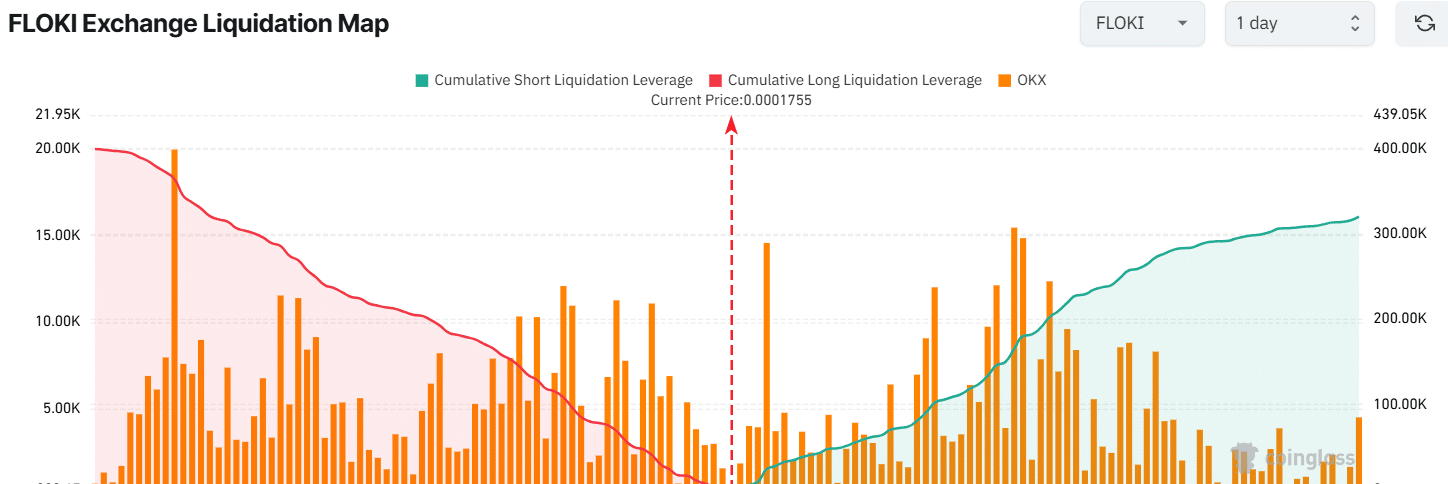

- Traders are over-indebted by almost $0.000158 at the low end and $0.000186 at the high end.

- Floki (FLOKI) could rise 15% to reach the $0.00021 mark.

Floki [FLOKI] will reverse its downtrend after the formation of a bullish price pattern. FLOKI, together with Cardano [ADA]Ripple[XRP]and Shiba Inu (SHIB), have shown a similar price recovery from December 24, 2024.

Increasing open interest

Amid the ongoing price recovery, interest from traders and long-term holders appears to be on the rise, as reported by on-chain analytics firm Coinglass. Data showed that FLOKI’s Open Interest (OI) increased by 14% in the last 24 hours.

Currently, the key liquidation levels are around $0.000158 on the downside and $0.000186 on the upside. According to Coinglass, traders are over-leveraged at these points.

Source: Coinglass

If current market sentiment remains unchanged and the price rises to $0.000186, short positions worth almost $165.35K will be liquidated.

Conversely, if sentiment changes and the price falls to $0.000158, long positions worth approximately $364.17K will be liquidated.

Combining these on-chain metrics, it appears that bulls are dominating the asset and could support the meme coin in the bull run. The rising yields and large long positions are likely driven by current market sentiment and FLOKI’s price action.

