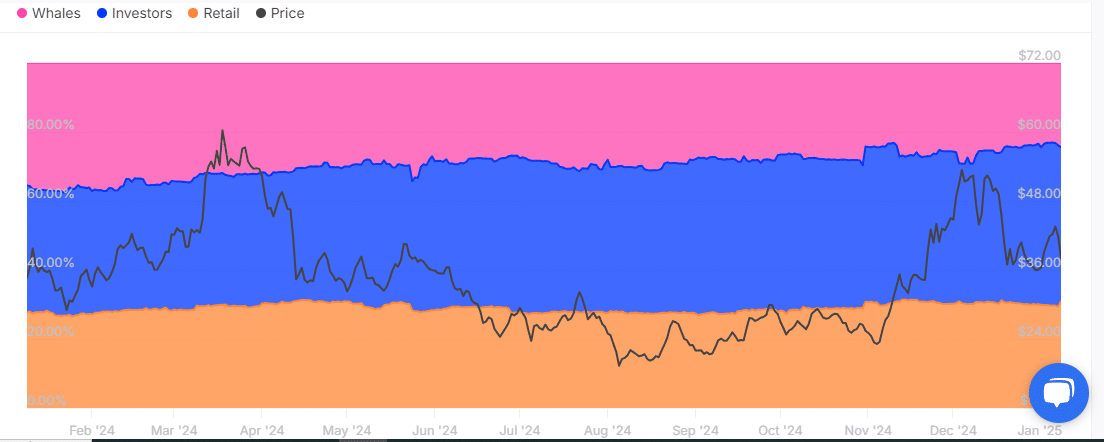

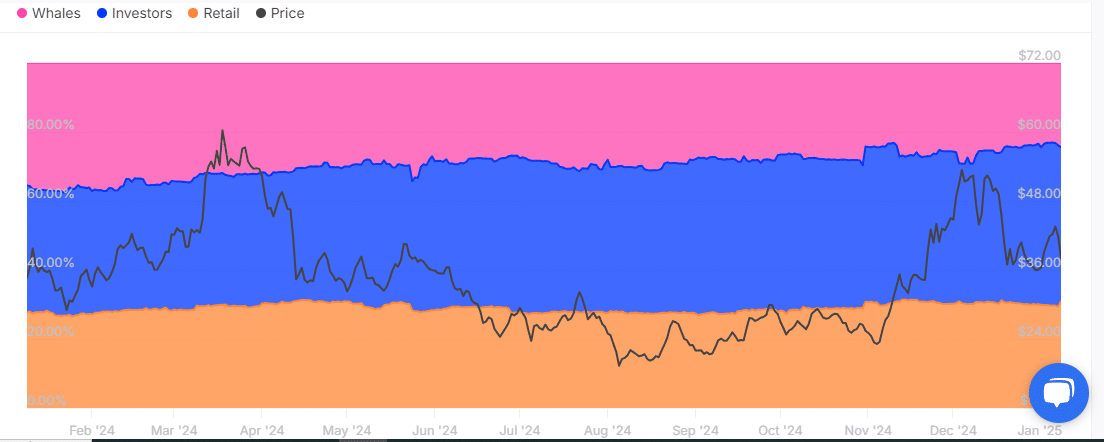

Whale stocks rose from 26.53 million AVAX (24.42%) on January 1, but fell to 25.59 million AVAX (24.35%) on January 8.

The most notable shift occurred in the investor category, which controls AVAX’s largest offering.

Source: IntoTheBlock

Investor holdings fell from 49.59 million coins (45.65%) to 47.06 million coins (47.78%).

Read Avalanche [AVAX] Price forecast 2025–2026

Retail also reduced its holdings from 32.51 million AVAX (29.93%) to 32.43 million AVAX (30.87%) during the same period.

The historical concentration data confirmed the outflow from all older categories. A confirmation that investors were leaning on the cautious side.