- Positioning for altcoins? These bearish signals call for caution.

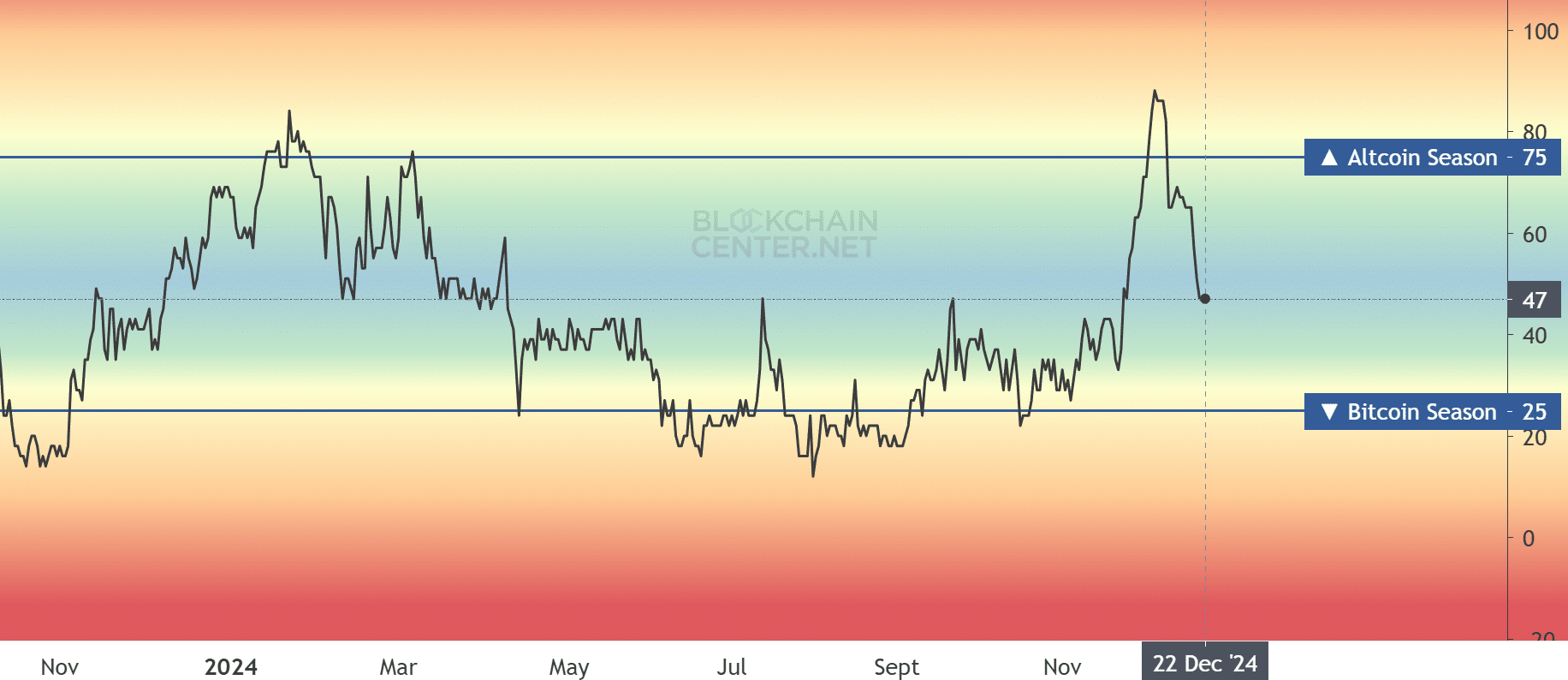

- The altcoin seasonal index fell below 50%, marking a new monthly low.

Altcoins are getting huge discounts after the recent market sale Bitcoins [BTC] correction.

These discounts have led some analysts to call for ‘buying the dip’. But on-chain analyst and founder of Alphractal, Joao Wedson, has sounded a warning to altcoin traders. He said,

“The best strategy is to stay in Stablecoins, and not in BTC or any Altcoins. Recent trends in performance and dominance are not favorable. The ideal exit was when BTC was above $106,000 – time to exit everything!”

