- Hashdex Files S-1 Amendment for Nasdaq Crypto Index US ETF.

- Bitcoin ETFs record new weekly inflow spike.

On November 25, Hashdex, a crypto asset management company, announced the filing of a second amended S-1 filing with the US Securities and Exchange Commission (SEC) for a Nasdaq Crypto Index US ETF.

Source: SEC

Hashdex’s crypto ETF chase

The latest change follows Hashdex’s original S-1 filing. The filing was amended in October because the SEC requested more time for review.

The ETF aims to include initially Bitcoin [BTC] And Ethereum [ETH]the two assets currently tracked by the Nasdaq Crypto US Index. According to the filing, the wallet could be expanded with additional digital currencies over time.

Hashdex’s ambitions reflect the broader efforts of key players such as Franklin Templeton and Grayscale. Just like Hashdex, Franklin Templetons The ETF proposed by Crypto Index ETF includes BTC and ETH.

Grayscale However, Digital Large Cap Fund aims to provide a more diversified experience. The ETF includes alternative cryptocurrencies such as Solana [SOL]Avalanche [AVAX]And Ripple [XRP] in his portfolio.

Discover BTC and ETH ETF trends

Meanwhile, the broader cryptocurrency ETF market continues to reach new milestones. Spot Bitcoin ETFs Recorded Net Inflows of $3.38 Billion in the Week of November 18 to 22—a remarkable 102% increase from last week’s $1.67 billion.

According to for SoSo Value this meant the largest weekly inflow ever and the seventh week in a row with positive flows. In contrast, total daily flows turned negative on November 25 as the ETFs saw $438.38 million disappear from the funds.

Interestingly enough, ETH is ETFs witnessed six consecutive days of outflow, before rebounding on November 22. At the time of writing, it recorded daily net inflows of $2.83 million.

Additionally, the total net assets of ETH ETFs surpassed double digits for the first time since launch, reaching $10.28 billion on November 25.

Another ETF for XRP?

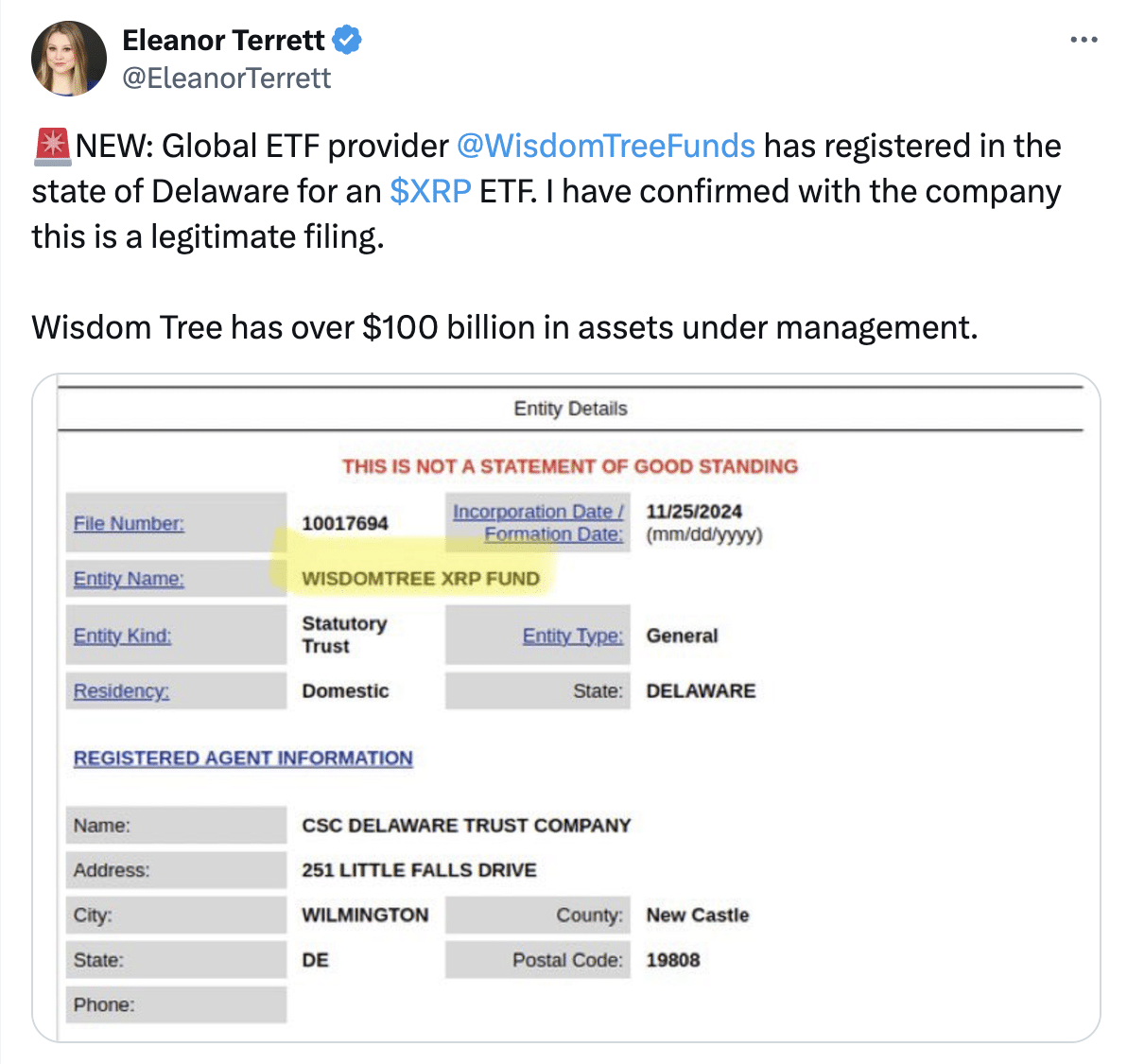

The ETF hype is not limited to BTC and ETH as the race heats up. In a notable development, WisdomTree, an asset manager and global ETF provider managing more than $100 billion in assets, has registered for an XRP-focused ETF in Delaware.

Source: Eleanor Terrett/X

According to Fox Business reporter Eleanor Terrett, this is the case movement is expected to precede an S-1 filing with the SEC. WisdomTree agrees Bitwise21Shares, and Canary Islands capital when submitting similar applications.

Gensler out, crypto ETFs in?

As the SEC’s regulatory landscape evolves, the wave of filings for crypto ETFs has fueled curiosity about their prospects in this changing environment.

Formerly AMBCrypto reported that Gary Gensler, the SEC chairman known for his tough stance on crypto regulation, will resign effective January 20, 2025.

His departure coincides with the start of Donald Trump’s second presidential term. The president-elect has pledged to position the US as a global crypto powerhouse.

This, in turn, could point to a more hospitable environment for crypto ETFs and other digital asset innovations.

While the stage has been set for major shifts in the ETF landscape, the question remains: will the SEC embrace this new era, or will the approval process remain a roadblock?

Well, the coming months promise to be a defining chapter in the evolution of the crypto market.