- The render rose 40.16% last day to a nine-month high.

- Market indicators suggested that the altcoin could reach a new ATH.

In the last 24 hours, Cause [RNDR] has seen a massive rally, reaching a 9-month high of $11,853. This represented an increase of 40.16% over this period.

The altcoin saw an exponential spike in trading activity, with volume increasing 244.93% to $4.23 billion. At the same time, the market capitalization rose past the $5 billion mark.

During this period, Render outperformed Bitcoin [BTC] despite BTC crossing the $100,000 mark. AI coins, Internet Computer Protocol, among others [ICP] fell by 2.08%, Bittensor [TAO] fell 5.23%, and NEAR Protocol [NEAR] rose by 2.7%.

Other major coins such as Ripple [XRP] fell by 9.71%, Solana [SOL] fell 0.70%, and Ethereum [ETH] Won 4.6%.

With Render experiencing such a massive uptrend, the question remains: can the altcoin maintain its momentum?

Can Render keep up the rally?

According to AMBCrypto’s analysis, Render is currently experiencing bullish sentiment with strong upside momentum.

AMBCrypto noticed this positive market sentiment and bullishness with the new number of investors entering the market. According to Coinglass data, Render’s Open Interest (OI) rose to an all-time high of $173.08 million in the past 24 hours.

When the OI rises, it means that more investors are opening new positions while existing ones hold their trades.

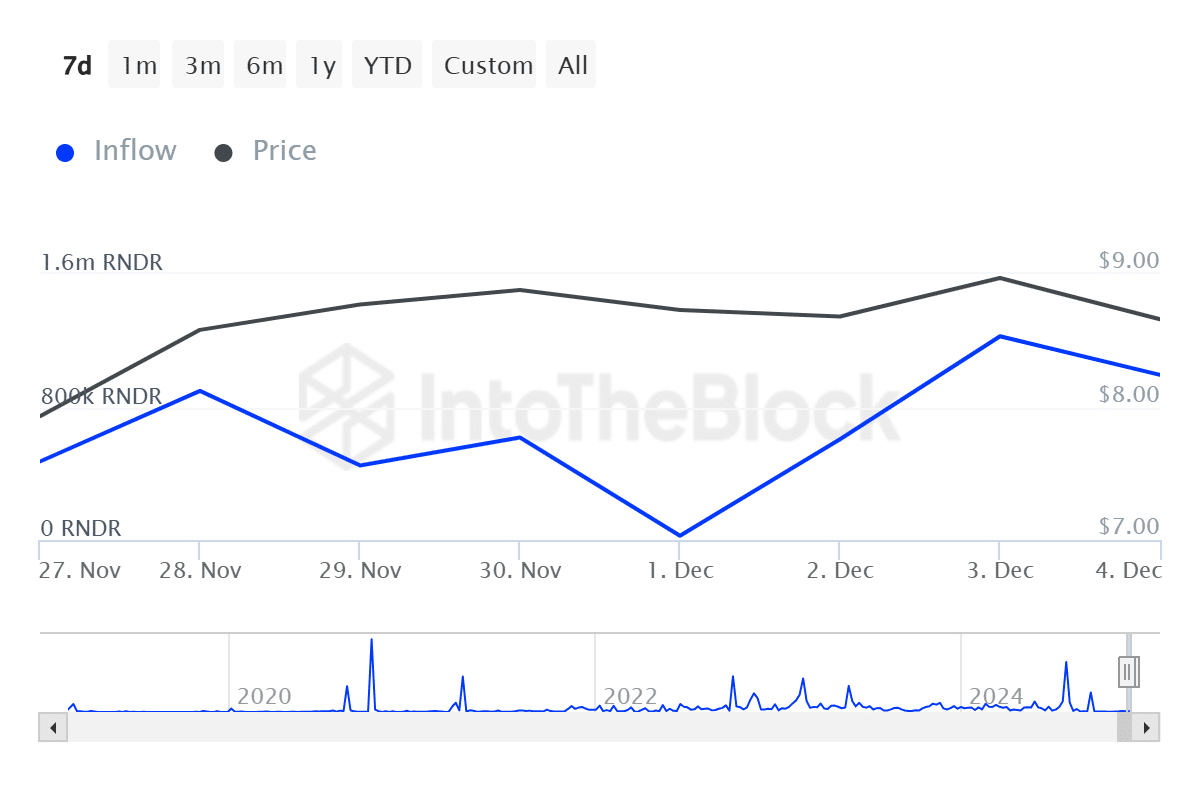

Source: IntoTheBlock

Moreover, since December 1, large investor inflows have increased by 4,627%, from a low of 26.02 thousand to a high of 1.23 million.

This increase indicates that whales are increasing their capital inflows through accumulations. Therefore, we can conclude that the rising open positions are mainly caused by whales, who are now significantly increasing trading volume by purchasing the altcoin.

