Bitcoin posted another remarkable price performance this past week, rising 19.16% according to data from CoinMarketCap. The crypto market leader set a new all-time high at $93,434 on Wednesday, as its chances of reaching a six-figure market price by the end of the year are now higher than before.

Amid the current market euphoria, CryptoQuant analyst Amr Taha has shared some market insights that could indicate an impending price drop.

Bitcoin Enters Profit-Taking Zone: Sell or HODL?

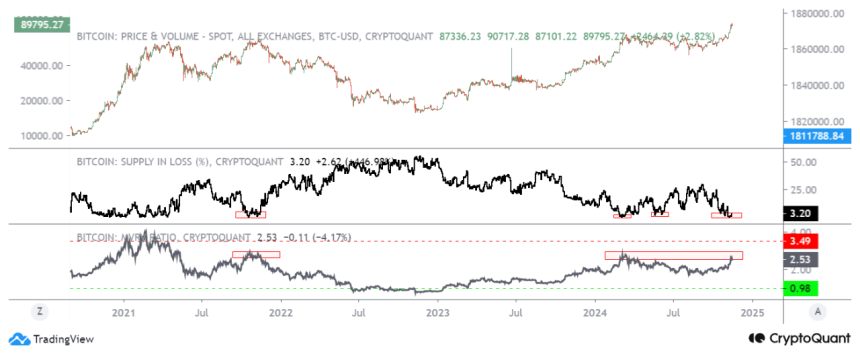

In one Quicktake post On Friday, Amr Taha stated that many investors may be preparing for a payout as the Bitcoin MVRV ratio reached 2.64. In general, market value to realized value is a trading indicator used to measure whether an asset is overvalued or undervalued, or to identify market tops or bottoms.

Amr Taha explains that a Bitcoin MVRV ratio above 2 indicates that investors currently own significant amounts of unrealized profits and are likely to start taking profits. However, historical data from late 2021 and early 2022 shows that profit-taking is occurring as the Bitcoin MVRV ratio moves towards a range of 2.5-3.5, and is accompanied by significant corrections.

Following the Bitcoin price surge in recent weeks, an MVRV ratio of 2.64 offers significant potential for a major price correction, despite minor price declines in recent days. This sentiment is further supported by the relative strength index (RSI), which is in the overbought zone.

However, Ama Taha further explains that Bitcoin can sometimes only form a significant market top when the MVRV ratio reaches a high of 4. Therefore, the major cryptocurrency at 2.64 could still continue its current upward price trajectory, if the bullish market momentum continues. The analyst advises investors to keep an eye on the MVRV ratio, as a rise to 3 would indicate the potential for further price gains, while a drop to a range of 1.5-2 suggests a local market top is emerging shapes is.

Short-term holders realized the limit reached $30 billion

In addition to Bitcoin’s alarming MVRV ratio, Taha also noted that short-term holders have now built a realized market cap of over $30 billion, a level last seen in March 2024. The CryptoQuant analyst stated that Bitcoin has historically seen significant price corrections undergone when the STH The realized cap reached similar levels, signaling a new warning to investors of a possible price drop.

At the time of writing, Bitcoin is trading at $91,738 with a gain of 3.97% in the last 24 hours. However, the asset’s trading volume is down 7.42% and is valued at $80.73 billion.