- BTC faced strong resistance at $98.9K.

- Selling pressure on BTC could soon increase, ending the bull run.

Bitcoin [BTC] has slowly moved towards the $100,000 mark, reflecting bullish market conditions. However, is this bull run sustainable, or will BTC fall victim to a price correction soon?

Bitcoin is approaching $100,000

After a week of massive price increases, the value of BTC started to get closer to $100,000. At the time of writing, the king coin was trading at $98.2K with a market cap of $1.94 trillion.

In the meantime, Ali Martinez, a popular crypto analyst, posted tweet, advising that investors should sell 25% of their BTC holdings once the coin hits $173K-$200K.

Going forward, he also mentioned selling 30% of the assets once the king coin reached the $200,000-$300,000 range.

Since these numbers were quite ambitious, AMBCrypto planned to dig deeper to find out if the path for BTC is clear.

Decoding the future of BTC

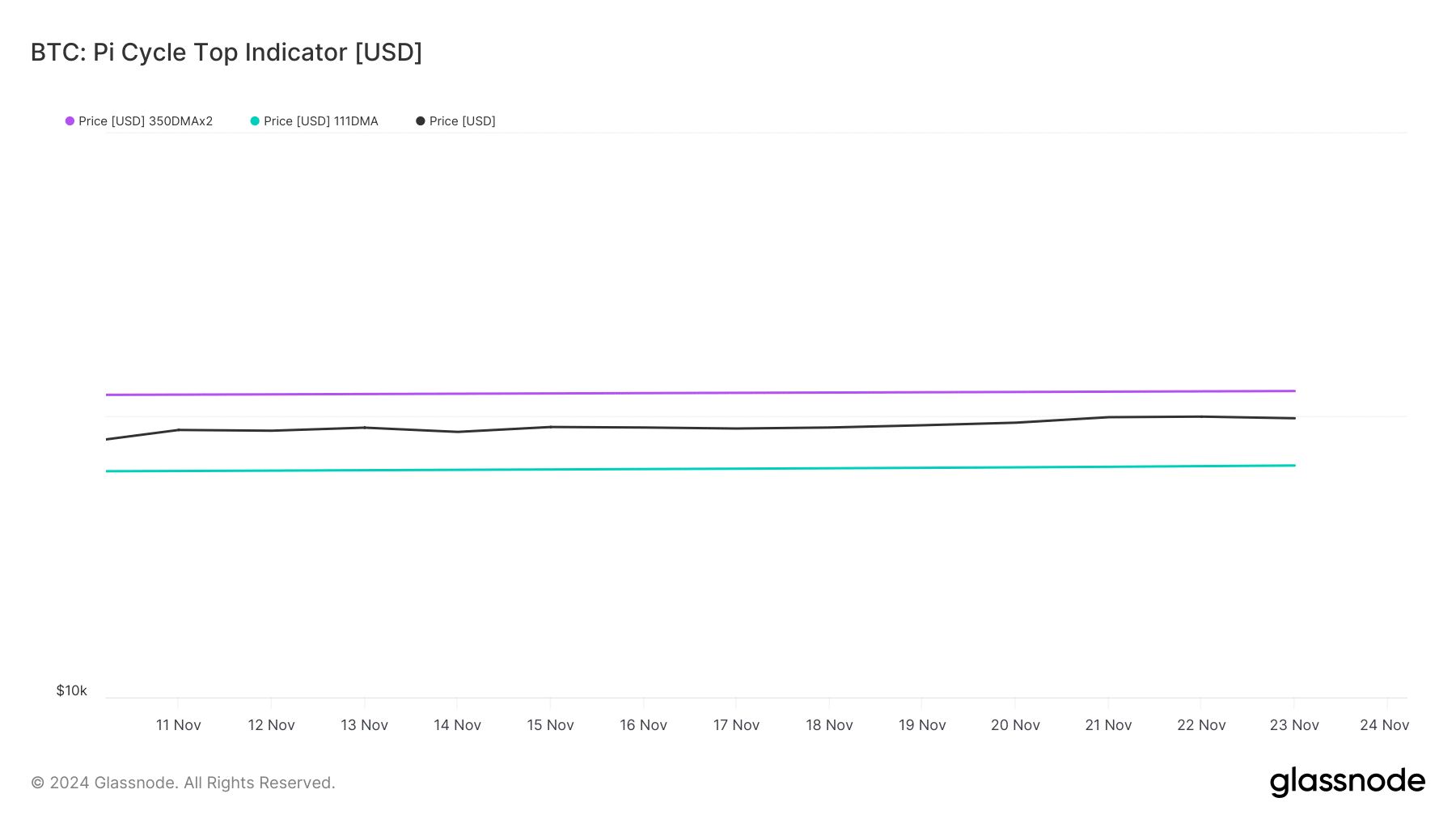

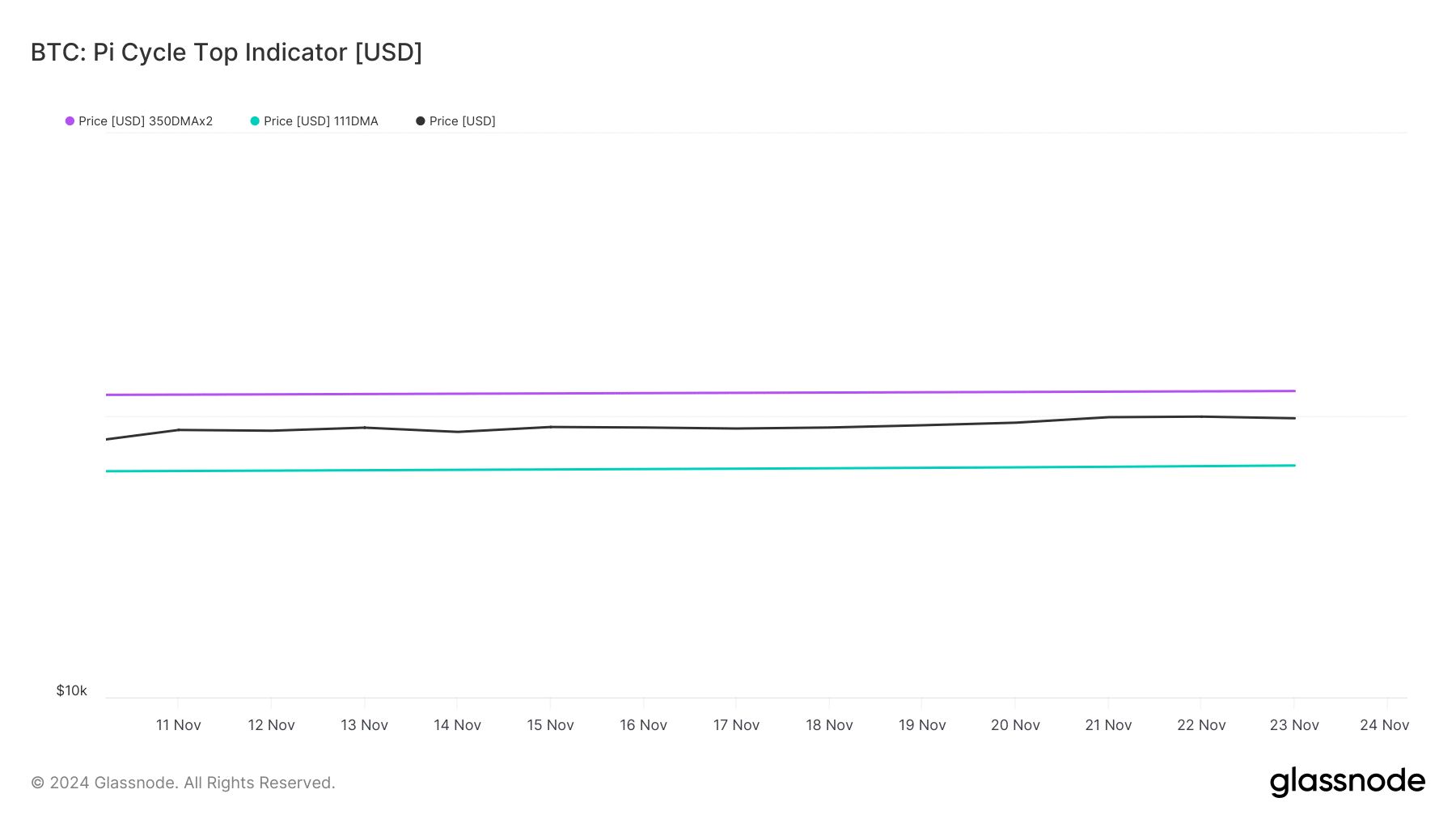

According to our analysis of Glassnode’s data, BTC was trading well within its range. To be precise, the Pi Cycle Top indicator revealed that the possible market top of BTC was $121,000, while the bottom of the market was $66,000.

