- The $0.88 support level for ADA remains crucial as technical indicators point to a possible rebound.

- Market sentiment shows indecisiveness, but a breakout above $0.88 could create bullish momentum.

Cardano [ADA] continues to face volatile market conditions, leaving traders on edge about its future trajectory. At the time of writing, ADA was trading at $0.8811, down 1.12% in the past 24 hours.

This decline underlines the importance of key metrics and technical levels in shaping the next step.

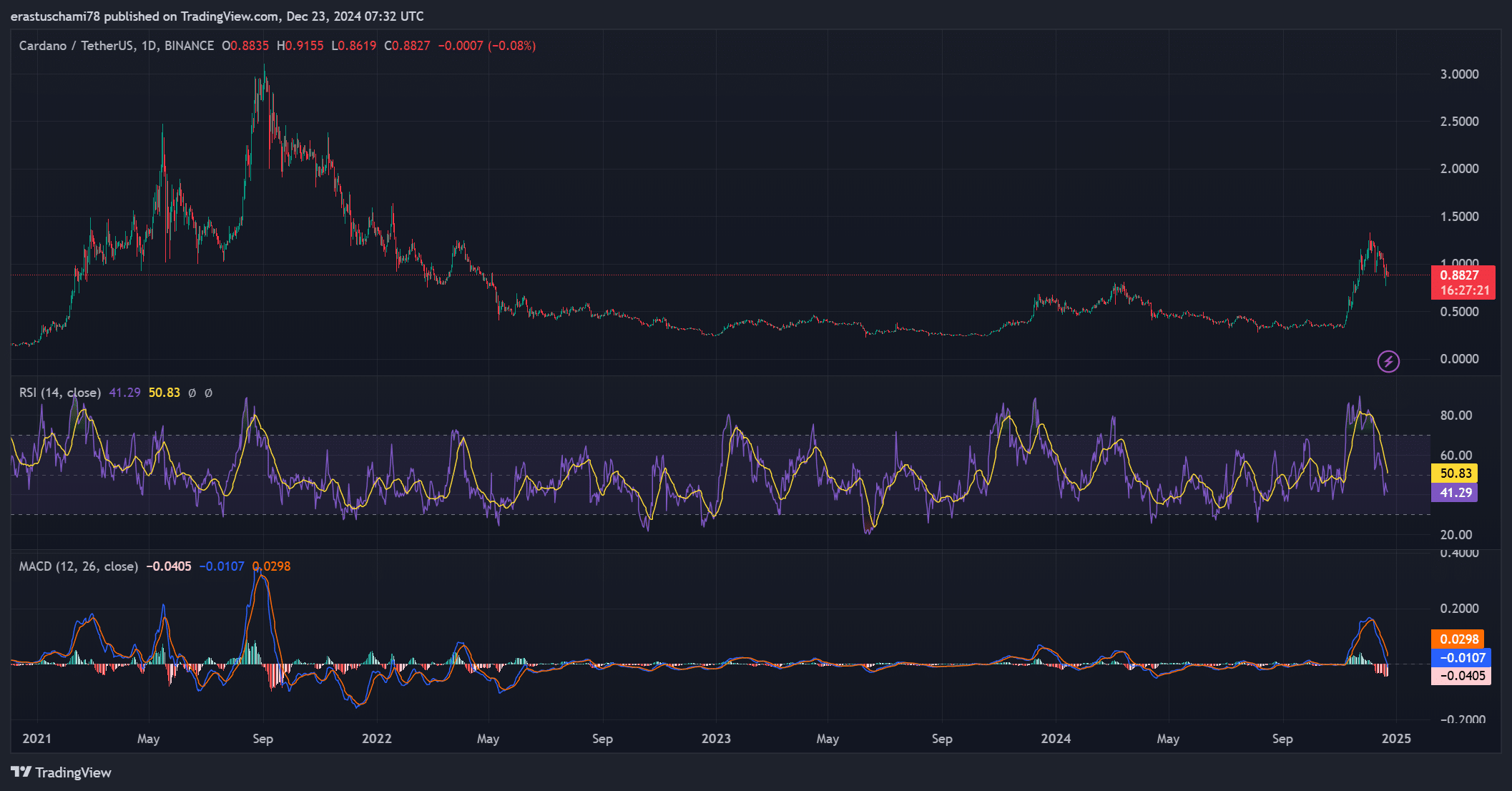

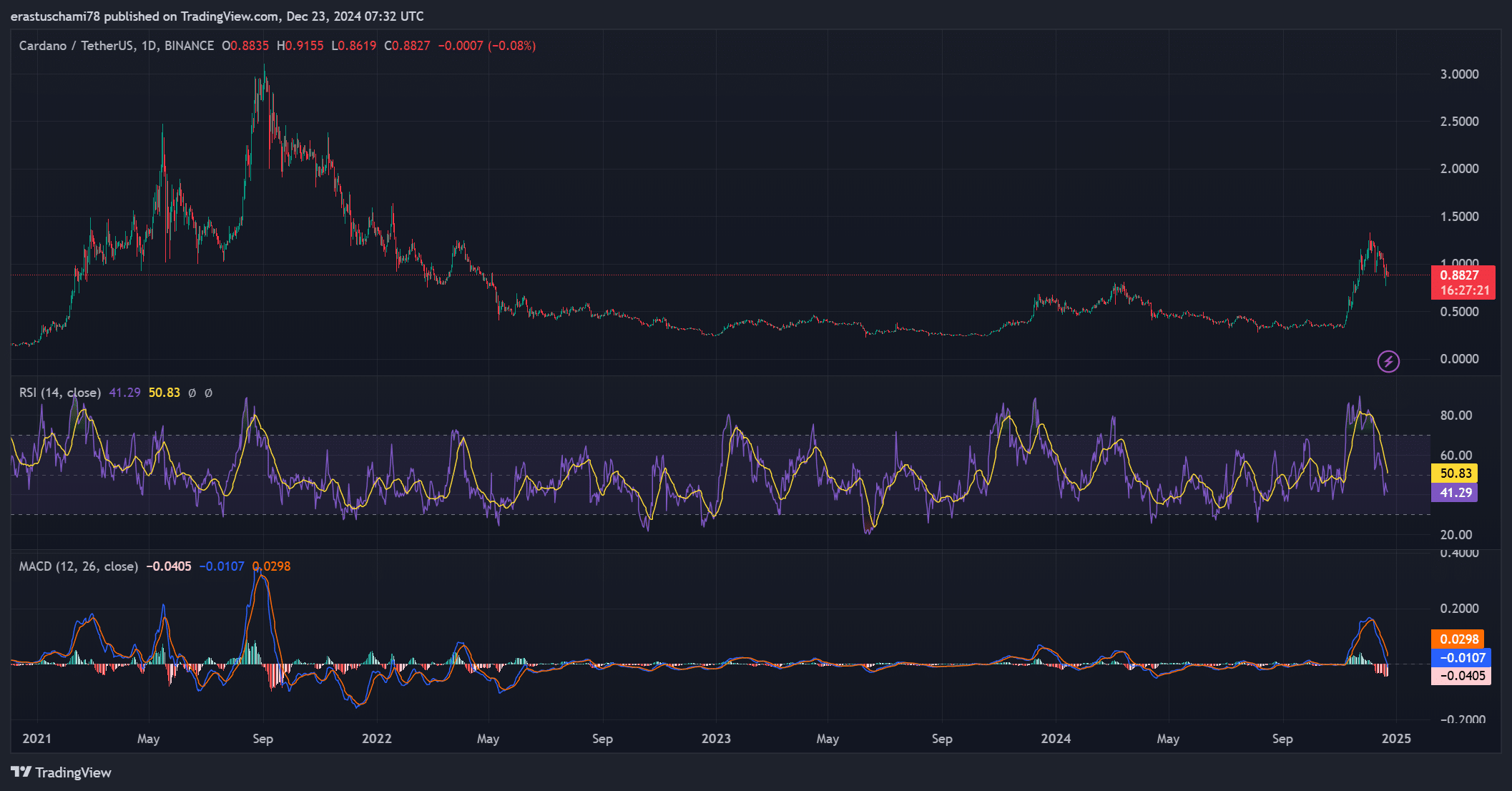

ADA Price Action Analysis

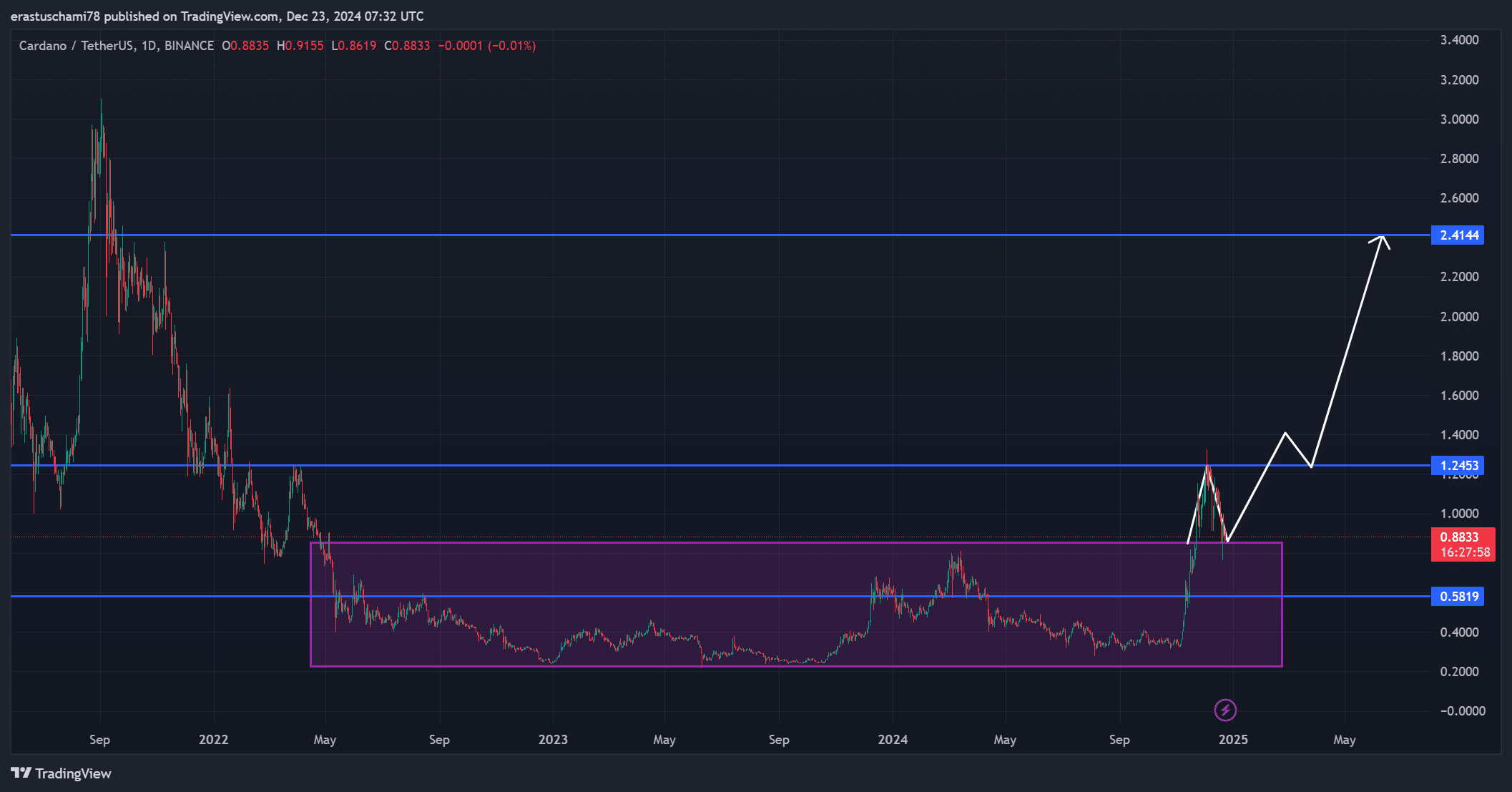

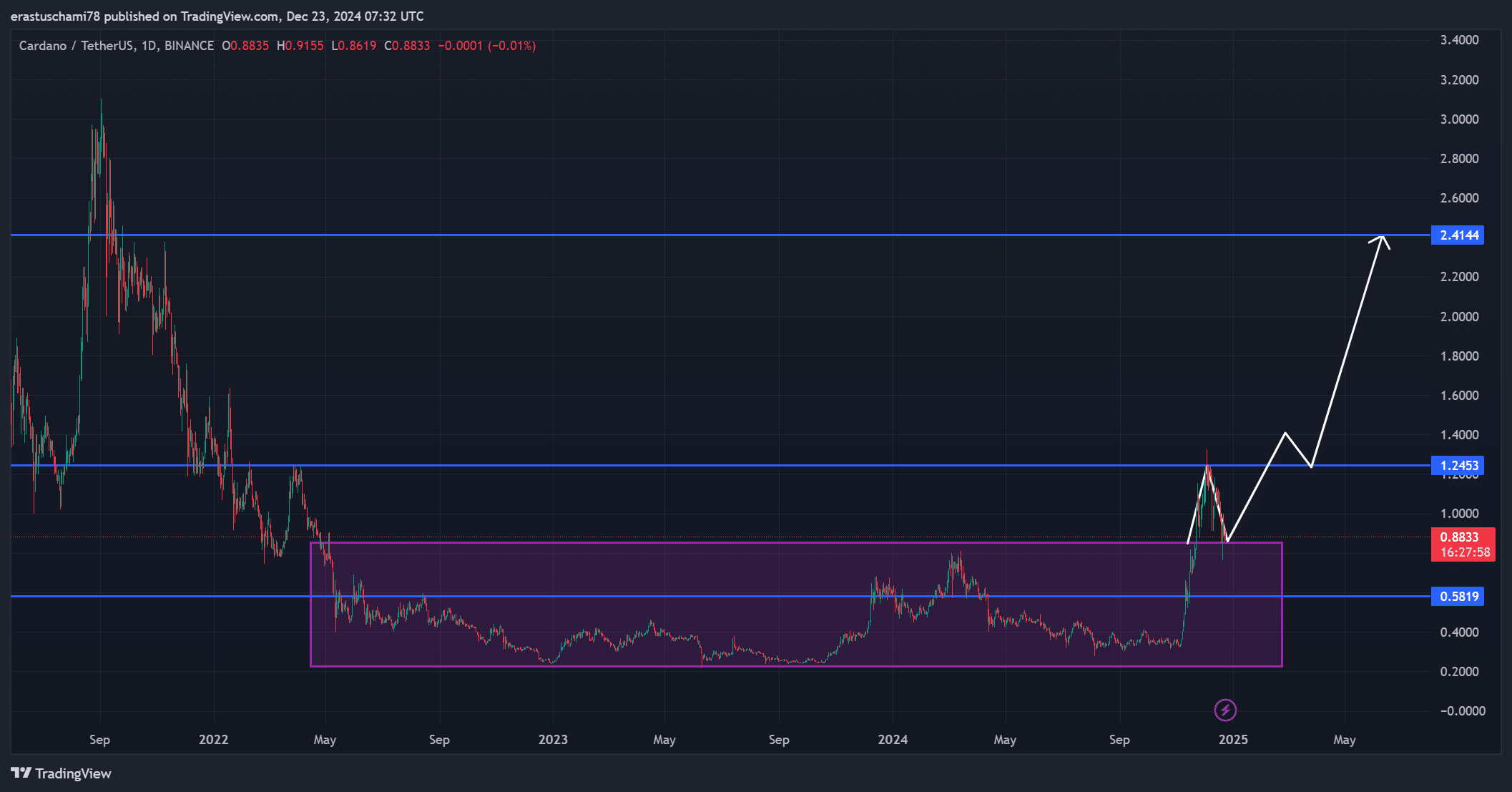

Cardano’s price shows a critical trade-off between consolidation and breakout phases. After spending much of 2023 between $0.58 and $0.88, the ADA rose toward $1.25 earlier this year but was rejected by this resistance.

