This article is available in Spanish.

Bitcoin (BTC) recently hit a new all-time high (ATH) of $93,477, as the leading digital asset moves closer to the long-awaited $100,000 target. Notably, the continued price rise has led to relatively moderate profit-taking, fueling hopes that BTC still has more room to rise.

Low profit taking for Bitcoin in the current cycle

According to a recent report by Glassnode, current BTC price momentum is mainly driven by strong mock question and increasing institutional interest. In particular, the victory of Republican US presidential candidate Donald Trump has increased optimism in the digital assets sector.

Related reading

The report highlights that more than 95% of Bitcoin supply is currently profitable. However, despite the high share of profitable holders, profit taking has remained relatively subdued during this cycle.

Historically, monthly profit realization has typically been between $30 and $50 billion during previous Bitcoin ATH cycles. The current price discovery phase has seen approximately $20.4 billion in realized profits.

This relatively low level of profit-taking in BTC’s current ATH cycle suggests that there is still more room for the BTC price to rise, potentially reaching the $100,000 mark before demand declines.

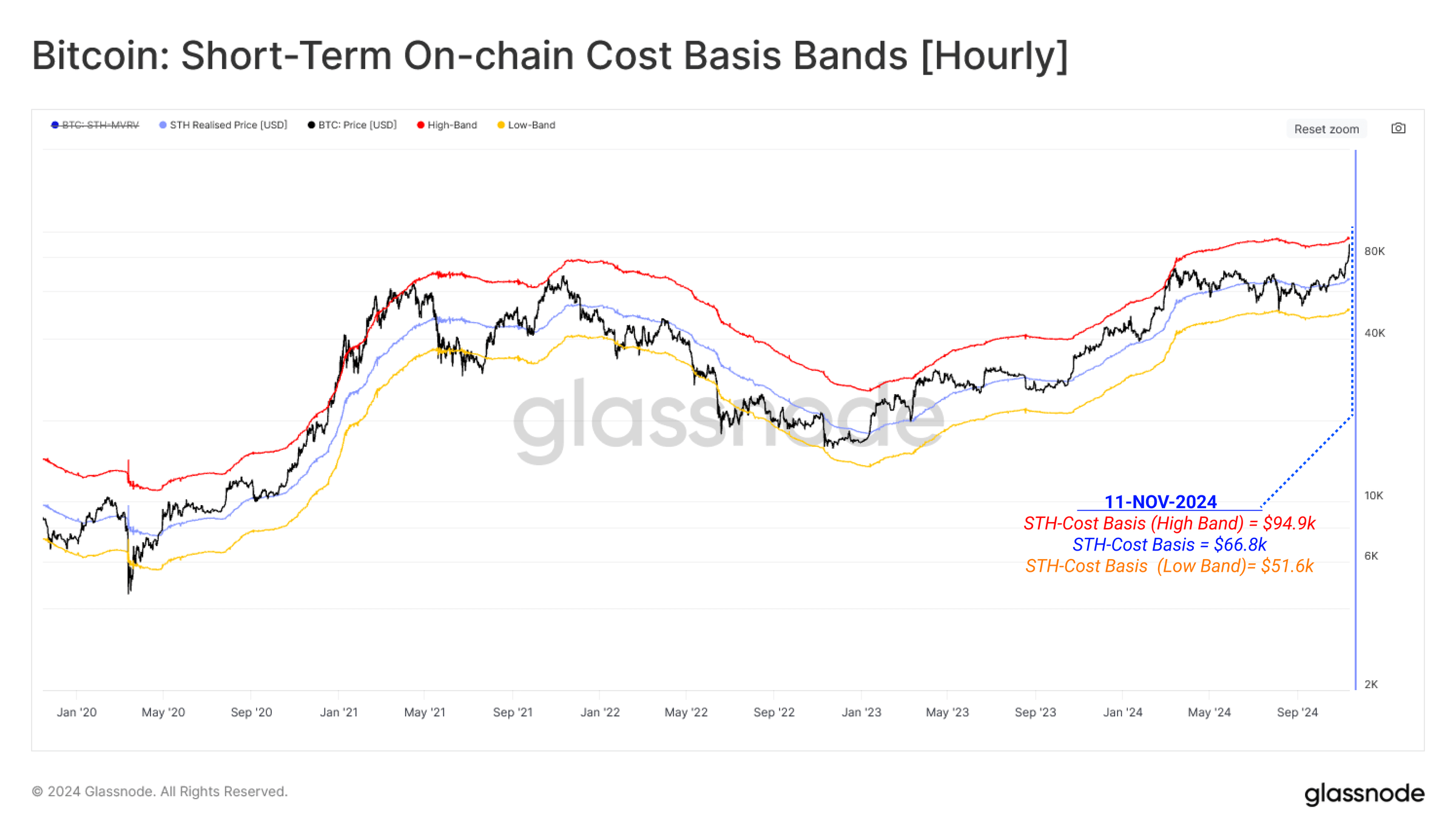

The chart below shows the cost basis of new BTC investors, along with the upper and lower statistical ranges. According to the report, during an ATH phase, BTC’s price repeatedly tests the higher bands as new investors enter the market at higher prices.

As can be seen from the chart above, BTC’s current spot price of $91,199 is just below the upper band of $94,900. Tracking price movements between these ranges can reveal when the market price might be high enough to force existing holders to sell their holdings.

Excessive leverage should be flushed before $100,000 BTC

While BTC Trades Less Than 10% Below the $100,000 Level, Industry Experts Say opinion that excess leverage needs to be flushed out before the top digital assets try to reach the six-figure target.

Related reading

Data from Coinglass shows that more than $718 million worth of crypto contracts were liquidated in the last 24 hours, affecting 202,074 traders.

Notably, contract liquidations were fairly evenly split between longs and shorts – 49.93% versus 50.07% respectively – indicating that there is no clear trading advantage despite strong bullish sentiment.

Some industry leaders remain optimistic about BTC’s future price action. In October, BTC mining company CleanSpark became CEO said that the top digital asset could peak at $200,000 in the next 18 months.

Arthur Hayes, co-founder of BitMEX, did the same recently predicted that BTC could reach $1 million under the Trump administration. BTC is trading at $91,199 at the time of writing, up 3.9% in the last 24 hours.

Featured image from Unsplash, charts from Glassnode and TradingView.com