- Bitcoin’s decentralization could be in jeopardy as mining becomes increasingly centralized

- The role of BTC ETFs in driving this shift cannot be overlooked

In the heart of Bitcoin [BTC] network are miners with large BTC holdings. In today’s volatile market, maintaining their reserves is more important than ever. What is interesting is the amount of BTC kept in the miner purses has fallen to an annual low of just 1.809 million.

While factors such as increasing mining difficulty, break-even costs, halving and reduced rewards are often blamed, there may be a deeper shift at play. This shift could erode miners’ influence in the market as more investors flock to alternative investment vehicles like Bitcoin ETFs.

As a result, Bitcoin’s network is in danger of becoming increasingly central, which begs the question: is this a step forward or a setback for Bitcoin’s decentralized future?

Bitcoin’s decentralized future may be under threat

A year after the 2008 financial crisis, Bitcoin emerged as a game-changer, eliminating the need for financial intermediaries. Over time, it has built a passionate community of ‘believers’ who see BTC not only as a digital asset, but also as a powerful symbol of decentralization.

It is no surprise that miners play a key role in realizing this vision. In the 15 years since Bitcoin’s inception, individual miners have grown into large corporations, now owning significant amounts of BTC themselves.

Marathon Digital Holdings (MARA) is leading on the way, with over 40,000 BTC in its reserves. While this is bullish for Bitcoin – increasing accumulation – it also signals a troubling trend: the growing centralization of mining power, which is now controlled by just a few key players.

The plot becomes increasingly complicated as investors increasingly turn to mining stocks as an investment vehicle, which is closely tied to the price of Bitcoin. When Bitcoin falls, these stocks follow suit, causing investors to suffer losses.

