- BlackRock’s Bitcoin ETF achieved a record trading volume of $4.1 billion.

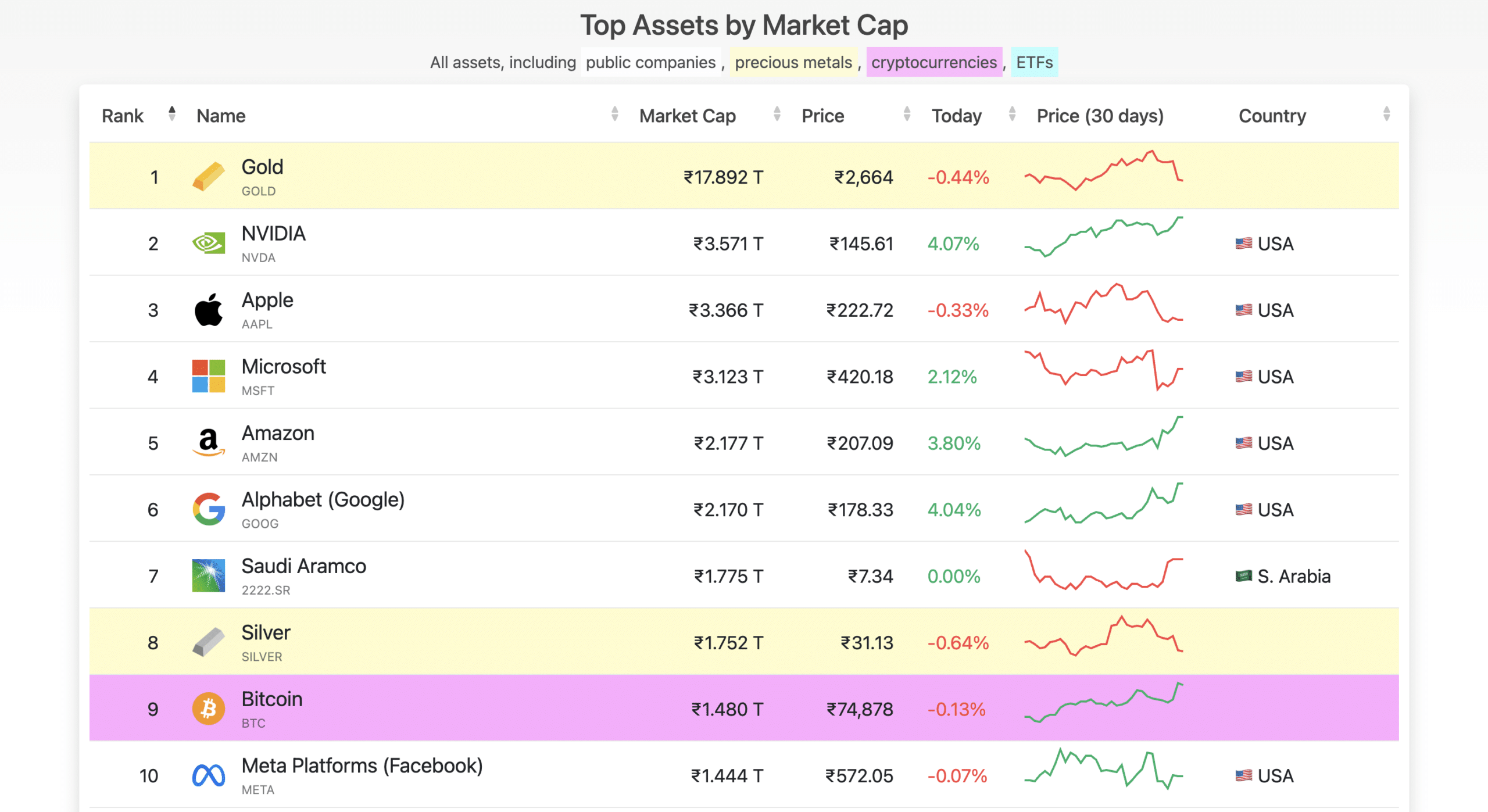

