- USDT often presents conflicting supply and demand signals, making it crucial to monitor them closely.

- With the market in the red, stablecoins could become an increasingly attractive alternative.

If Bitcoin [BTC] is digital gold, Tether [USDT] is the digital dollar, which is firmly holding its $1 peg.

Once a niche asset, USDT has seen a massive increase in demand, making it the go-to tool for seamless transactions – whether for everyday purchases or massive cross-border transactions. transfers.

This increase is clearly visible, with the global supply of stablecoins reaching a record $190 billion, adding more than $60 billion since the start of 2024.

However, in the crypto world, the supply/demand dynamic takes on a whole new meaning.

Exploring the two sides of the coin

USDT, the most widely used stablecoin in the crypto market, has long acted as a safety net in times of shaky market sentiment. We are currently seeing that trend again.

December started strong, with Bitcoin not only surpassing $100,000 but also hitting a new all-time high of $104,000 within the first five days. As a result, USDT dominance fell to a six-month low of 3.80%.

However, with Bitcoin’s next market top still uncertain, inconstancy is ramping up. If this trend continues, more investors could turn to USDT’s stability, especially with a bearish MACD crossover further supporting this shift.

Moreover, from an economic point of view, supply increases to meet rising demand.

With the stablecoin delivery Valued at $190 billion – including $60 billion this year – it is clear that demand for USDT is growing rapidly, especially among the major players.

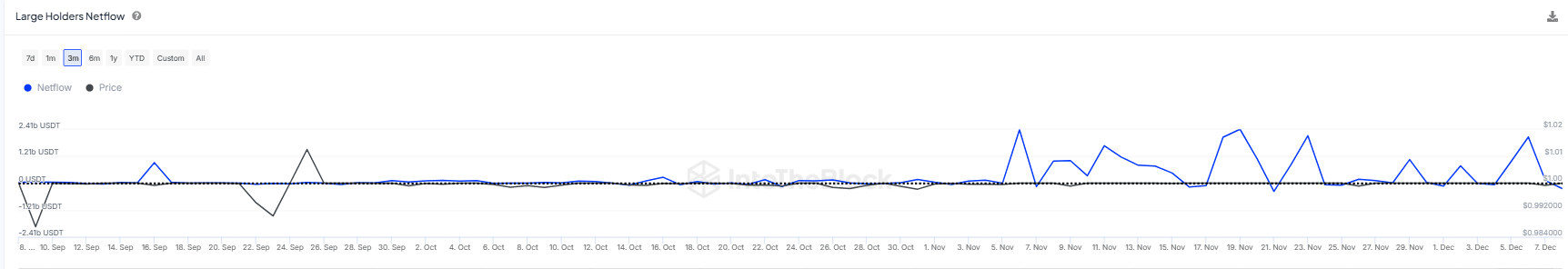

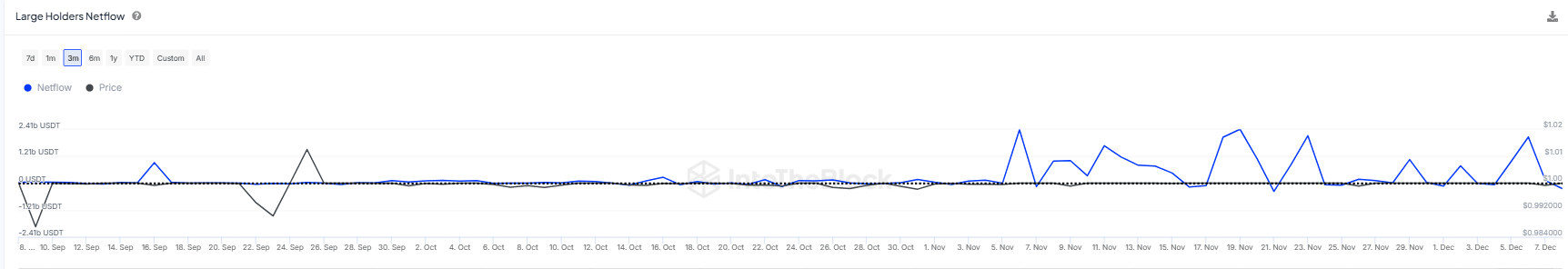

Source: IntoTheBlock

In November alone, Whales ramped up their USDT accumulation, raising over $2 billion in four separate time periods, further cementing the stablecoin’s growing role as a hedge against higher-risk assets.

However, this may represent only one side of the coin. The rising demand for USDT does not necessarily spell doom for the market. In fact, it could mean the opposite.

