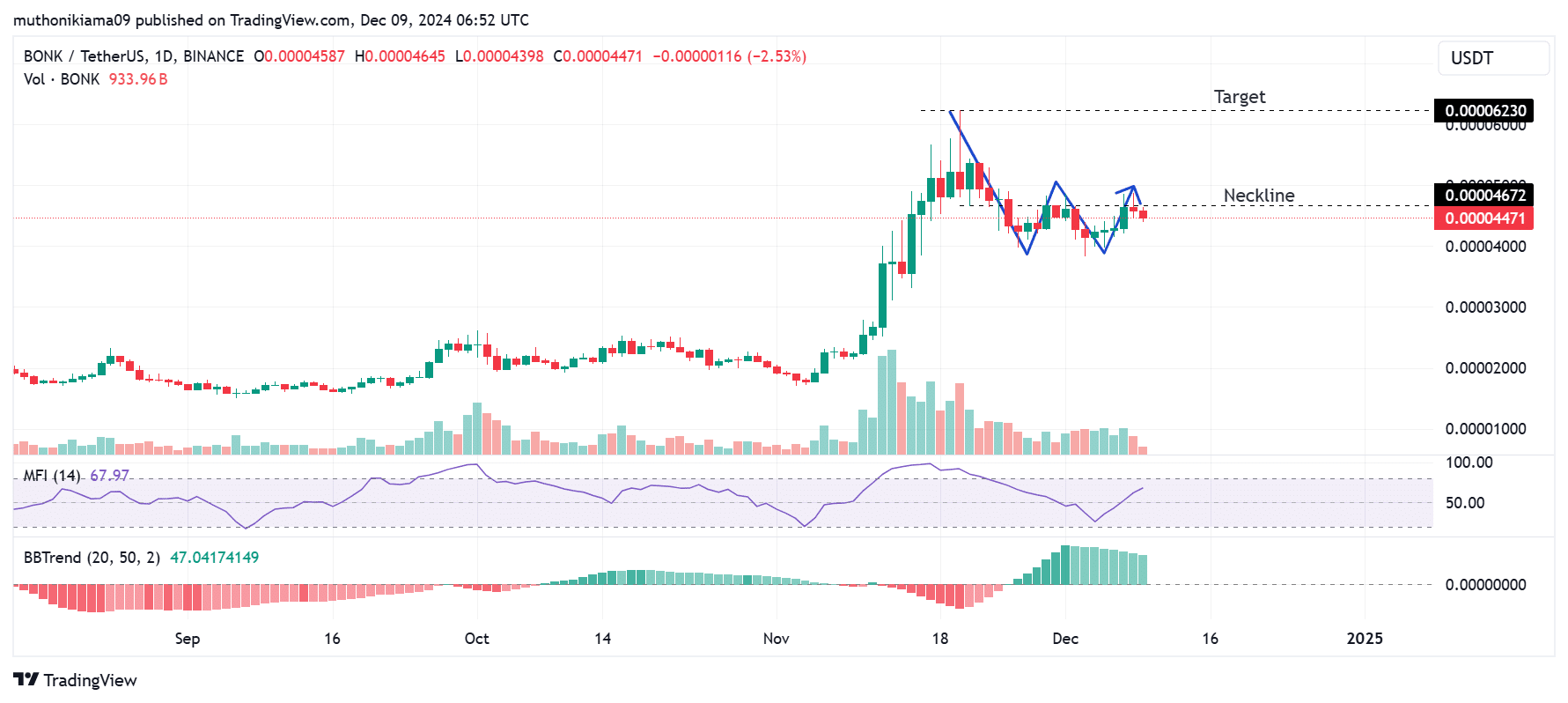

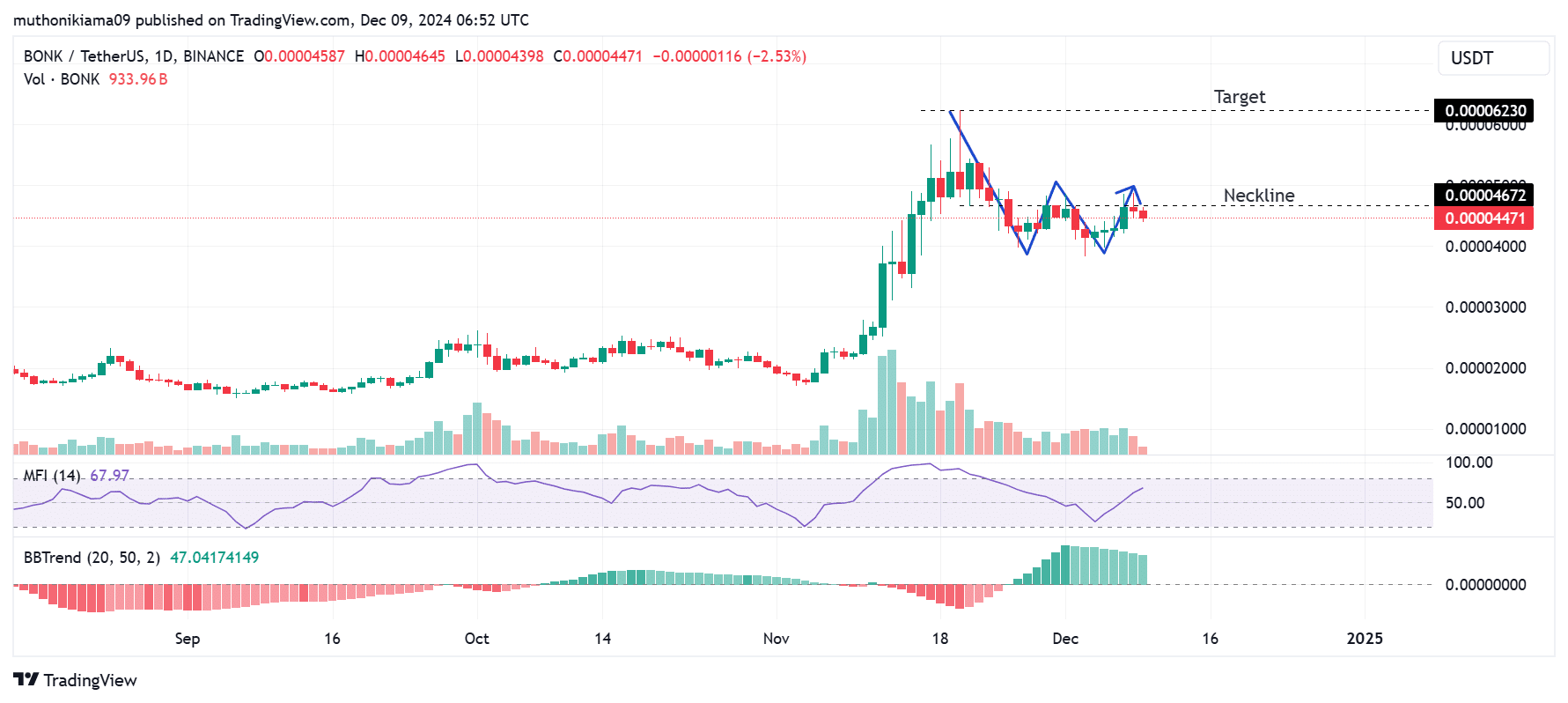

- BONK has formed a double bottom pattern on a higher timeframe chart, indicating a bullish trend reversal.

- However, a lack of high trading volumes in the derivatives market could lead to price consolidation.

Bonk [BONK]the second largest meme coin on the Solana [SOL] blockchain, fell 4% in 24 hours to trade at $0.0000448 at the time of writing. Trading volumes also fell by 40% per CoinMarketCapwhich reflects the downward trend in the broader market.

Despite this recent decline, BONK was among the best performing tokens in 2024. In fact, it is up over 200% year to date.

As 2024 draws to a close, BONK is already showing signs of making even more gains in the coming weeks.

BONK forms a double bottom pattern

BONK has formed a double bottom pattern on the one-day chart, which typically signals a reversal from a downtrend to an uptrend.

The meme coin reached the peak of this double bottom pattern on November 20, when its price rose to an all-time high of $0.0000623. After falling to reach its first bottom, BONK formed a neckline at $0.000046, and it is once again testing resistance at this level.

If BONK reverses this resistance level, which is also the neckline for the double bottom pattern, it could spark a rally past $0.0000623, paving the way for a new ATH.

On the other hand, if it fails to break this resistance and falls below the $0.000040 support level, it will negate the bullish thesis and trigger a downtrend.

Source: Tradingview

Technical indicators on this chart indicate that an uptrend is very likely. The Money Flow Index (MFI) has tilted north, indicating high buying pressure and rising capital inflows into BONK.

Moreover, the MFI has a score of 67, showing that momentum remains bullish and that BONK is still not overbought.

The BBTrend indicator confirms that the bulls are in control. However, the fading histogram bars suggest momentum could be weakening.

