- One analyst pointed to Bitcoin’s fractal patterns as evidence that holders are positioning the asset for sustainable growth.

- Data suggested that Bitcoin is far from reaching its cyclical market peak, leaving room for significant price gains.

In the short term: Bitcoin [BTC] The performance over the past 24 hours reflects weaker sentiment, which fell 1.53%, with bearish trends gaining strength. However, broader indicators suggest this pullback is temporary, with the market expected to recover as sentiment improves.

For a deeper dive into Bitcoin’s potential trajectory, AMBCrypto provides a detailed analysis of the key metrics driving its prospects.

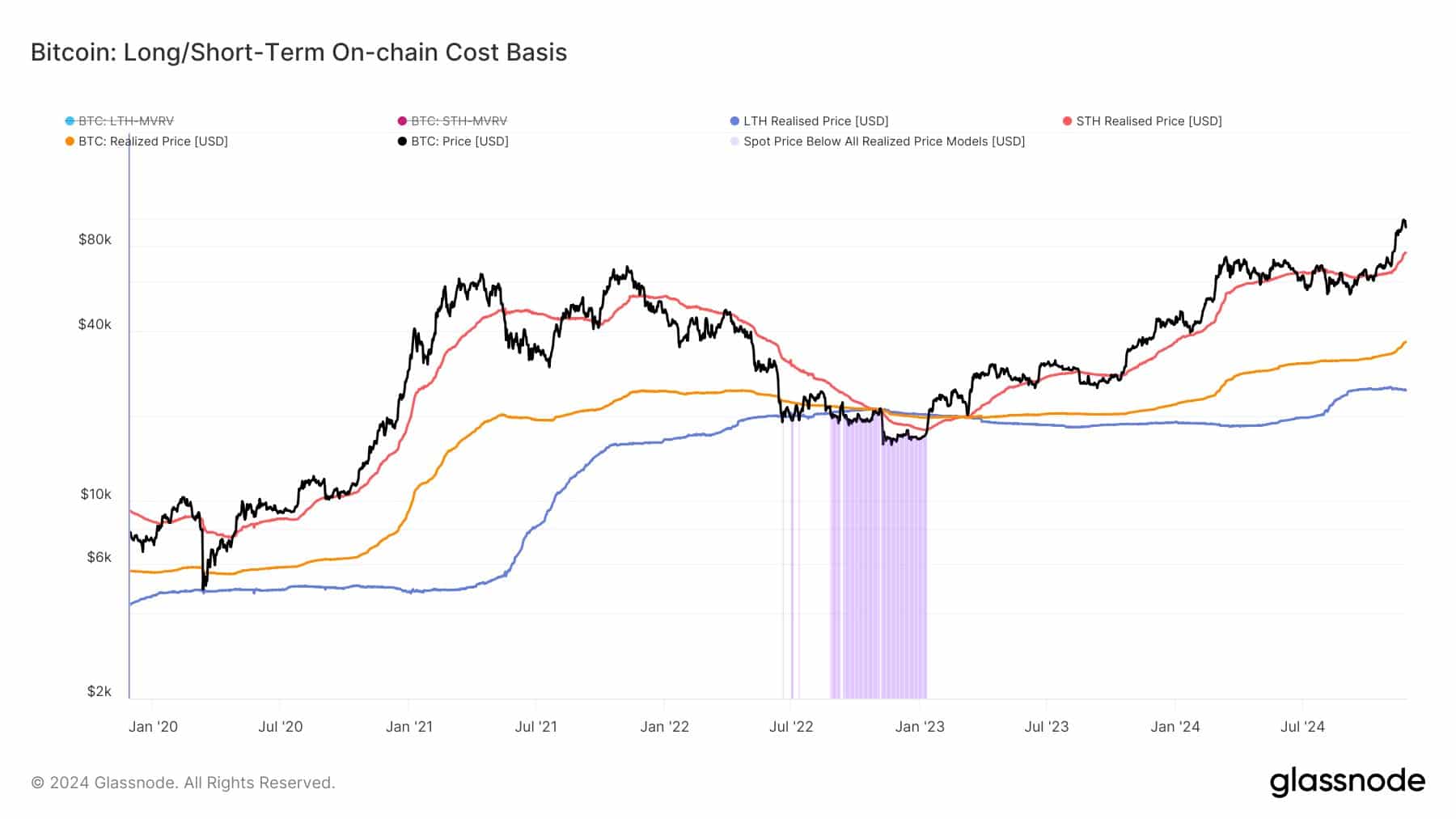

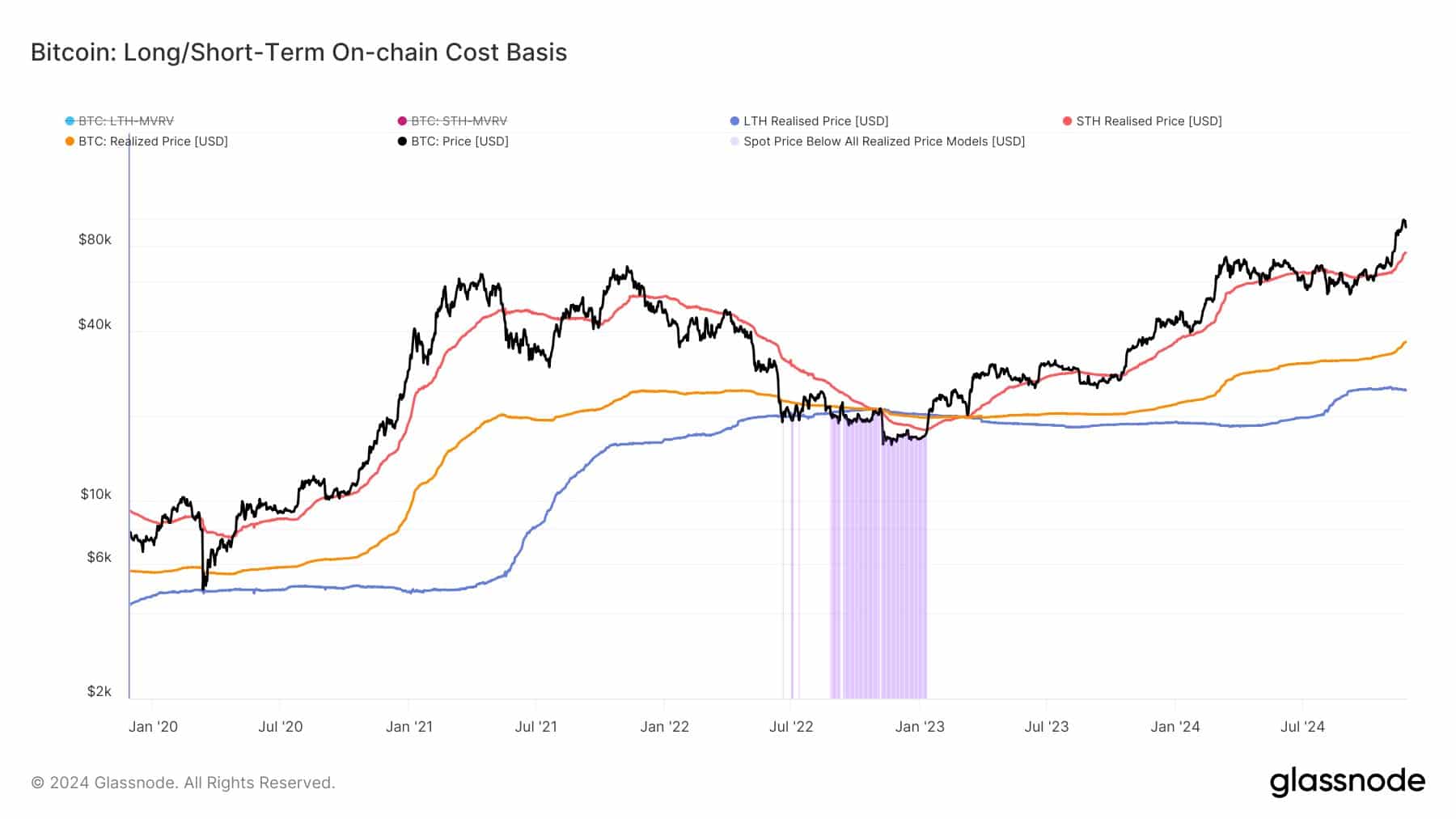

Long-term holders remain stable as short-term buyers provide important support

Analyst James Van Straten believes Bitcoin is at a pivotal moment, similar to late 2020, when its value fell to $10,000 before rising to $60,000.

Van Straten’s analysis highlights the importance of short-term holders’ realized profits (STH RP) as an important level of support. Historically, when BTC returns to this level, buying activity increases, pushing the price back up.

He noted:

“Note how the realized price has started to rise, while the realized profit of long-term holders (LTH RP) remains flat or on a downward trend.”

Source:

When long-term owners’ realized gains remain flat or decline, it often indicates that they are confident in the long-term value of the asset and are holding or accumulating the asset rather than selling it. This behavior supports the bullish momentum and stabilizes the market.

If the trend continues, BTC is likely to recover from the recent dip, with a recovery to the STH RP level implying a return to upward movement.

Further findings from AMBCrypto are consistent with this outlook and point to additional indicators supporting the potential for a price recovery.

