- Despite recent periods of decline, Bitcoin remains close to the $10,000 level

- Miners dumped their largest amount of holdings in months as the price hit a major milestone

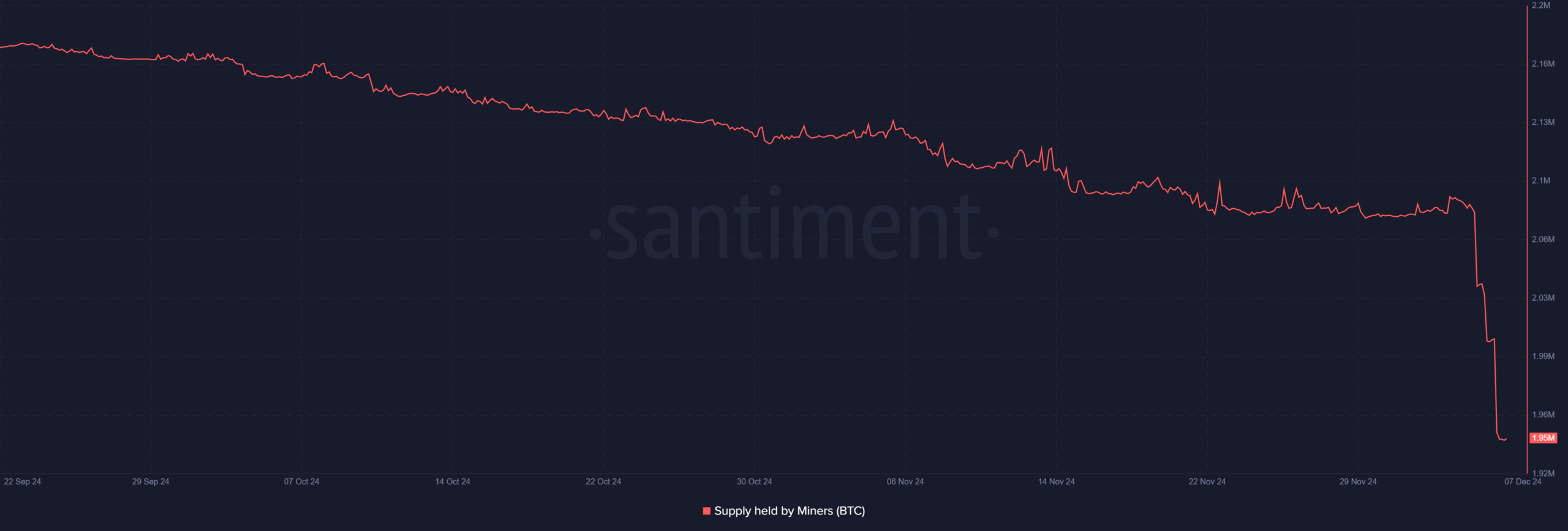

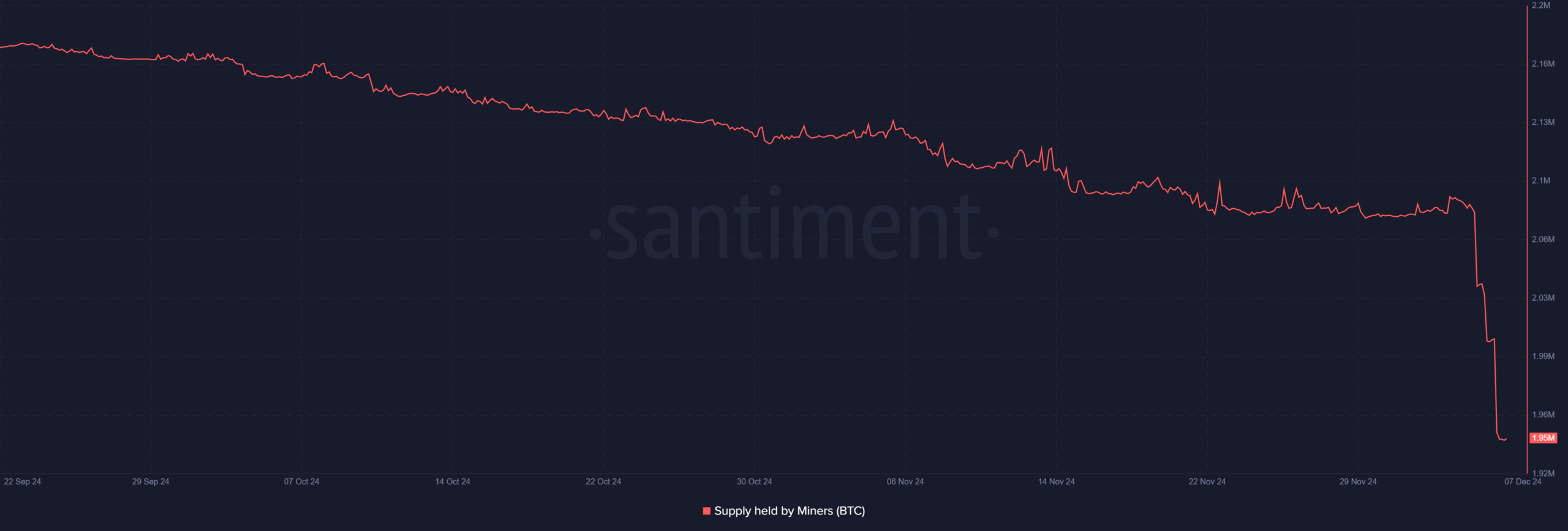

Bitcoin miners have offloaded a whopping 85,503 BTC in the last 48 hours, bringing miners’ balances down to around 1.95 million BTC – the lowest level in recent months. In fact, this marks the sharpest decline in mining ownership in 2024.

As expected, this also raises questions about its impact on Bitcoin’s price.

Sales and price trends of Bitcoin miners

The recent dip in miner balances is the biggest since February, but has not yet had a direct impact on Bitcoin’s price momentum. An analysis of the miner’s supply on Santiment revealed it was worth more than 2 million as of December 5.

However, at the time of writing this had fallen to around 1.95 million.

Source: Santiment

Historically, significant selloffs in mining companies have often coincided with market corrections, but in 2024 there has been a disconnect between mining activity and price trends. Despite this sell-off, non-mining whales and sharks continue to accumulate – highlighting the complexity of market dynamics.

