- The bull flag pattern indicated a break towards altcoin’s $2,168 resistance

- At the time of writing, net flows showed a positive change of +$34.8k in just 24 hours

ApeCoin has shown promising signs of growth lately, fueled by a rise in market activity and bullish technical indicators. In fact, the altcoin’s price rose 3.24% in 24 hours to trade at $1.61 at the time of writing.

On the numbers front, an increase in high transaction volume and positive net flows indicated strengthening market sentiment. On the other hand, a bull flag pattern on the charts indicated a breakout to higher resistance levels.

As a result, many ApeCoin traders now expect a near-term increase in the altcoin’s value.

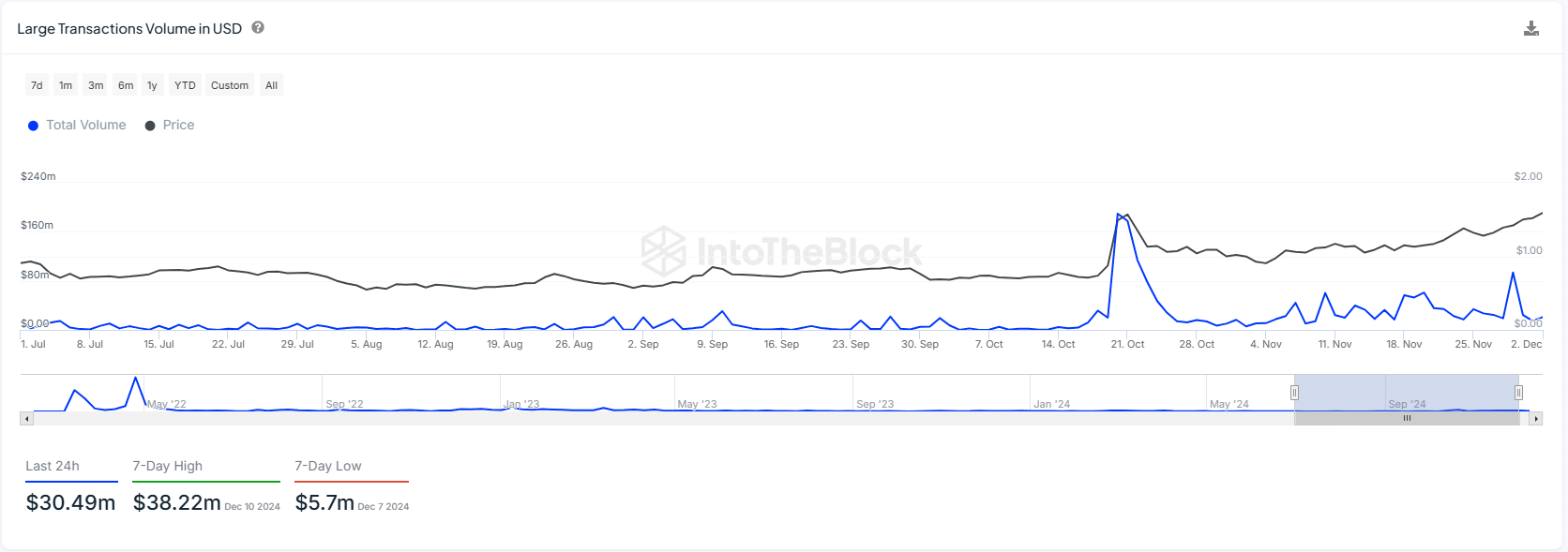

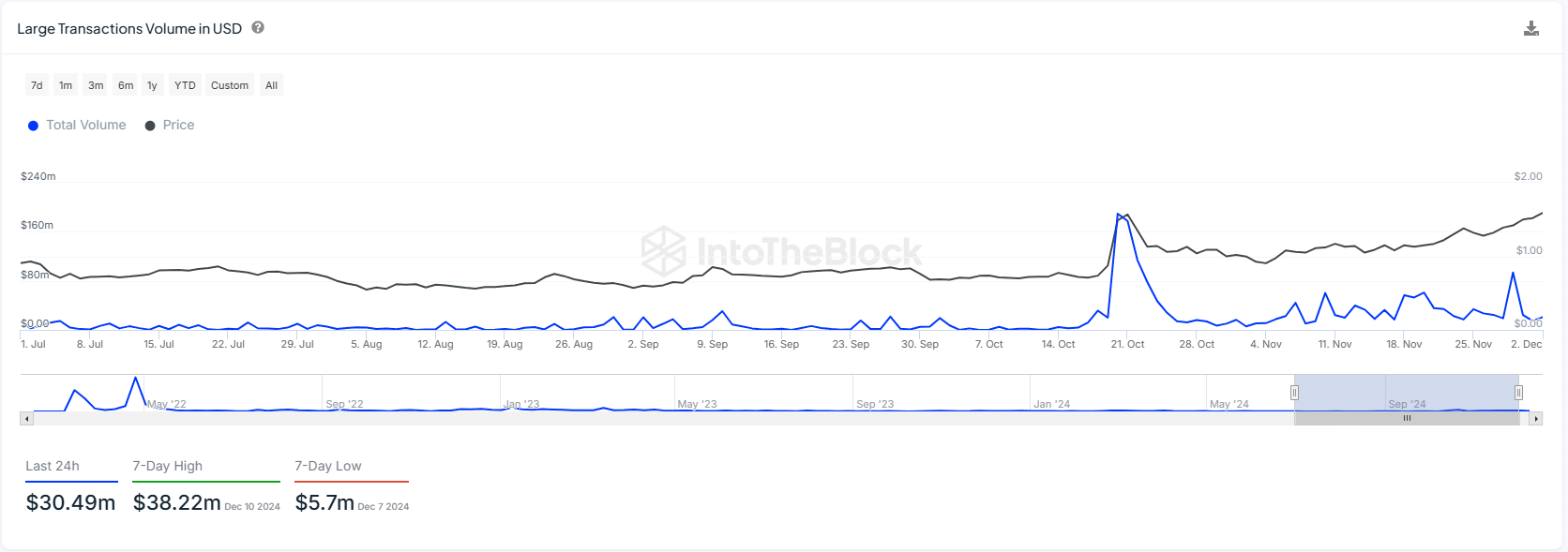

The large transaction volume continues to increase

ApeCoin’s recent performance has been marked by high transaction volumes, indicating strong investor interest. In the last 24 hours alone, major transactions amounted to $30.49 million, peaking at $38.22 million on December 10.

Source: IntoTheBlock

In recent months, the token has consistently attracted large transactions, demonstrating increased attention from institutional and large investors.

This growing market interest likely contributed to the steady increase in ApeCoin’s price, especially in late October and early December.