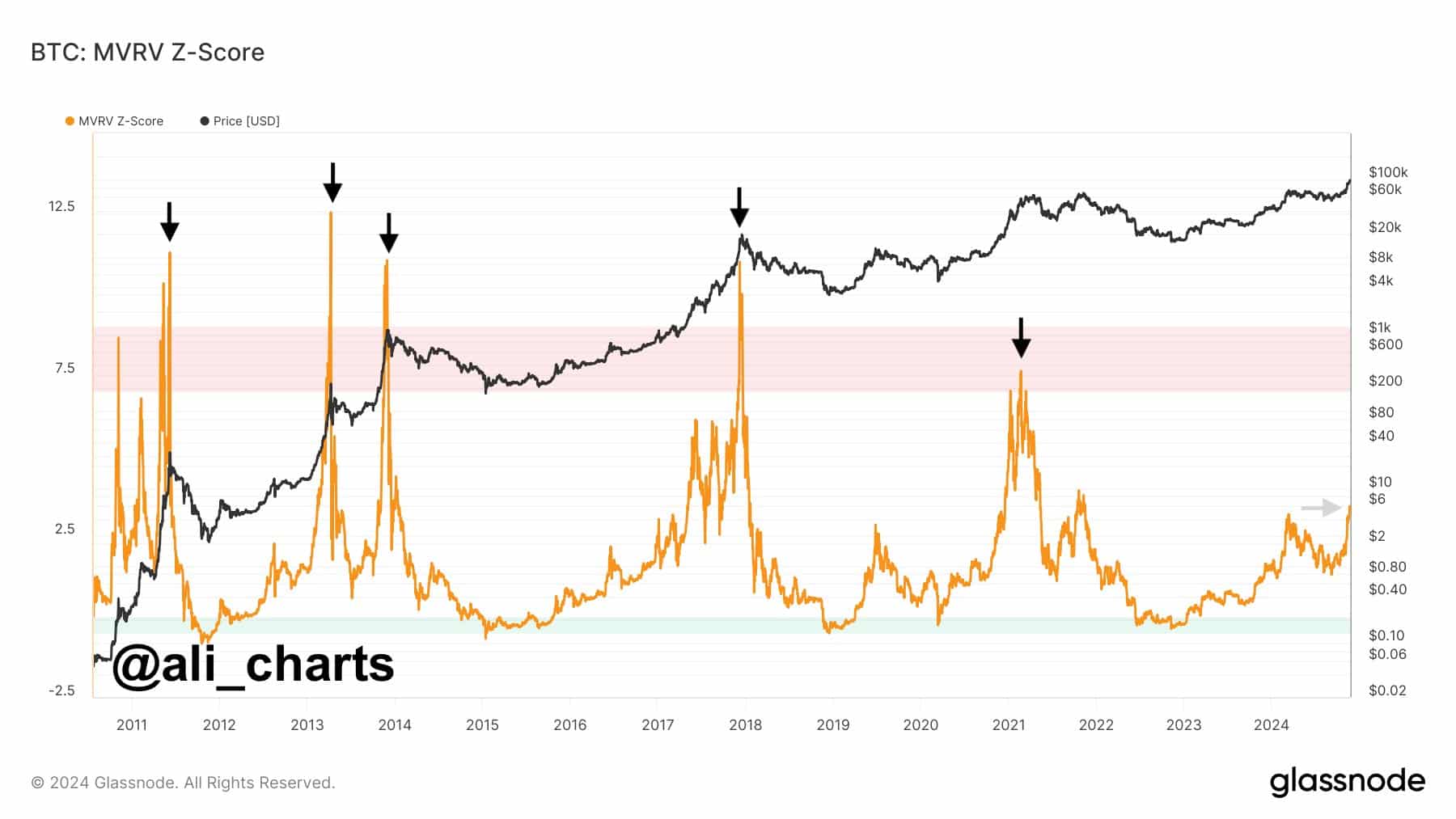

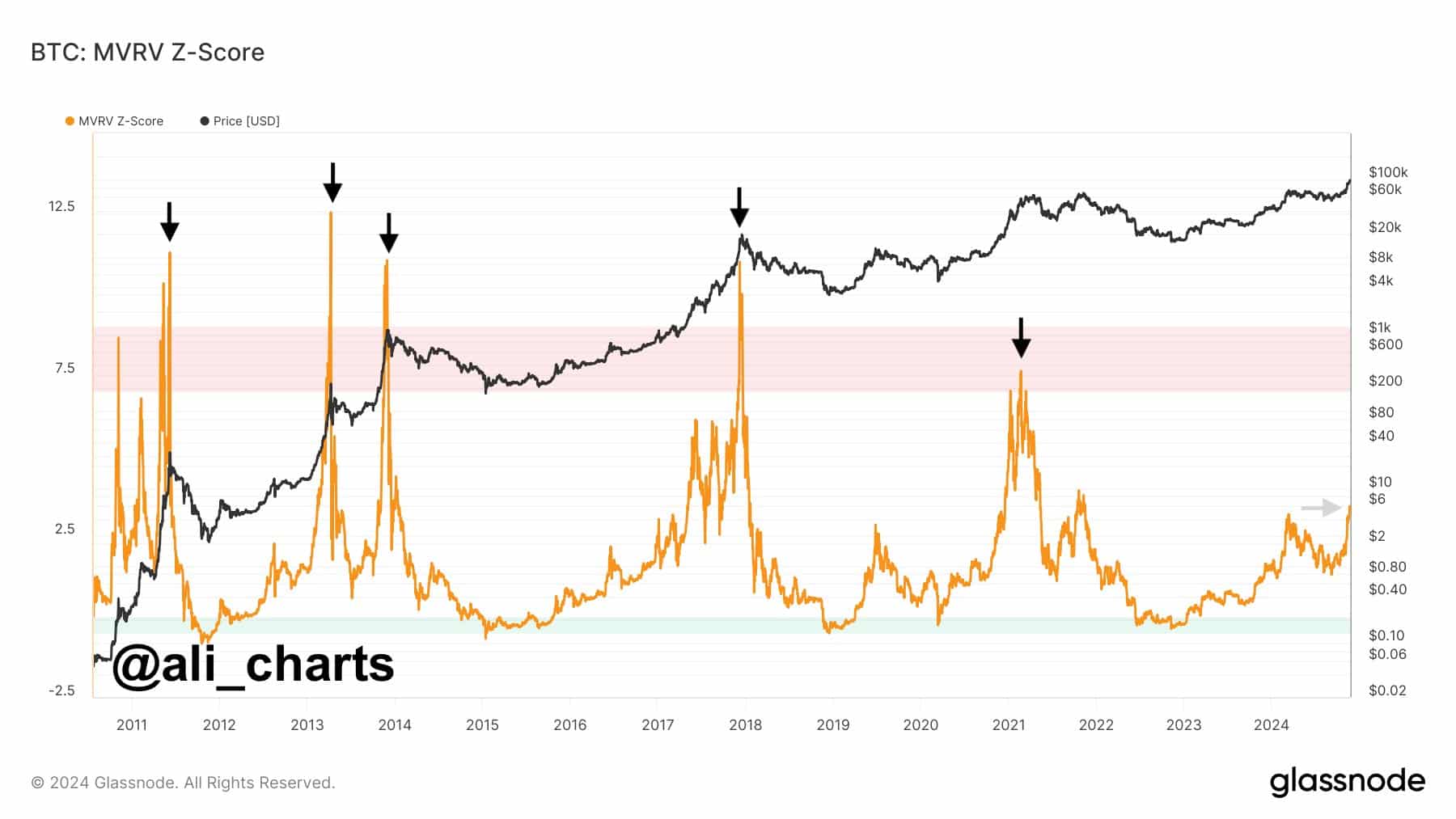

Bitcoin Market Outlook: Room for Further Gains

Crypto analyst Ali Chart claims that Bitcoin still has good upside potential recent postwith broader market sentiment remaining bullish. According to Ali, BTC is still a long way from reaching a cyclical market top – a peak that is typically followed by a big drop.

In his words:

“BTC is far, far, far away from a market top!”

Ali’s analysis is based on the Market Value to Realized Value (MVRV) Z-Score, which currently places BTC in the lower range of the chart. This suggests that there is plenty of room for growth, as the metric indicates that BTC has yet to approach overvalued territory.

Source:

If the MVRV Z-Score begins to trend upward, the price of BTC will likely follow suit, possibly signaling the start of a sustained rally.