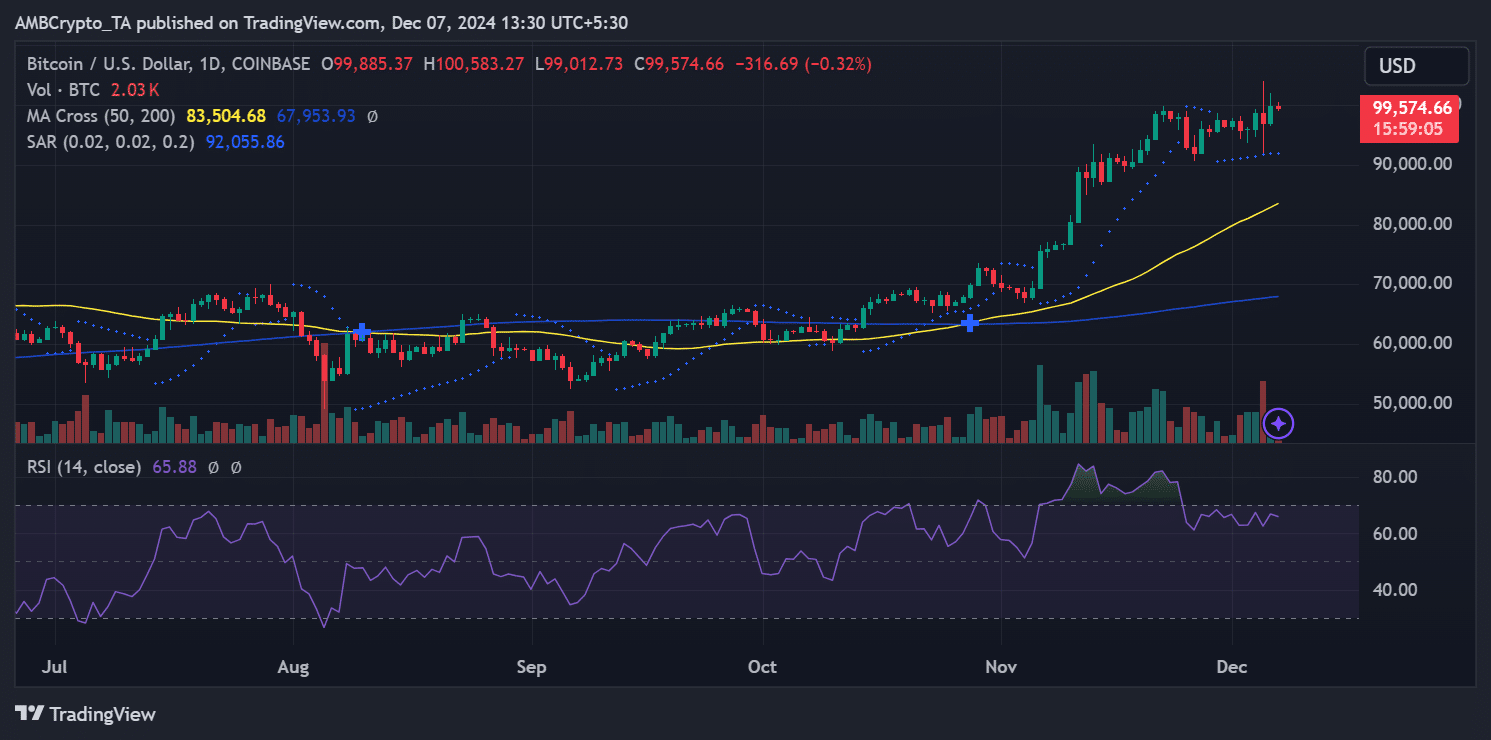

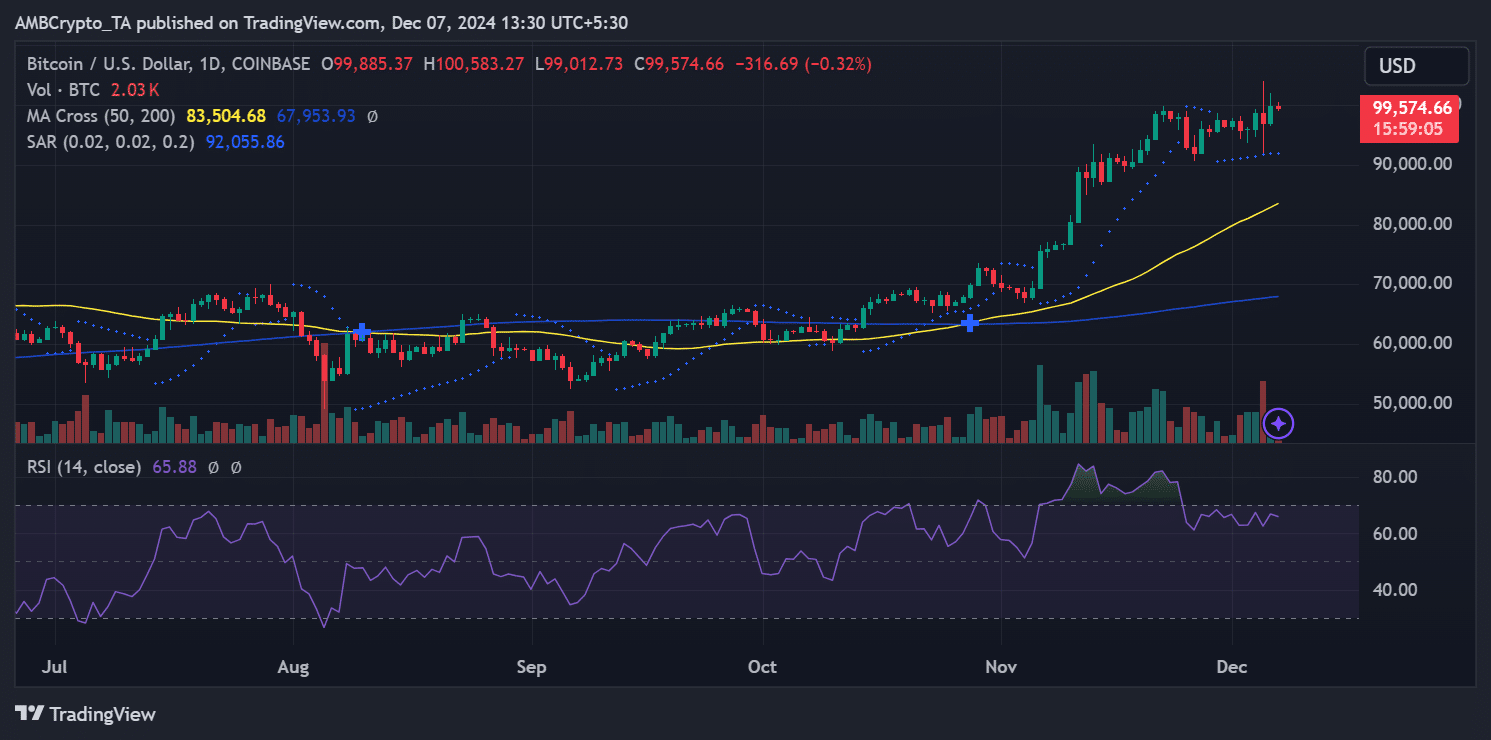

At the time of writing, Bitcoin appeared to be consolidating near its psychological resistance at $100,000. The Relative Strength Index (RSI) marked 65.88 – a sign that assets remain in bullish territory, although overbought conditions were not yet clear.

The parabolic SAR and moving averages further supported a bullish bias, with the price trading well above the 50-day and 200-day moving averages at $83,504 and $67,953, respectively.