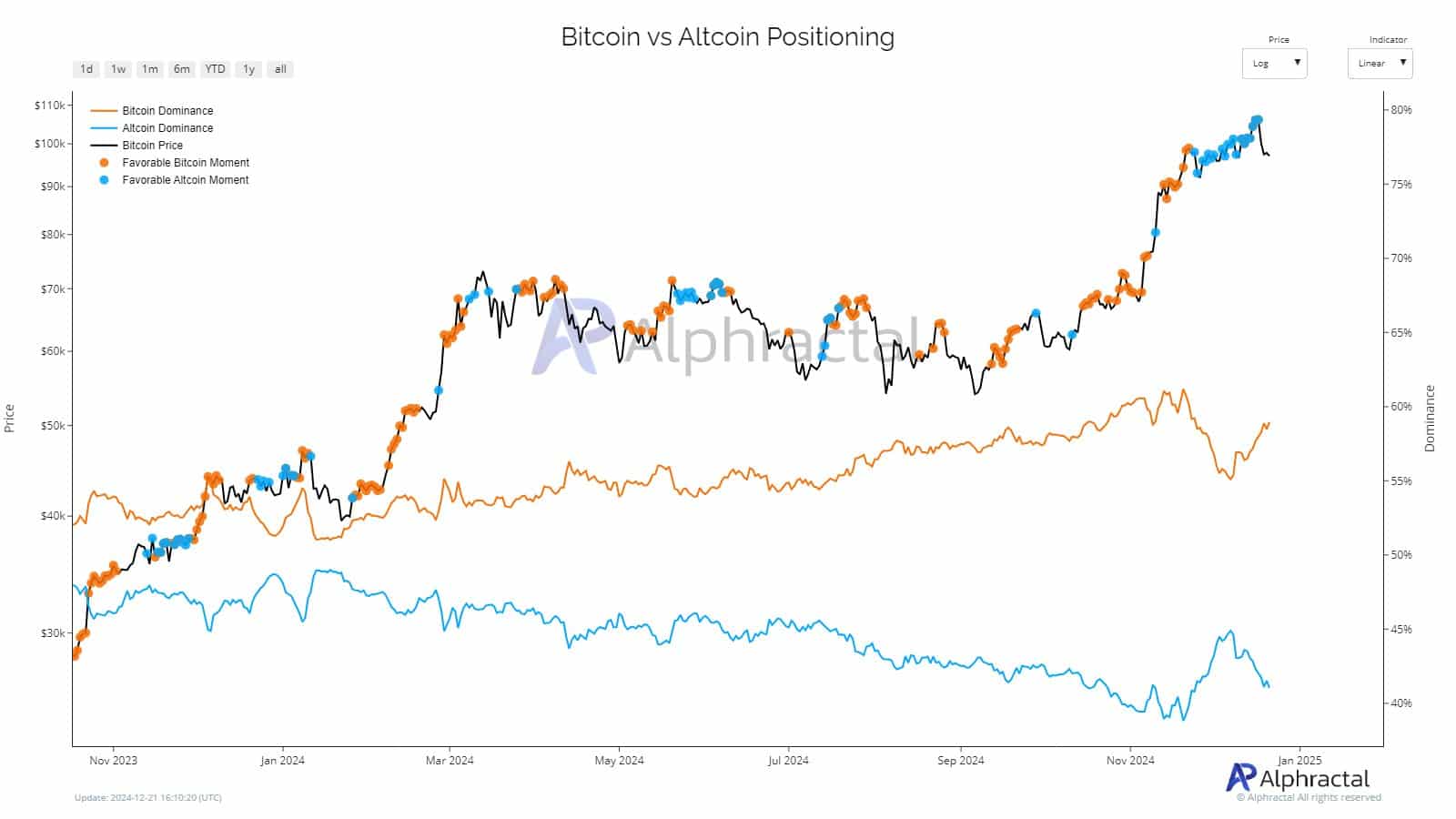

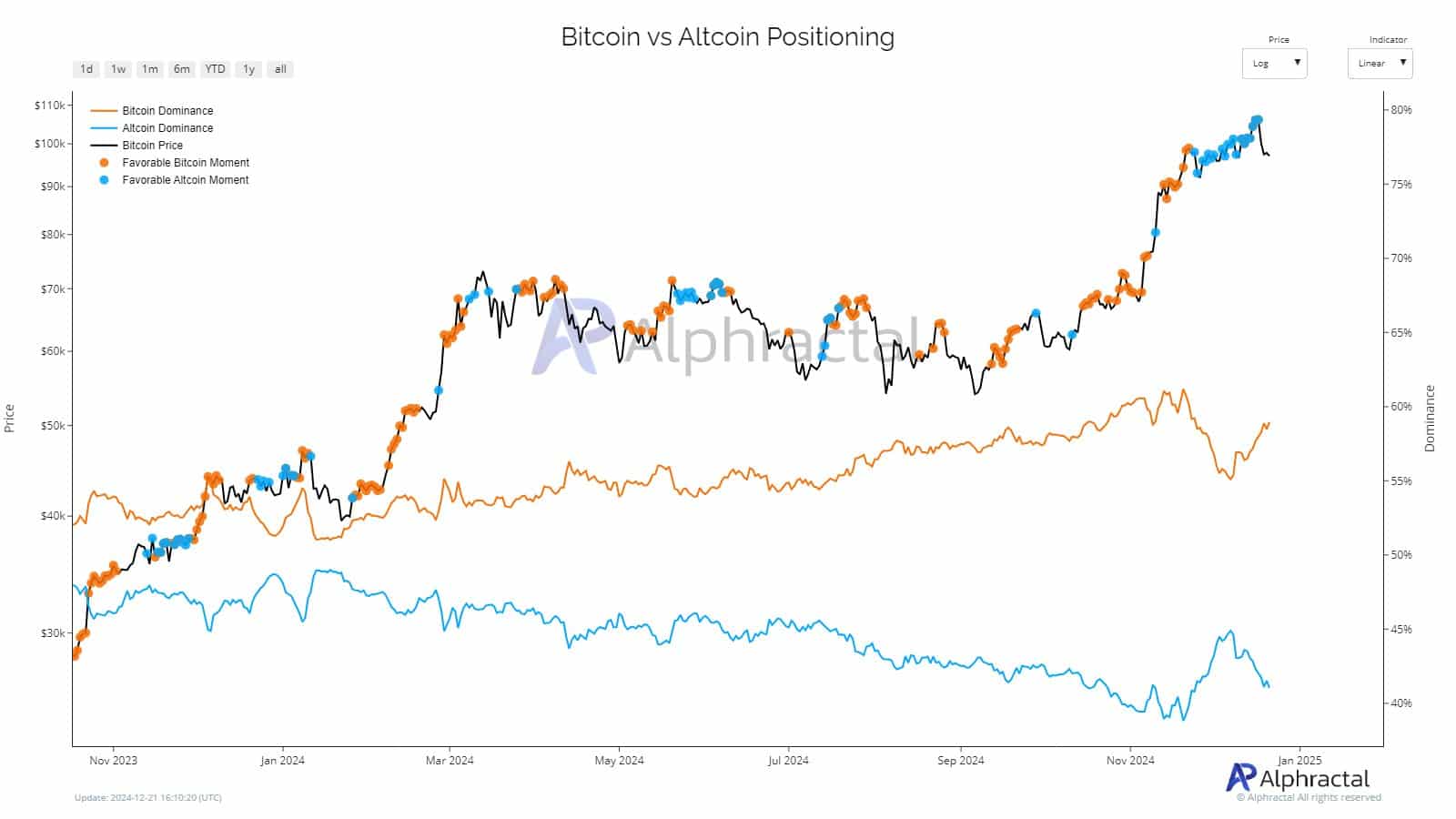

Source: Alpharactal

Wedson cited a rise in Bitcoin versus altcoin positioning, which meant more capital flowing from altcoins into BTC and stablecoins.

Is it time to buy altcoins?

According to Wedson, BTC’s dominance marked a low above 54% and could strengthen in the coming weeks and months. He projected the scenario as ‘terrible for altcoins.’

He added that the altcoin scenario was made even worse as BTC’s 90-day dominance change turned positive for the first time since November’s wild altcoin rally.