Just like after the election results, when big whales took in over $2.5 billion in USDT and positioned themselves to exchange for Bitcoin, this trend could be the harbinger of a major rally.

Does high USDT demand mean a correction or a rally?

Clearly there are two dynamics at play. Either market participants are unloading USDT in anticipation of a massive bull run that will push supply to new highs, or fear of a correction is driving a rush to hoard USDT as a safe haven.

Looking at the chart above, whales have significantly reduced their USDT positions over the past two days – from over $2 billion to a position of -$240 million – showing strong conviction in upcoming gains.

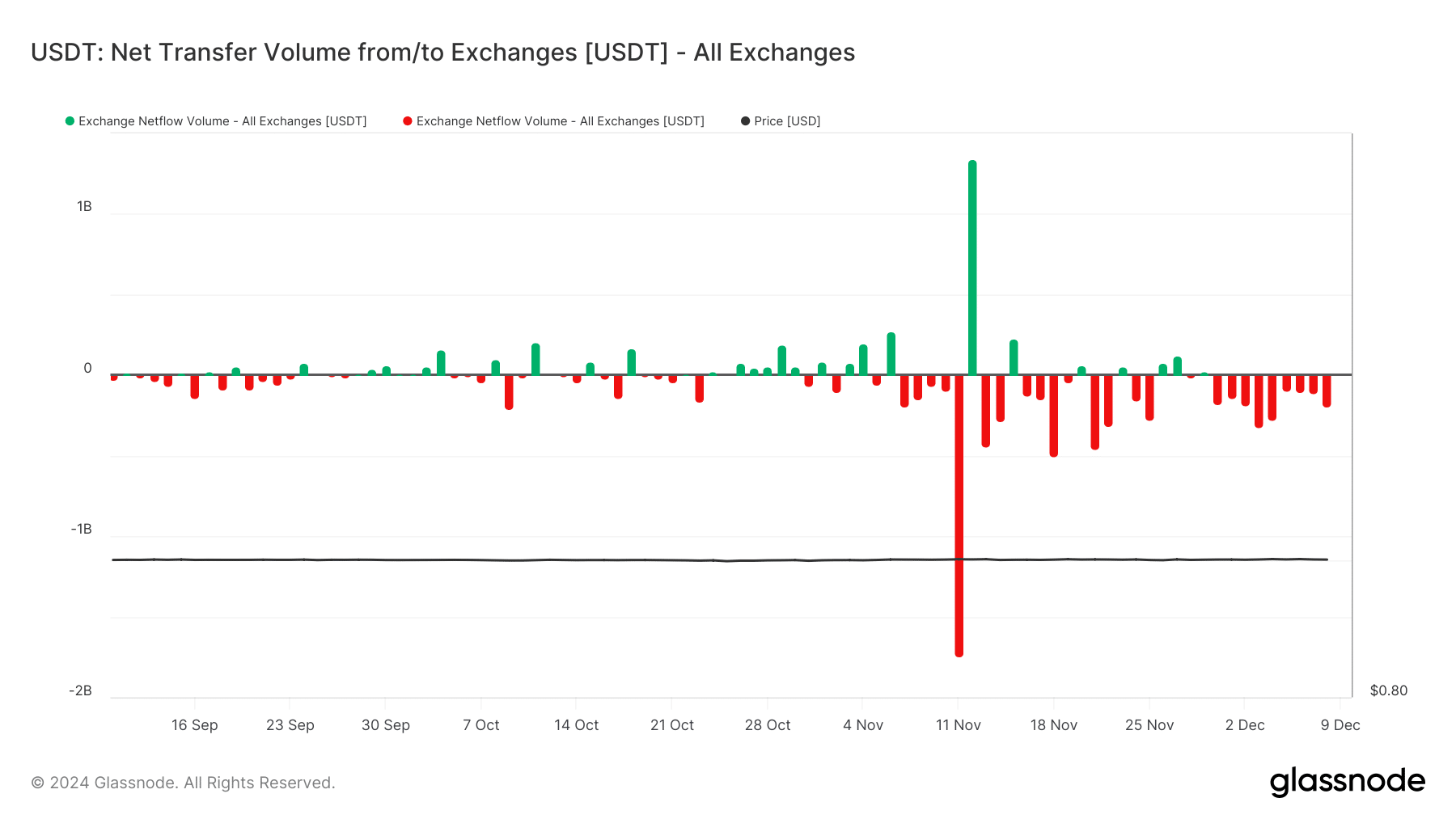

