- A poll of the move’s price forecast as MOVE recovered well from its short-term retracement.

- The retest of the 78.6% level and its defense revealed bullish conviction.

Movement [MOVE] has performed well in the past 24 hours, gaining 12.09%, while the altcoin market lost 1.7%. This strong relative performance was an encouraging sight for the bulls.

Bullish structure for MOVE, but also some volume issues

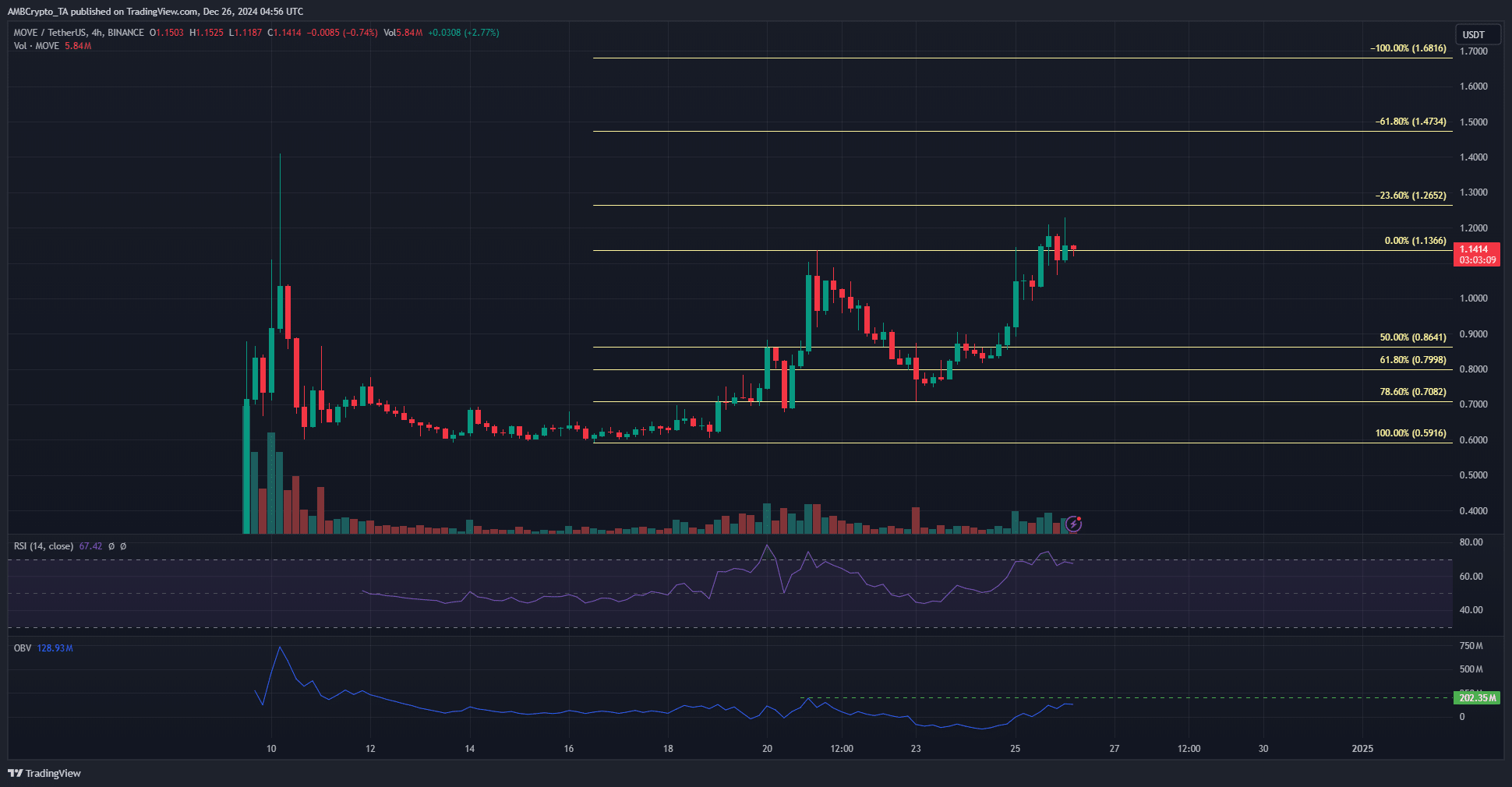

Source: MOVE/USDT on TradingView

Movement crypto’s price action was strongly bullish. After rallying from $0.59 to $1.13, it saw a retracement to $0.7, the Fibonacci level of 78.6%.

Since then, the token has rebounded strongly, helped in part by Bitcoin [BTC] short-term bullishness over the past few days.

During MOVE’s recovery, trading volume had surged higher. While this was an encouraging sight, the OBV had yet to break a local high.

This showed that buying pressure has increased, but was not yet great enough to overshadow the sales from December 20.

