This is a segment from the Empire newsletter. To read the full editions, subscribe.

This is not a happy story. But I can’t get it out of my head.

Earlier this month, it was reported that 21-year-old Alabama resident Berman Nowlin — convicted of bank fraud and money laundering for pulling an NFT rug in 2022 — had died by suicide.

A district court in Florida had found him guilty just three weeks earlier. He was later sentenced in January and faced a maximum prison sentence of five years.

The rug in question referenced a short-lived Bored Apes-inspired project Association for Undead Apesincluding three NFT collections released over two months.

Nowlin was described as the developer who coded the smart contracts.

Undead Apes were briefly popular Open Sea

A second person, Devin Rhoden, managed the art model engine for the NFTs. Rhoden is a 23-year-old senior airman in the United States Air Force who worked as a cyber analyst.

Here is the timeline as shown in the lawsuits:

March 2022: On Solana, 2,500 Undead Apes NFTs were minted for 0.05 SOL each (~$10,000 at the time). UndeadApes were “unique monkeys with over 60 hand-drawn traits on the Solana blockchain. Ready to tackle the Metaverse.”

Later in March 2022: 750 Undead Lady Apes were minted on Solana for 0.75 SOL each (~$53,400). These were supposed to have DeFi features: stakers would earn up to six times, 75% of the royalties would go back to the liquidity pool, and the rest would go to the team.

April 2022: The minimum prices for the first Undead Apes collections reached 3.6 SOL (~$400) and 6 SOL ($660) respectively. In terms of SOL, that’s 72x and 8x initial coin prices.

Later in April 2022: A third coin was announced for Undead Tombstones, featuring a collaboration with Stoned Ape crewan unaffiliated project that would have driven up coin prices.

It was said that Tombstones would offer additional features for existing Undead Apes holders that could generate additional returns on investment.

Two hours later: TheStoned Ape crew denies any association or involvement with Association for Undead Apes. The Undead monkeys team exits the coin shortly afterwards – taking the proceeds – and the floor prices for all related NFTs immediately drop by 85%.

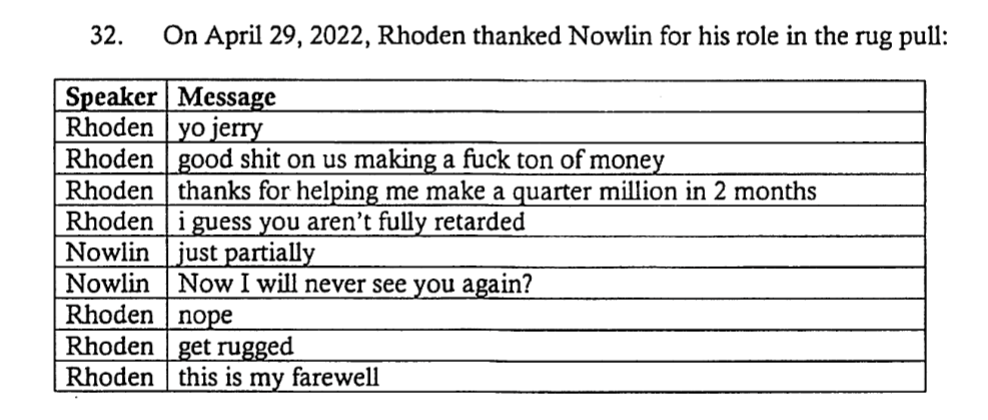

Discord members then received a message from Rhoden in the Undead Ape Association chat and say, “You’re all stupid.”

Authorities traced carpet-pulling revenues of $161,548, which had been paid out in U.S. dollars and split approximately equally between Nowlin and Rhoden’s bank accounts.

Judging from the evidence provided by prosecutors, there appeared to be a plan to keep an eye on the whole time. The FBI was initially tipped off by another Air Force member who lost money in the scheme.

Yet two things haunt me. The first is the relatively low amount of money extracted from the carpet pull.

Perhaps I have become desensitized to much larger fraud cases over the years, but it was still enough for Rhoden to get five years’ probation after pleading guilty, and his testimony would have led to the conviction of Nowlin, who is now deceased .

The other is that Nowlin had been diagnosed with autism. His family described him as above average when it came to intelligence, but he had the emotional maturity of a fourteen-year-old. He reportedly taught himself to code and spent most of his time online, playing video games and chatting in Discords.

Some of the messages between the Undead Apes team come from court documents

There is so much about crypto that is larger than life – often larger than any life we could ever imagine. But the Undead monkeys carpet pulling was none of those things.

Of course, people lost money very quickly. Who knows what would have happened if the team had actually kept their promises. More than likely they would have still lost money.

Usually, reading about carpet pulling is accompanied by some schadenfreude. Perpetrators are caught under all kinds of crazy circumstances, which makes for fascinating crime stories.

Fraud is bad and bad actors need to be caught. That’s what happened with the Undead monkeys pulling carpet. Sadly, it now serves as a dark reminder that while the money and assets are silly and digital, the stories are painfully real.