Therefore, the possibility of BTC heading towards $100,000 was not too ambitious.

Source: Glassnode

In fact, investors were still considering buying Bitcoin. AMBCrypto reported rather that 65K BTC was recently withdrawn from the exchanges.

These coins were valued at over $6 billion, indicating that BTC buying pressure has increased significantly.

According to CryptoQuant data, buying pressure remained high. This was evident from BTC’s declining foreign exchange reserve.

A decrease in buying pressure generally indicates that the chances of a sustained price increase are high, as investors showed confidence in the king coin.

Source: CryptoQuant

In addition, Bitcoin’s Coinbase Premium was also green. This meant that buying sentiment was dominant among US investors, which could also support BTC’s growth towards $100,000.

However, nothing can be said with absolute certainty.

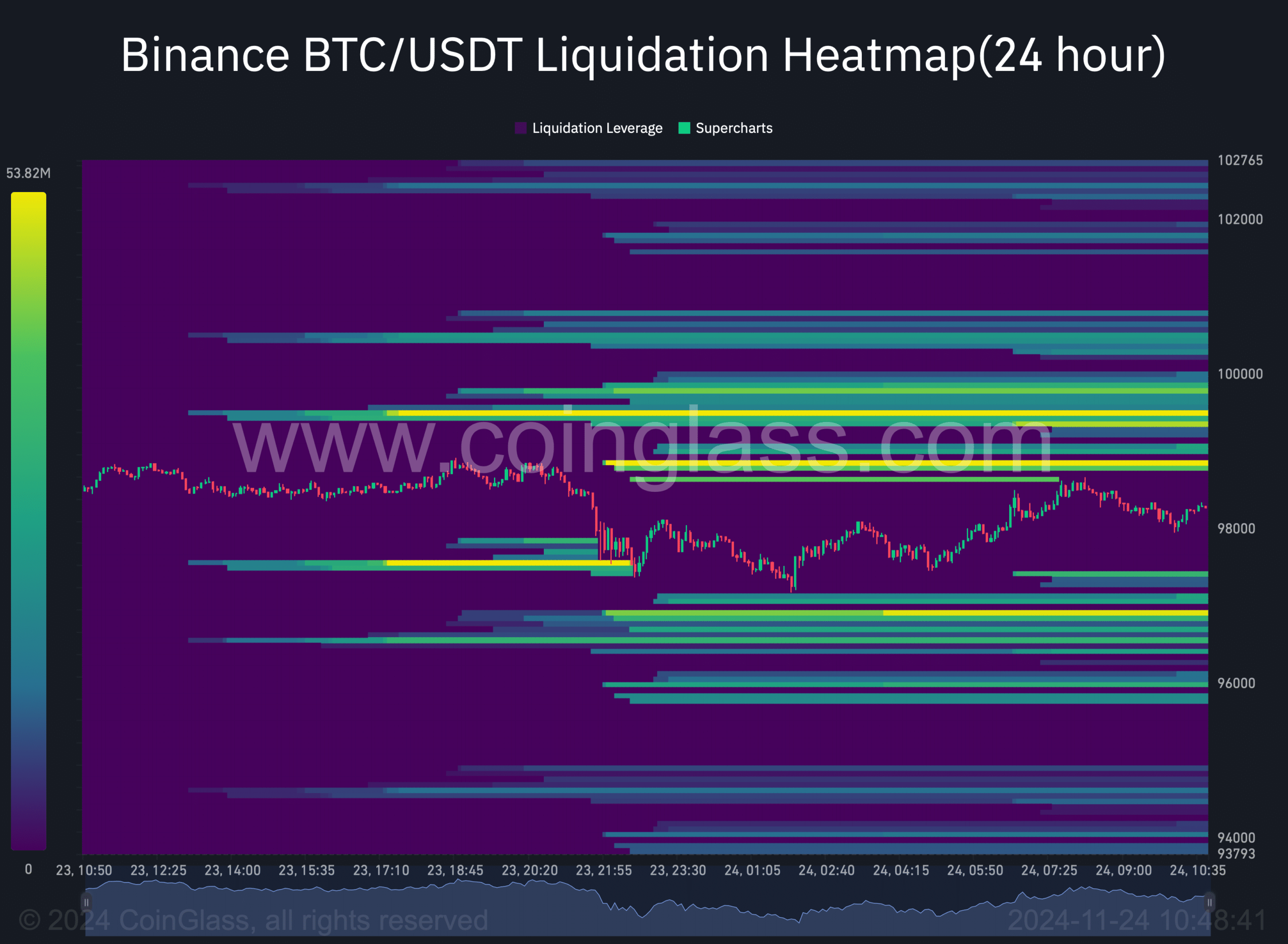

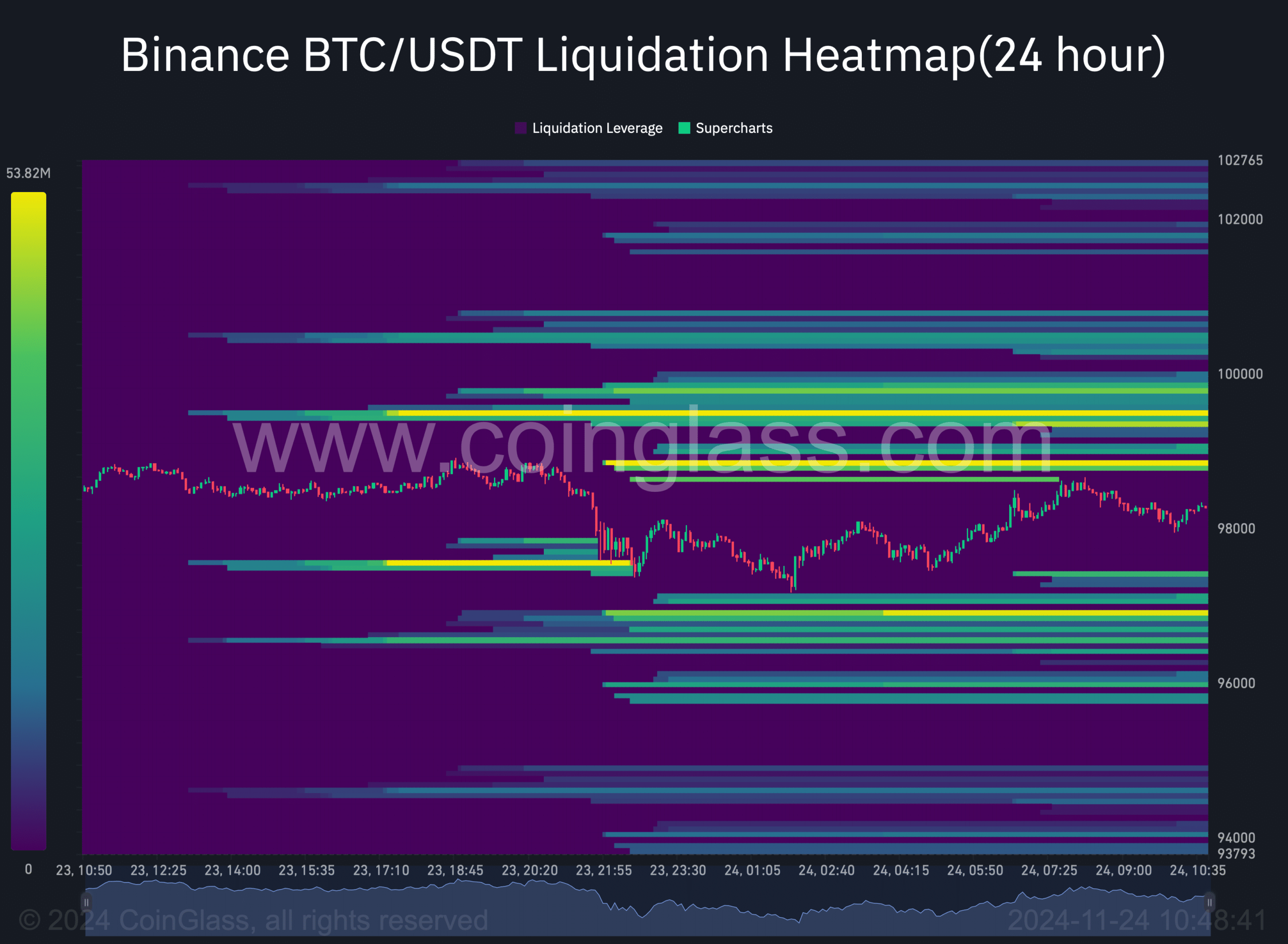

King Coin’s liquidation heatmap also suggested it faced strong resistance at $98.9K. An increase in liquidations often acts as a barrier, which can result in a rejection and price correction.

