Bitcoins [BTC] Its dominant position has recently shown signs of decline, with market share falling below key thresholds.

As a result, more and more capital is flowing into altcoins, sparking debate among investors and analysts.

Is this a sign that Bitcoin is losing its grip on the market, or is it just a temporary dip in an otherwise dominant trend?

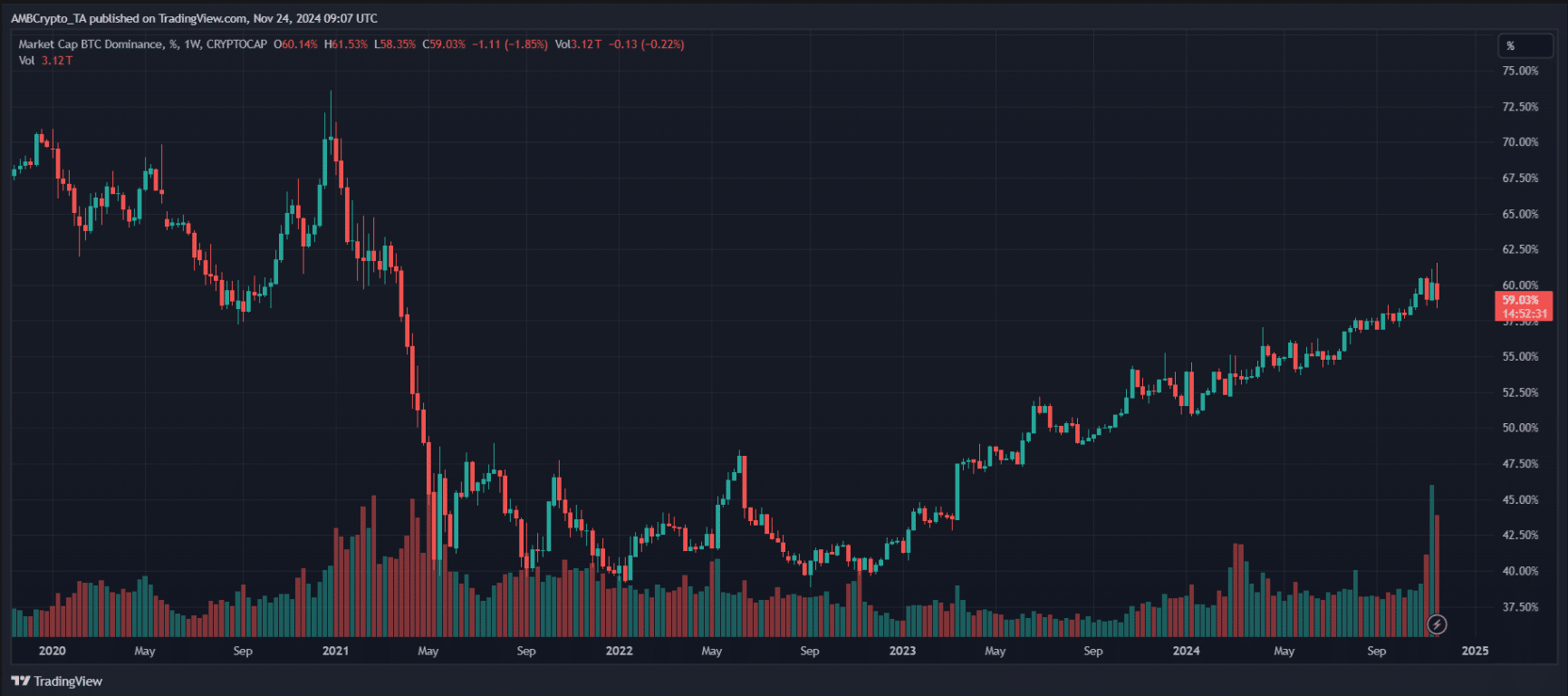

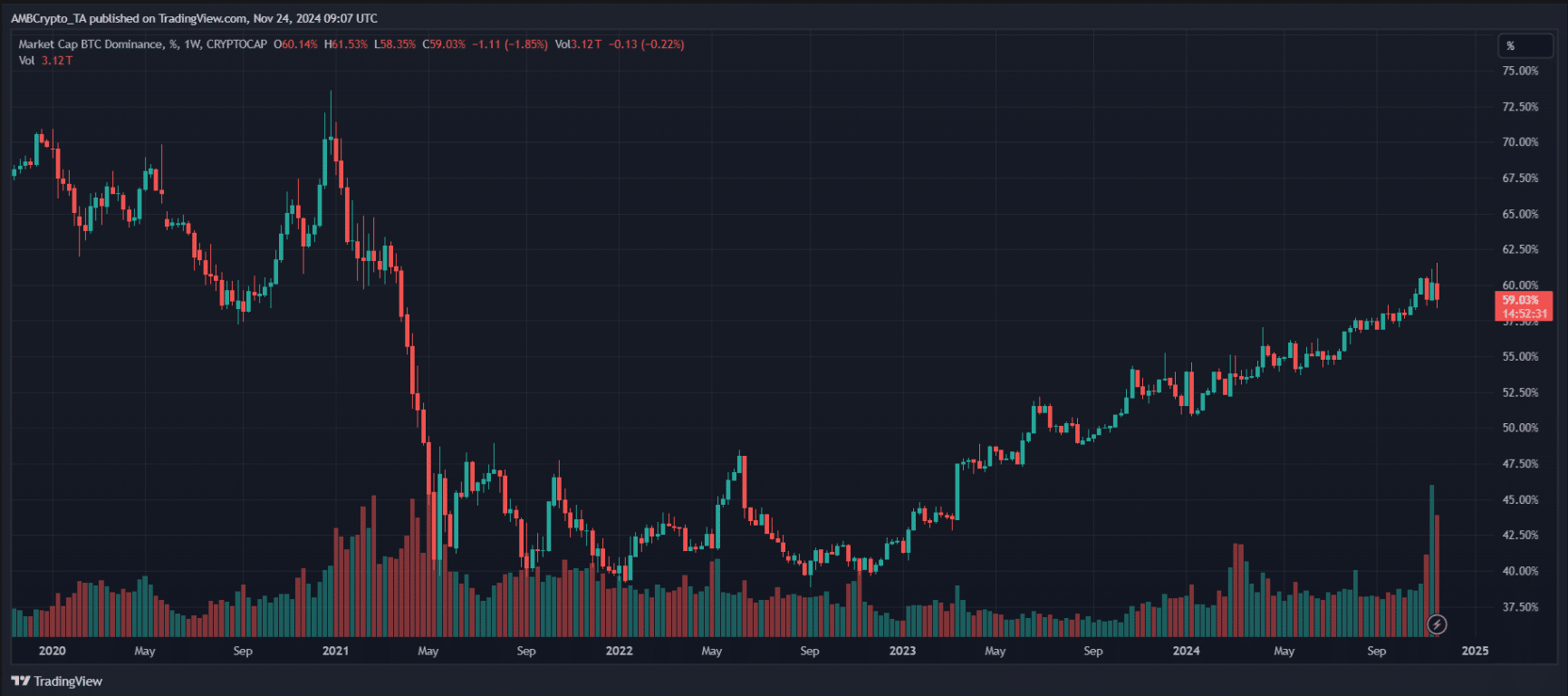

The fall of Bitcoin’s dominance

Source: TradingView

As shown in the attached 1-day chart, Bitcoin’s dominance has fallen below a significant 50% threshold, reflecting a zoomed-out projection of its weakening grip on the crypto market.

This decline suggested growing investor interest in altcoins, with capital flowing into Ethereum [ETH]Solana [SOL]and emerging tokens – potentially challenging Bitcoin’s supremacy.

Source: TradingView

Historically, Bitcoin’s dominance has fluctuated with market cycles.

During the early crypto era, it held more than 90% of the market, but the 2017 bull run marked a shift as altcoins surged, reducing its dominance to below 40%.

Although Bitcoin has regained some ground in subsequent cycles, reaching around 70% in 2021, its market share has suffered steady erosion since then.

