- The cryptocurrency market saw more than $489 million in total liquidations after Bitcoin and most altcoins fell lower.

- Forced sales due to prolonged liquidations and profit taking fueled the downward trend.

The cryptocurrency market saw a spike in volatility this weekend after all of the top ten largest cryptos by market capitalization traded lower.

At the time of writing, the market was showing signs of recovery, but the total market capitalization was still down 0.47% in 24 hours to $3.35 trillion.

Bitcoin [BTC] saw violent price swings after fluctuating between $95,700 and $98,600 in the past 24 hours. In the meantime, Ethereum [ETH]The largest altcoin fell 1.39% to trade at $3,383 at the time of writing.

In addition to a sharp increase in volatility, which is often seen during weekends due to low trading volumes, several other factors also caused the price drop.

$360 million worth of prolonged liquidations fueled the downward trend

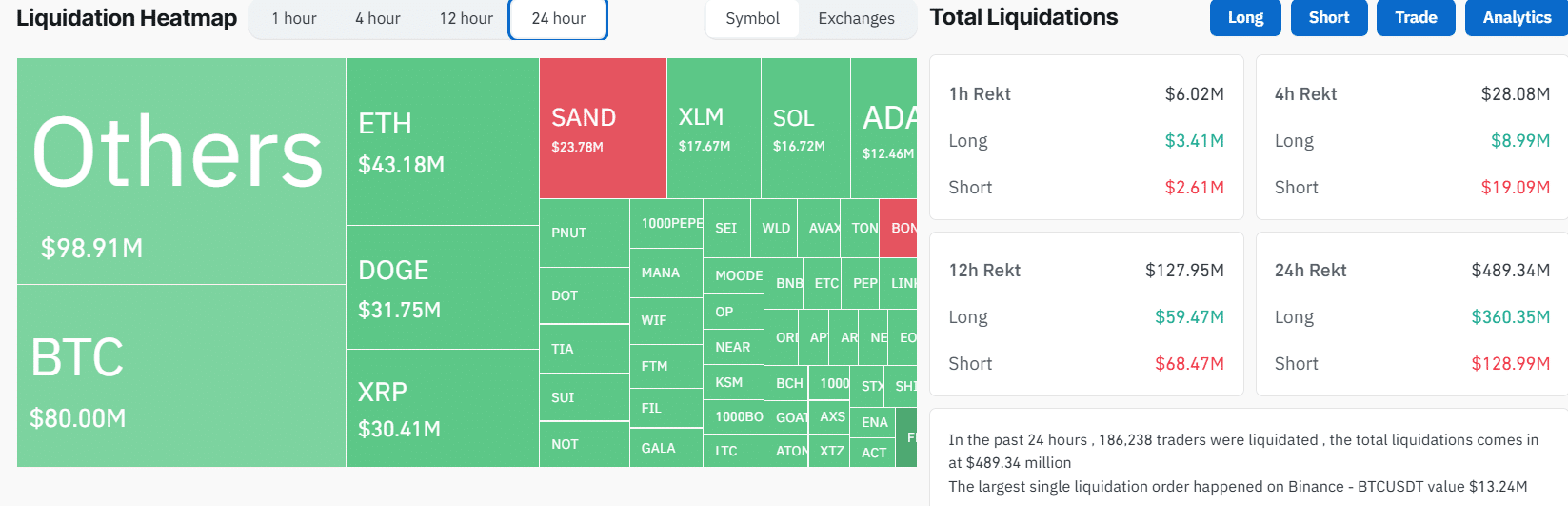

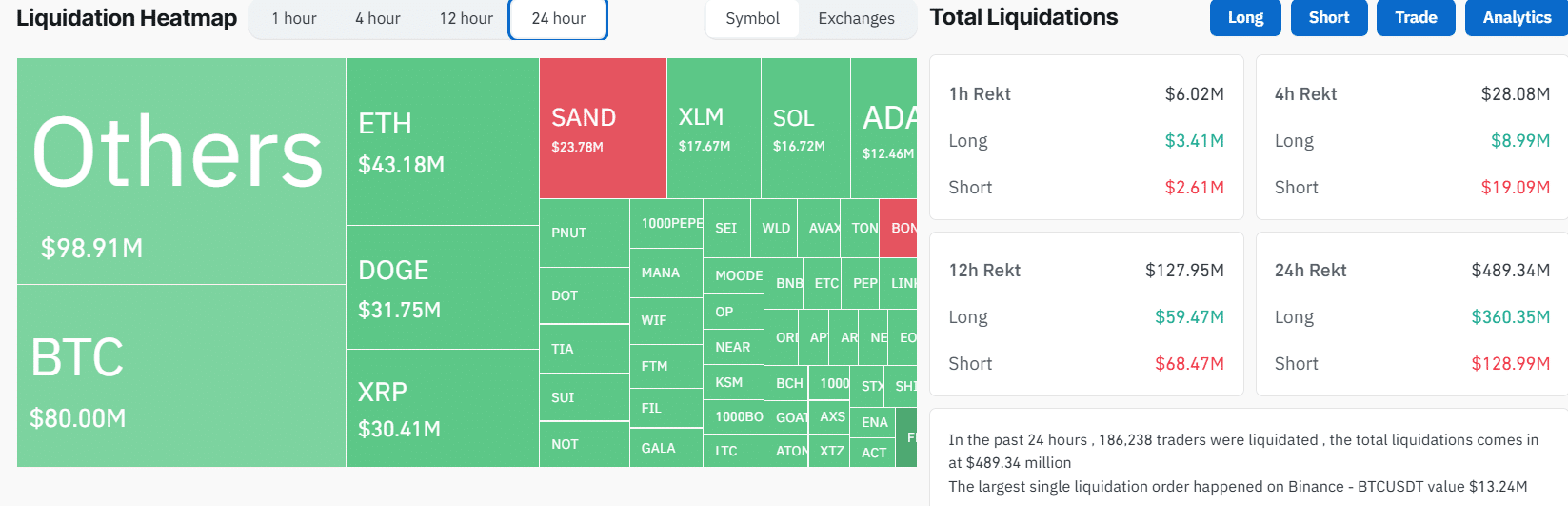

Data from Mint glass shows that in just 24 hours, total liquidations in the crypto market reached $489 million. These liquidations affected more than 186,000 traders.

Traders with leveraged long positions took the biggest hit, with more than $360 million wiped out. Bitcoin recorded $56 million in liquidations, marking BTC’s largest single-day liquidations in over a week.

At the same time, Ethereum and Dogecoin [DOGE] saw the highest liquidations among altcoins, wiping out $32 million and $21 million respectively.

Source: Coinglass

When long traders are liquidated, they are forced to close their positions through selling. Therefore, this scenario fueled the recent recession.

Profit-taking activity

As mentioned earlier, weekends are usually associated with low trading volumes. As a result, a slight increase in buying or selling activity can have a significant impact on the price.