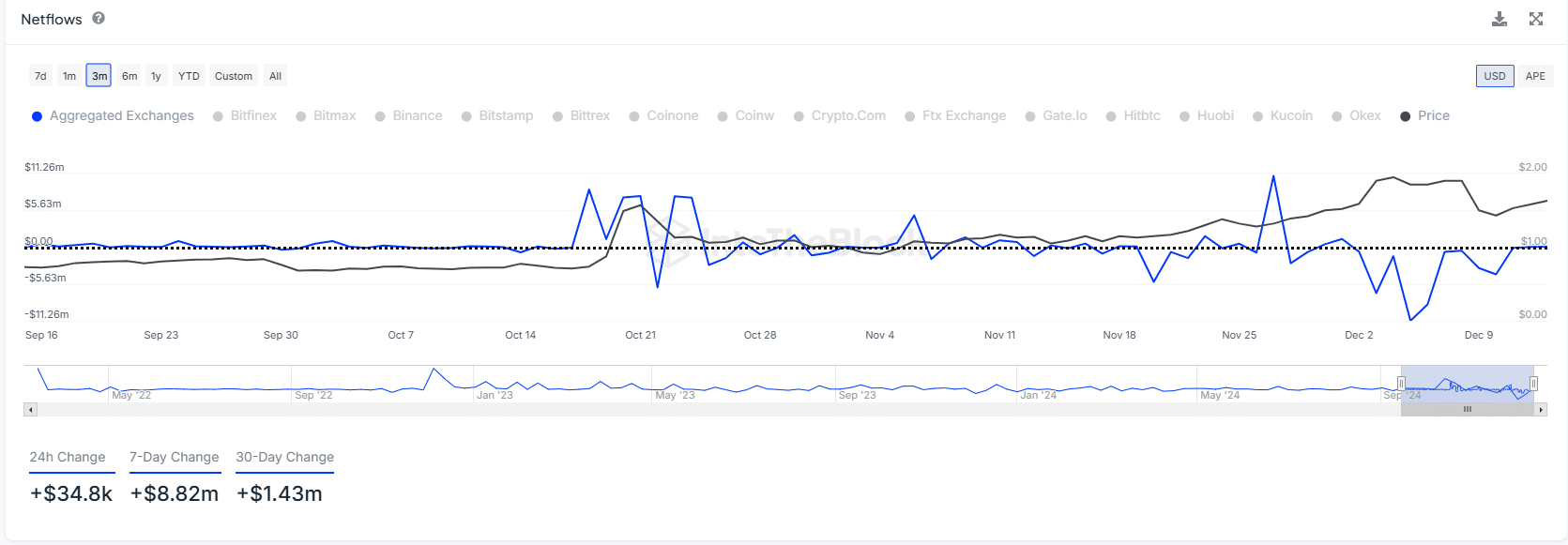

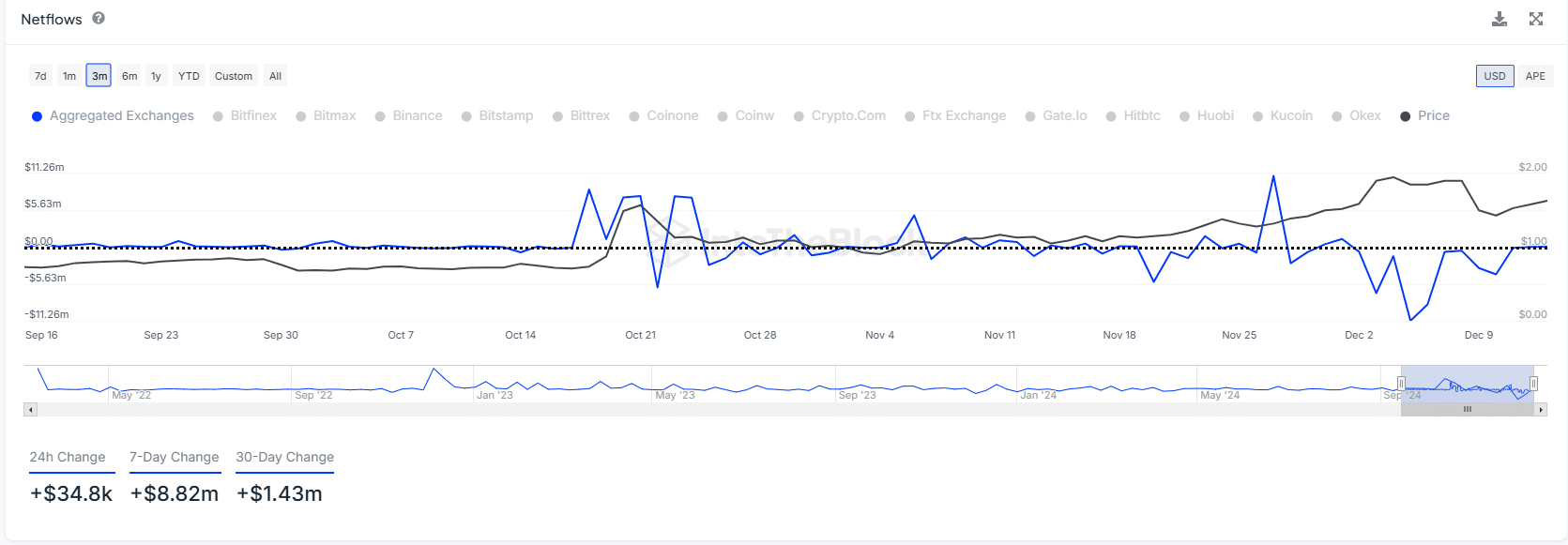

ApeCoin’s net flows underline the growing confidence

The increase in ApeCoin’s net flows further highlighted the growing confidence in the token. Over the aforementioned period, net flow showed a positive change of +$34.8k, with a significant increase of +$8.82m in the past week.

These moves are a sign of increased demand for the altcoin, especially as more investors are now moving money into ApeCoin.

Source: IntoTheBlock

The larger trend over the past month revealed net flows totaling +$1.43 million – a figure that closely matches the price increase, reinforcing the bullish outlook for ApeCoin.

The Bull Flag pattern indicates a breakout

At the time of writing, technical indicators also pointed to a bullish outlook for ApeCoin. For example, the 4-hour chart showed a classic bull flag pattern, indicating that a breakout could occur. The flagpole is followed by a period of consolidation, during which the price stabilizes before rising above the key resistance levels.

The Adaptive Volatility-Controlled LSMA at $1,463 acted as a dynamic support zone, keeping the structure intact for a breakout.

If ApeCoin breaks above $1.66, it would confirm the continuation of the uptrend.

