- ADA is down 9% over the past seven days.

- Despite the decline, large whales have gathered.

Cardano [ADA] has had a turbulent week, losing more than 9% of its value amid a broader bearish market and a lack of significant catalysts. Despite this decline, an intriguing development has emerged: whale accumulation is increasing.

This raises a crucial question: could big investors lay the groundwork for a price rebound?

Price performance and technical analysis

Cardano’s price performance has faced significant challenges over the past week. After multiple failed attempts to break the $1.12 resistance level, the token is now trading at $1.10, reflecting a clear decline.

Source: TradingView

Technical indicators show a more nuanced picture. The Relative Strength Index (RSI) is at 58.66, indicating a neutral position indicating potential momentum as buying pressure increases.

Moreover, the ADA remains above the 200-day moving average, around $0.77. Historically, this level has acted as a critical bottom for bullish momentum.

ADA recently formed a golden cross, with the 50-day moving average rising above the 200-day moving average. However, the inability to break the resistance at $1.12 raises questions about whether the token can sustain an upward move in the short term.

Accumulation of Cardano whales: a possible contrarian signal?

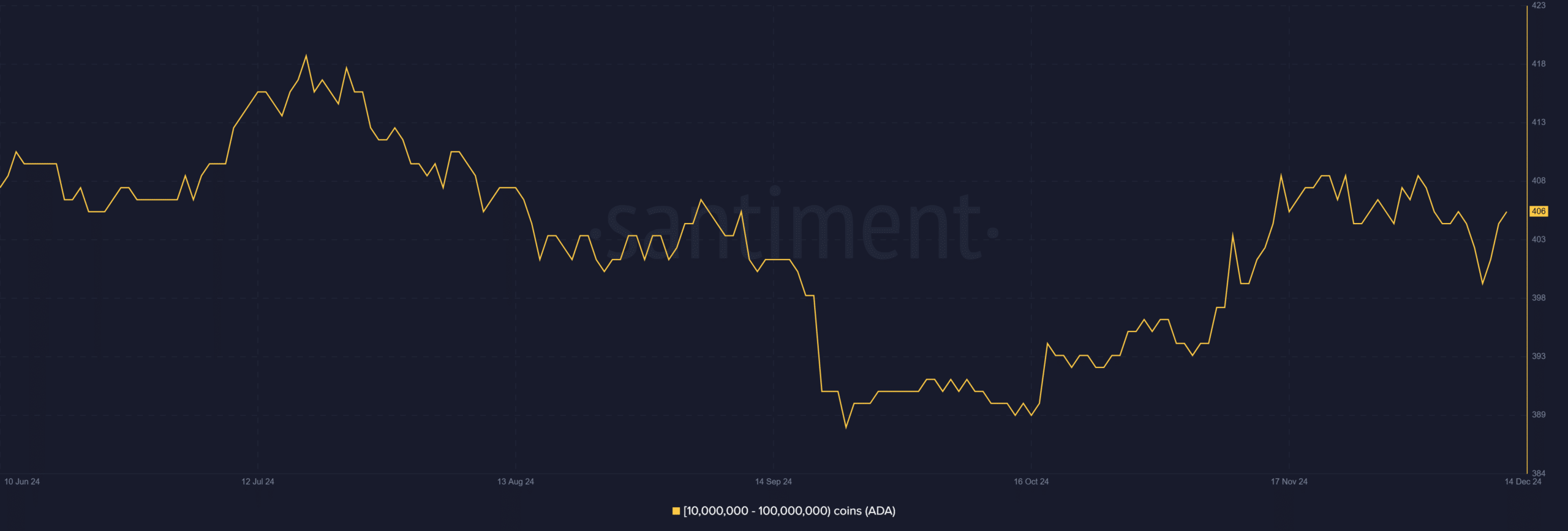

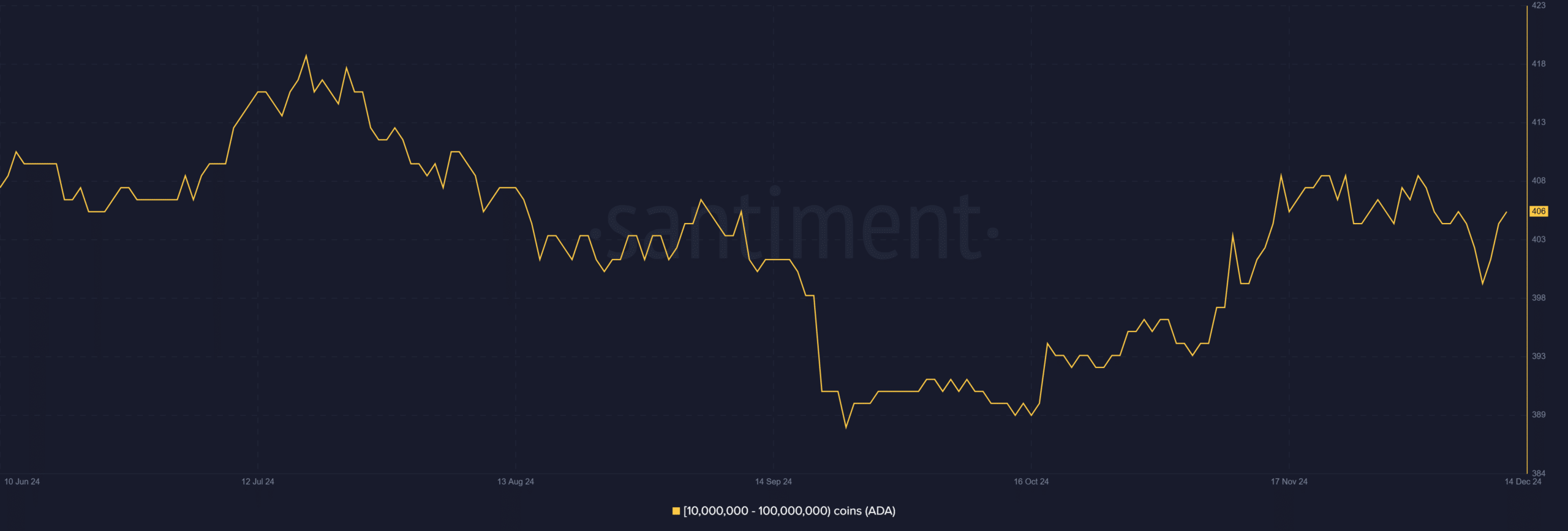

Although price developments are disappointing, data about the chain shows a different story. Whale accumulation has increased dramatically recently, with wallets holding between 10 million and 100 million Cardano significantly increasing their balances.

Source: Santiment

According to Santimentthese large holders are now responsible for one of the highest accumulation levels in recent months.

Such behavior is often interpreted as a bullish signal, as whales typically accumulate during perceived market lows in anticipation of future price increases. Their actions indicate confidence in ADA’s long-term potential, even as short-term price dynamics remain bearish.

