- Baby Doge saw a surge in demand, likely driven by a message from Elon Musk.

- Whales dominated most of Baby Doge’s supply, indicating an optimistic outlook.

Baby Doge [BABYDOGE] just made it onto the list of the top winners of the last 24 hours. This was due to a robust rebound that took the stock to a 10-month high, but the reason for this bullish performance is quite interesting.

Baby Doge holders were delivered on the morning of December 7, when the token caught the bulls’ fancy.

The memecoin attempted a rally earlier in November but it was shot down, forcing it to give up its previous gains. December also started with slow momentum.

Despite recent sluggish performance, Baby Doge has posted an impressive bullish performance in September.

The stock rose just over 82% in the past 24 hours, suggesting it can still attract bullish attention.

Source: TradingView

The Elon Musk phenomenon

Baby Doge’s heavy bullish price action was not random, but may have been a reaction to it a message by Tesla head Elon Musk. For the uninitiated, the market has a history of rallying around its social media posts.

But could this be a signal that Baby Doge’s upside is limited? That doesn’t necessarily have to be the case. Notably, IntoTheBlock’s data showed that whales held 98.99% of the memecoin’s total circulating supply at the time of writing.

It is worth noting that Baby Doge has yet to be listed on major exchanges such as Binance or Coinbase.

A listing on these exchanges sometime in the future could signal that there is room for growth. On the other hand, this may require robust demand from the retail segment.