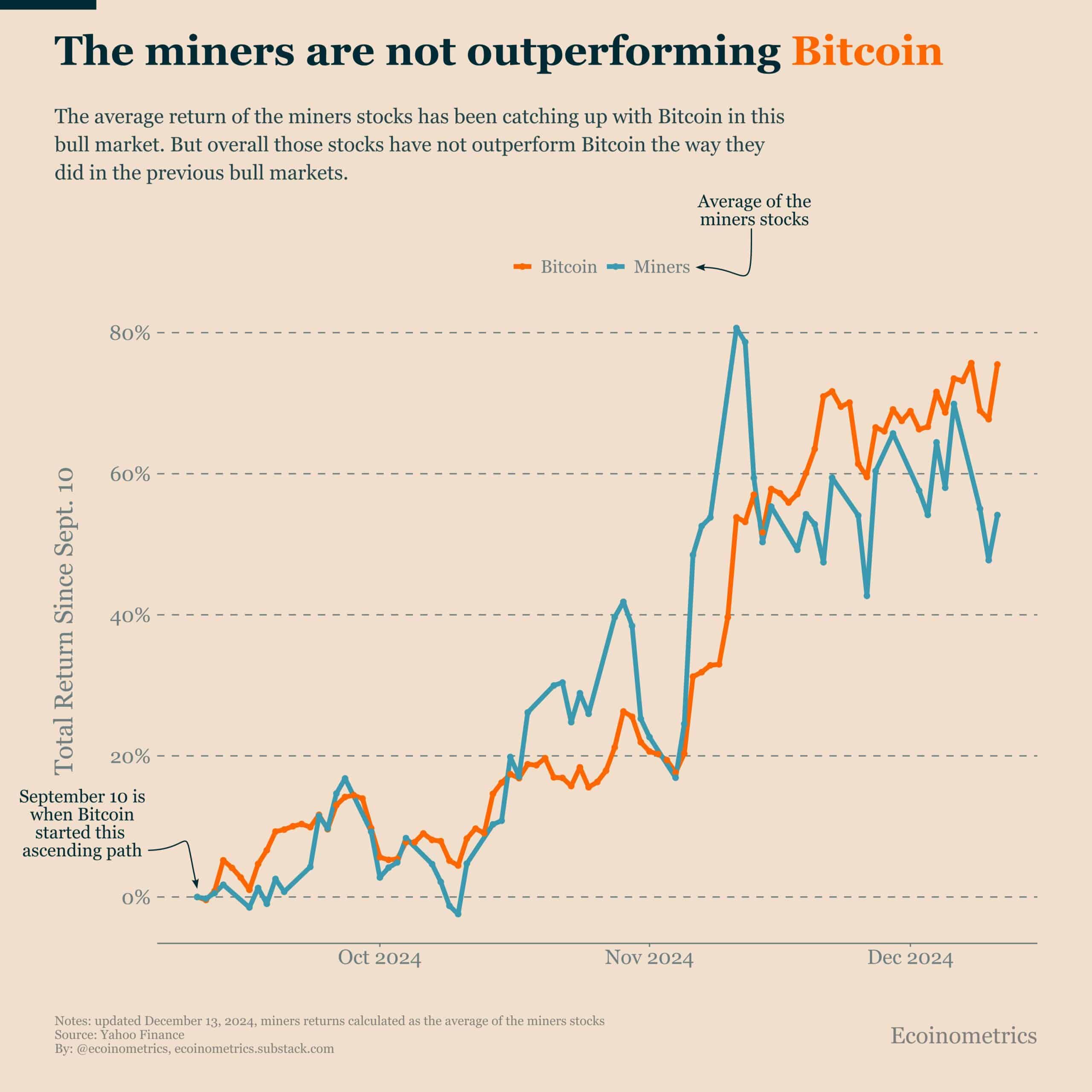

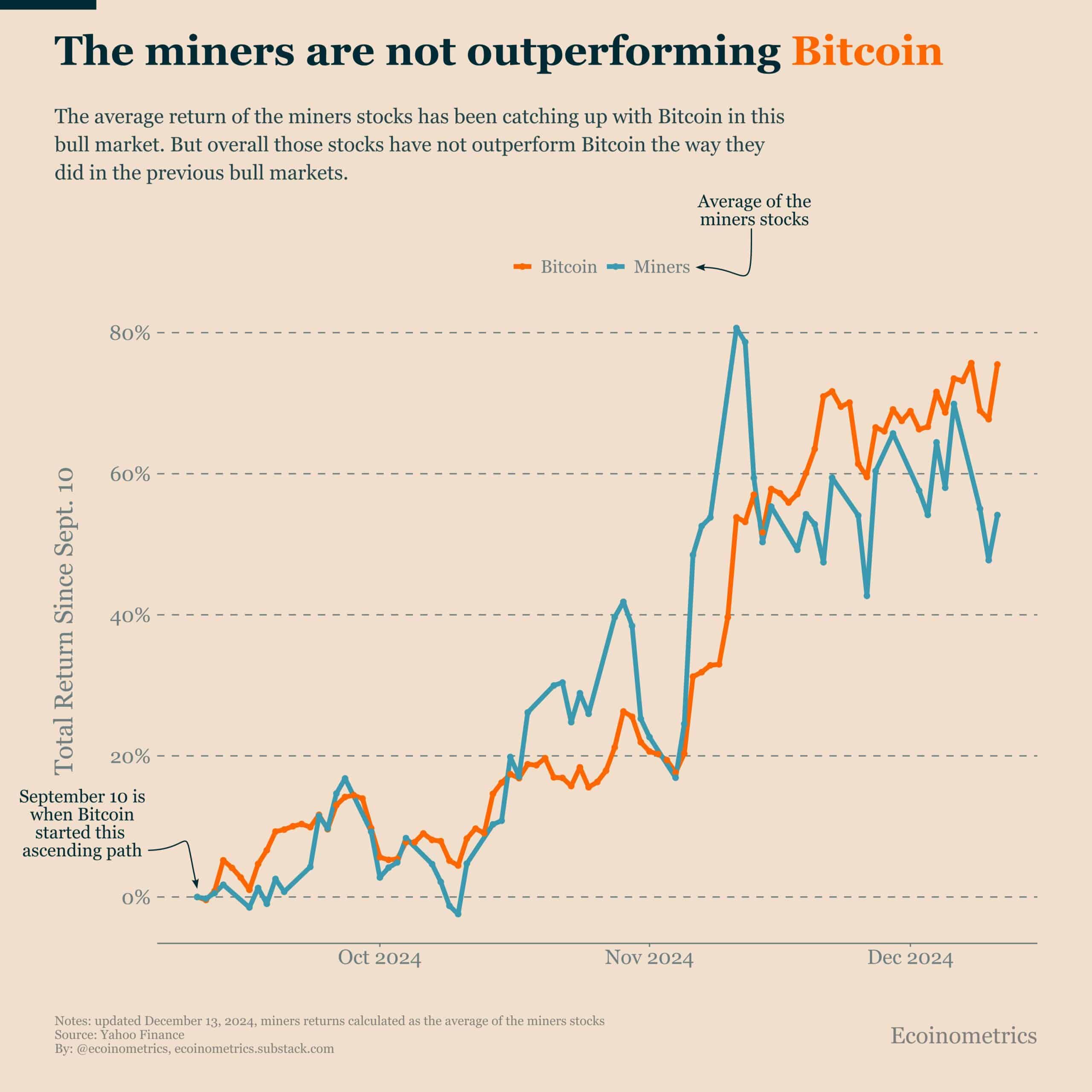

Source: Ecoinometry about X

As ROI continues to shrink, more investors are pulling out, forcing mining companies to sell or close their Bitcoin holdings. These dynamics, in turn, directly or indirectly impact the price of Bitcoin, adding yet another layer of volatility to the market.

A closer look at the chart above revealed an interesting pattern: expected returns on Bitcoin holdings did not pan out as mining companies expected, especially as Bitcoin approached the $100,000 mark.

In a typical scenario, this would have caused mining stocks to soar, attracting new investors eager to get a piece of the action.

And yet Marathon Digital Holdings (MARA) is in a steady downtrend, signaling a shift in a market that demands deeper exploration.

What’s behind this change?

Since their launch in January, Bitcoin ETFs have made it easier for both institutional and retail investors to gain exposure to Bitcoin without actually owning it.

This new investment vehicle eliminates the complexity of portfolio management and mining. In fact, on the day the “Trump pump” started, $1.3 billion came in inflow were included in Bitcoin ETFs.

It’s clear that these newer players are quickly overtaking traditional mining stocks, offering a “less risky” route for investors eager to tap into Bitcoin’s potential.

Read Bitcoin [BTC] Price forecast 2024-2025

But here’s the catch: this shift is not without risks. Such as large institutions such as BlackRock (IBIT) spoon By producing massive amounts of BTC, Bitcoin’s decentralized nature is starting to feel the pressure. In fact, at last count, BlackRock held a whopping 530,000 BTC.

With such major players in the mix, their influence on Bitcoin’s price is undeniable. Investors need to stay alert, be cautious and monitor their investments closely.