Source: Tradingview

The Relative Strength Index (RSI) stood at 51.39, showing neutral momentum with no signs of overbought or oversold, leaving room for more gains. Additionally, the Awesome Oscillator (AO) flashed green bars – a sign of mild positive momentum.

If this pattern holds, the price could rise towards the USD 2,168 resistance level. However, a breakdown below $1.54 could signal a bearish reversal towards the key support level at $1.32.

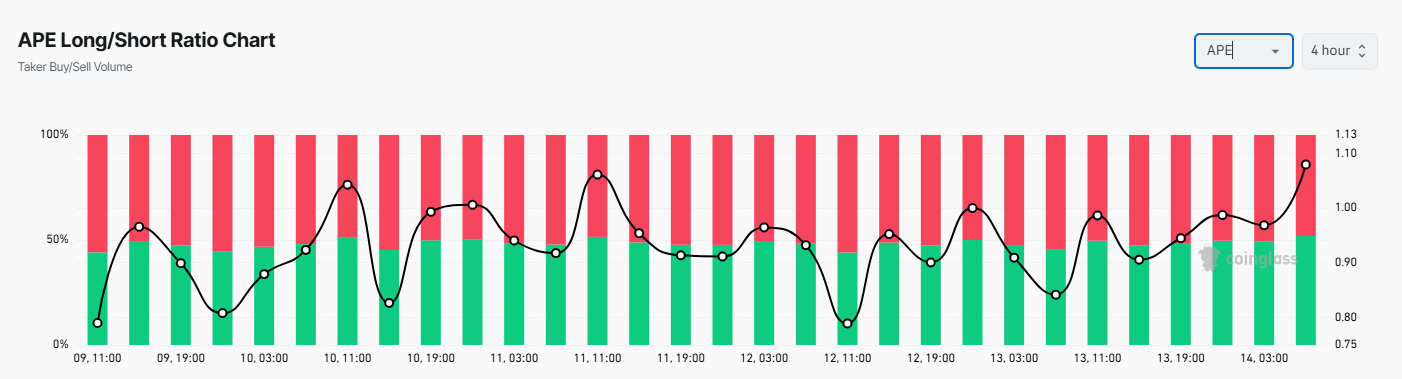

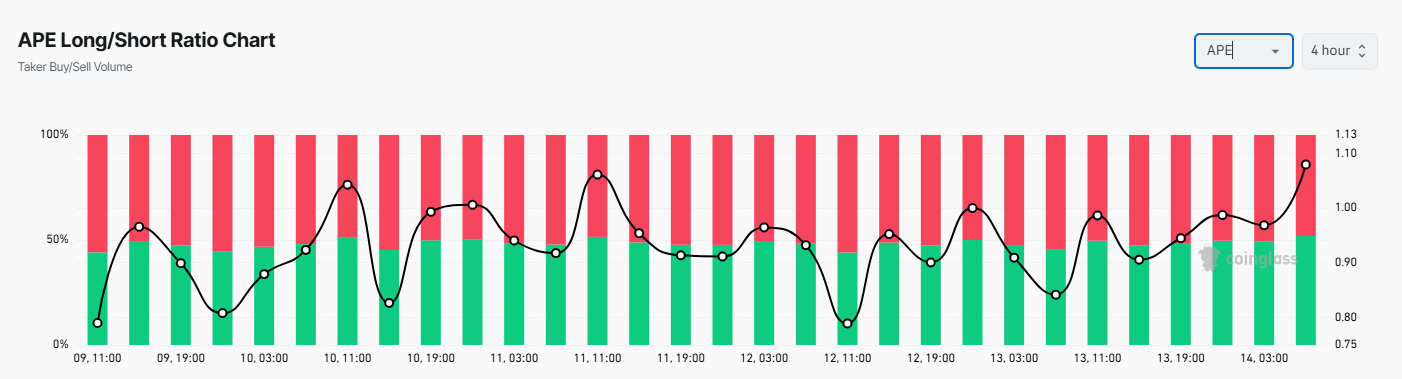

Long/short ratio analysis

An analysis of the long/short ratio for ApeCoin also supported the case for an upward move. The ratio recently rose to 1.10, indicating that long positions outweigh short positions.

Source: Coinglass

This shift in sentiment is a sign of growing bullish confidence in ApeCoin’s short-term prospects.

While market sentiment remains mixed, a higher long/short ratio indicates strong buying interest. This could push ApeCoin’s price higher if the trend continues itself.