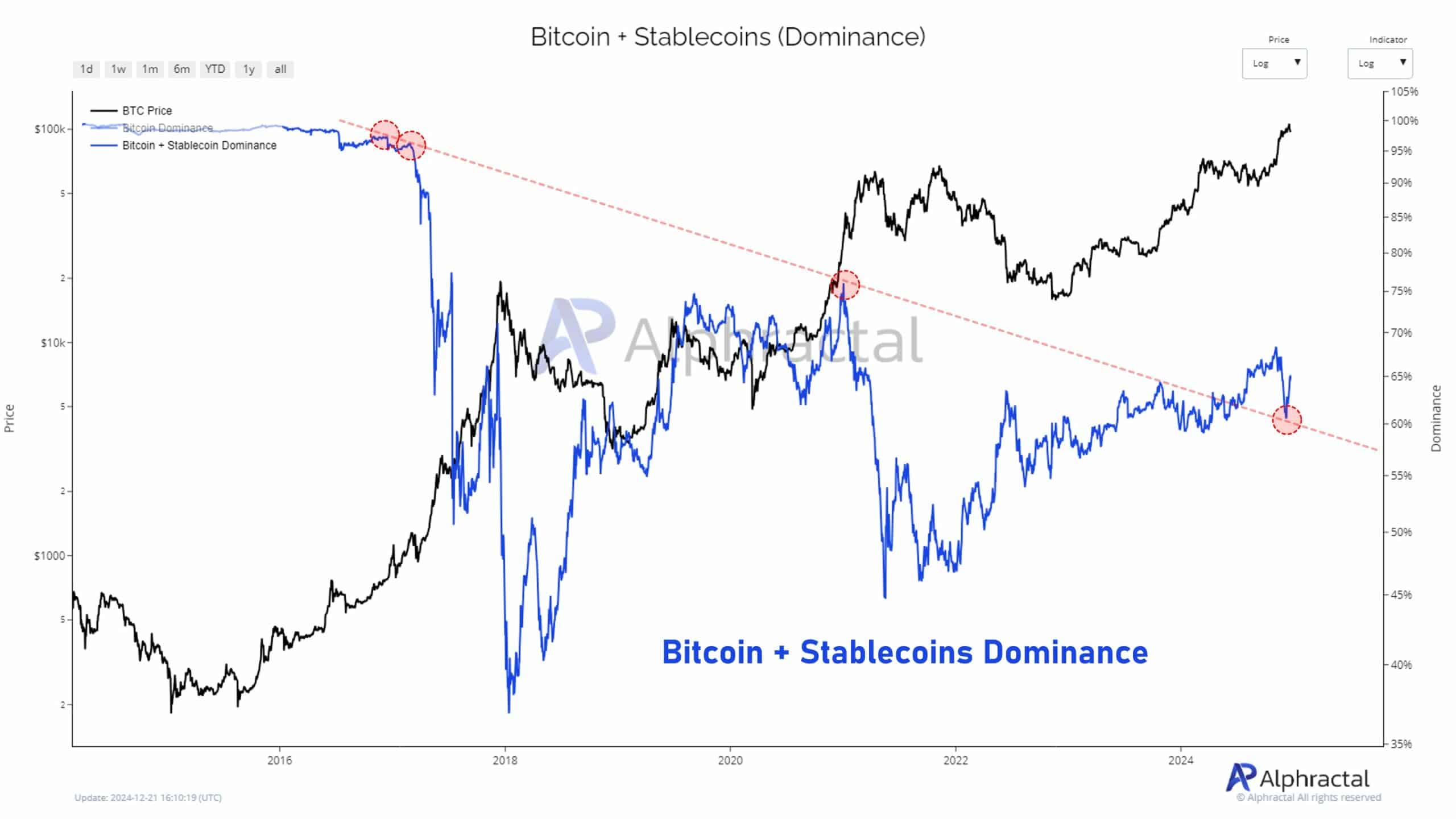

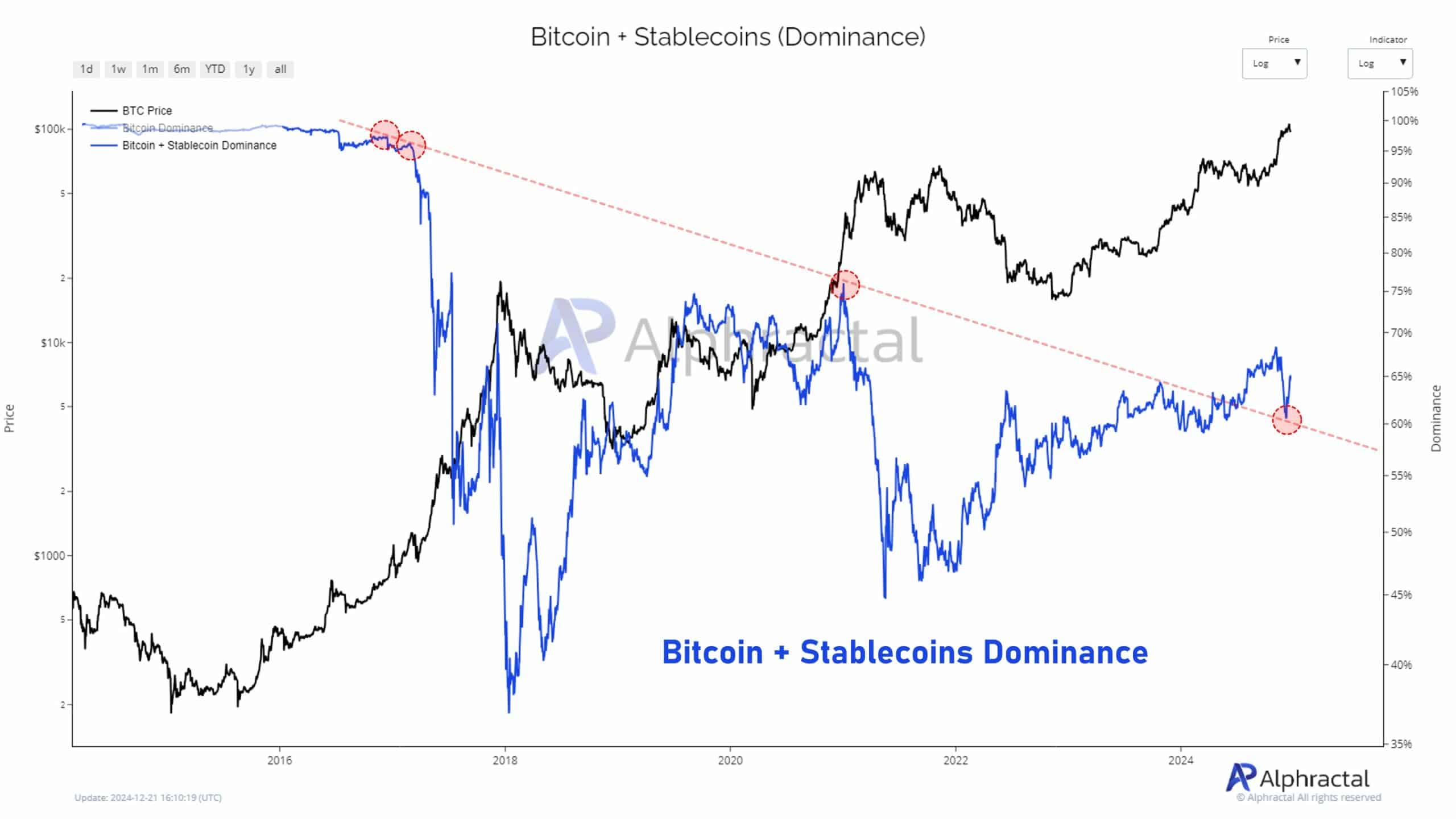

Source: Alpharactal

In short, the altcoin sector may not recover strongly from the recent correction. Most top and mid-cap altcoins are down 10%-30% over the past week.

Ripple [XRP] And Cardano [ADA] saw huge dumps among the top altcoins. XRP fell almost 10% but remained above $2. On the contrary, ADA lost 18% and fell below $1 during the same period.

Interestingly enough, Ethereum [ETH] held the mess much better. It fell only 6% but defended $3.5K as support.

Other outliers like it, though Hyperfluid [HYPE] And Pudgy penguins [PENGU] increased by 40% and 425%.

That said, the altcoin sector’s overall performance slowed even further, with the Altcoin Season Index falling to a monthly low of 50%.

Source: Blockchain Center

Will the expected ‘Santa rally’ boost altcoins’ prospects? Well, that remains to be seen as the available data was clearly leaning towards bears. A potentially strong one nonetheless bounce back in 2025, interest in the altcoin market could renew.