- Whales have been steadily accumulating BTC, a factor that has contributed to the recent price increase.

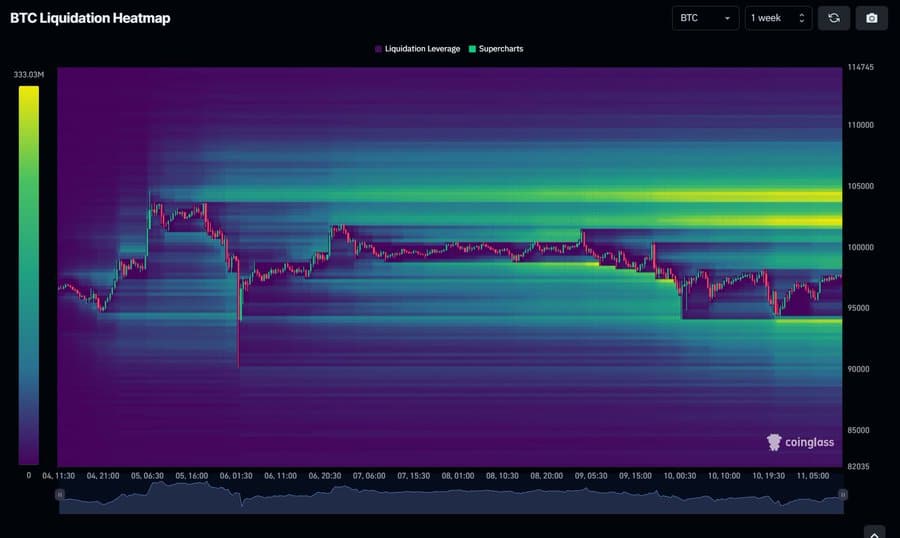

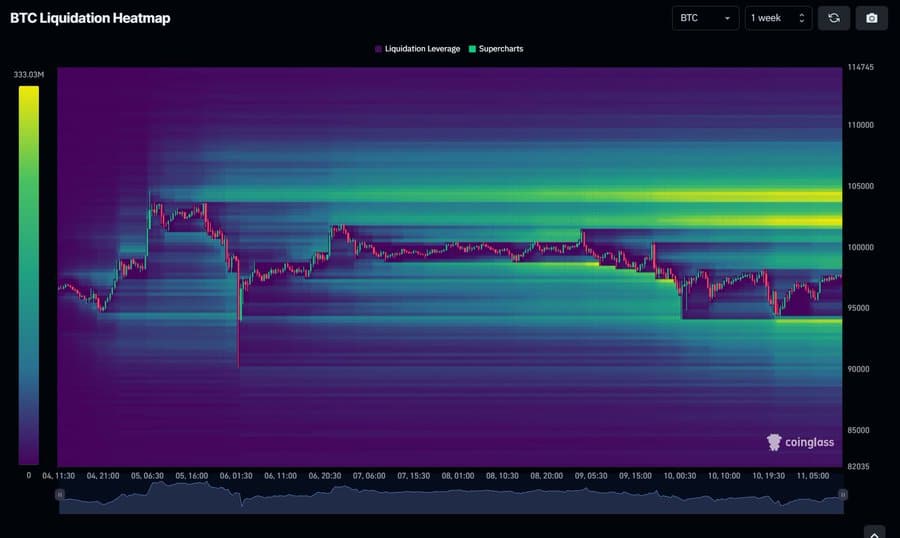

- There was also little liquidity under the price of Bitcoin, with large resistance levels above, especially with a new price target.

In the past 24 hours, Bitcoin [BTC] is up 2.73%, recovering from a dip that saw the price fall to $94,150.05 after hitting a high of $104,000 earlier this month.

The recent rise in BTC’s price is largely driven by growing investor demand as large-scale acquisitions continue to drive up prices.

