- An analyst has warned that a Bitcoin pullback of up to 30% could be in the offing.

- This is despite strong bullish sentiment and expectations of a continued rally.

Bitcoin [BTC] has shown remarkable strength in recent weeks, rising 39.51% over the past month and raising its market cap to $1.85 trillion.

However, in the last 24 hours there has been a decline of 5.15%, indicating a possible pause in the uptrend.

While this decline may indicate a healthy correction, bullish fundamentals still remain. Bitcoin could regain strength and resume its climb after this period of consolidation.

Potential BTC correction?

Crypto analyst King Young Ji has warned that BTC may undergo a significant correction before resuming its upward trajectory.

“Even in a parabolic bull run, Bitcoin could see a 30% pullback”

He noted, citing historical data to support his claim.

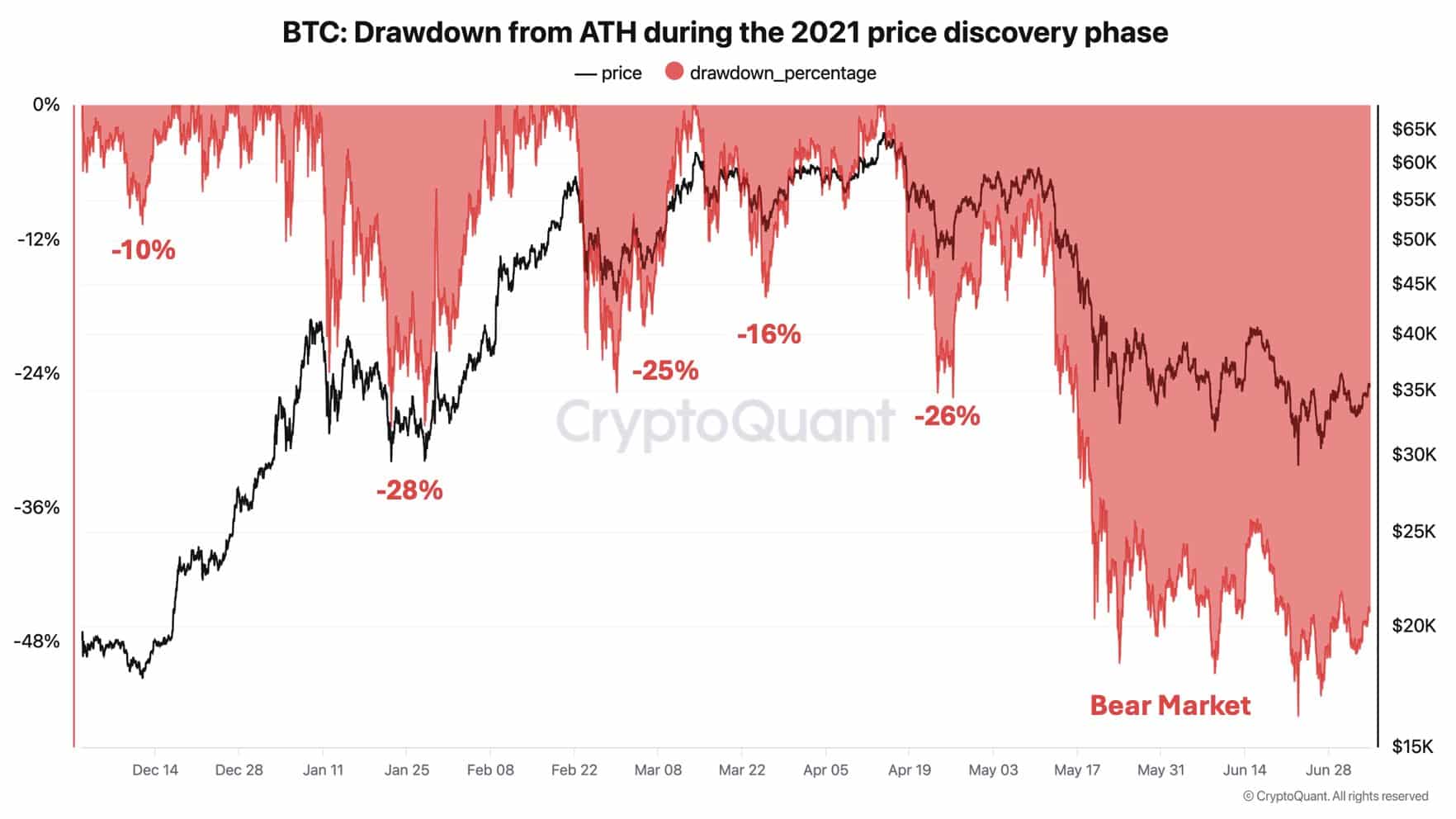

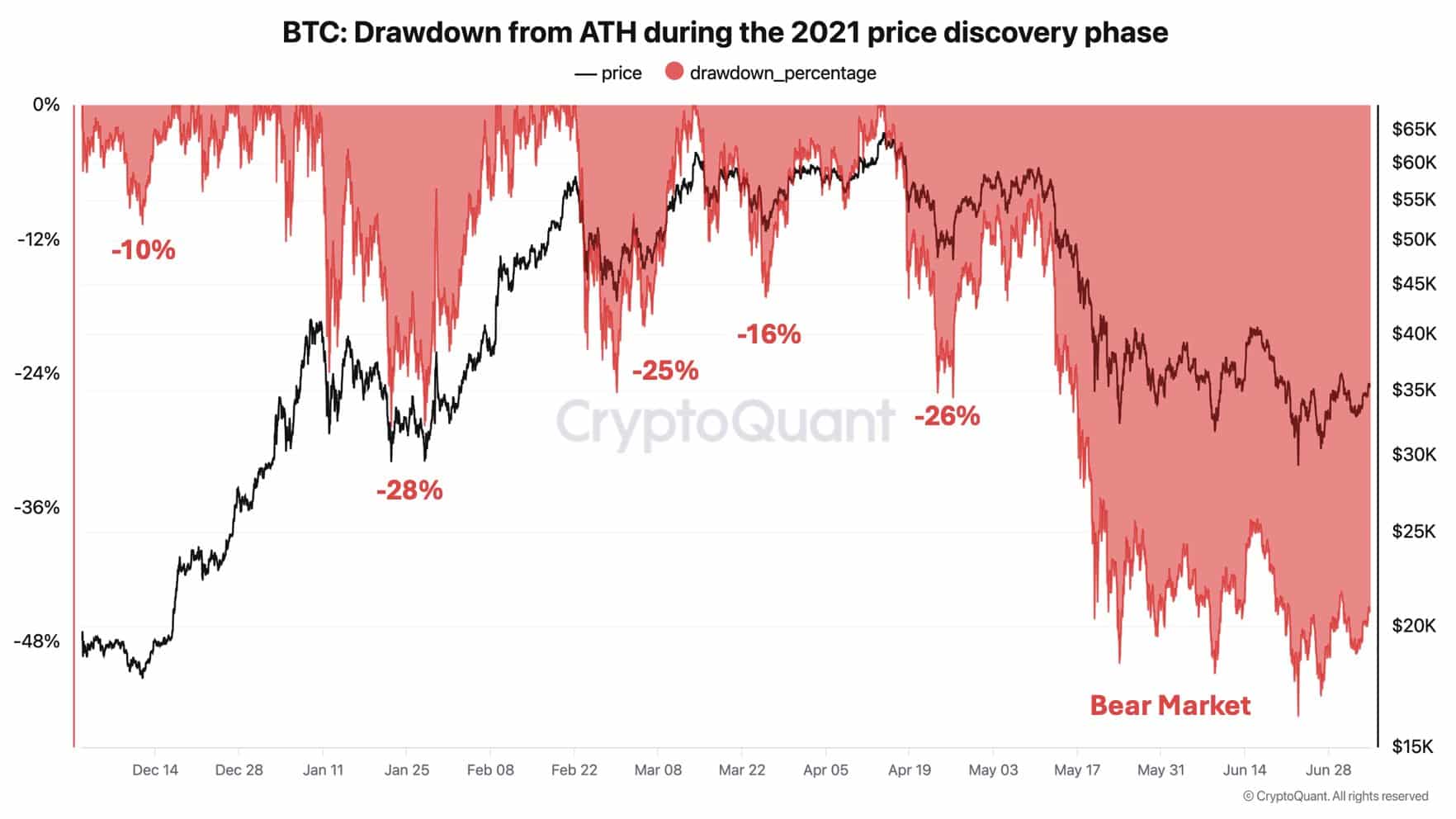

He pointed to Bitcoin’s performance during the 2021 bull run, where prices rose from $17,000 to $64,000. Despite the strong rally, BTC experienced five notable corrections.

The smallest decline was 10%, while the largest reached 28%, highlighting the volatility of even bullish market phases.