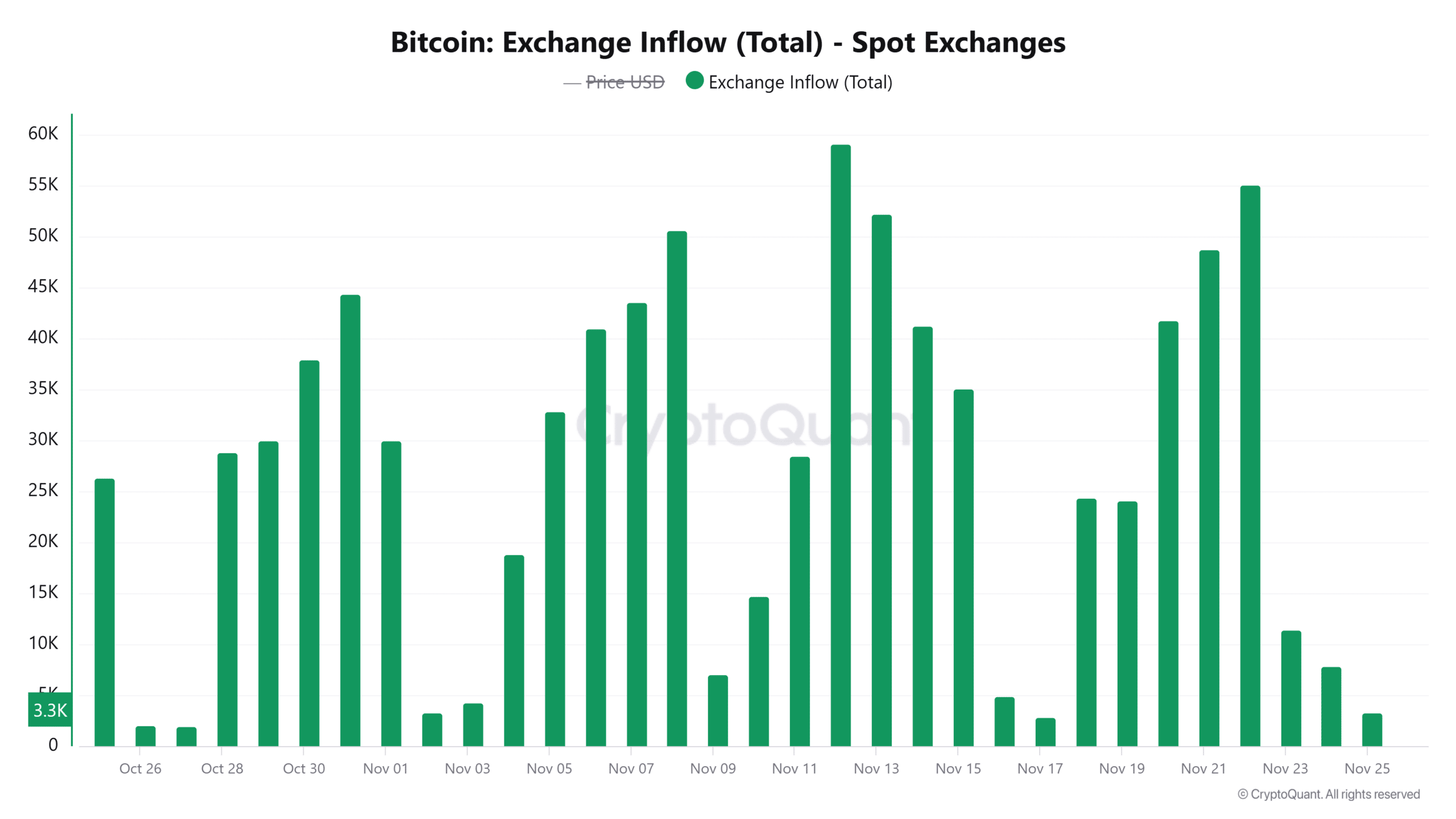

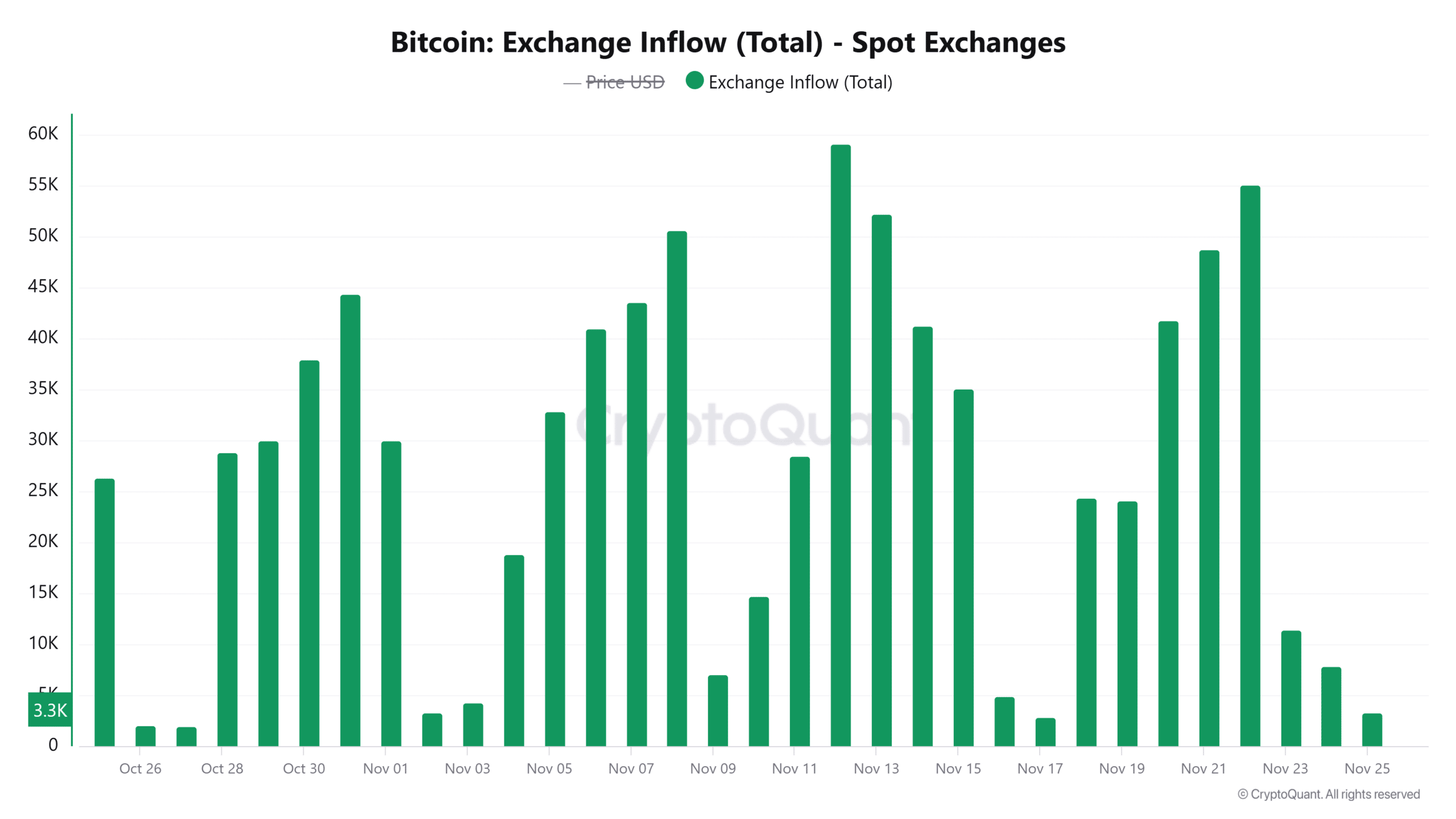

Data from CryptoQuant shows that more than 74,000 BTC have been moved to spot exchanges in the last three days. These inflows suggest that some traders are eager to take profits after recent gains.

Source: CryptoQuant

Moreover, of this amount, approximately 19,238 BTC was deposited on exchanges this weekend. Possible selling activity following these deposits may have fueled a downward trend in Bitcoin prices and subsequently altcoins.

Market sentiment still shows greed

Despite the recent correction, market sentiment remains bullish. This can be seen in the Fear and Greed Index with a value of 82, indicating ‘extreme greed’.

While this metric shows that traders are very optimistic and confident, it can also indicate an upcoming correction or trend reversal. Traders should therefore be wary of signs of intense profit-taking as this could fuel further declines.