Now back near $0.88, this level serves as a vital support zone. If the ADA holds here, it could stage a recovery towards $1.25, eventually aiming for $2.41 as momentum builds.

However, if this level is not maintained, it could lead to a decline towards the $0.58 range. Therefore, ADA’s ability to maintain support at $0.88 will be crucial for price direction.

Source: TradingView

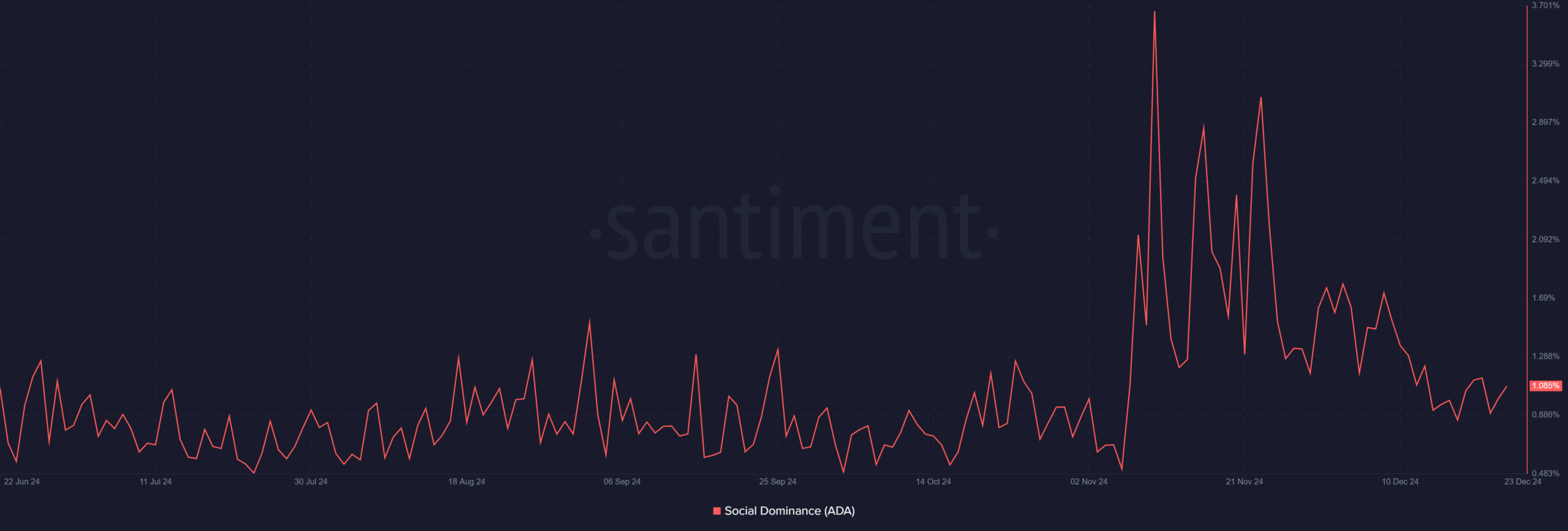

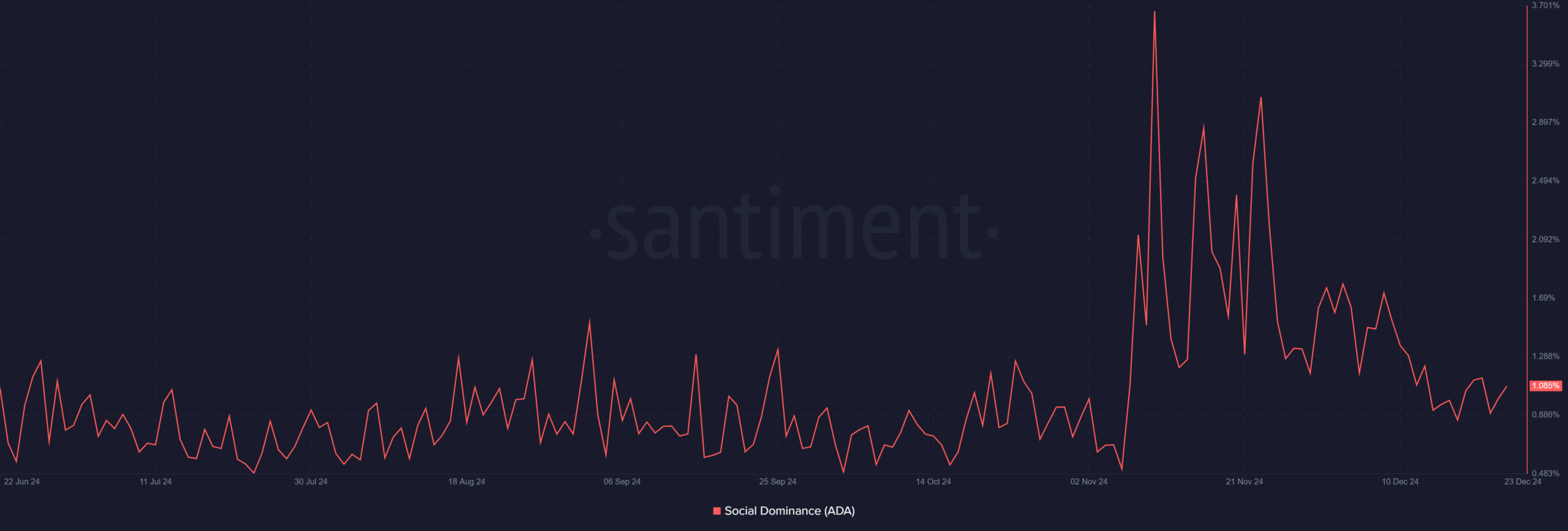

Analysis of ADA social statistics

ADA’s social dominance shows a slight increase, rising to 1.08%. While not a huge increase, it does reflect the growing interest and discussions around Cardano among the crypto community.

Historically, greater social engagement has often been associated with price movements. Furthermore, consistent social dominance could indicate renewed investor confidence, which would further fuel price action.

Source: Santiment

Technical indicators point to a possible reversal

The RSI currently stands at 41.29, indicating that the ADA is approaching oversold territory. This metric often signals an impending price recovery as selling pressure eases and buyers regain control.

Meanwhile, the MACD is showing bearish momentum, but the histogram suggests that the bearish trend is weakening. A possible crossover in the MACD lines could further confirm a shift towards bullish sentiment. Therefore, close monitoring of these indicators will be essential.

