- TIA looks poised to rise to $8.3 if it clears its immediate resistance.

- To continue its bigger rally towards $11.96, TIA needs to maintain its bullish momentum.

Celestia [TIA] has emerged as a top performer in the recent altcoin rally. Despite a slight decline of 3.45% in the last 24 hours, the price continues to rise 22.80% this week, maintaining a strong overall uptrend.

At the time of writing, TIA is at a key point, and AMBCrypto Analysis is closely watching to determine next steps.

A barrier to the TIA meeting

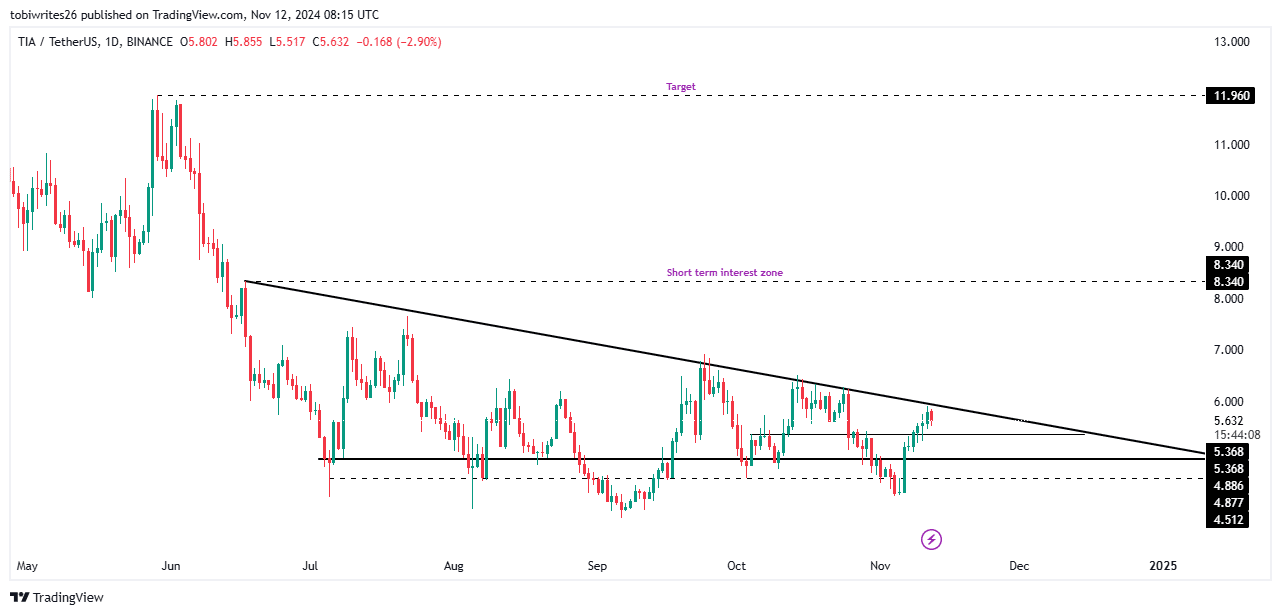

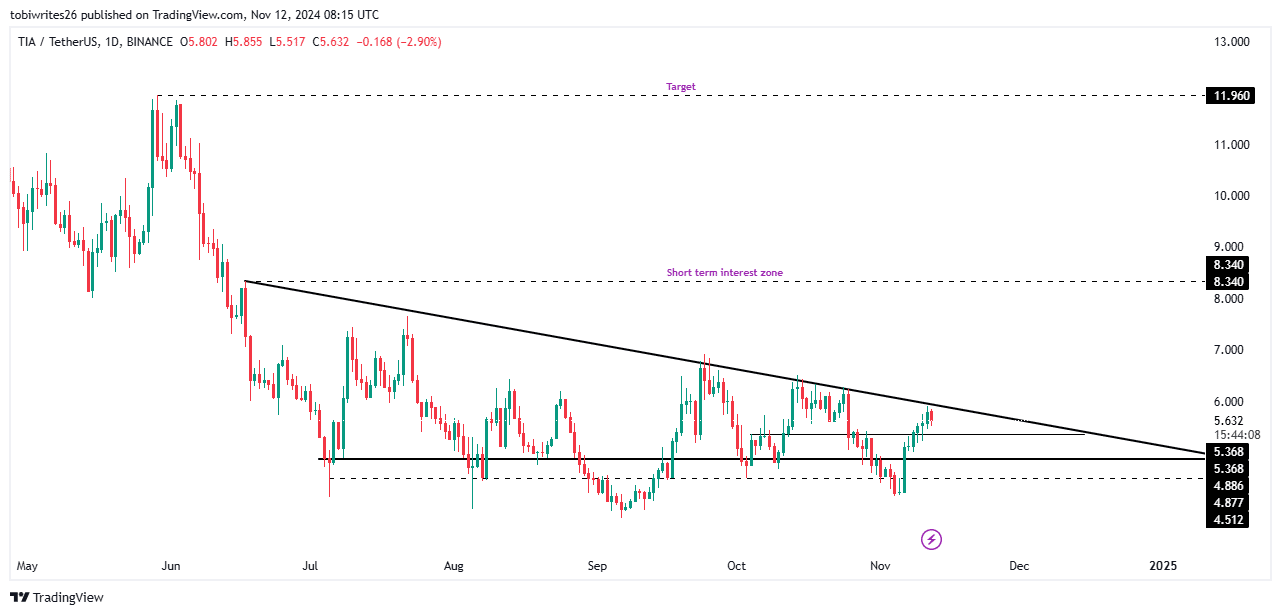

TIA’s recent rally is largely driven by a bullish triangle pattern. However, to maintain its upward momentum, it must break the pattern’s resistance line.