Source: TradingView

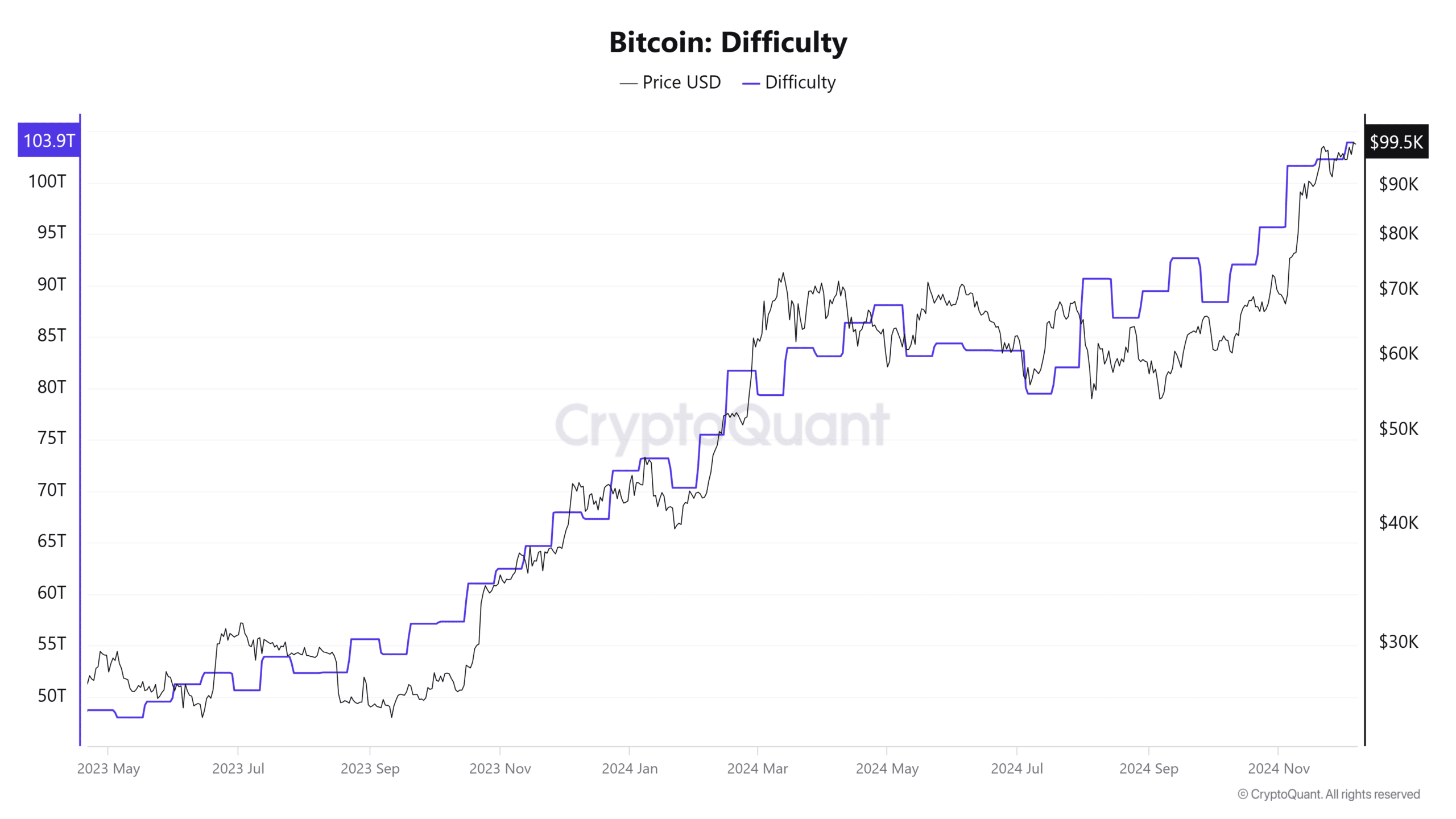

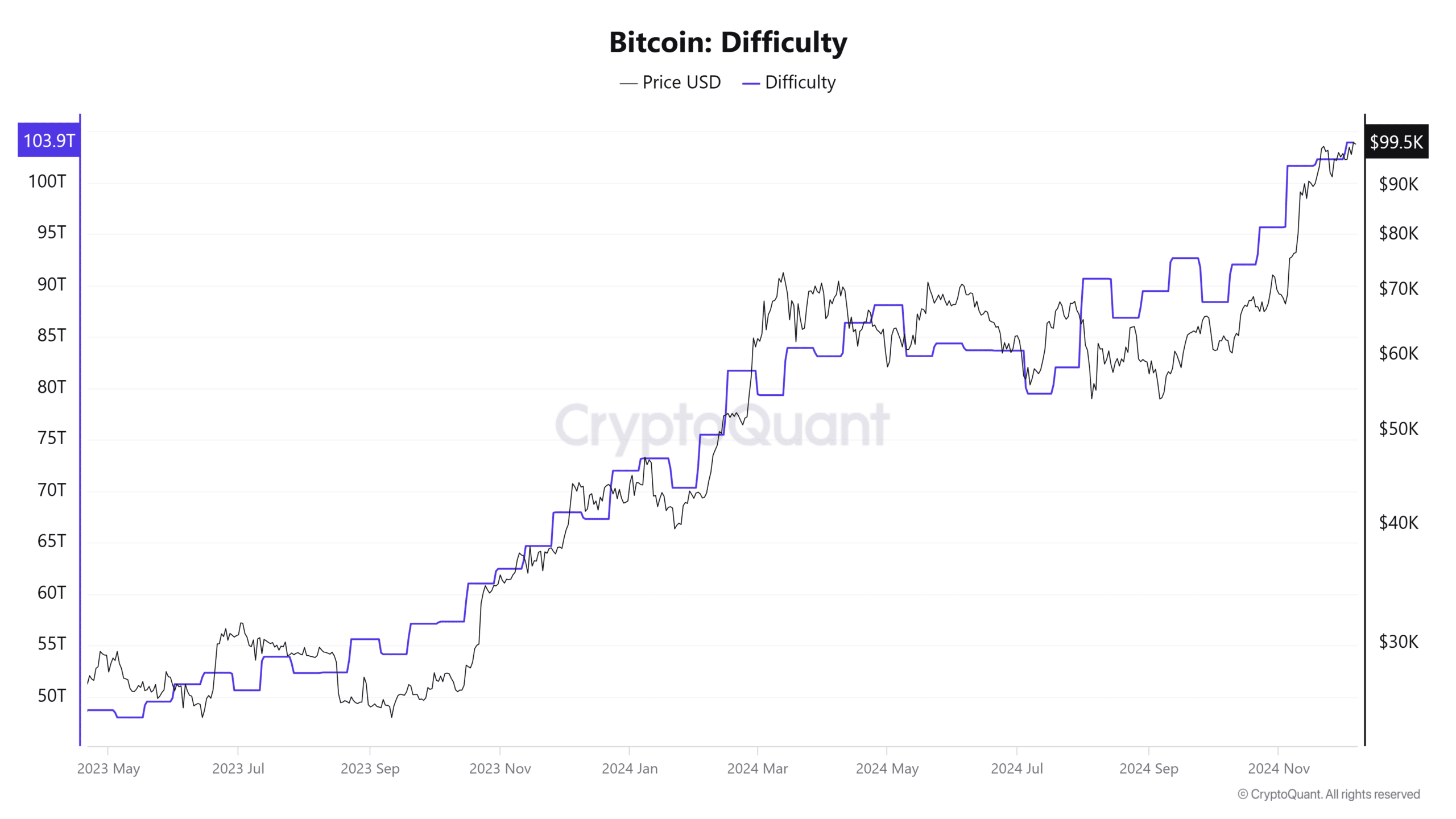

Network metrics – Hashrate, difficulty and turnover

An analysis of Bitcoin’s hashrate found that it reached an all-time high of over 900 EH/s. The continued increase indicated strong competition among miners.

Combined with a record network difficulty of 103.9T, high mining activity has continued despite the decline in miners’ balance sheets.