Active address trends and retail sentiment

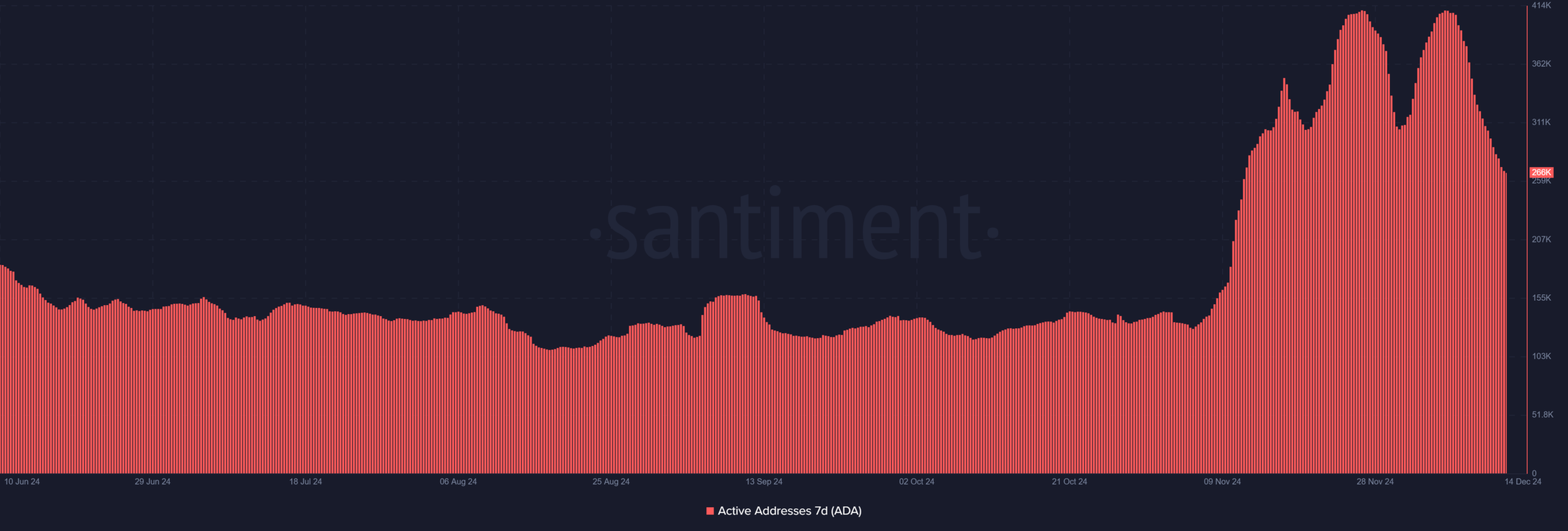

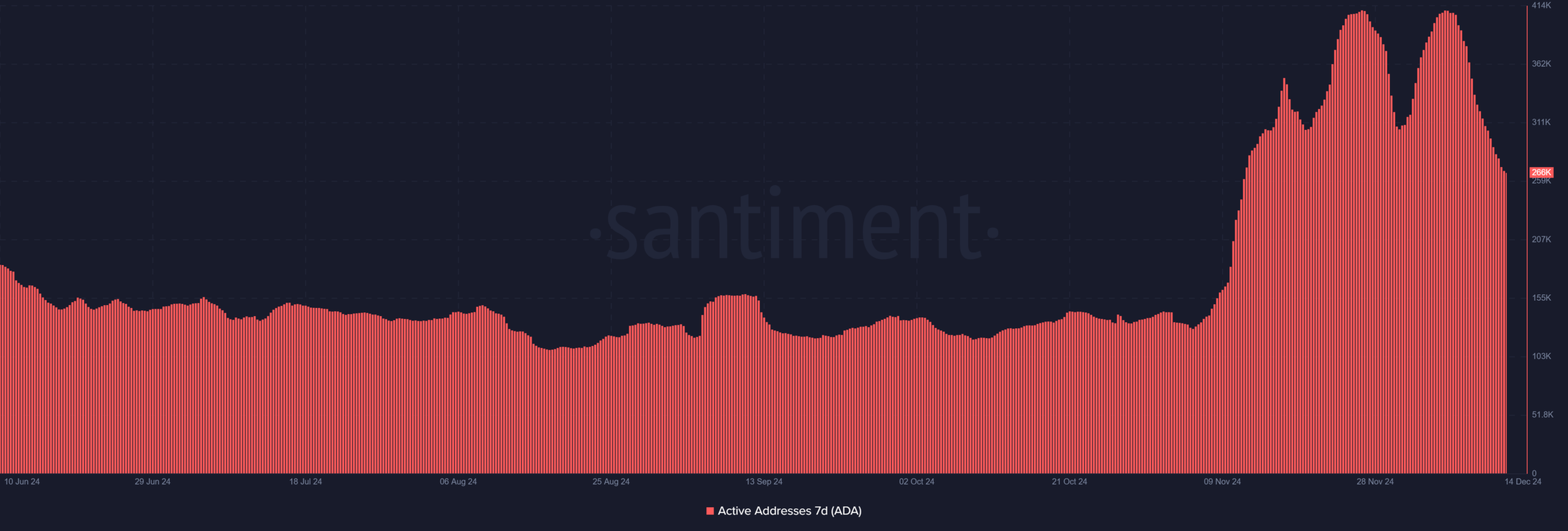

In contrast to whale activity, retail involvement is declining. The number of seven-day active addresses rose significantly in late November and has since fallen to around 266,000.

This decline signals reduced activity from smaller investors, who have historically played a critical role in ADA price increases.

Source: Santiment

The difference between increasing whale accumulation and declining retail participation highlights an important shift in market dynamics. Whales may be positioning themselves for a potential recovery, while retail investors remain cautious amid broader market uncertainty.

What’s next for ADA?

Cardano’s current situation is a delicate balance between conflicting signals. On the one hand, the continued accumulation of whales could eventually lead to a price rebound, especially if retail interest picks up again.

In this case, ADA could break the $1.12 resistance level and potentially target $1.20 or higher.

On the other hand, the continued lack of retail involvement and further rejections at key resistance levels could lead to bigger losses. If bearish pressure continues, ADA could test the next major support level around $0.90, a historically important zone.

– Realistic or not, here is the market cap of ADA in terms of BTC

ADA’s performance over the past week reflects a market at a crossroads. While the token’s decline underlines the challenges of broader bearish conditions, the steady increase in whale ownership offers a glimmer of hope for a possible reversal.

Whether ADA is on the brink of a recovery or faces further corrections depends on how these factors play out in the coming days.