- Spot Bitcoin ETFs recorded historic inflows of $3.13 billion per week, demonstrating growing investor confidence.

- Altcoins such as Solana, XRP and Litecoin witnessed significant institutional inflows amid Bitcoin’s dominance.

The ripple effects of Donald Trump’s victory in the presidential election continue to make waves in the cryptocurrency market, fueling a sustained period of growth and activity.

Last week, the market reached a crucial milestone when global investment products saw net inflows of approximately $3.13 billion.

This increase was largely attributed to increased interest in US spot Bitcoin [BTC] Exchange-Traded Funds (ETFs), which underline the evolving dynamics of the market.

Crypto inflow breaks record

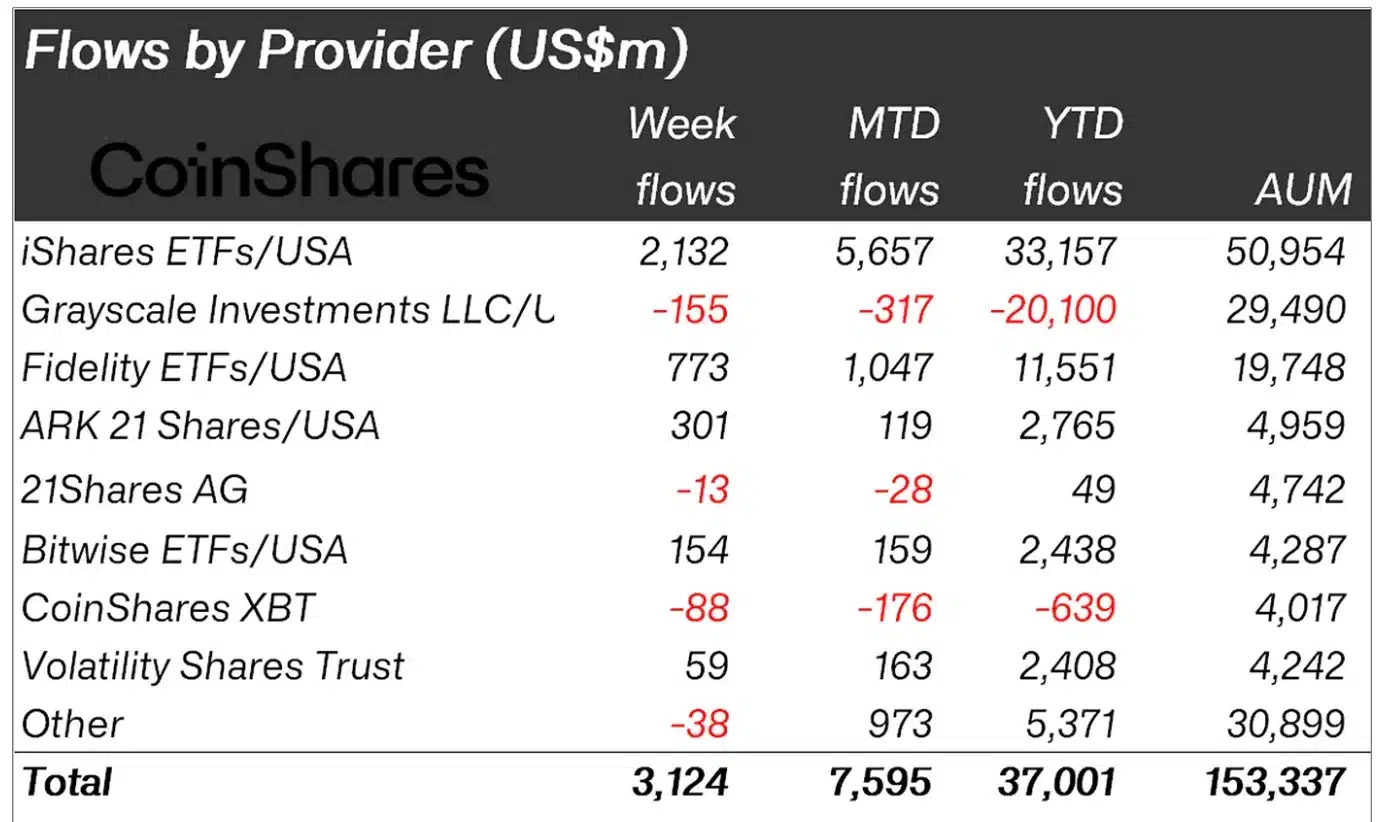

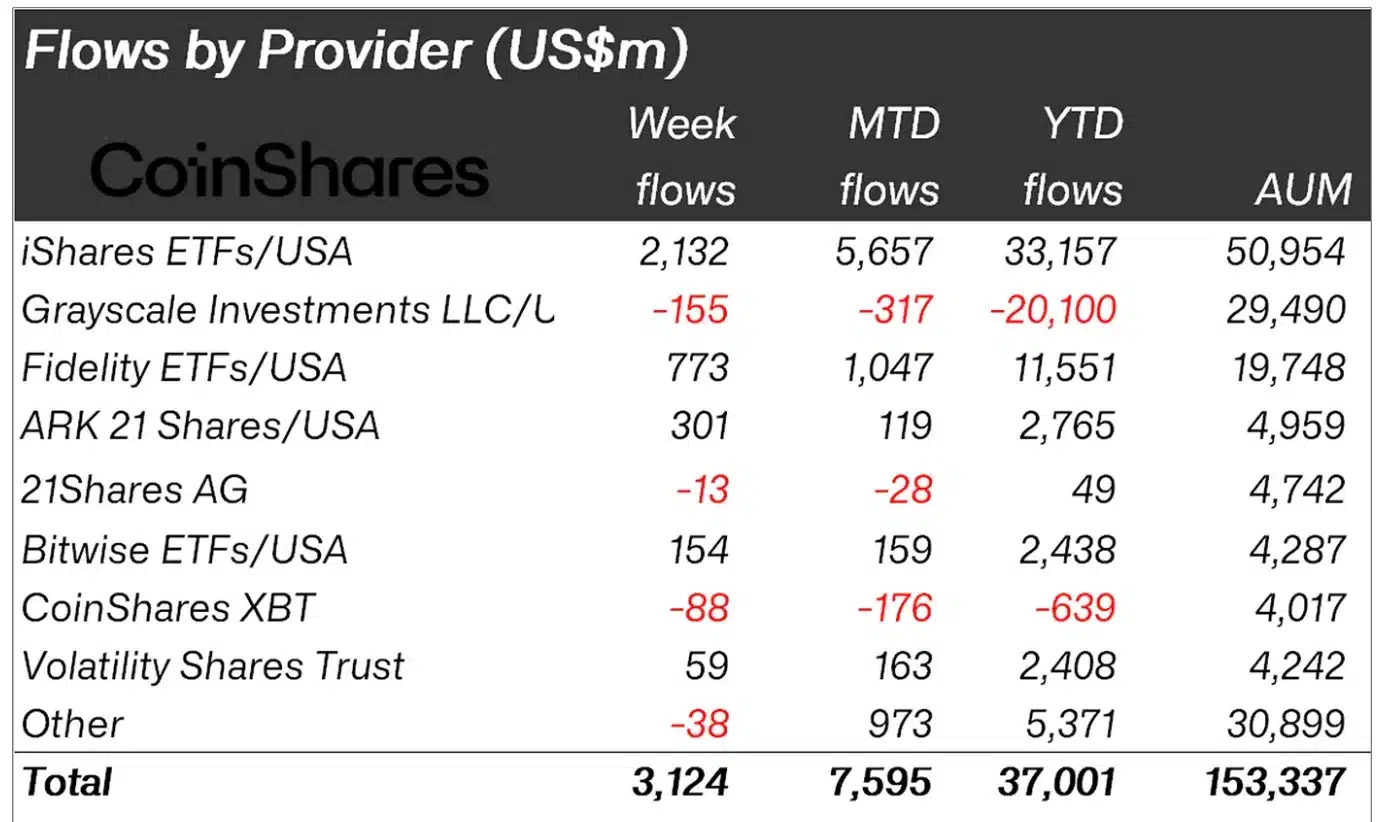

According to CoinShares data, this development highlighted growing investor confidence and the transformative impact of political and economic shifts on the crypto space.

According to the report,

“Digital asset investment products saw their largest weekly inflows ever, totaling $3.13 billion, bringing total inflows this year to a record $37 billion.”

This was for the week of November 18 to 22, where spot Bitcoin ETFs delivered an impressive 102% increase from the previous week’s $1.67 billion, as reported by SoSoValue.

These gains also marked the seventh consecutive week of positive inflows, demonstrating continued momentum and growing enthusiasm among investors. In addition, total assets under management (AUM) rose to a record high of $153 billion.

Amid this surge, BlackRock’s IBIT continued to dominate the market, with net assets of $48.95 billion as of Nov. 22, with cumulative inflows of $31.33 billion.

In contrast, Grayscale’s GBTC had $21.61 billion in net assets, but has experienced outflows of more than $20 billion since inception.

Source: blog.coinshares.com

Blackrock’s IBIT exceeds

In fact, a deeper analysis revealed that a significant portion of last week’s inflows, around $2.05 billion, came from IBIT.

