- DOT has shown classic signs of a healthy, growth-driven retracement.

- However, patience may be tested before an outbreak occurs.

Polka dot [DOT] reflects the broader market’s recovery from a four-month slump, largely fueled by post-election hype that pushed the stock close to $6. However, a three-day pullback saw the stock drop to $4.75, with daily lows of almost 7%.

As is often the case with crypto, every dip presents an opportunity for investors to push the price higher by establishing resistance as new support. Trading at $5.64 at the time of writing, if DOT has followed this strategy, there is a good chance that it is poised to break the $6 ceiling, with the next target possibly reaching $7.

Consolidation required for DOT to break $6

Interestingly, DOT’s peak around $6 coincided with an overbought RSI on the daily chart, indicating an overheated condition. This led to panic among traders, who feared an impending correction and exited the cycle before it could occur.

Normally, an exit without sufficient buying pressure leads to a pullback. In contrast, consolidation – where there is a balance between buying and selling – often sets the stage for a breakout.

Looking at DOT’s daily chart, a retracement brought the price down to almost $4,775. However, two huge green candlesticks in the days that followed, each notching a higher high, show that bulls have taken advantage of the dip and purchased DOT tokens at a discounted price.

Sure, the bulls have shown confidence in Polkadot’s long-term prospects, but this may not be enough to guarantee a clear breakout. To achieve a breakout, bulls need to keep the price above $5, which could potentially lead to consolidation.

The reasoning is clear: if we consider the overall market performance of other coins, Polkadot still lags behind rivalsmany of which have posted impressive double-digit weekly gains. This volatility makes DOT more sensitive to sharpness swings.

Therefore, to avoid panic selling, bulls should focus on maintaining current momentum. Consistent accumulation will be critical to prevent DOT from changing course and stabilize the price, laying the foundation for sustainable growth in the future.

$7 may still be too ambitious

As mentioned earlier, DOT is showing classic signs of a healthy growth-driven retracement, with the price expected to fluctuate within a certain range in the coming days.

This behavior is the result of a strategy employed by spot traders to allow DOT to consolidate, especially in a market facing uncertainty.

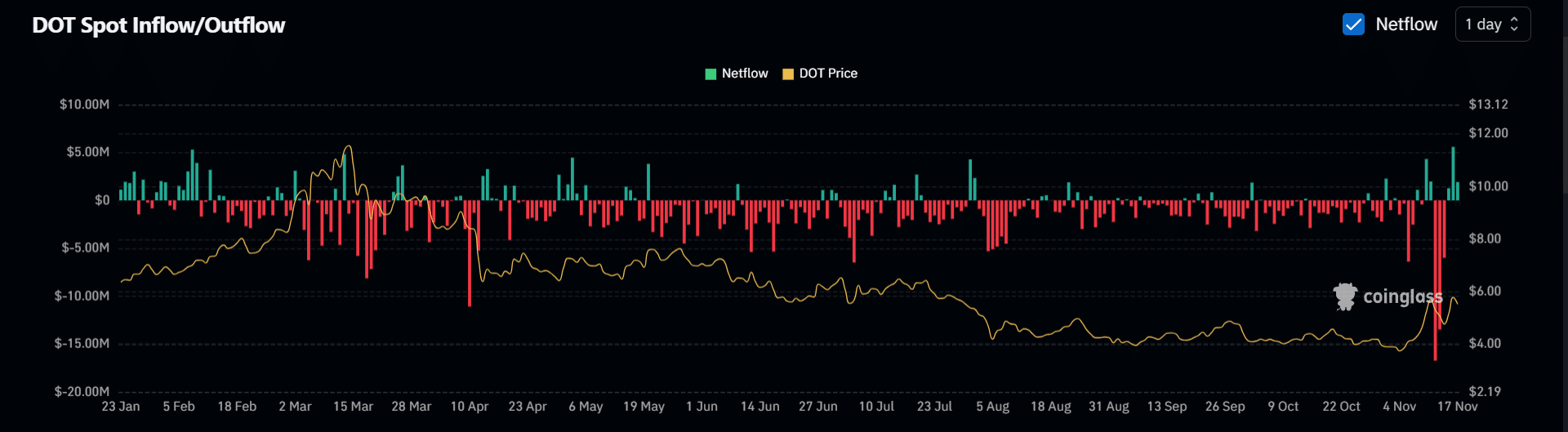

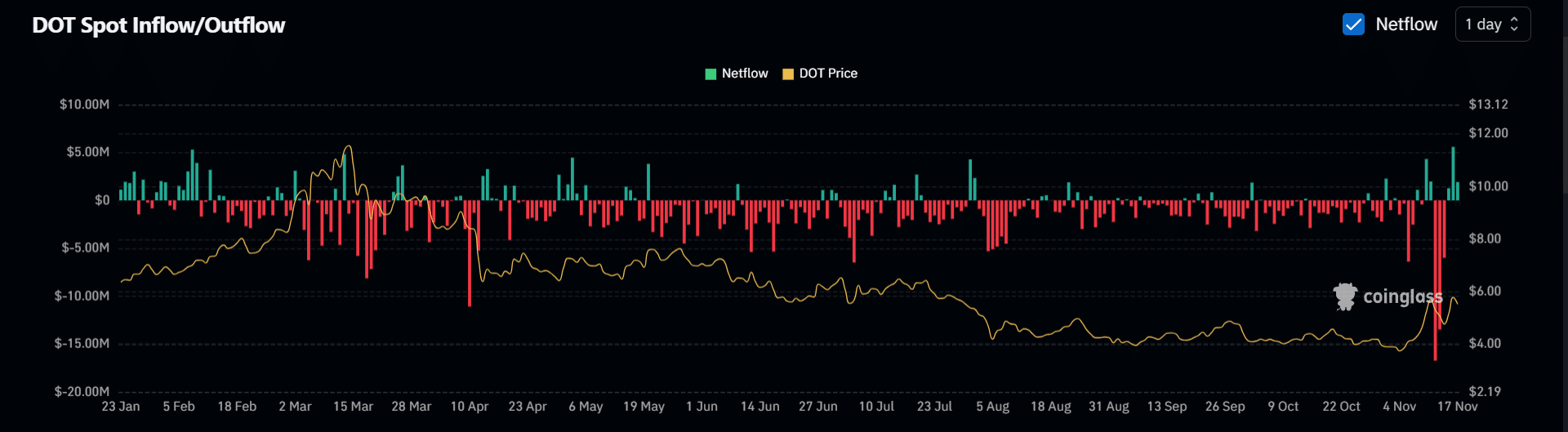

While the next major move towards $7 largely depends on Bitcoin breaking through key psychological levels, the consistent red candlesticks moving south on the chart below indicate a bullish outlook, positioning DOT for a possible breakout towards $6.

Source: Coinglass

However, despite net outflows reaching an annual high of $16.3 million, the impact on DOT’s price was opposite to expectations. While high net outflows usually indicate aggressive accumulation, DOT fell 7%, indicating potential distribution by large HODLers.

So unless this dynamic changes, it may be difficult for DOT to target $7 as its next price.

Read Polkadot [DOT] Price forecast 2024-2025

While continued buyouts are expected to stabilize Polkadot and confirm $5 as new support, a more significant accumulation of large HODLers will likely determine whether DOT can approach $6.

This could change once BTC crosses $93,000, giving whales the right incentive to enter.