- Analysts highlighted growing demand in the spot market as futures activity cooled, supporting Bitcoin’s upward momentum.

- Bitcoin’s MVRV ratio of 2.69 and rising Open Interest suggested further potential for price growth.

Bitcoin [BTC] continues to dominate headlines as it continues to do so upward momentumand recently hit a new all-time high of $107,822.

This latest milestone highlighted Bitcoin’s impressive performance to date, which was over 150% at the time of writing.

However, after reaching this peak, the asset underwent a modest correction and traded at $107,064. This reflected a slight decline of 0.6% from the recent high, but still represented a 2% gain over the past day.

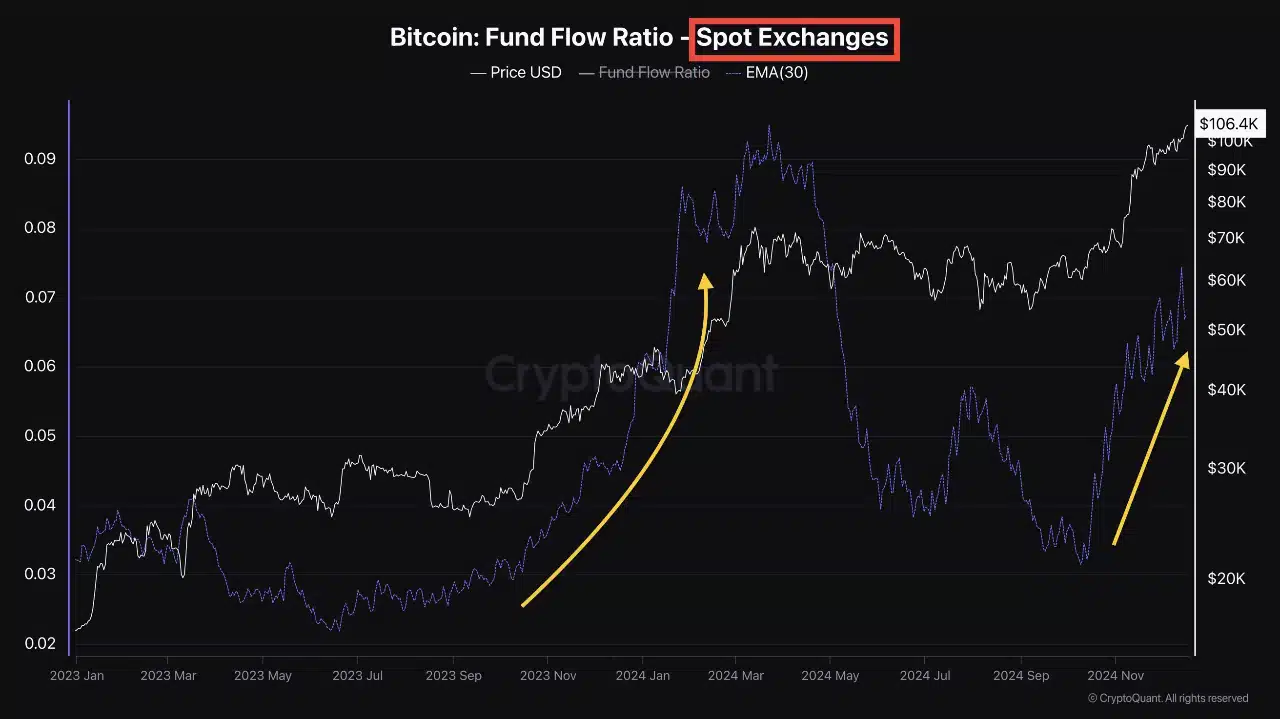

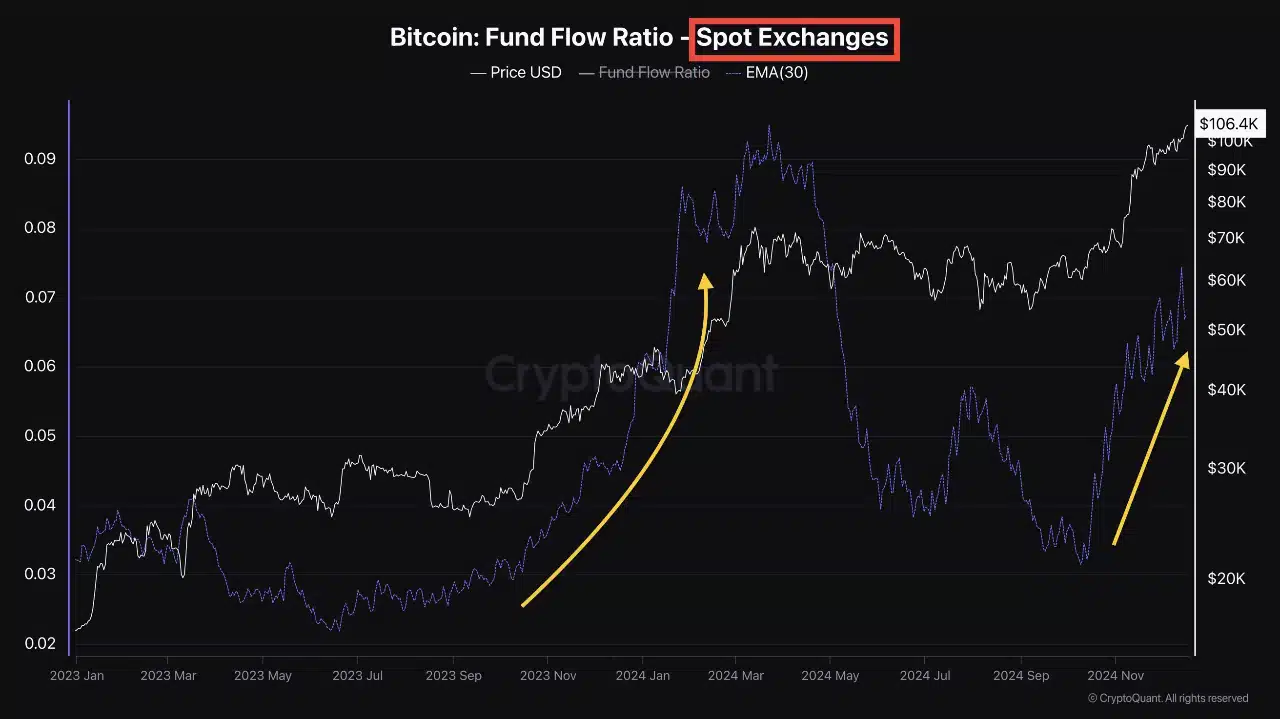

Amid this price performance, a recent analysis of CryptoQuant shed light on the underlying market forces contributing to the current rally, highlighting the increasing role of spot market demand in supporting Bitcoin price growth.

Spot market demand is driving Bitcoin’s momentum

According to the CryptoQuant analyst, Bitcoin’s ongoing bull cycle, which began in early 2023, was initially fueled by speculative activity in the futures market.

However, since October 2024, the trend has shifted as both the spot and futures markets saw an increase in trading volumes, leading to further upward momentum in Bitcoin’s price.

Source: CryptoQuant

More recently, as activity in the fFutures market begins to cool, the spot market is gaining dominance.

This shift signals that buying pressure from long-term investors and retail participants is increasing, reducing the speculative surplus and creating a stronger foundation for sustainable price growth.

The analyst also pointed out that the funding rate, analyzed using a 30-day exponential moving average (EMA), shows no signs of late-cycle overheating.

This indicates that Bitcoin’s bullish trajectory has room for further expansion without immediate signs of correction.

The report further suggests that while the Futures market is likely to experience cycles of increased activity and liquidations, this volatility could attract additional capital inflows into the spot market.

Growing optimism

In addition to the surge in spot market demand, other key Bitcoin metrics further confirmed the asset’s positive outlook.