Therefore, although MOVE has made a new higher high, it could struggle to move higher due to insufficient volume. Meanwhile, the RSI showed momentum was clearly headed higher.

The next targets are $1.26, $1.47 and $1.68. In the short term, the $1.2 zone is a resistance area, while the $1.03-$1.05 region is a demand zone.

A drop below $0.997 would turn the structure bearish and could be an early warning of a new retracement.

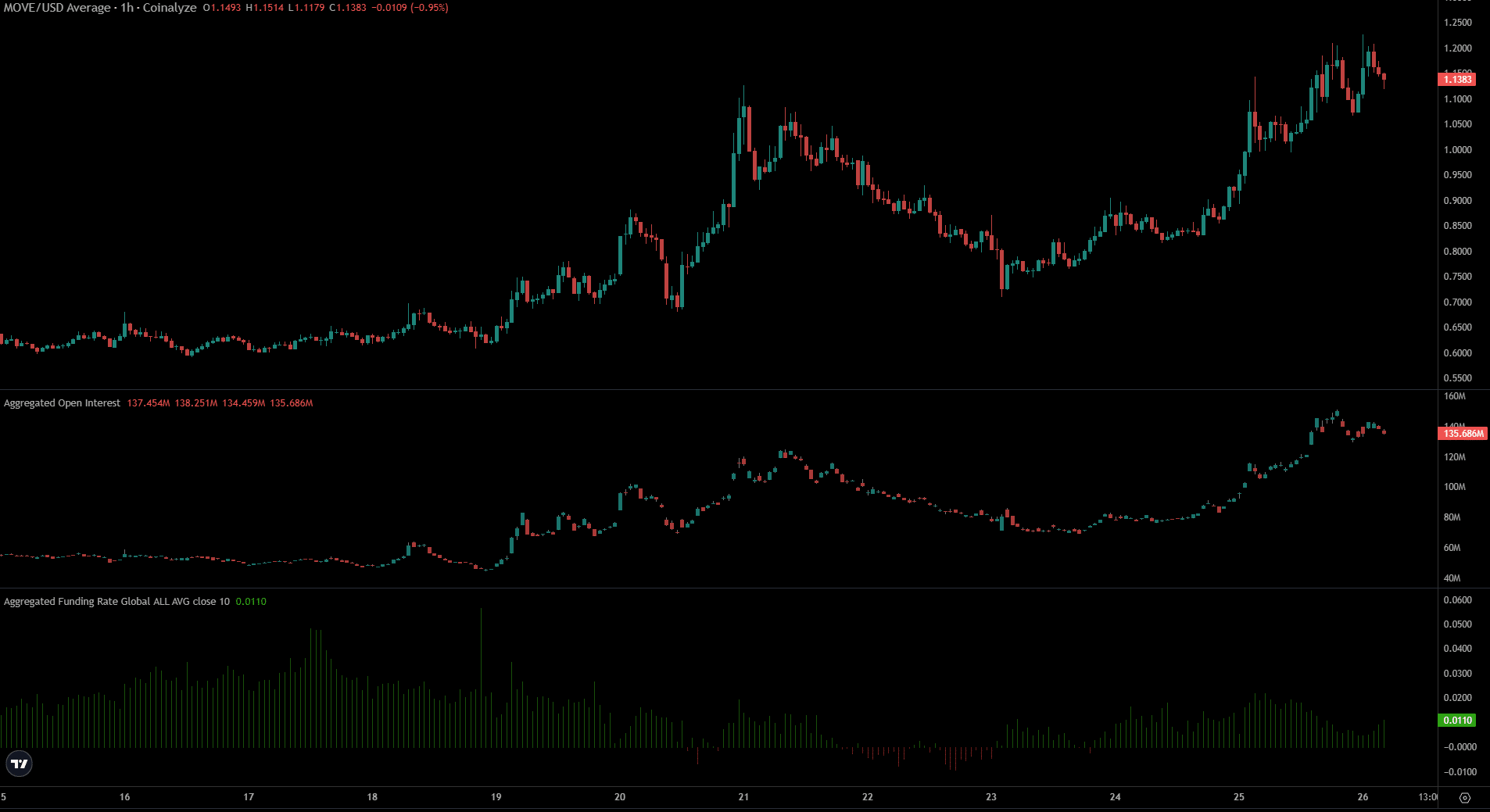

Open Interest almost doubles in three days

Since December 23, Open Interest has almost doubled, from $71.8 million to $135.68 million at the time of writing.

Read Movement [MOVE] Price forecast 2025-26

This reflected heavy bullish speculative activity as MOVE posted gains over the past three days.

The financing rate was also positive, reflecting bullish sentiment. Sustained demand in the spot market would likely help the movement token gain strength and surpass the $1.2 resistance zone.

Disclaimer: The information presented does not constitute financial advice, investment advice, trading advice or any other form of advice and is solely the opinion of the writer