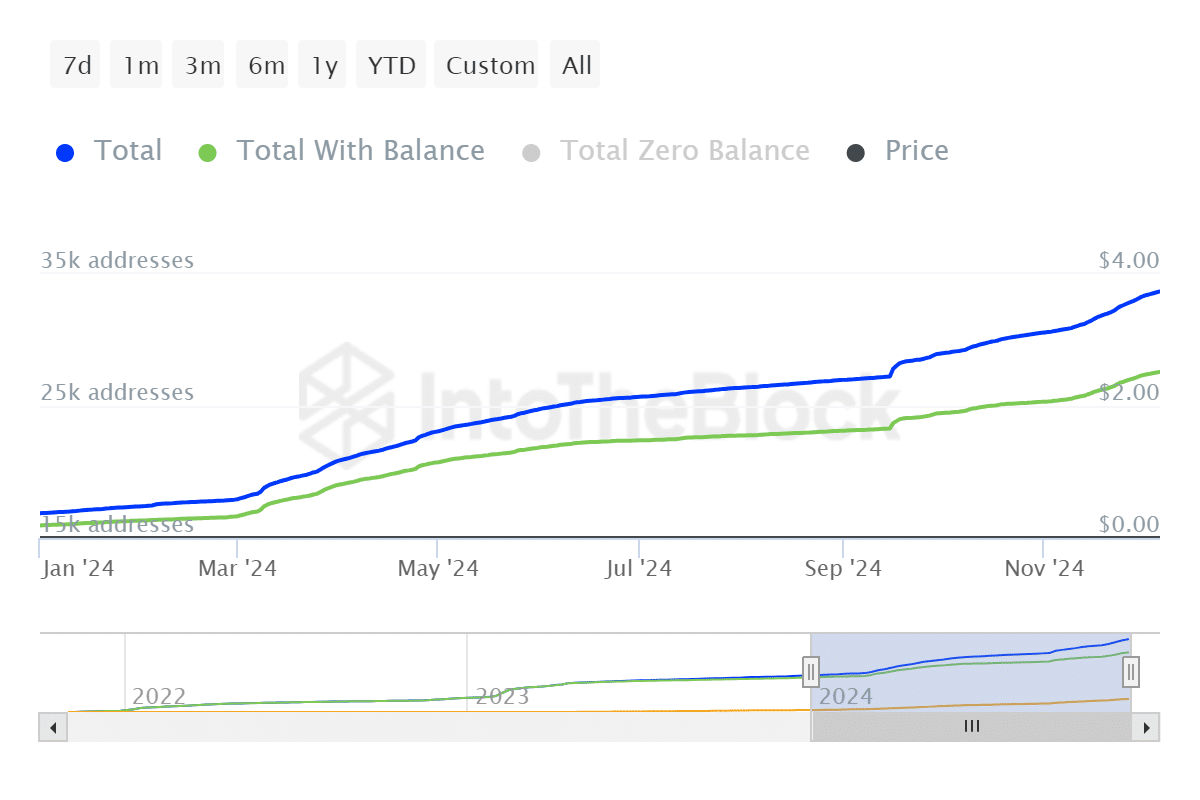

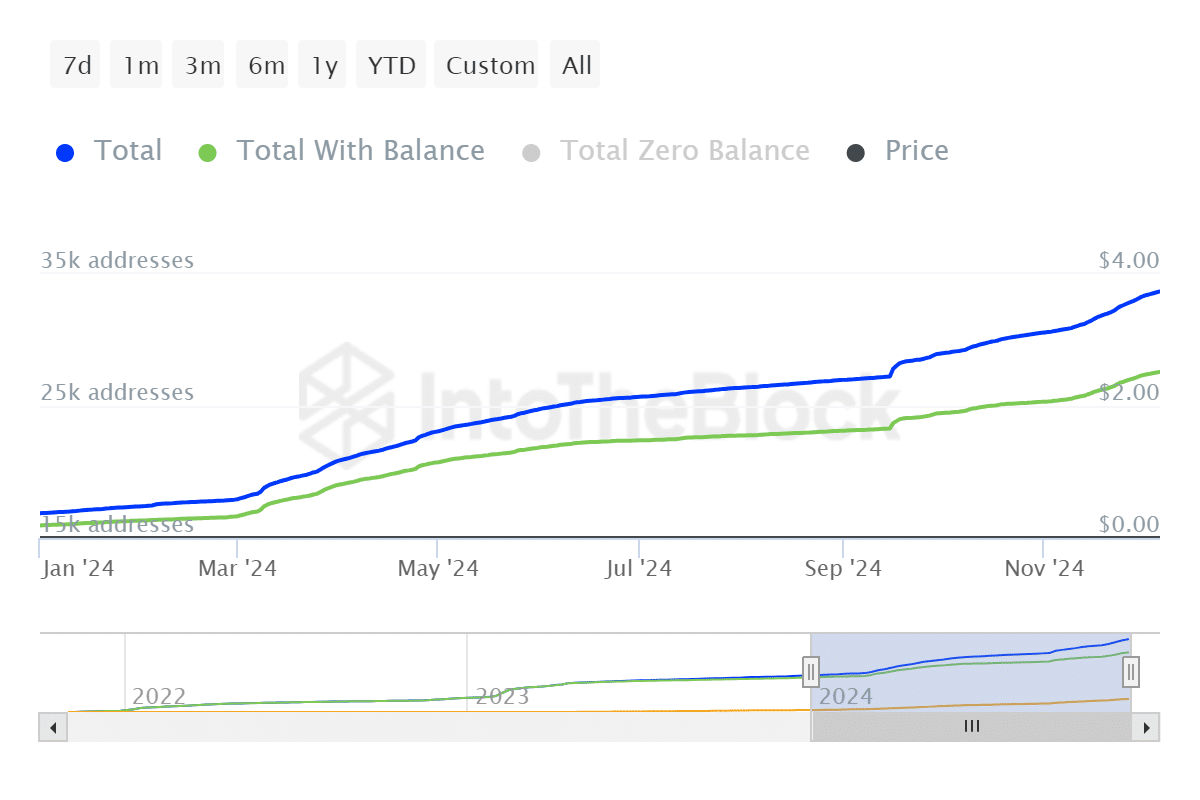

Speaking of retail, Baby Doge coin addresses have been on the rise since early 2024. It had just under 16,000 addresses with balances, and that number has since grown to 27,580 addresses.

The latest statistics showed that it had 33,680 addresses.

Source: IntoTheBlock

On the other hand, Mint glass Baby Doge has recorded $2.51 million worth of spot net flows in the last 24 hours. This despite the large price increase in the same period.

Meanwhile, Open Interest in the derivatives segment rose to $2.41 million.

The above observations were also accompanied by an increase in short liquidations, peaking at $51,010. This indicates that most of the demand was mainly in the derivatives segment.

Read Baby Doge’s [BABYDOGE] Price forecast 2024–2025

It could also indicate that the rally may have been caused by the mass accumulation of whales.

The fact that whales still hold the majority of the currency suggests that a surge in demand from the retail segment is anticipated. Investors should therefore pay attention to listings on major stock exchanges.