This article is available in Spanish.

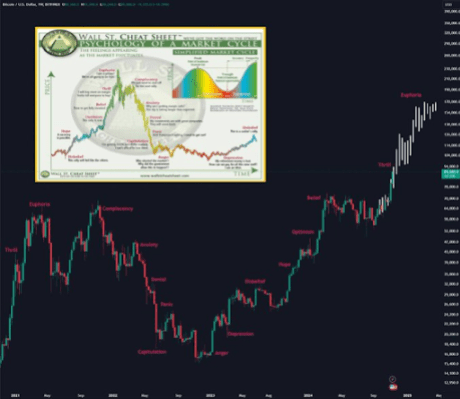

Crypto analyst Ash Crypto has revealed that Bitcoin has entered the ‘sensation phase’. The analyst further explained what to expect from the future crypto flagship as it has entered this phase of the bull run.

What to expect from Bitcoin in the ‘sensation phase’

In an X-post, Ash Crypto revealed that Bitcoin is entering the exciting phase. Based on this, he told market participants to expect high volatility and more liquidation. Overall, the analyst noted that Bitcoin’s price trend will be positive as it continues to rise new all-time highs (ATHs). He predicts BTC will rise to $150,000.

Related reading

His accompanying chart shows that the exciting phase of the market cycle is when investors and traders can become over-excited about the bull rally and decide to go all-in on leverage. However, as Ash Crypto indicated, this could go wrong as many liquidations will take place during this period.

Despite this being a bull market, the Bitcoin price has corrected at several points after reaching new highs and flushing out overextended longs in the process. Alex Doornhead of research at Galaxy Research, also explained earlier this year that bull markets are not straight lines and that significant price corrections are expected.

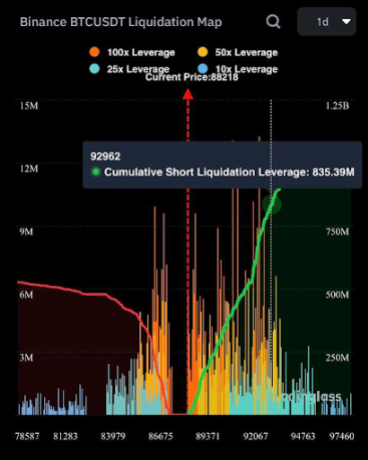

In the long run, however, the bears are getting the short end of the stick in a bull run as prices rise. Crypto analyst Ali Martinez recently revealed that more than $800 million will be liquidated if Bitcoin rebounds to $93,000. This is a price level that BTC just reached two days ago when it rose to a new ATH of $93,400.

The Bitcoin price has since corrected and fallen below $90,000. This was partly due to the US PPI Inflation Datawhich was higher than predicted. This development has raised some doubts about whether the Fed will be willing to cut rates further in December.

More price correction in the short term?

Ali Martinez suggested that the Bitcoin price could fall further in the short term. In an X-post, the crypto analyst said that the newspaper Relative Strength Index (RSI) shows that Bitcoin is in overbought territory, which is usually a signal of a potential price correction ahead.

Related reading

This price correction could also be happening because Bitcoin investors want to secure profits. Martinez revealed that $5.2 billion in BTC gains have been made and the sell-side risk ratio has increased to 0.524%. He warned market participants to remain alert and proceed with caution. Bhutanese government falls among the whales that are already making a profit, as they recently sold $33 million worth of BTC, just weeks after selling $66 million worth of BTC.

At the time of writing, the Bitcoin price is trading around $87,780, down more than 2% in the past 24 hours. facts from CoinMarketCap.

Featured image created with Dall.E, chart from Tradingview.com