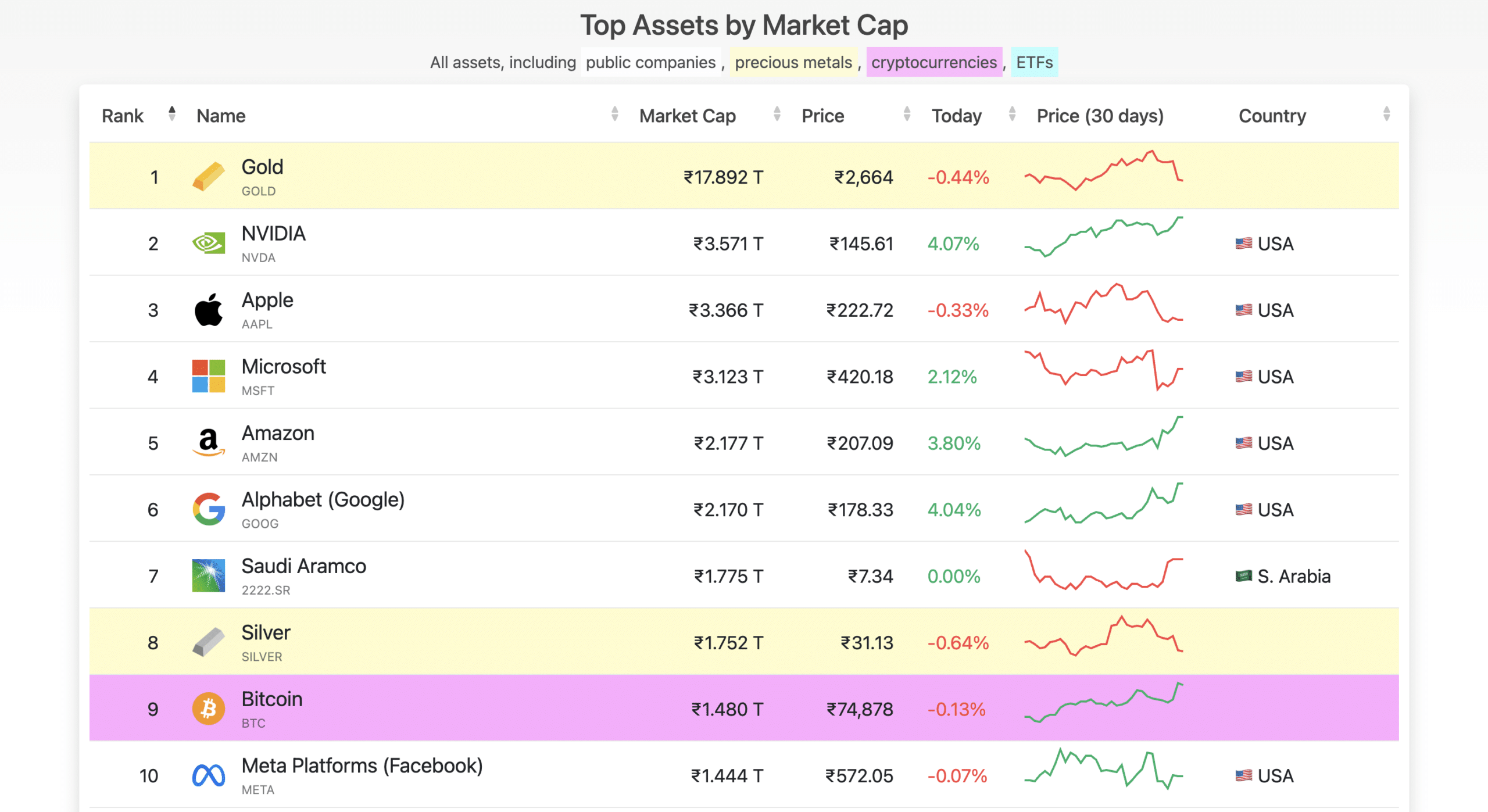

- BTC is the ninth largest asset in the world.