Source: TradingView

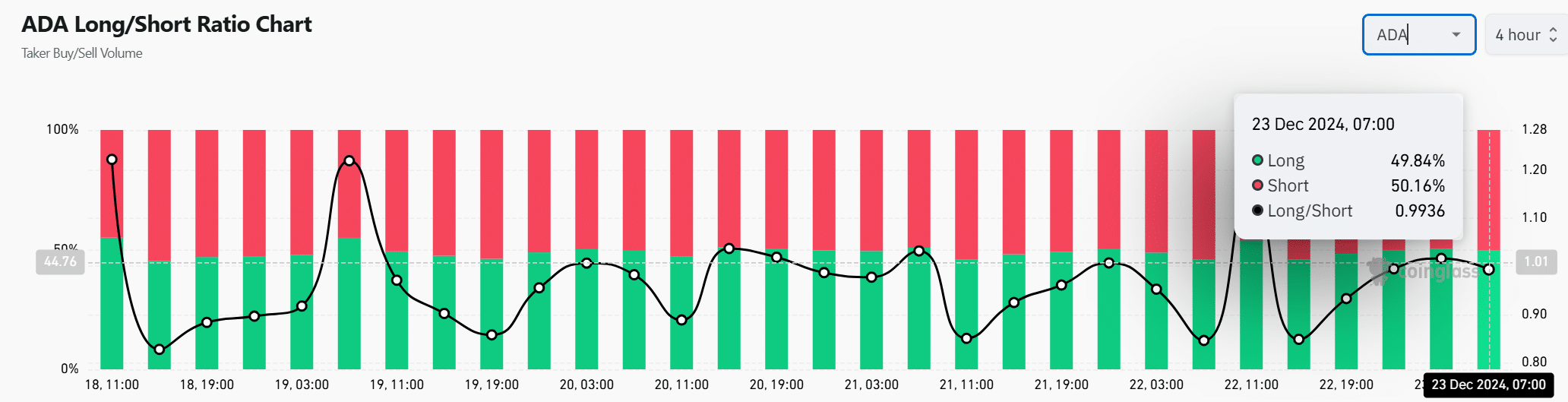

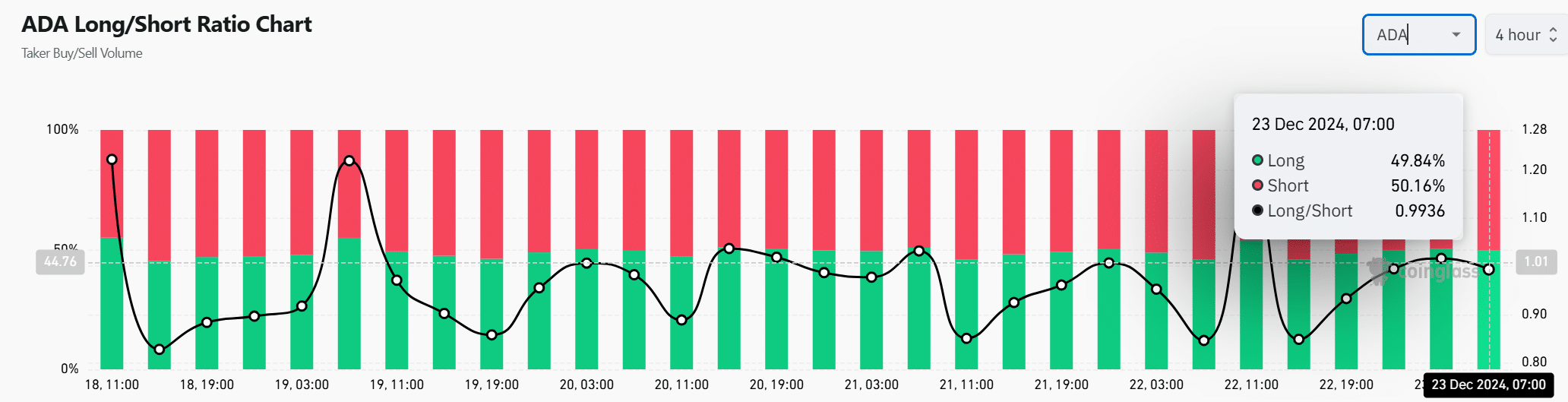

ADA long/short ratio and market sentiment

The long/short ratio for ADA is 0.9936, with short positions slightly better than long positions at 50.16%. This almost even split reflects the indecisiveness of the market.

However, any break above $0.88 could see long positions increase as traders anticipate a bullish breakout. Conversely, failure to hold support could reinforce bearish sentiment.

Source: Coinglass

Read Cardanos [ADA] Price forecast 2023-24

ADA’s future depends on its ability to hold the $0.88 support level. If so, a rise to $1.25 is likely, with the potential to reach $2.41 in the coming months. However, a breakdown could see the price retest at $0.58, delaying a bullish recovery.

For now, Cardano remains in a critical phase where patience and key-level monitoring are essential.