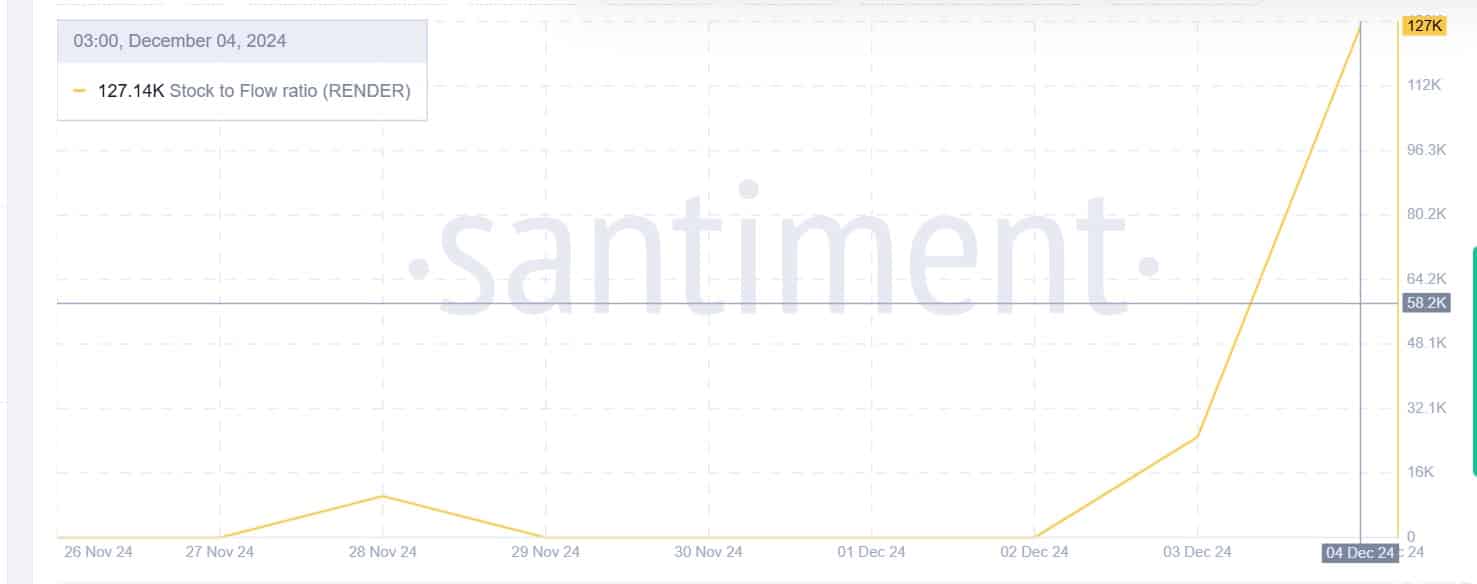

Source: Santiment

Render’s Stock-to-Flow ratio has increased from 0 to 127.14k in the past week. This shift indicates that the altcoin has moved from oversupply to scarcity. As a result, scarcity leads to higher value through increased interest.

In general, greater scarcity leads to greater demand, which often leads to higher prices.

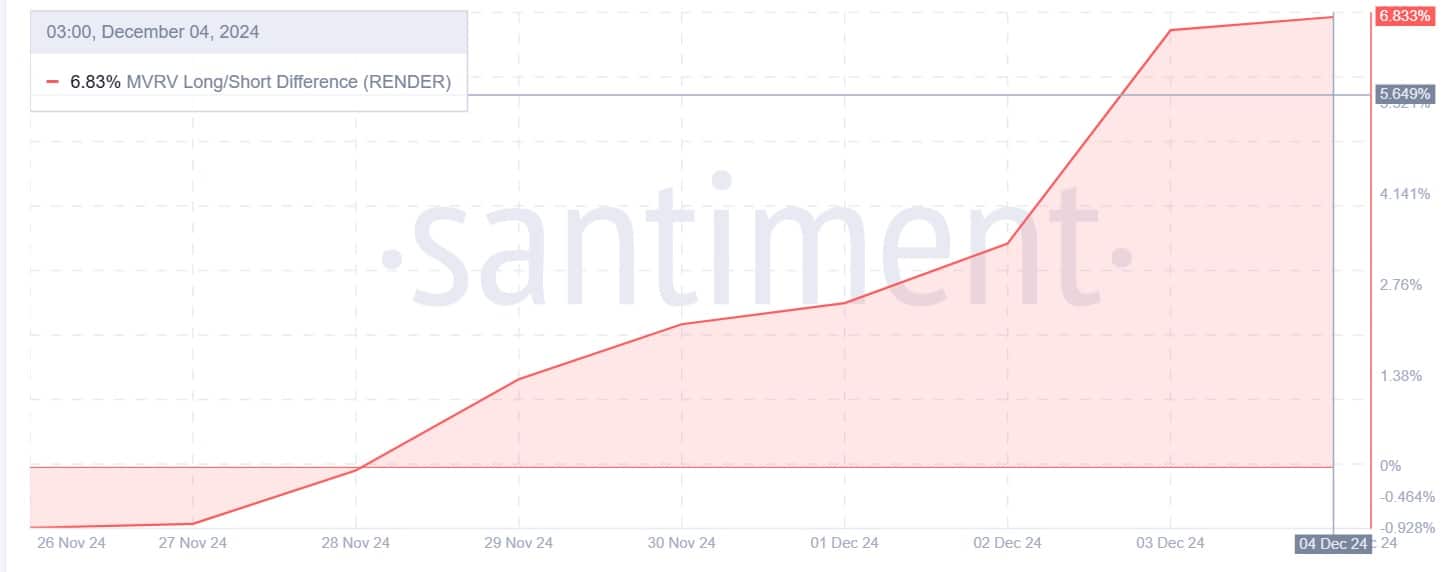

Source: Santiment

Finally, Render’s MVRV Long/Short Difference has increased persistently over the past week, from 0.04% to 6.83%, at the time of writing. This increase implies that long-term holders’ profit margins have increased significantly, even as they remain confident in the altcoin’s prospects.

Read Renders [RNDR] Price forecast 2024–2025

In conclusion, Render is currently experiencing bullish sentiments, positioning the altcoin for further gains.

If current conditions persist, Render will encounter resistance around $12,095. Above this level, resistance is minimal and the altcoin could reach a new all-time high.