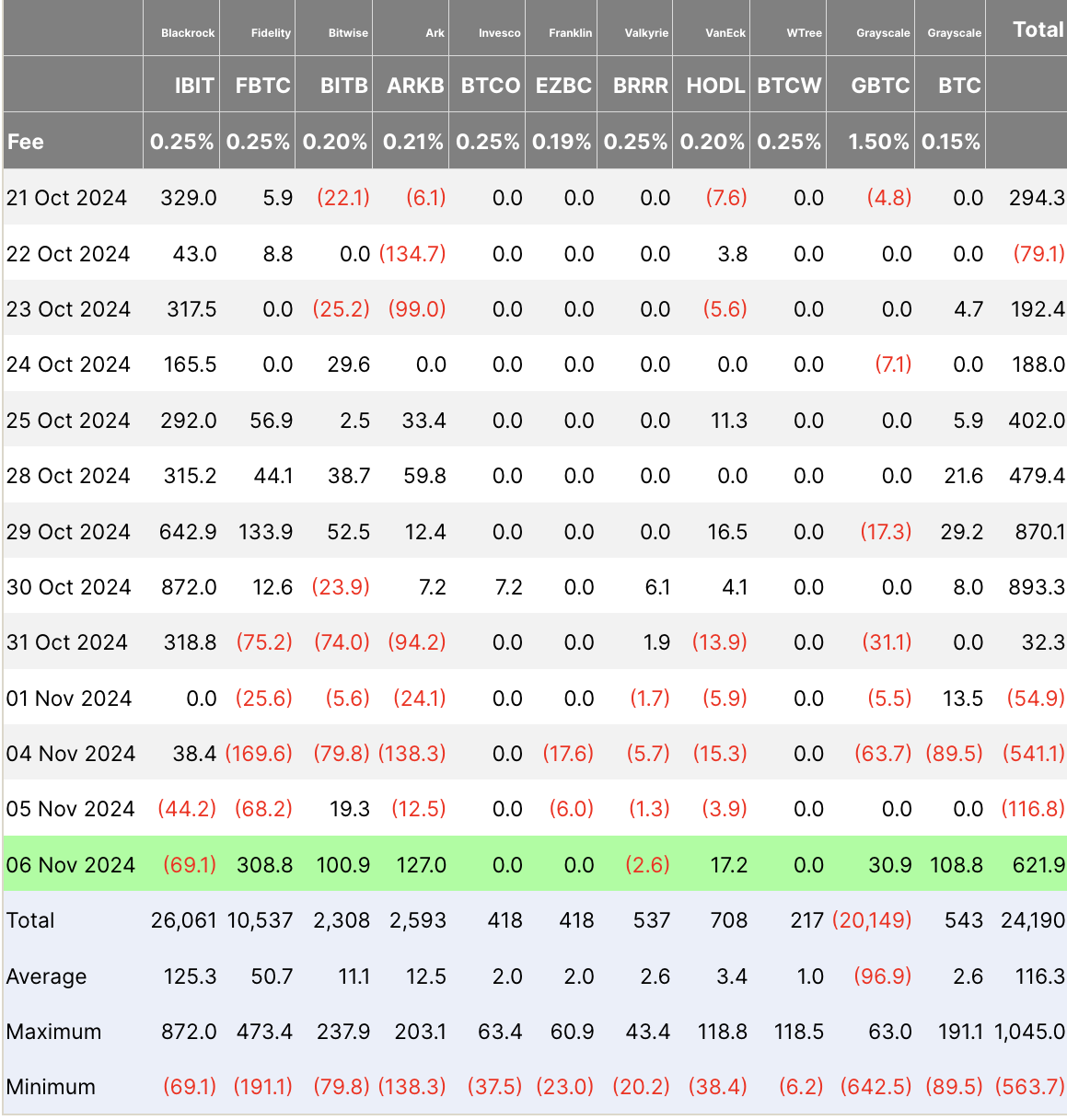

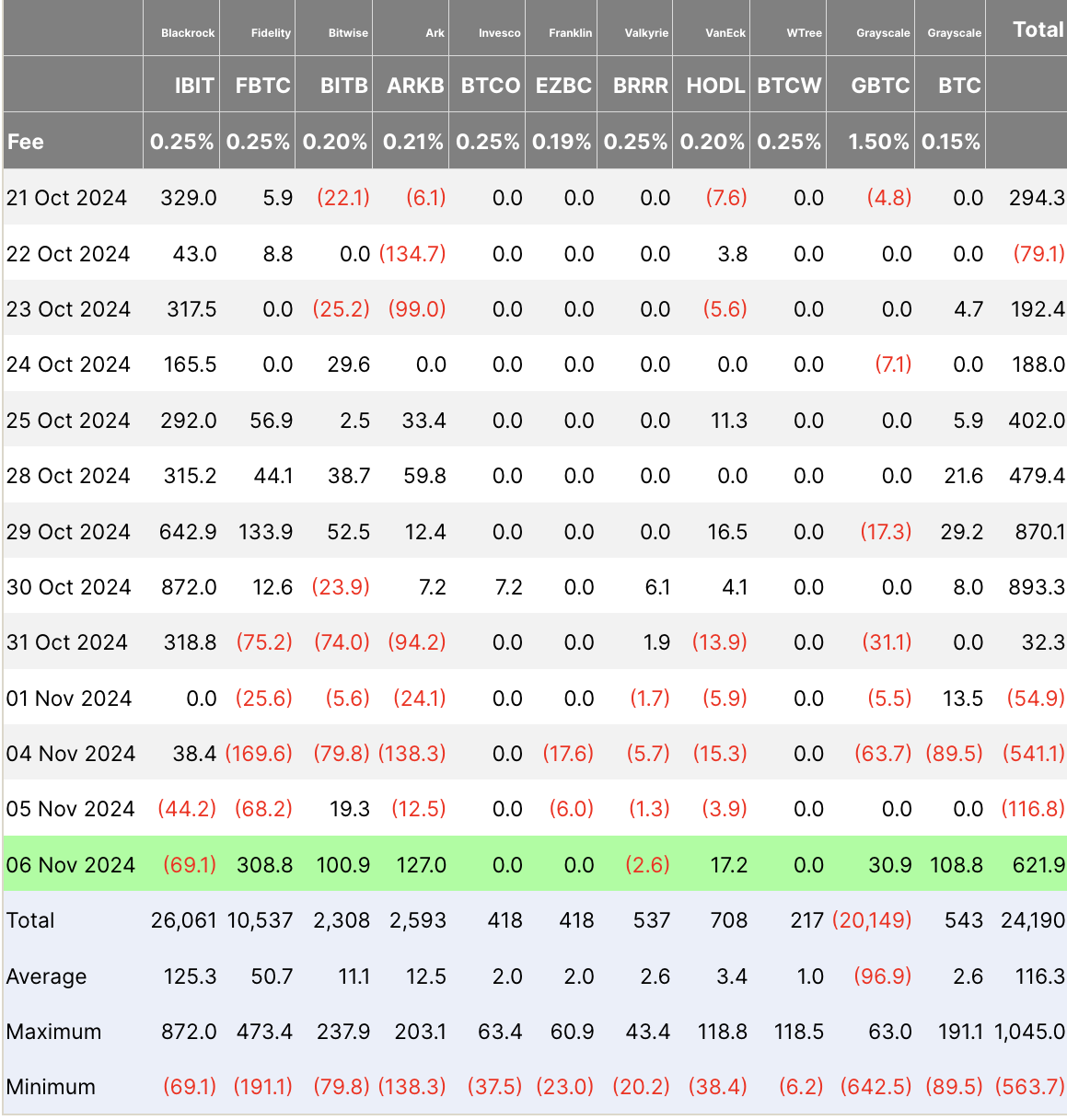

Bitcoin [BTC] Exchange Traded Funds (ETFs) got off to a rough start in November. However, after three straight days of outflows, the ETFs finally registered massive inflows.

According to facts from Farside Investors, daily total net inflows rose to $621.9 million on November 6, effectively breaking the previous streak of outflows.

This increase coincided with that of Donald Trump yield to the presidency for a second term.

Trump had promised regulatory reforms and strong support for the crypto industry, which could be another reason for this surge.

IBIT sees outflow

Surprisingly, this time IBIT did not lead the recent increase in inflows.

Instead, it posted daily net outflows of $69.1 million, following an outflow of $44.2 million the day before.

IBIT was joined by BRRR, which saw daily outflows of $2.6 million.

Source: Farside Investors

On the other hand, ETFs such as GBTC, FBTC, ARKB, BITB, BTC and HODL recorded positive inflows, while the rest of the funds experienced no inflows at all.

BlackRock’s Bitcoin ETF is making history again

Despite the dip, Eric Balchunas, senior ETF analyst at Bloomberg, says marked on X (formerly Twitter) that IBIT reached an unprecedented trading volume of $1 billion within the first 20 minutes of market opening.

This increase, which equaled normal daily volume, contributed to IBIT’s record day with a traded value of $4.1 billion. He noted:

“It was also up 10%, the second best day since launch”

Balchunas elaborated that the collective group of Bitcoin ETFs recorded a trading volume of $6 billion.

In addition, most ETFs doubled their average volume. The analyst described it as:

“An all-round fantastic day for a baby category that never ceases to amaze.”