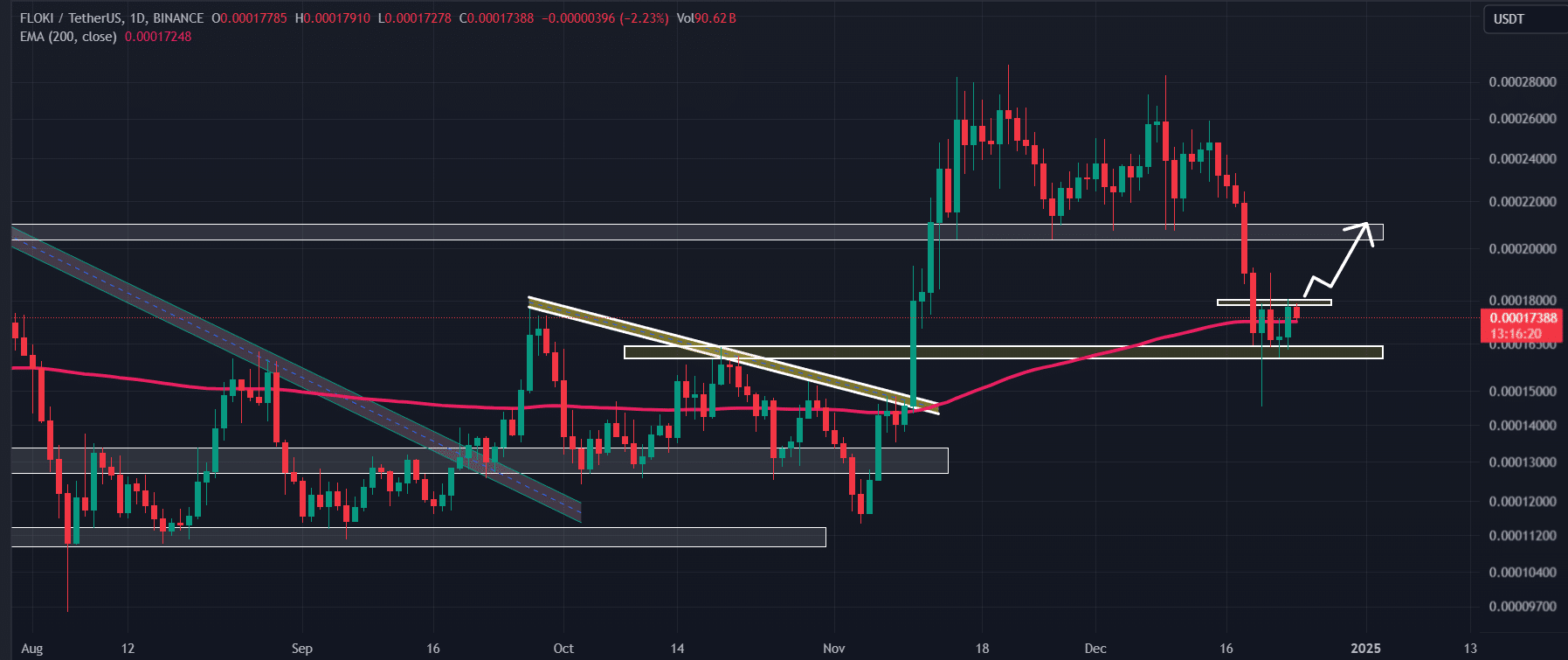

Floki’s technical analysis and key level

According to AMBCrypto technical analysis, FLOKI has formed a bullish Morning Star candlestick pattern at the crucial support level of $0.00016 and the 200 Exponential Moving Average (EMA) on the daily time frame.

Despite this bullish outlook, the meme coin is currently facing resistance around $0.000175.

Source: TradingView

Based on recent price action and historical momentum, if FLOKI breaks above the $0.000175 resistance level, it could rise 15% to $0.00021.

FLOKI’s bullish thesis only holds true if it closes a daily candle above $0.000175. Otherwise it may fail.

Realistic or not, here is FLOKI’s market cap in BTC terms

At the time of writing, FLOKI was trading around $0.000175 and experiencing upward momentum of over 3.2% over the past 24 hours.

During the same period, trading volume fell by 14%. This indicates lower participation from traders and investors compared to the day before.