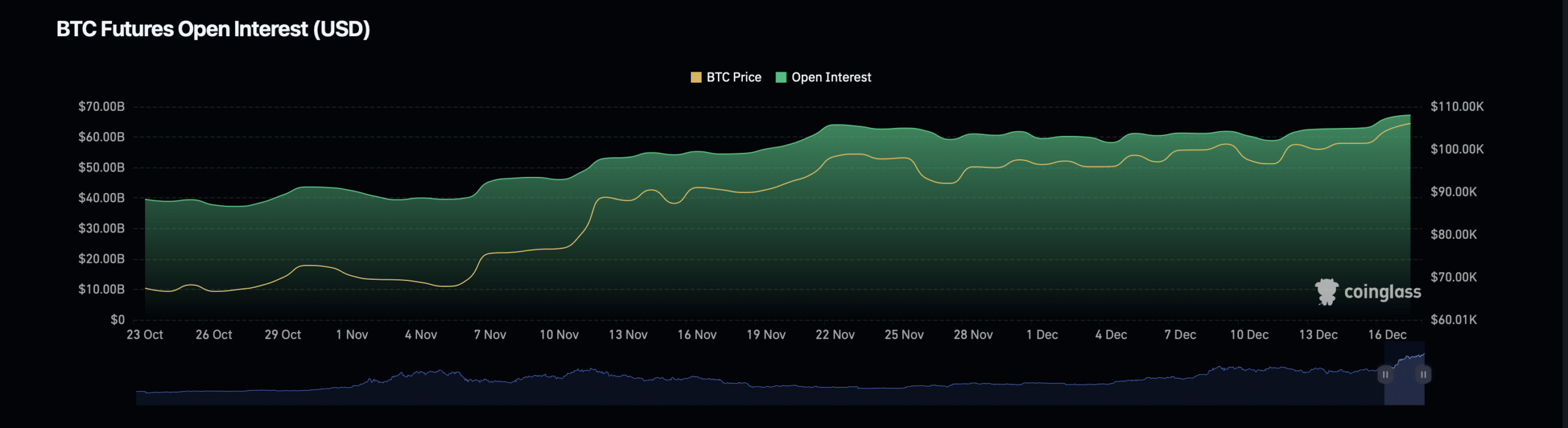

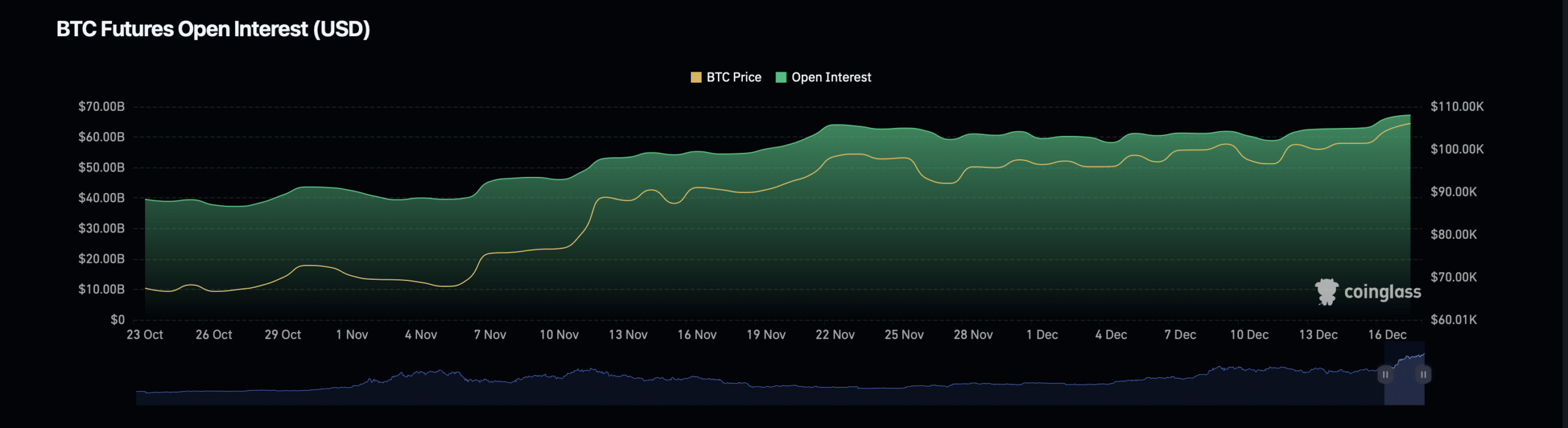

Facts from Coinglass revealed that Bitcoin’s Open Interest – a measure of the total value of outstanding Futures contracts – has risen alongside its price.

Source: Coinglass

Specifically, BTC open interest rose 2.56% to $68.82 billion, while longer-term data showed a substantial increase of 19.13%, bringing the total to $100.63 billion.

Rising open interest generally indicates increasing market activity and investor confidence in Bitcoin’s future price movement.