This cycle-induced ebb and flow highlights how evolving narratives, technological innovations, and investor preferences shape the market, forcing Bitcoin to compete with an increasingly diverse ecosystem of digital assets.

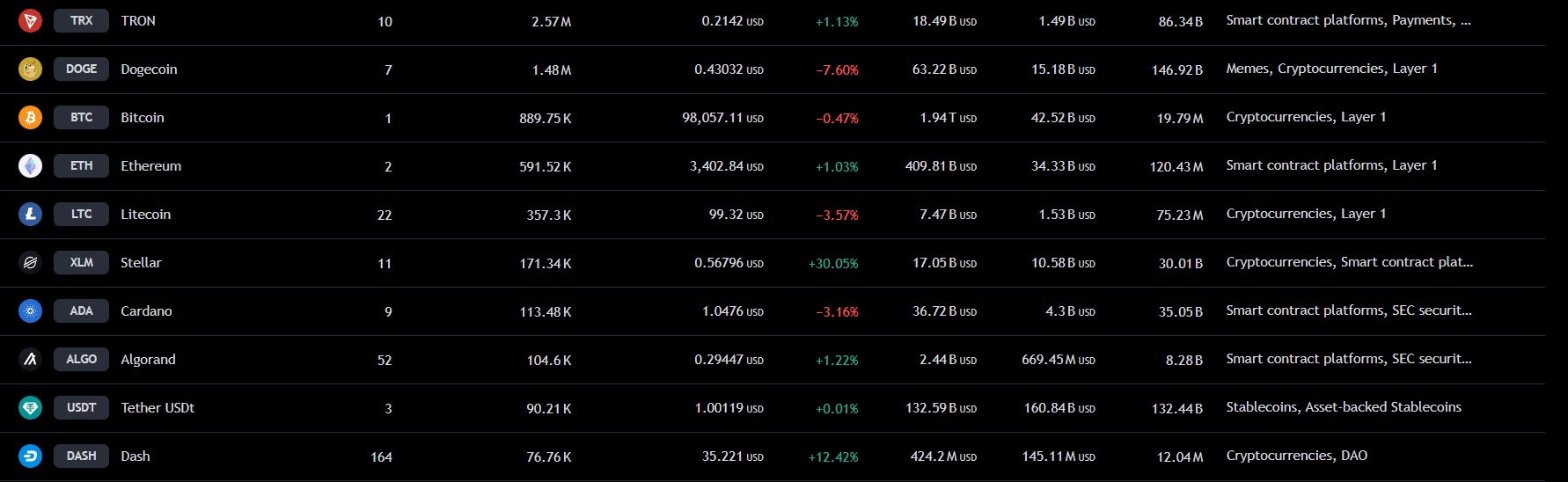

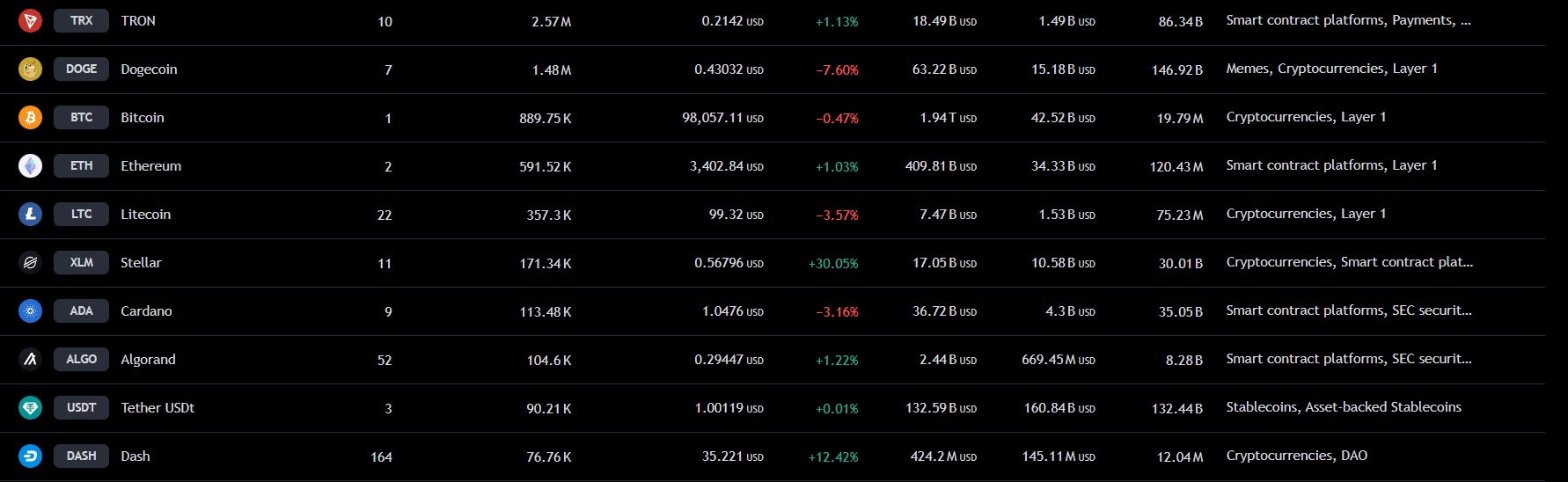

Altcoin Season: Coins Lead the Charge

Source: TradingView

The transition of capital into altcoins signals a potential altcoin season, as evidenced by the ranking of coins based on active addresses.

Coins like Ethereum, Stellar [XLM]and TRON [TRX] are experiencing remarkable growth and benefiting from increased network activity.