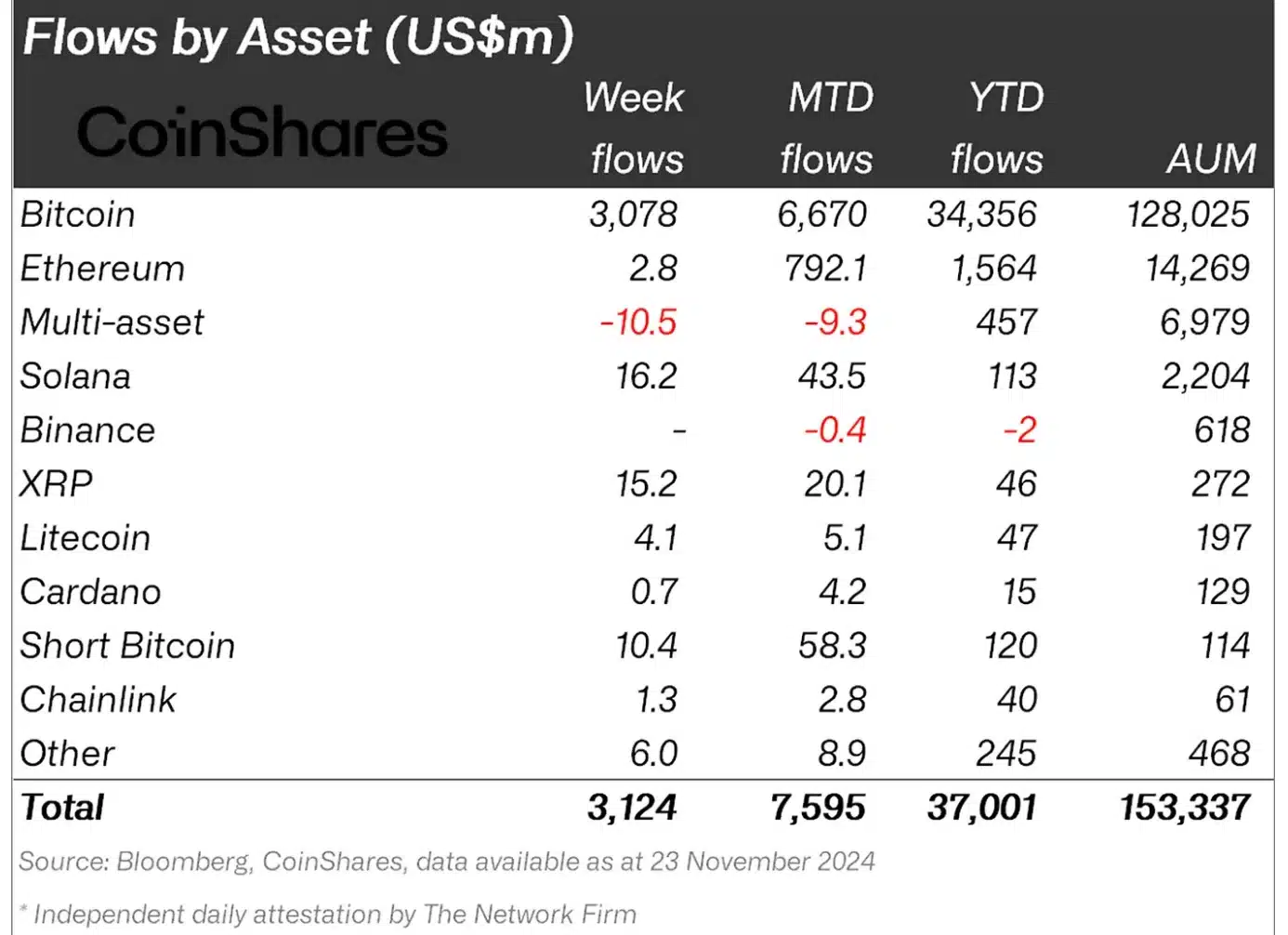

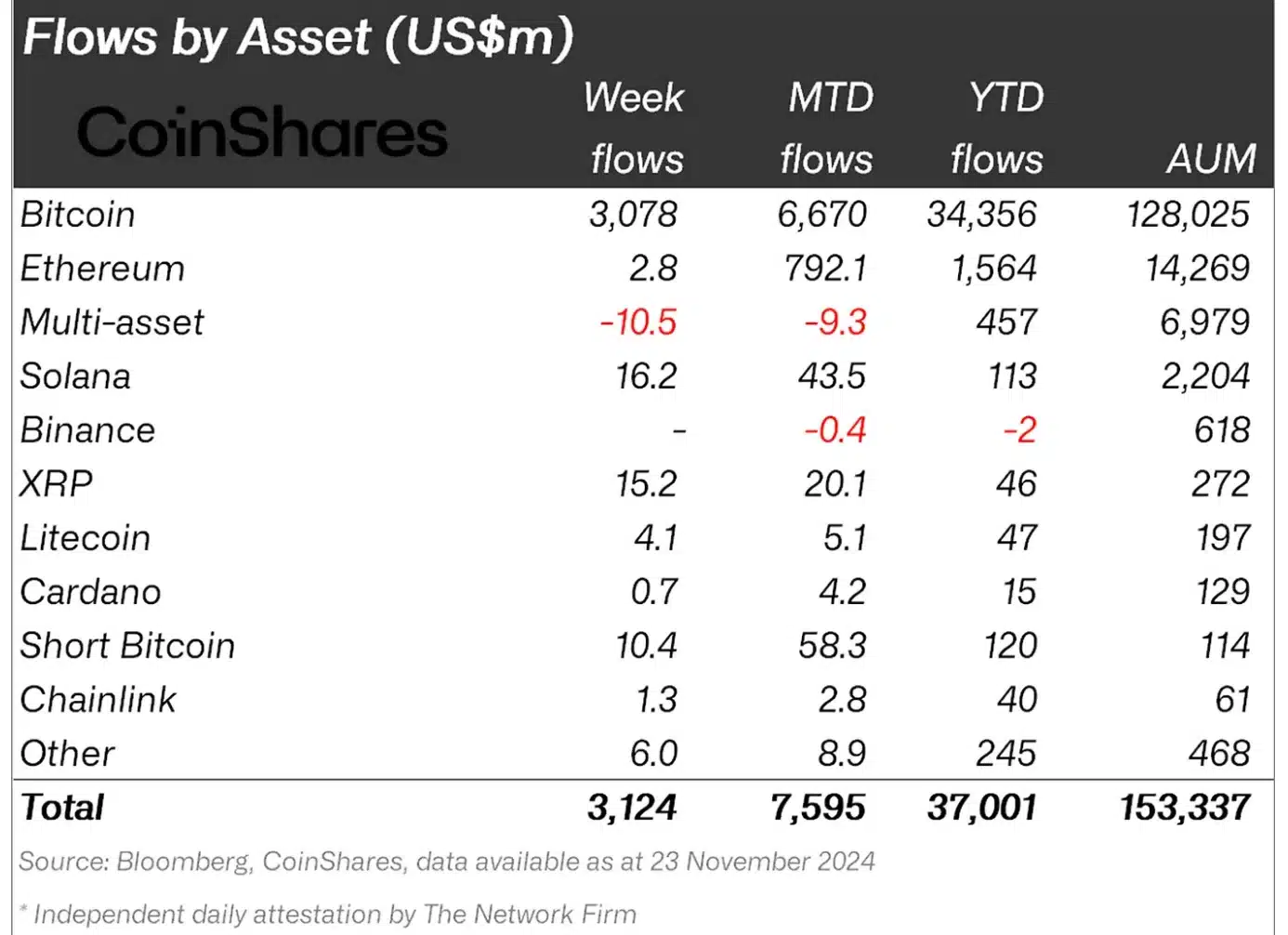

These Bitcoin funds led the way, contributing $3 billion to the weekly total – a stark contrast to the modest first-year inflows of $309 million for US gold ETFs.

Thus, while Bitcoin’s price rise has continued to attract interest from both institutional and retail investors, it has also led to an inflow of $10 million into short Bitcoin products.

This pushed the monthly payment for these products to $58 million – the highest level since August 2022.

Bitcoin is not alone

That said, while Bitcoin dominated the inflow charts, altcoins also demonstrated their growing appeal among institutional investors.

Solana for example [SOL] led the altcoin pack with an impressive net weekly inflow of $16 million, better than Ethereum [ETH]which registered $2.8 million.

Other notable artists included Ripple [XRP]Litecoin [LTC]and Chainlink [LINK]which grossed $15 million, $4.1 million and $1.3 million respectively.

Source: blog.coinshares.com

These numbers reflect increasing confidence in the altcoin sector, fueled by strong price momentum and increasing adoption of these digital assets across different use cases.

Needless to say, these developments clearly underlined the profound impact of the election on the crypto market.

However, it is crucial to know that other factors can also have this effect has influenced the trends. James Butterfill, head of research at CoinShares commented:

“This recent surge in activity appears to be driven by a combination of looser monetary policy and the Republican Party’s cleanliness in the recent US elections.”