Whales lead the charge

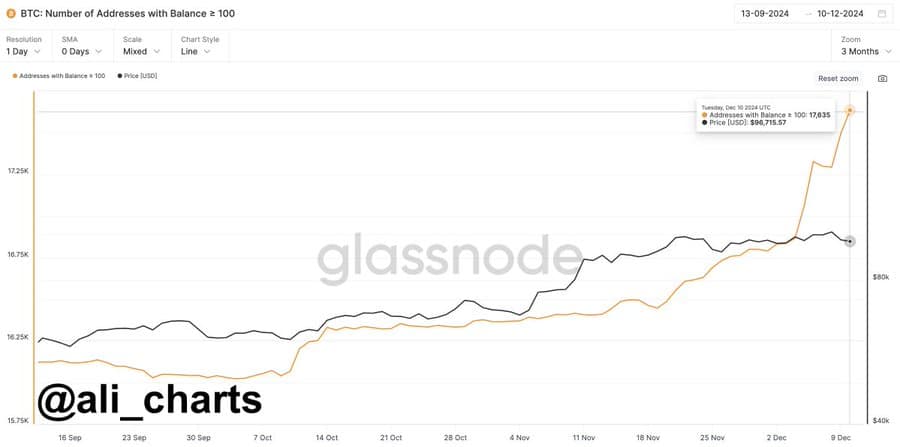

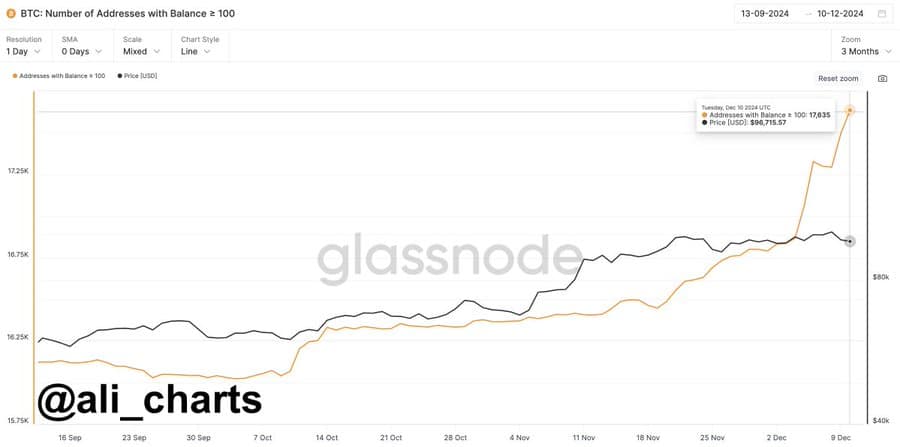

Interest in Bitcoin has surged again, with whales playing a key role in the recent price surge, according to cryptocurrency analyst Ali Chart using data from Glassnode.

The chart highlighted that large investors, or whales, have acquired BTC in significant quantities. He pointed to a chart showing 342 wallets, each holding more than 100 BTC (estimated at around $10 million based on CoinMarketCap), taking advantage of BTC’s sharp drop to $90,000.

Source:

In particular, such moves indicate that whales are seeing the dip as an opportunity to acquire BTC at a discounted price in anticipation of another market rally, which has already occurred with BTC now trading above $100,000.

BTC could be aiming for a new high

Liquidity data from Coinglass, shared by analyst Mister Crypto, suggests the coin is about to hit a new high, potentially keeping the price above the $100,000 threshold.

Liquidity levels indicate key price points where assets tend to gravitate, acting as magnets that attract price movements.

Source:

At the time of writing, BTC has cleared all significant liquidity levels below the current price. The next critical resistance point is at $105,000, which surpasses the previous all-time high target of $104,000.

Iincreased liquidity on the market

Whale tracker reports that Tether (USDT) has spent another $1 billion at Tether Treasury. This meant an influx of liquidity into the market.

This increase in liquidity reflects the growing demand for USDT, which market participants will likely use to acquire crypto. Now that BTC is positioned as a prime candidate, it will be able to benefit from these inflows as traders use USDT to buy Bitcoin.

In a related report, Whale Tracker notes that market confidence in the currency is returning. A large holder recently returned 7,999 BTC – worth over $800 million – to secure wallets for safekeeping.

Given these developments, it seems increasingly likely that BTC will soon reach a new all-time high.