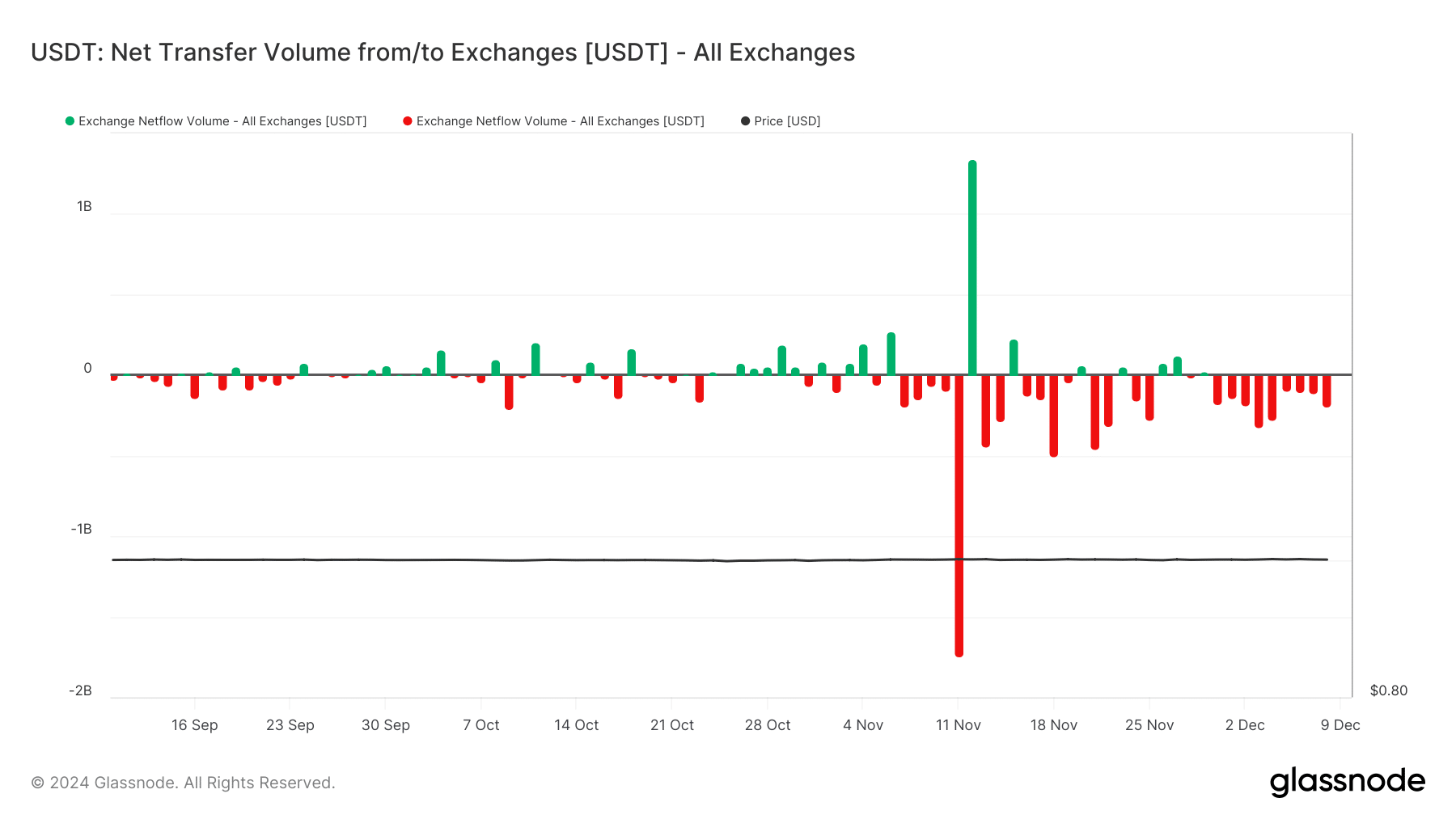

However, the retail sector seems to be taking a different path. Since early December, there have been consecutive red bars, indicating an increasing withdrawal of USDT from exchanges.

Source: Glassnode

Unlike before, when USDT accumulation indicated Bitcoin’s bullish outlook, investors can now turn to stablecoins for safety. Why?

Read Bitcoin’s [BTC] Price forecast 2024-25

Bitcoin’s four failed attempts to break $100,000 raise concerns about that overvaluationand a lack of FOMO make investors more cautious.

So as volatility increases, traders are either chasing quick, big profits in mid- and low-cap tokens, or looking to stablecoins as a safer bet.