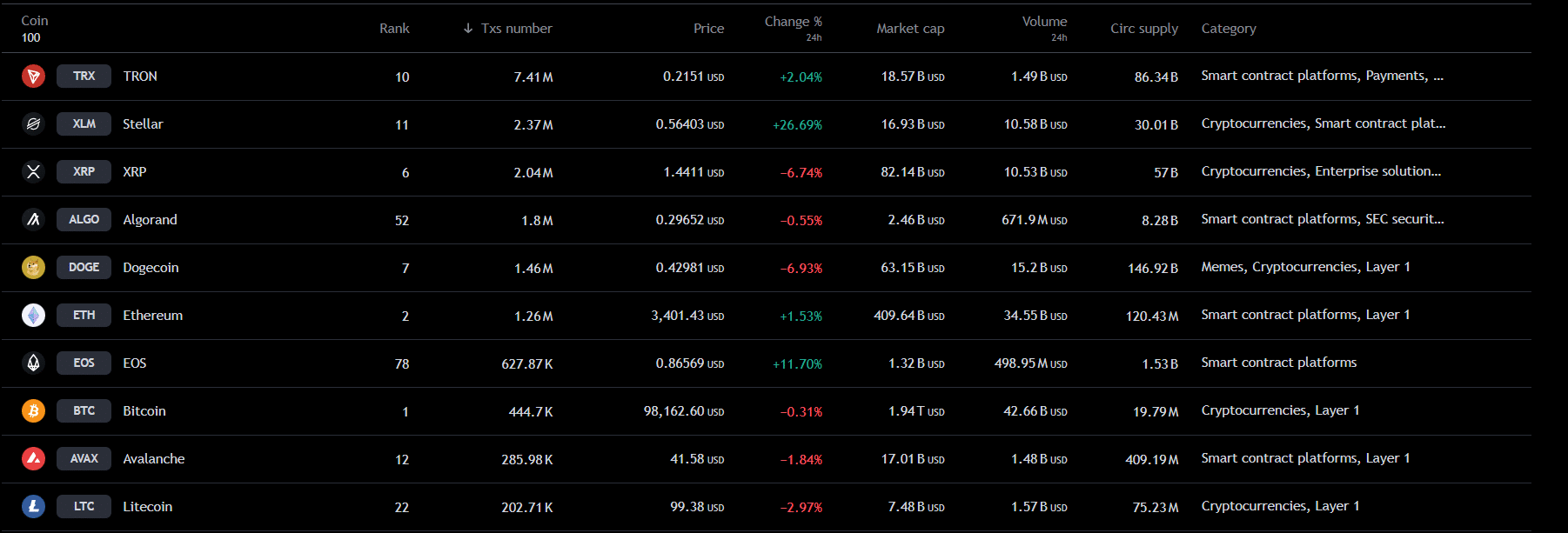

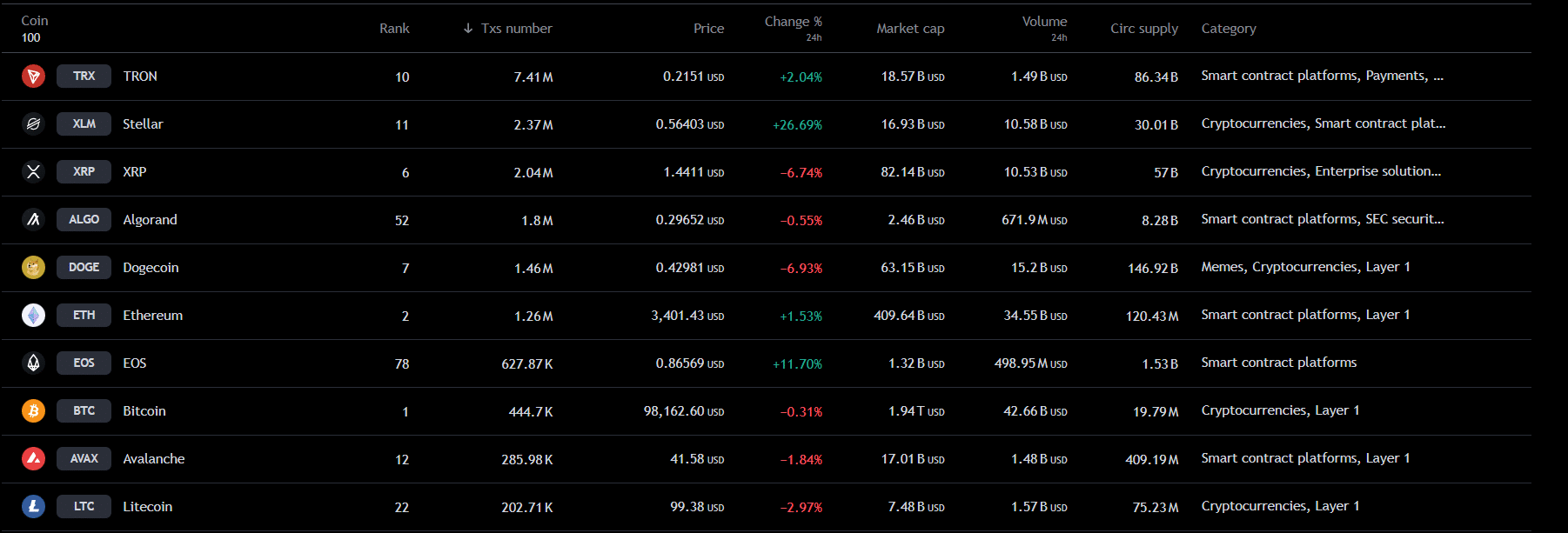

Source: TradingView

The transaction rankings further highlight TRON’s dominance, with 7.41 million transactions demonstrating TRON’s growing role in payments and DeFi.

Stellar followed closely with 2.37 million, highlighting its strength in cross-border remittances, while Ethereum remains relevant with 1.26 million, with a focus on high-value activities such as DeFi and NFTs.