Source:

Based on his analysis, BTC’s current rally could undergo a similar correction. While troubling, such pullbacks are part of a healthy market cycle and often precede further gains.

However, the analyst advises caution as the market navigates through this phase.

Transaction volume and active address increase

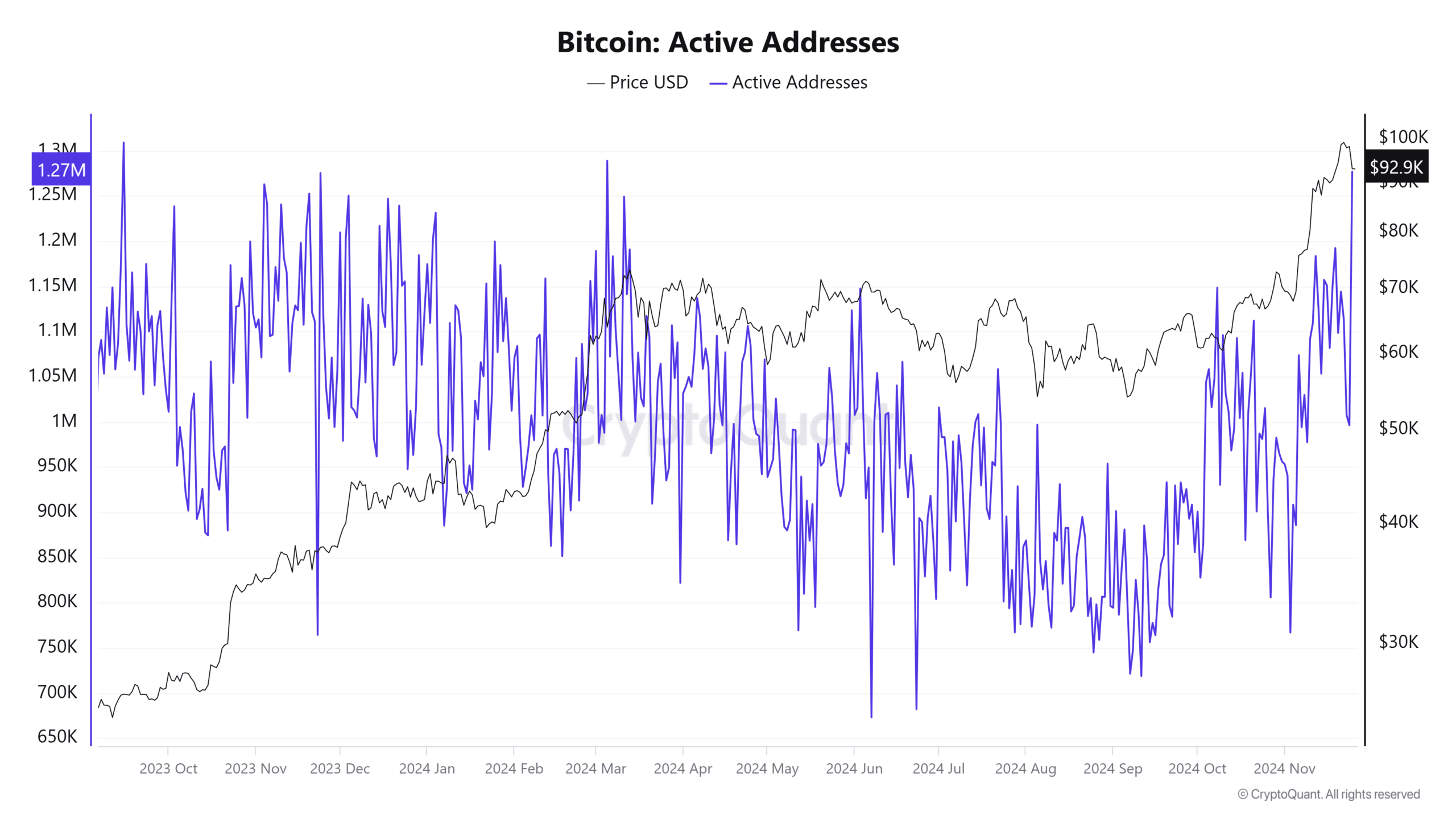

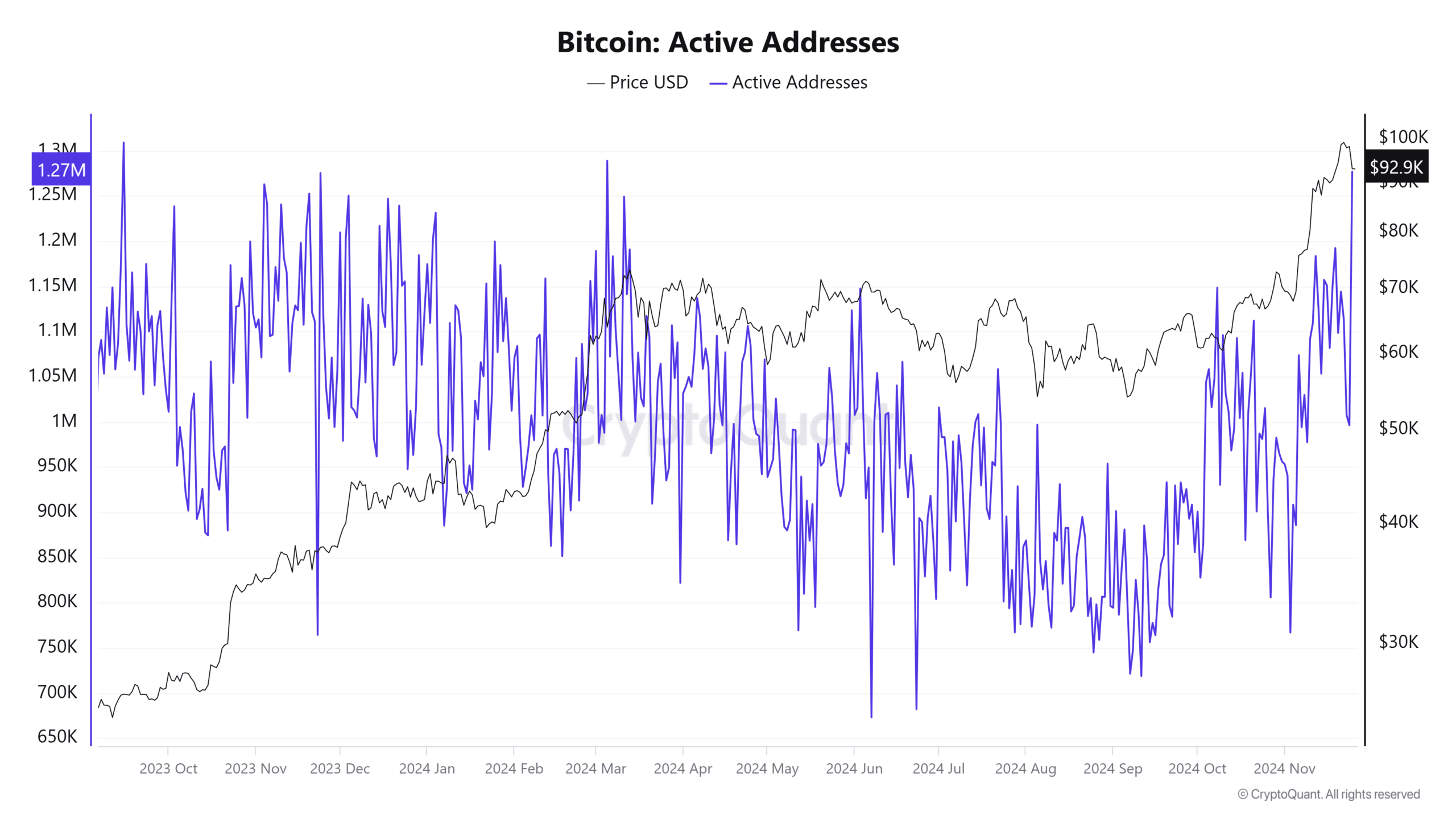

Bitcoin network activity is gaining momentum, with a sharp increase in transaction volume and active addresses – both key indicators of a potential rally.

Active addresses rose to 1,276,535, a level last seen in May. This increase is accompanied by a 56.27% jump in transaction volume, reinforcing the possibility of bullish momentum.

Active addresses are calculated based on unique wallets participating in BTC transactions (sending or receiving) over a certain period of time, in this case the last 24 hours.

Source: CryptoQuant

Meanwhile, token transfer volume has rebounded sharply after a sharp decline the previous day. More than $1 million worth of BTC has moved, reflecting renewed investor activity.

If this uptrend continues, Bitcoin could regain strength and move higher in the coming days.