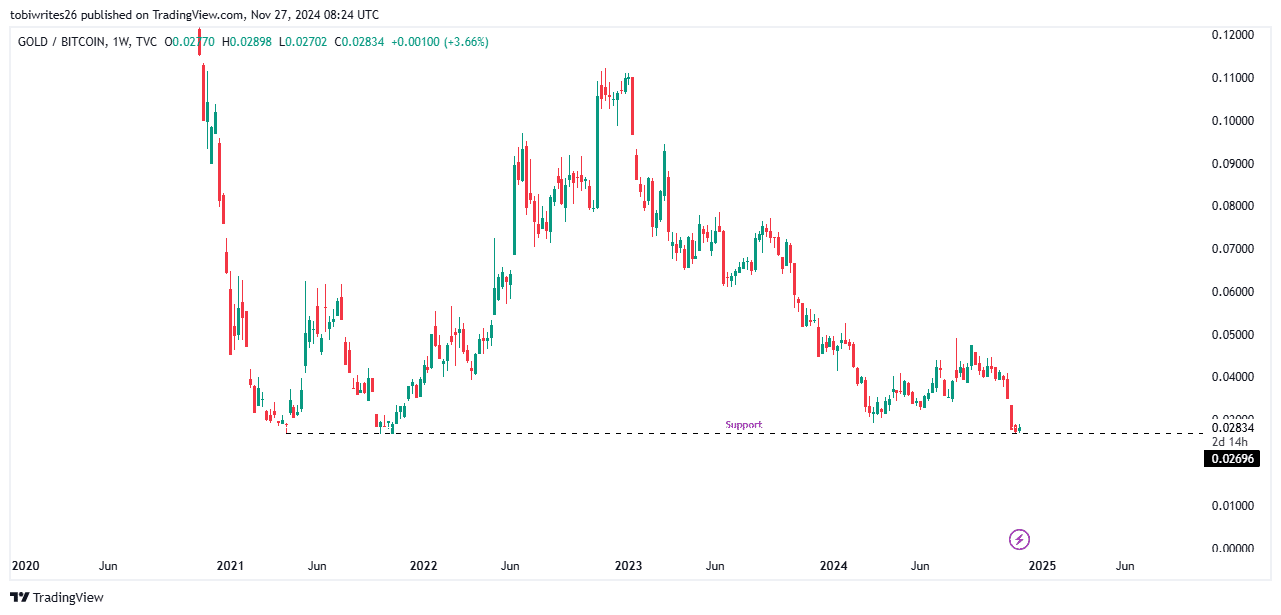

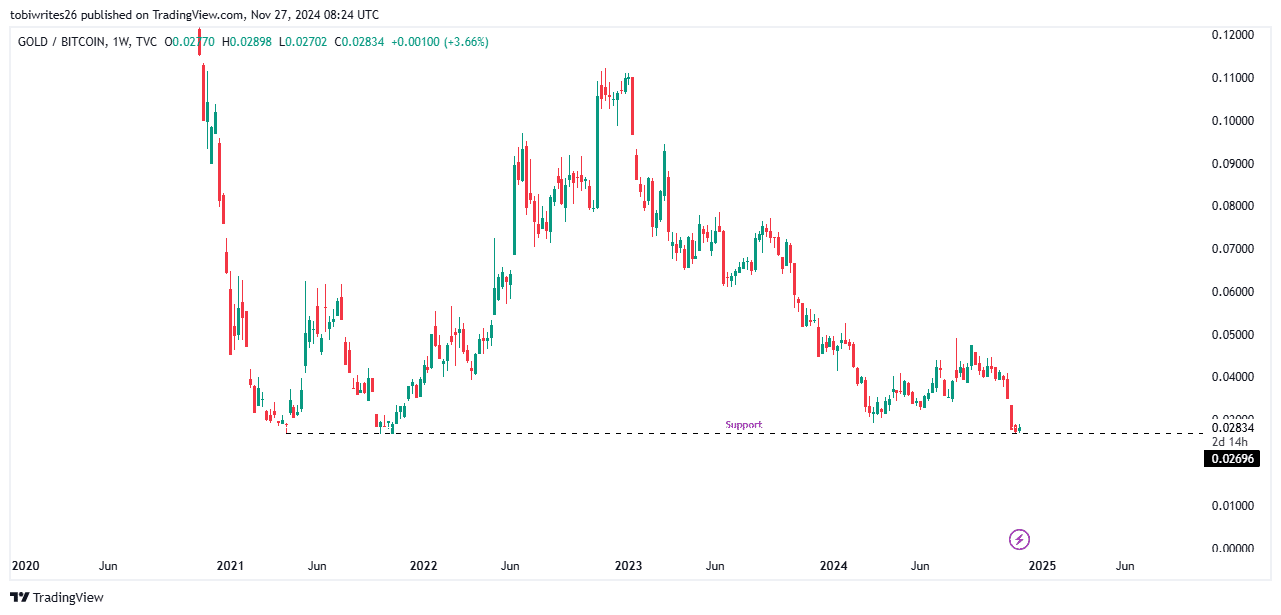

Will Bitcoin Overtake Gold?

Recent analysis shows that if Bitcoin continues to gain value against gold, it could eventually surpass the precious metal in dollar terms, as shown in the chart.

Read Bitcoin’s [BTC] Price forecast 2024-25

This shift could occur if BTC breaks through the current support level, which has limited further declines.

Source: trading view

A collapse here would also highlight a change in market sentiment, with more investors viewing digital assets as a serious economic force – a development that would be bullish for Bitcoin.