- Supra bulls have been quiet for the past 13 trading hours.

- The low trading volume during the retracement meant that a strong bullish swing would be possible in the coming days.

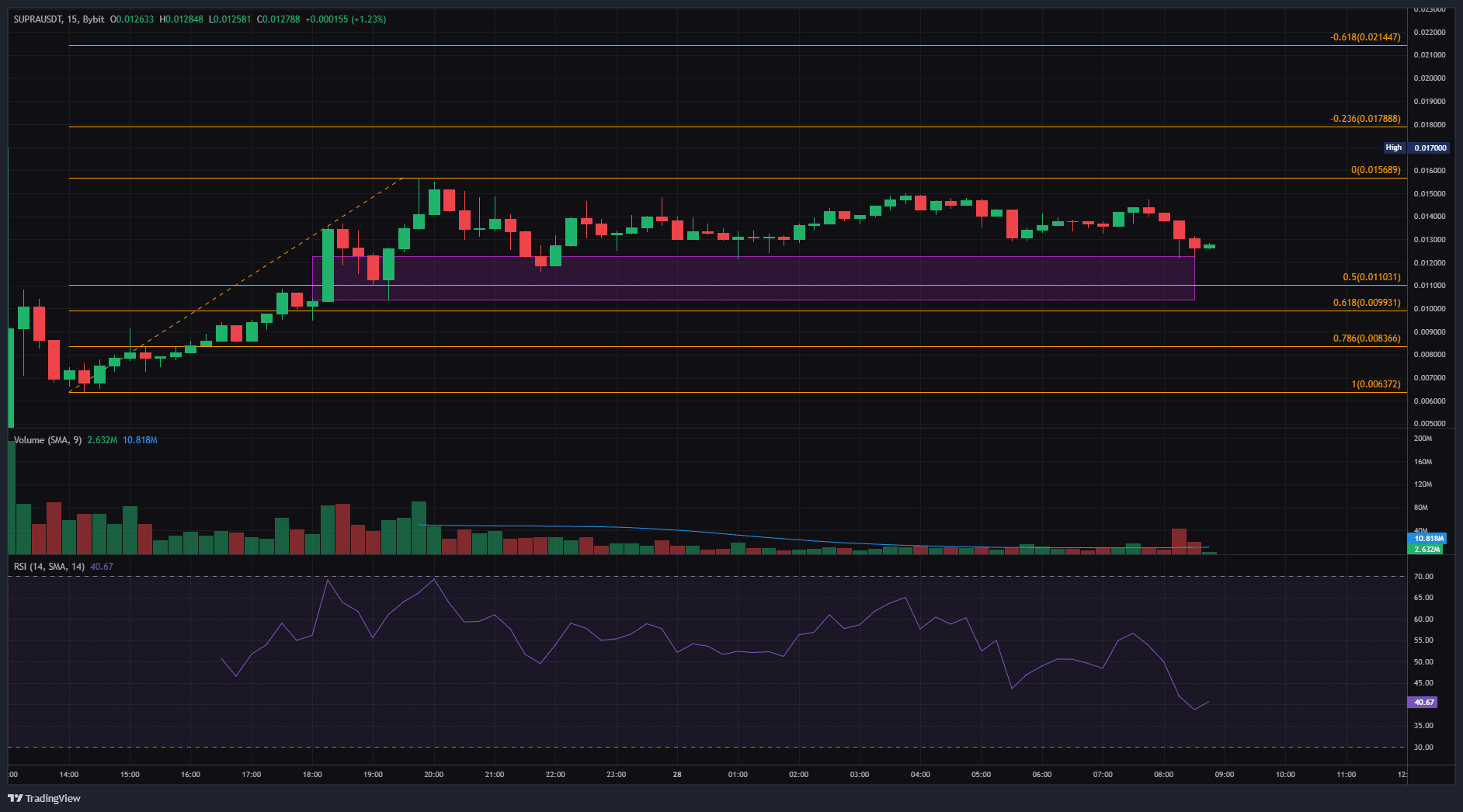

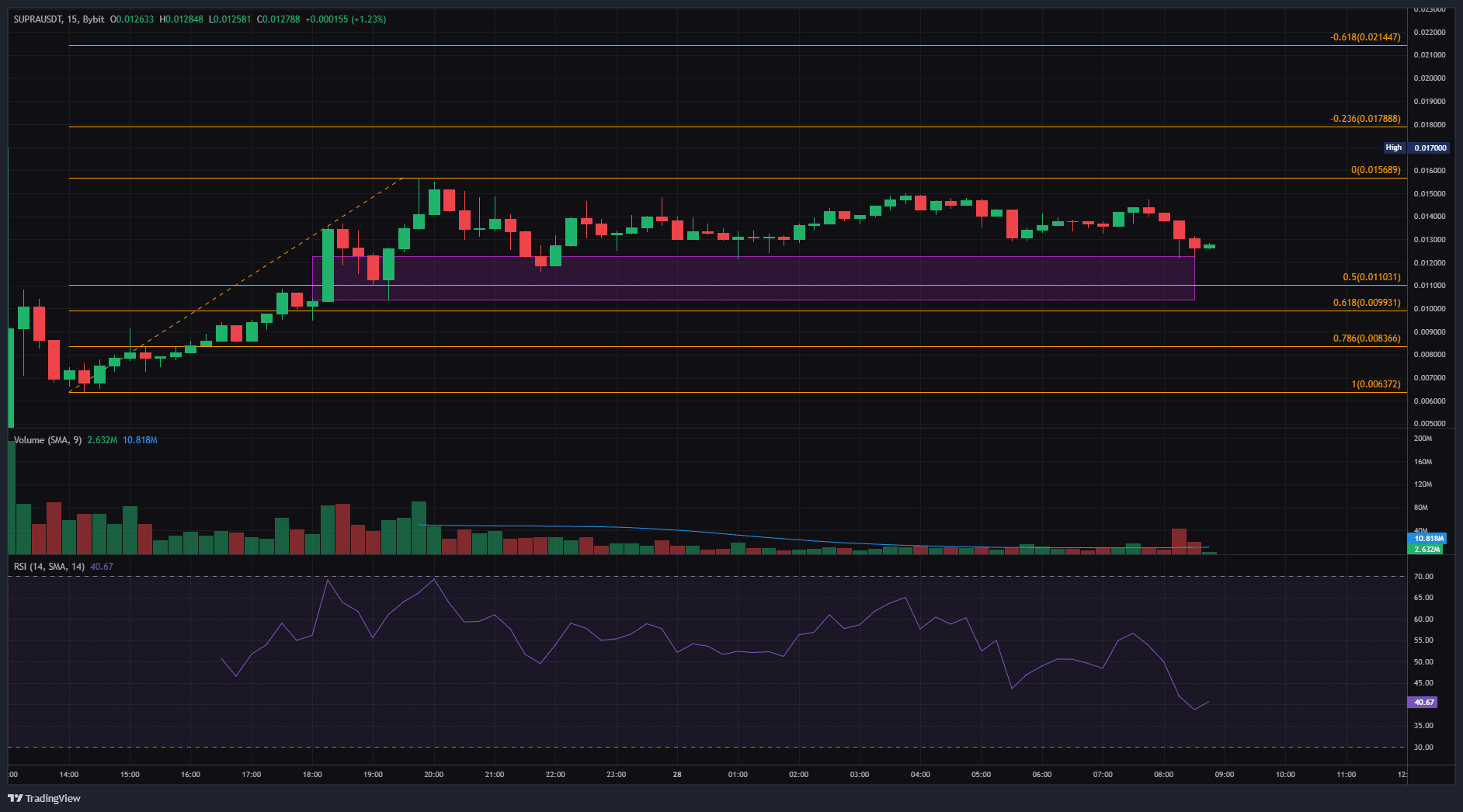

Upstairs [SUPRA] crypto rose 137% in less than six hours on November 27, the day it started trading on the Bybit exchange. Over the past 13 hours, the token’s market cap of $80.65 million has consolidated above a short-term support zone.

Supra-crypto bulls defend the psychological round number support at $0.01

Source: SUPRA/USDT on TradingView

A series of Fibonacci retracement levels were plotted based on the rally that Supra crypto saw on November 27th. This move reached from $0.00637 to $0.01569.

Over the past 16 hours, SUPRA has defended the $0.0105-$0.012 demand zone, which coincided with the 50% retracement level.

However, the token’s RSI has fallen below neutral 50 within a span of 15 minutes. Moreover, the market structure in this time frame is also bearish as the token made a new lower low below $0.0129.

Trading volume was low over the past 16 hours, indicating that selling pressure during Supra crypto’s retracement phase was low. This was an encouraging sign, but over the past few trading sessions we have seen a spike in selling volume.

Traders can expect volatility to increase in the coming days. A move below the outlined demand zone would likely take Supra crypto to the 78.6% retracement level at $0.00836. Such a dip can provide a buying opportunity.

Realistic or not, here is the market cap of SUPRA in terms of BTC

Bitcoin [BTC] has slowly climbed higher from the $91,000 mark, reaching $95,000 in the last 32 hours. Continued upside momentum for BTC could increase SUPRA’s chances of a rally.

However, these small-cap coins don’t always move in sync with the rest of the market and may decide to pump or dump out of sync with Bitcoin or the other large-cap assets.

Disclaimer: The information presented does not constitute financial advice, investment advice, trading advice or any other form of advice and is solely the opinion of the writer