Source: CryptoQuant

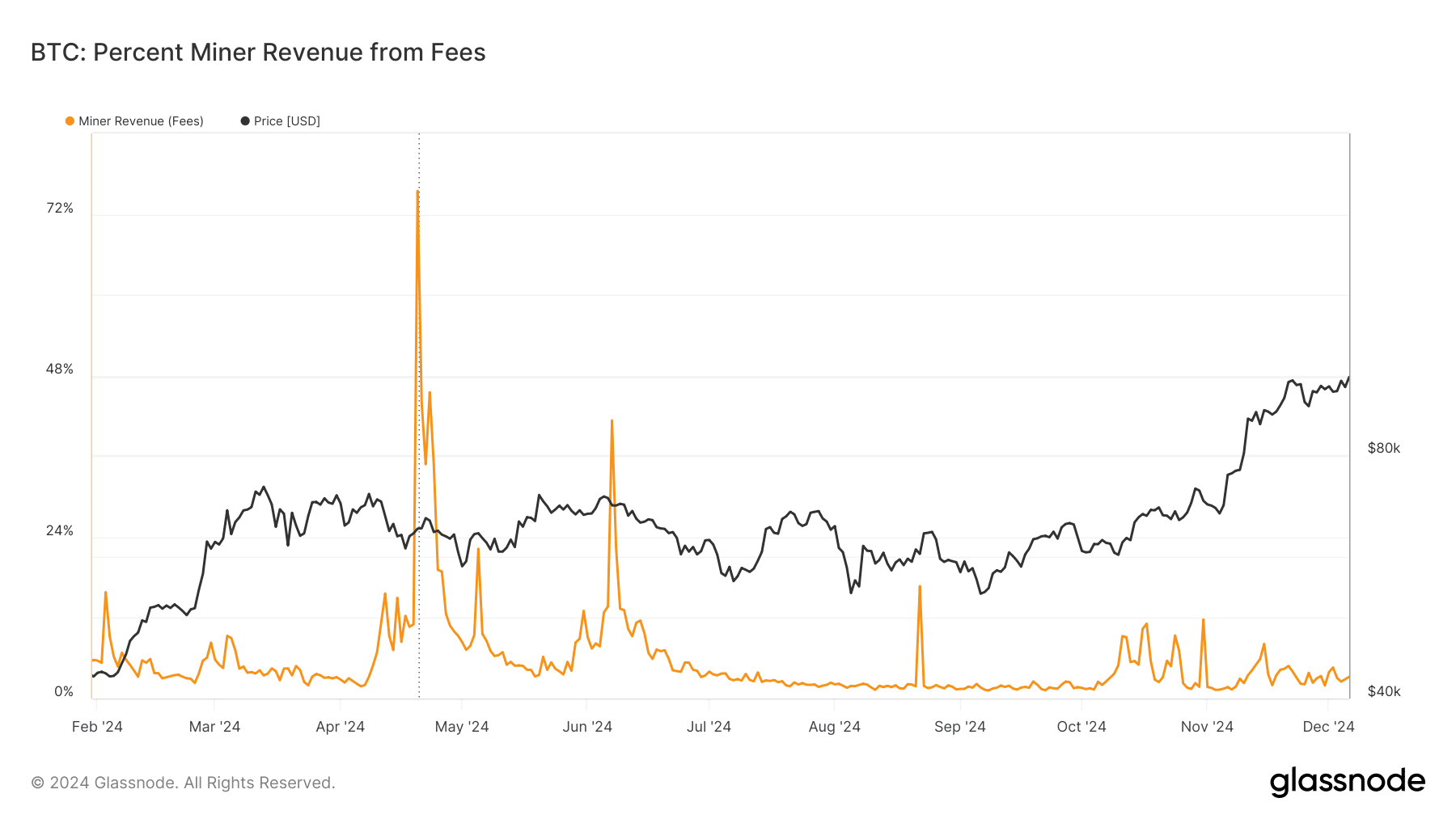

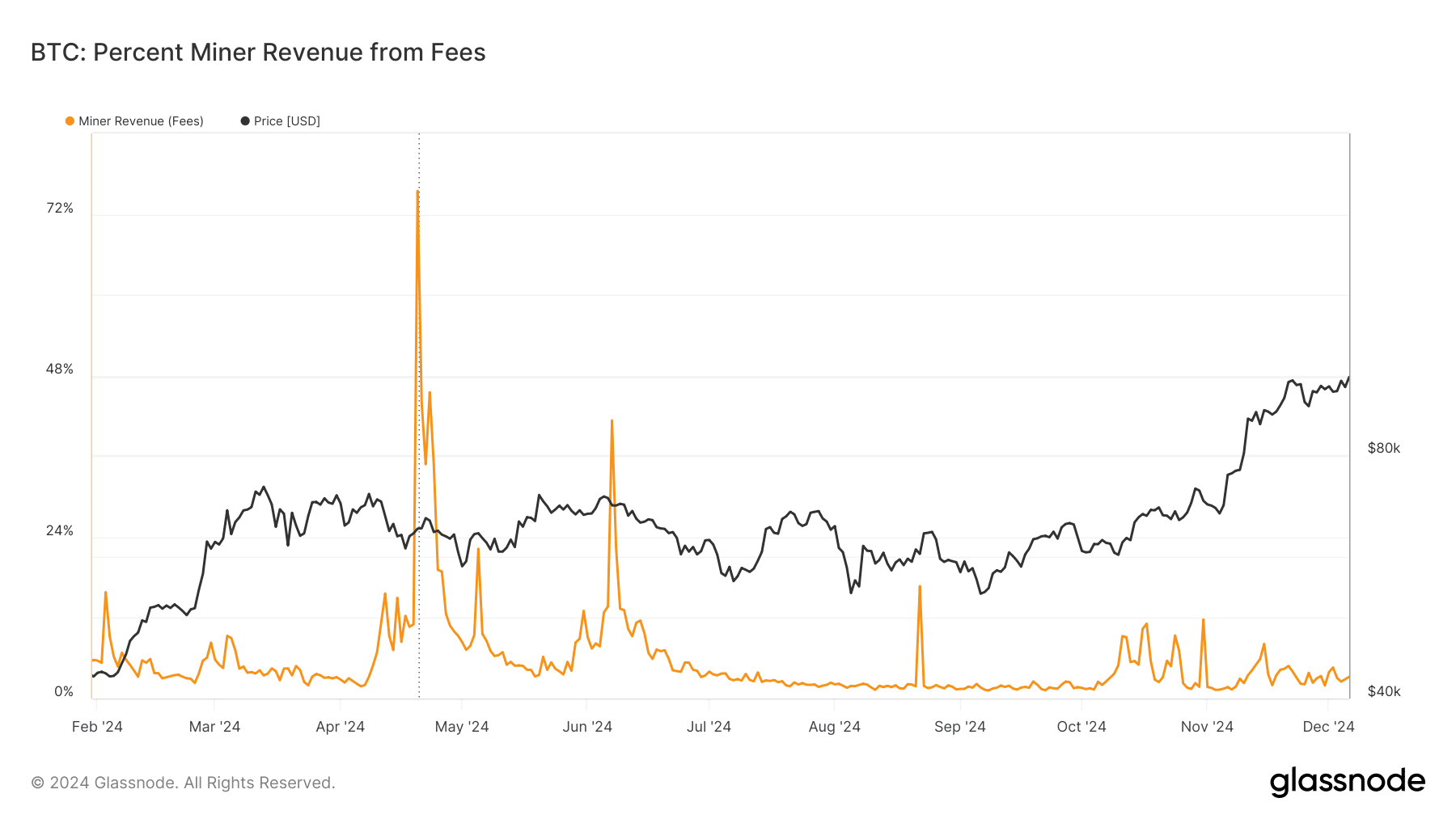

Furthermore, miners’ revenues from fees remain low, with transaction fees accounting for only about 10% of miners’ total revenues.

This is significantly lower than the peaks previously seen in 2024, highlighting miners’ dependence on block rewards.

Source: Glassnode

Implications for the price of Bitcoin

The difference between miner activity and price trends underlined the maturity of the Bitcoin market. Despite major sell-offs, Bitcoin’s price has remained resilient and nearly consolidated its all-time high as buyers stepped in to meet the selling pressure. However, continued selling by miners could lead to increased volatility, especially if compounded by macroeconomic or liquidity concerns.

Bitcoin’s ability to maintain its price around $100,000 amid significant selling by miners reflects the growing influence of non-mining market participants and the asset’s wider adoption.

Read Bitcoin (BTC) price prediction 2024-25

As miners adjust their holdings, market participants will be closely watching whether Bitcoin is able to break through its psychological resistance and continue its rally. The coming weeks will be critical in determining whether the recent mining sell-off marks a potential turning point or merely reflects short-term market adjustments.