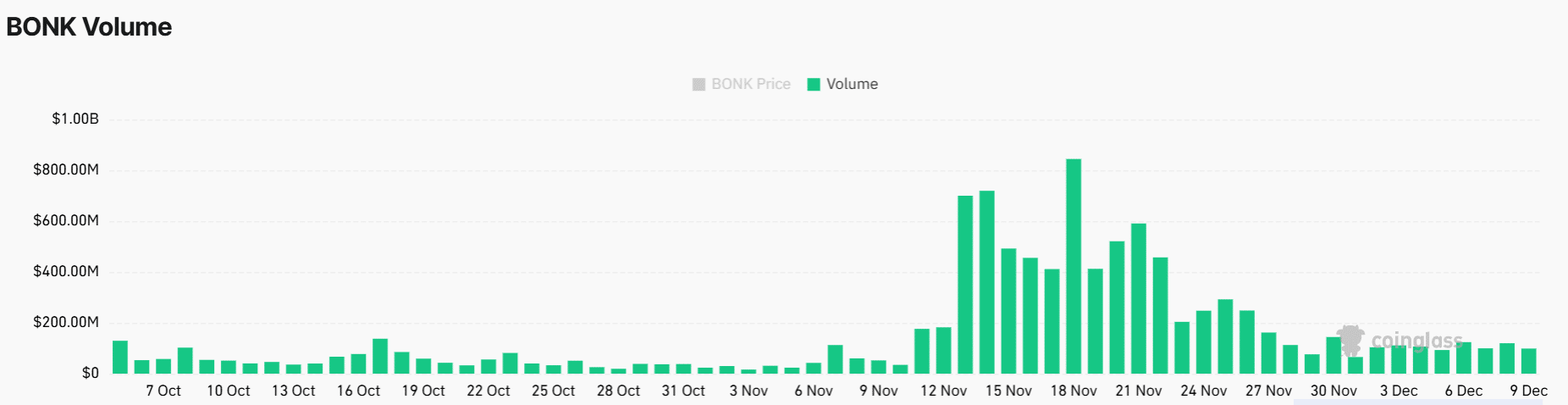

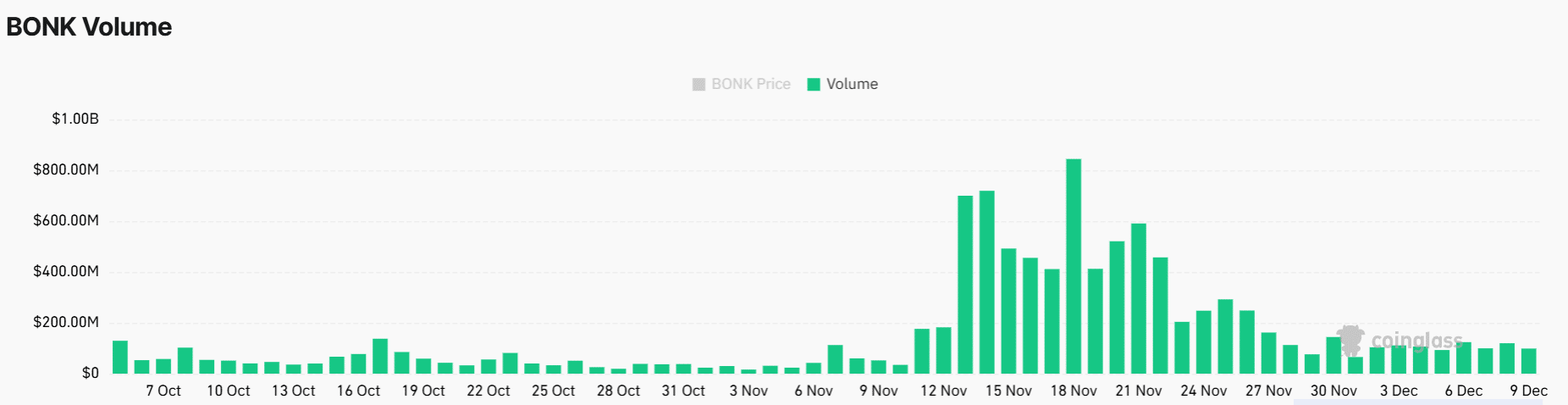

Derivatives trading volumes could precede consolidation

Trading volumes around BONK in the derivatives market have fallen significantly over the past two weeks, as shown by Coinglass data. These volumes reached record highs in mid-November as BONK recovered to an ATH.

Source: Coinglass

At the same time, BONK’s open interest has fallen from $64 million to $26 million in three weeks, further highlighting the lack of high market participation.

If there is no new uptick in speculative activity, BONK could become stuck in a bandwidth-constrained consolidation.

Read Bonk [BONK] Price forecast 2024-2025

Can BONK turn WIF around in 2025?

As AMBCrypto reportedBONK momentarily surpassed dog hat (WIF) in November to become the largest Solana meme coin. WIF has since regained its top spot with a market cap of $3.68 billion, versus BONK’s $3.34 billion.

If BONK overcomes the resistance at $0.000046 and confirms the double bottom pattern, it could lead to a sustained uptrend in 2025, which will consequently support market capitalization growth. A new ATH for BONK could dethrone WIF again.