Therefore, it will be crucial for BTC to move above that level so that it can target $100,000.

Source: Coinglass

Read Bitcoins [BTC] Price prediction 2024–2025

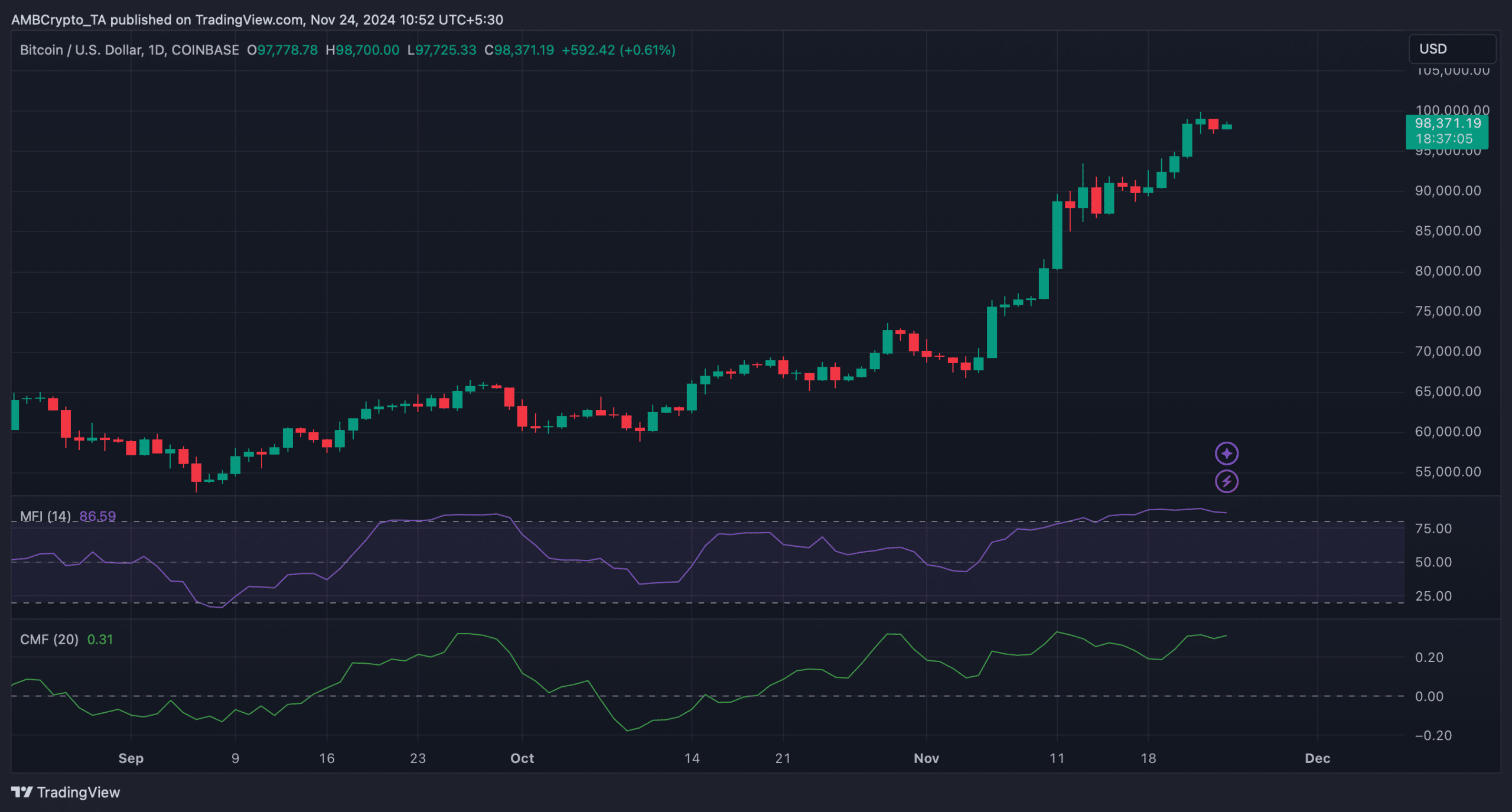

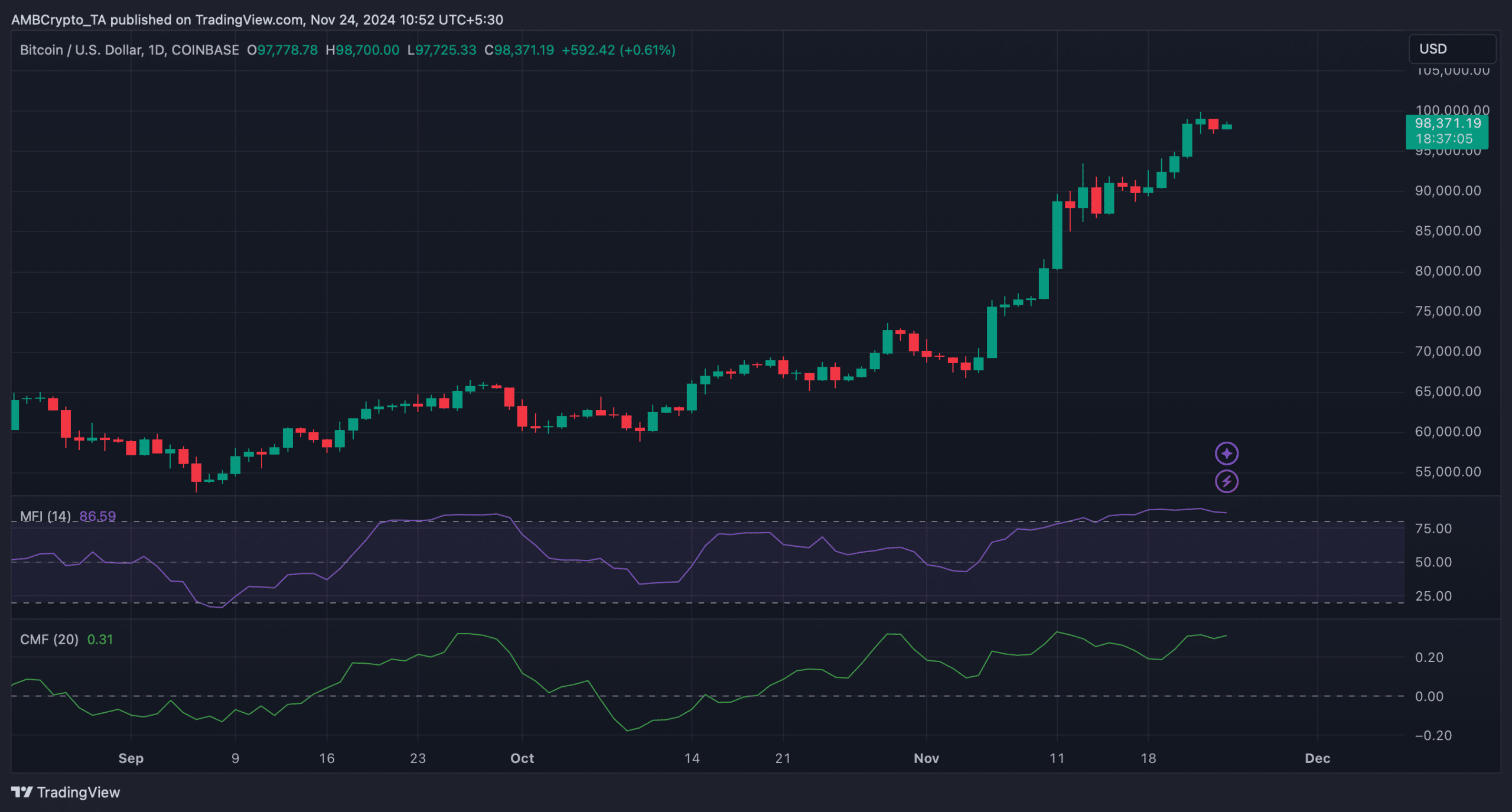

Bitcoin’s Chaikin Money Flow (CMF), which measures buying and selling pressure, also registered an increase. This further supported the argument that buying pressure would be high.

However, the Money Flow Index (MFI) was in the overbought zone, which could trigger a sell-off, causing the price of BTC to fall.

Source: TradingView