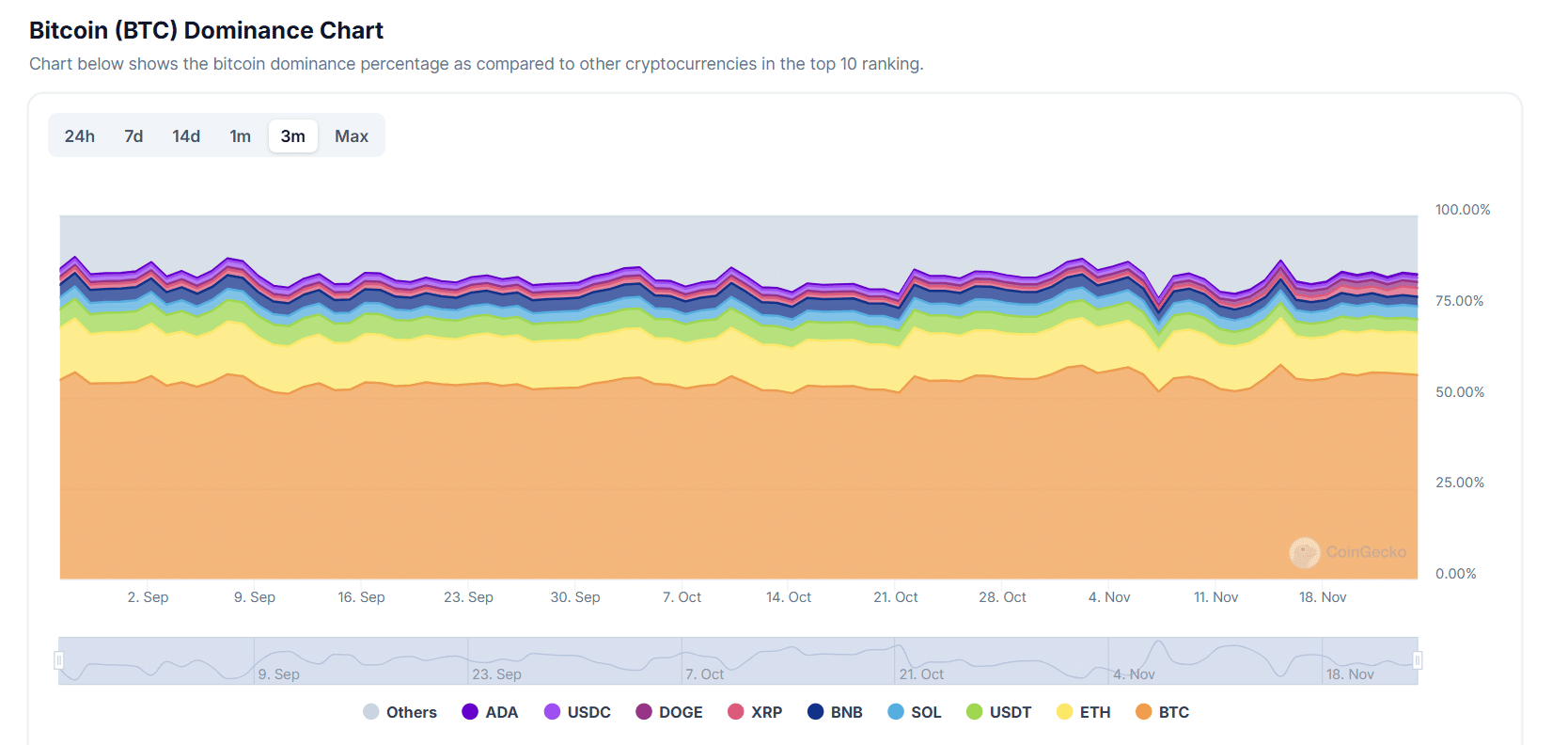

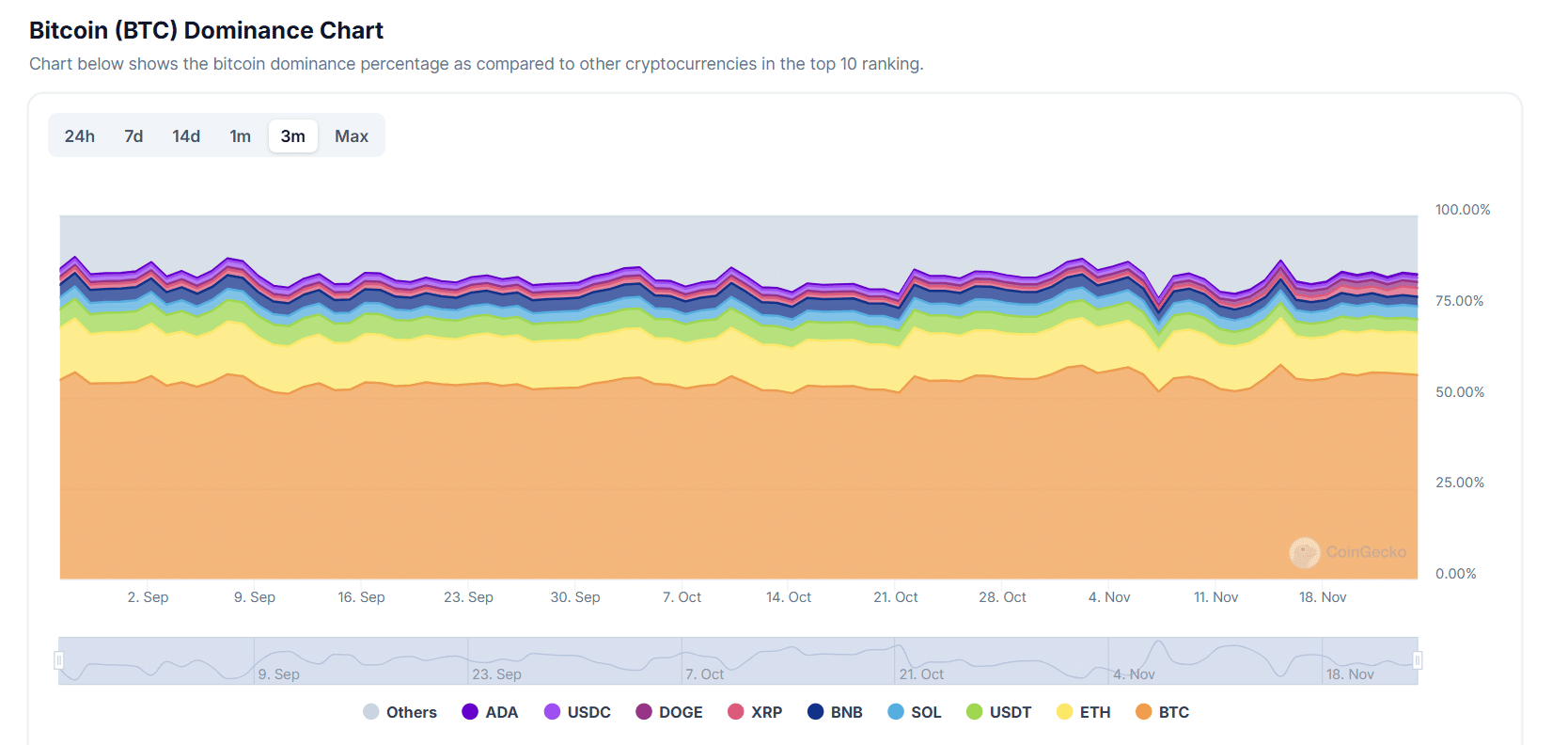

Source: CoinGecko

Insights from the Bitcoin dominance chart have further strengthened this trend. Bitcoin’s decline in market share has allowed altcoins like Ethereum, Solana and TRON to gain significant space.

Ethereum now holds more than 20% of the market share in some sectors, with emerging players such as Avalanche [AVAX] see a steady influx.

This dynamic signals a reallocation of capital as investors seek value beyond Bitcoin.

Has altcoin season finally arrived?

The shift from Bitcoin dominance to altcoins is caused by a combination of factors.

Regulatory pressure has also pushed investors toward altcoins with compliant frameworks, such as Stellar, while macroeconomic uncertainty drives diversification.

Technological advancements, such as Ethereum’s upgrades, further improve altcoin competitiveness.

Read Bitcoin’s [BTC] Price forecast 2024-25

Although cyclical, Bitcoin’s market share decline reflects a maturing ecosystem, with altcoins gaining structural importance and signaling a potential long-term shift rather than a fleeting ‘altcoin season’.

This diversification highlights the changing priorities of investors in a rapidly changing market.