This setup presents multiple pricing scenarios. In a bullish scenario, TIA will break resistance and first aim for a short-term target of $8.34, with the potential to eventually reach $11.96.

Alternatively, it could find support at $5,368 before attempting a breakout.

Source: TradingView

In a bearish case, TIA could drop to the channel’s base at $4,886, with further pressure potentially pushing the price towards $4,512.

Market sentiment is mixed

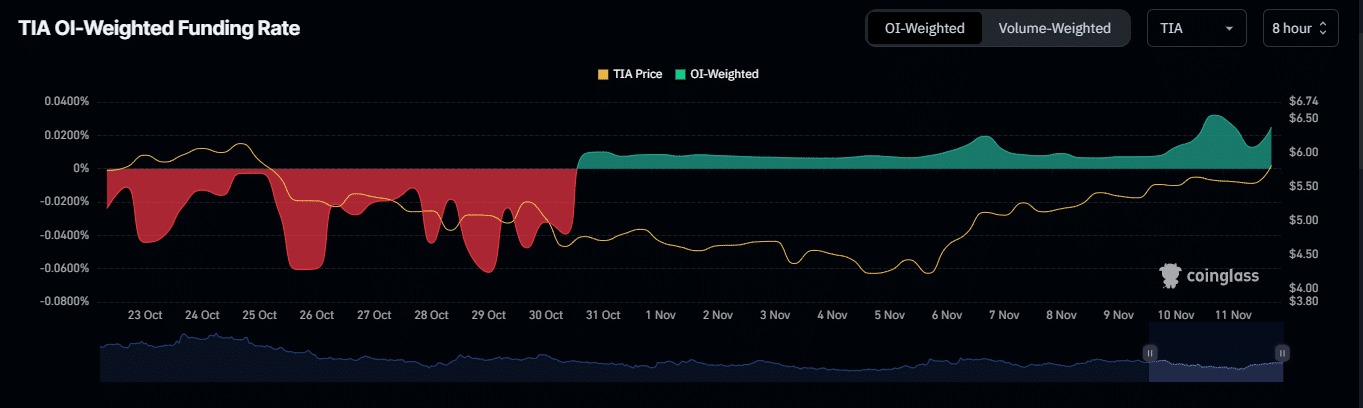

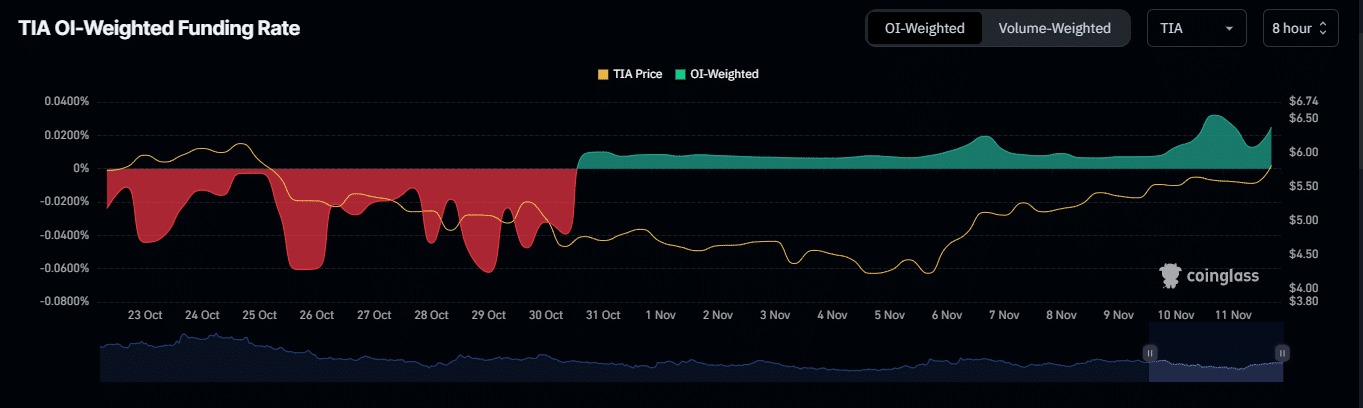

As of now, market sentiment for TIA was mixed, although data was coming out Mint glass showed a bullish trend in Open Interest and Open Interest Weighted Sentiment.