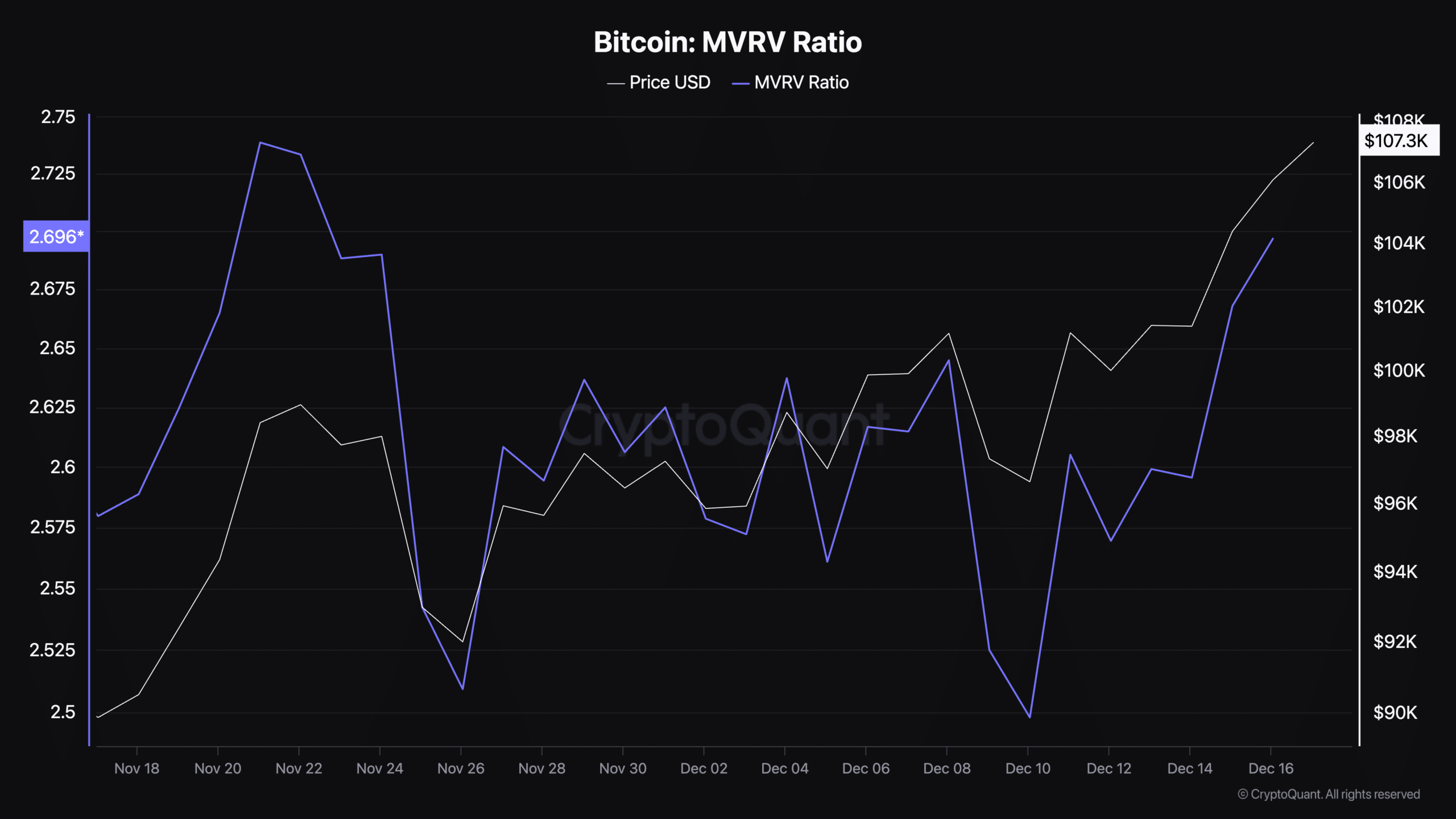

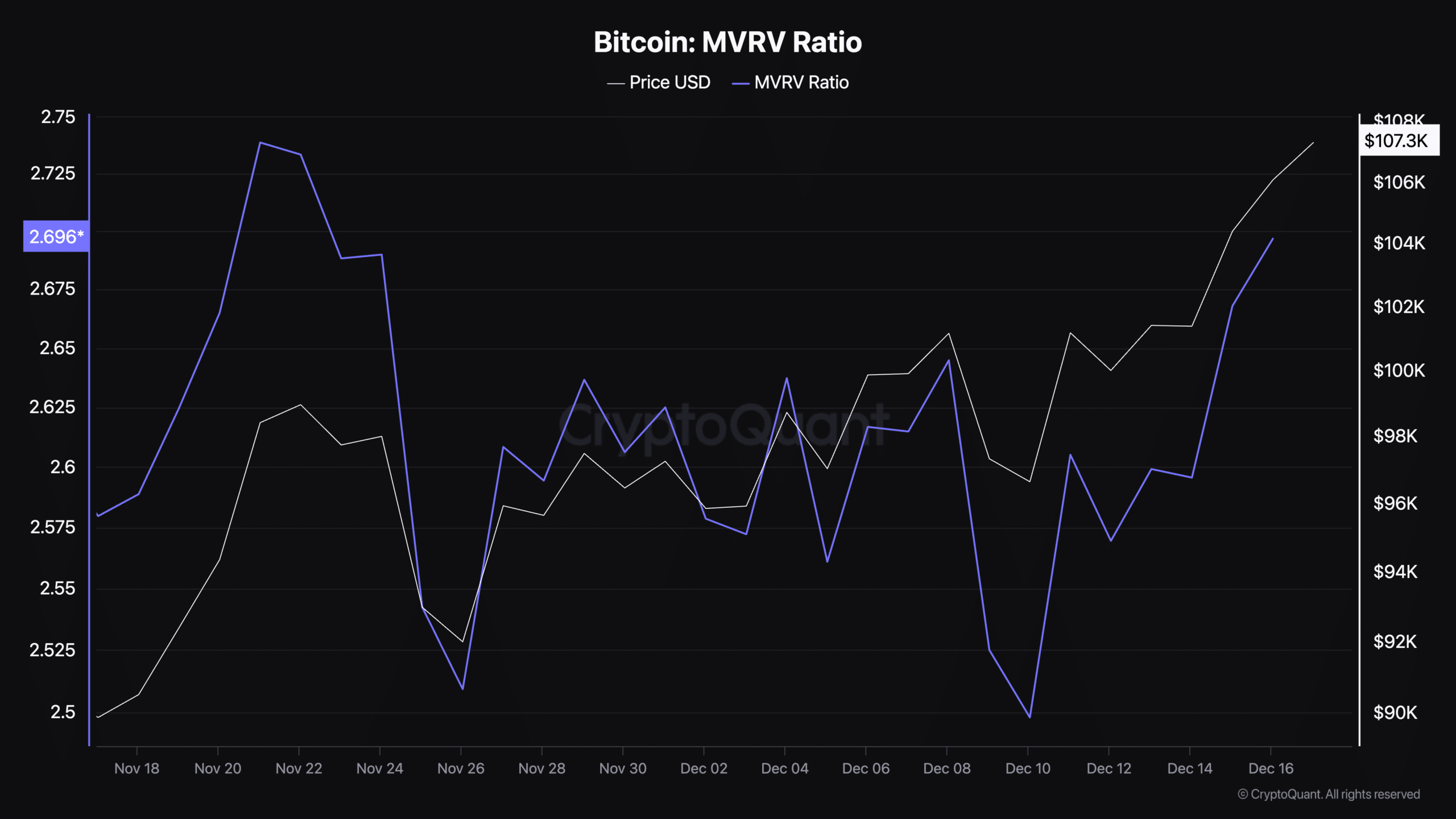

Additional, CryptoQuant Data highlights Bitcoin’s market value to realized value (MVRV) ratio, which rose to 2.69 on December 16.

The MVRV ratio is an important metric in the chain used to evaluate whether an asset is overvalued or undervalued relative to its realized value.

Source: CryptoQuant

Read Bitcoin’s [BTC] Price forecast 2024–2025

An MVRV ratio above 2.5 indicates that Bitcoin is in a strong bull phase, but it also suggests that investors could start taking profits soon.

Historically, MVRV values have signaled above 3 market peaks, so the current level of 2.69 suggests that Bitcoin still has room for upside, while indicating that traders should be cautious.