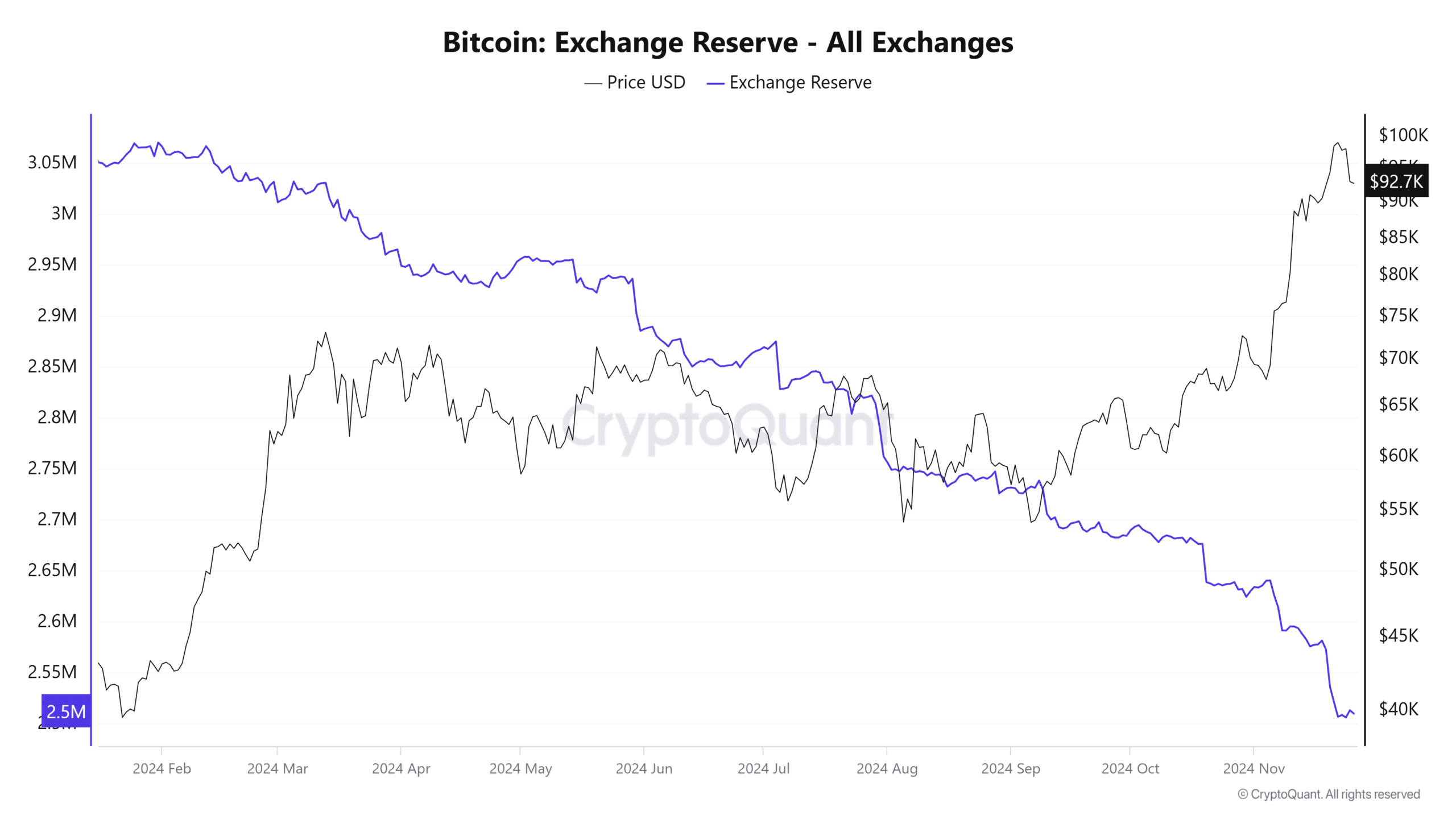

Foreign exchange reserves continue to decline

Bitcoin exchange reserves, which track the total supply of BTC on various exchanges, have continued to decline.

Over the past seven days, reserves have fallen by 2.75%, with only 2,507,706 BTC available on the exchanges at the time of writing – a trend that shows no signs of slowing.

Source: CryptoQuant

Such a drop typically indicates that market participants are moving their BTC to self-custodial wallets, prioritizing personal control over their assets.

Read Bitcoin’s [BTC] Price forecast 2024–2025

This behavior often corresponds to long-term bullish sentiment as investors reduce the supply available for trading or selling.

If this trend continues, it could strengthen the bullish outlook for Bitcoin, potentially pushing the asset’s price higher as supply on exchanges continues to decline.