Open Interest, which reflects the number of unsettled derivatives contracts, was bullish for TIA, rising 5.45% to $248.39 million at the time of writing.

The Open Interest Weighted Sentiment, which assesses the strength and direction of trading positions based on contract volume, has also remained bullish, rising steadily since October 31, reaching a high of 0.0453%.

Source: Coinglass

Both metrics suggested a likely continued run for TIA with the recent gains.

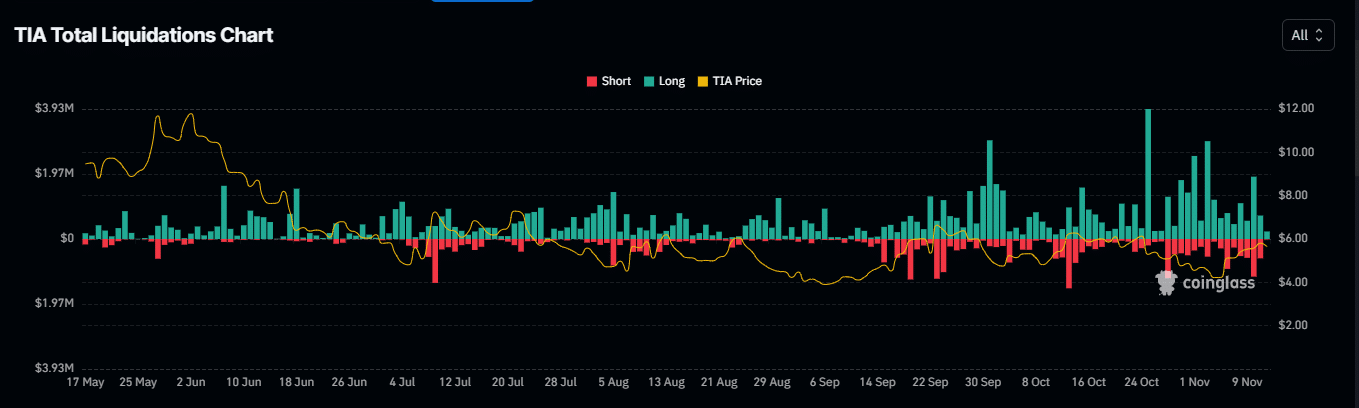

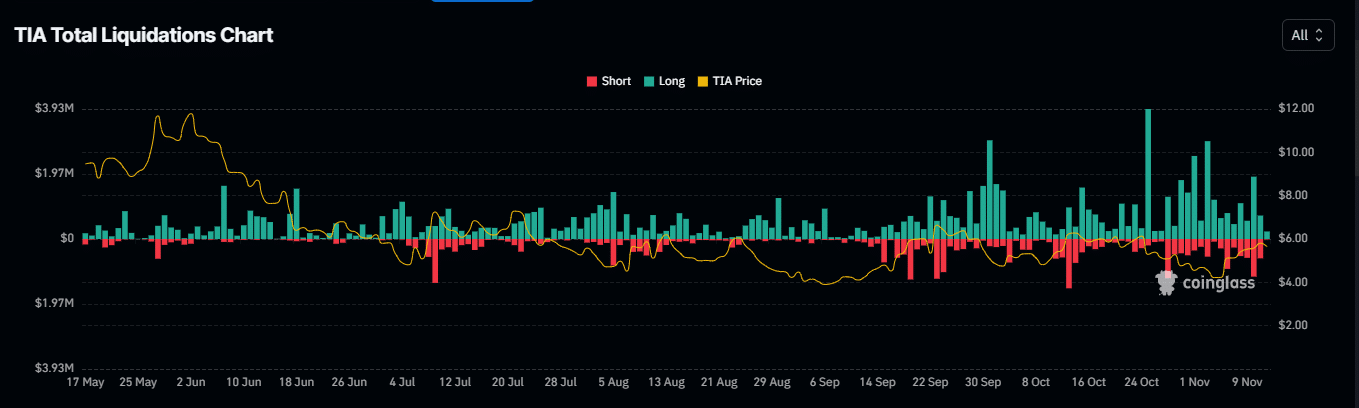

However, additional indicators pointed to potential bearish pressure. In the past 24 hours, $1.67 million in long liquidations indicates that traders anticipating a breakout have suffered losses.

Source: Coinglass

Read Celestia’s [TIA] Price forecast 2024–2025

Additionally, Exchange Netflow showed significant inflows of TIA into exchange portfolios, indicating that some traders may be preparing to sell, either to lock in gains or due to declining confidence in further gains.

For a clear directional trend, market sentiment would have to adjust. If bullish momentum dominates, TIA could rise towards $11.96.

![Celestia [TIA] eyes $11.96 amid bullish momentum: will it happen?](https://bitcoinplatform.com/wp-content/uploads/2024/11/Abdul-TIA-1000x600.webp)