- Saylor could announce the purchase of $3 billion BTC after the latest hint.

- Will the announcement cause BTC to reach the elusive $100,000 level?

Michael Saylor, co-founder of MicroStrategy, has hinted at a likelihood Bitcoin [BTC] scoop on the latest proceeds from bond sales.

In his Nov. 24 X-post, Saylor said indicated that the company needs to buy more BTC.

“We need more green dots on SaylorTracker.com.”

Source:

Last time he made a similar one afterhe then announced an offer of 51.78K BTC. As a result, the market expected a similar outcome, probably a buying spree of $3 billion (about 30,000 BTC) of the latest bond (convertible bonds) sales proceeds.

Will it push BTC to $100,000?

At the time of writing, the company owned 331,200 BTC, worth over $32 billion. The company had previously announced a bold plan to acquire $42 billion worth of BTC through a 21/21 strategy.

The first half, $21 billion, would be purchased with debt (such as convertible bonds), while the remaining half would be financed by issuing shares. Based on the latest steps, the implementation of the plan has gained momentum.

As a Bitcoin proxy, the company’s stock, MSTR, has seen tremendous growth, thanks to cryptocurrency volatility and its massive BTC holdings.

According to options analysis firm Amberdata, the implied volatility of MSTR (future expectations) has remained high. This suggested that the company might sell more debt and equity to buy more BTC. The result could give MSTR and BTC a boost in the near term.

Part of the Amber data report read,

“The market activity makes me think MSTR could still do something completely, COMPLETELY, insane (like rally to $1,500 by EOY while BTC breaks past $100k and FOMO buys at $120-$140k)

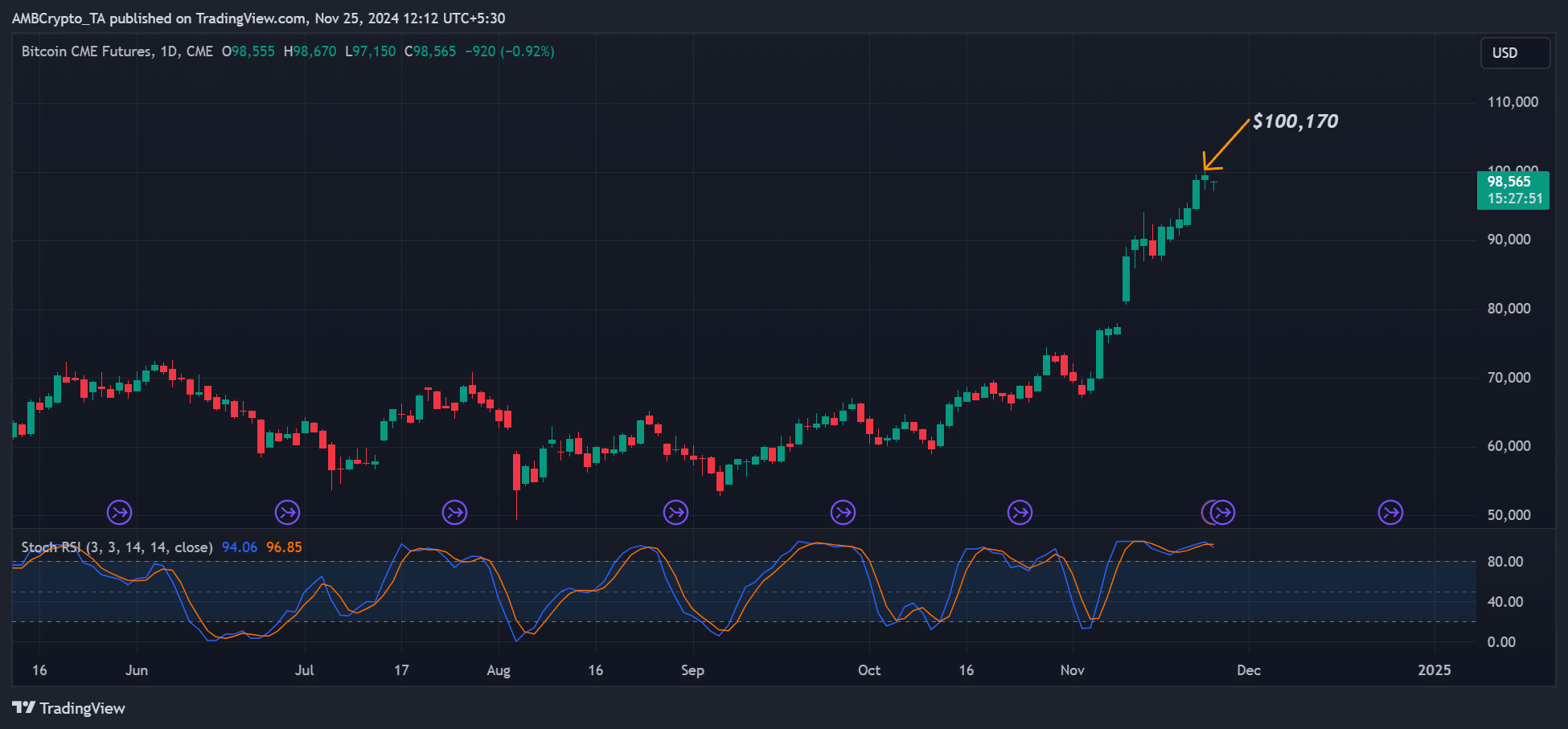

At the time of writing, BTC was valued at $98.3K, following a 9% rally last week. However, the long-awaited target of $100,000 remained elusive on the spot market this past weekend.

Interestingly, CME Bitcoin Futures hit a new all-time high (ATH) of $100,170, raising hopes that the spot market could soon reach the $100,000 milestone. Whether Saylor’s announcement of purchasing BTC will accelerate the goal remains to be seen.

Source: Bitcoin CME Futures, TradingView

On the other hand, MSTR was valued at $421 at the time of writing, up 6% before the US market opened on November 25. Market experts expected the stock to gain momentum ahead of its likely inclusion into the Nasdaq 100 before December 2024.