At the time of writing, IBIT said held 433,644 BTC worth over $30 billion, cementing its position as the leading Bitcoin ETF currently listed in the US

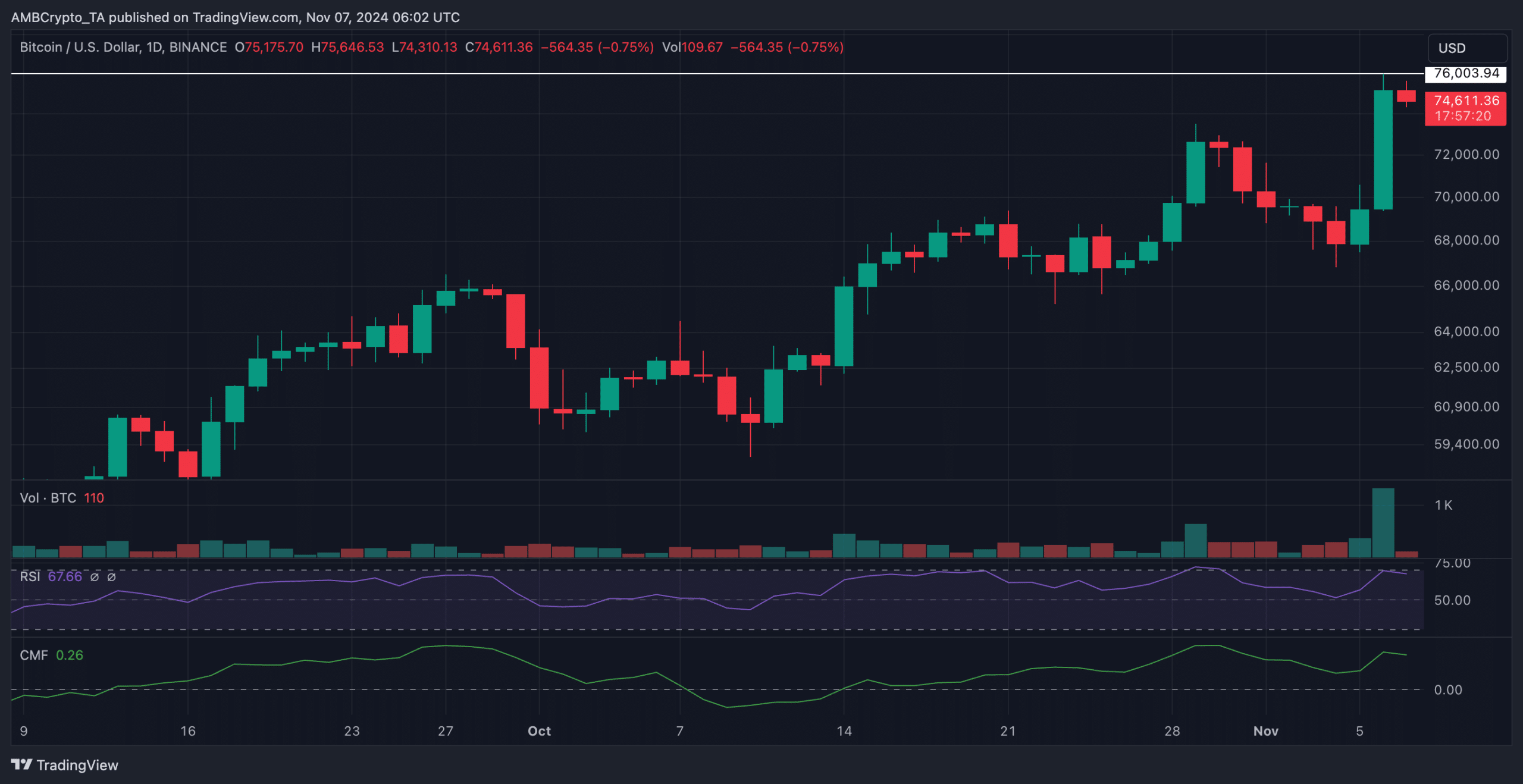

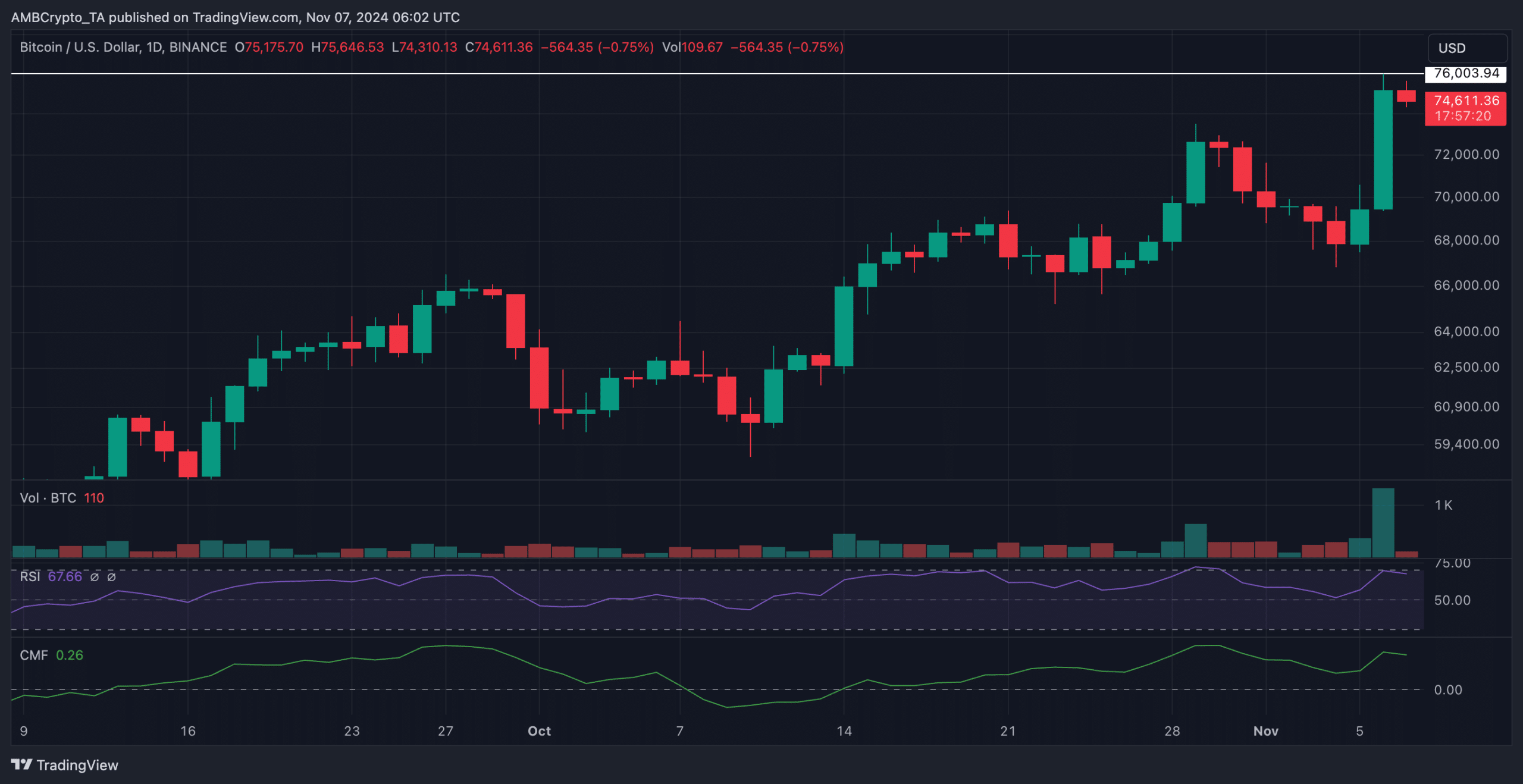

BTC’s performance after the elections

In the aftermath of Trump’s re-election, IBIT was not the only one to set new highs.

Bitcoin also saw a significant increase, setting a new all-time high at over $76,000. This came shortly after BTC reached an all-time high of $75,000 before the election results.

At the time of writing, the price of BTC had fallen to $74,611, reflecting a decline of 1.83% from the peak.

There was a small decline of 0.32% in the past 24 hours CoinMarketCap.

Meanwhile, the daily chart’s RSI stood at 67.66, signifying strong bullish momentum.

This reading indicated that while BTC remains below the overbought threshold, there is still potential for additional upside if buying pressure continues.

Source: TradingView

Moreover, the CMF indicator stood at 0.26. This indicated strong capital inflows into BTC and reinforced the overall positive trend.

BTC overtakes Meta

Notably, the price rally has pushed BTC’s market cap to an impressive $1.48 trillion at the time of writing. This allowed it to surpass Meta, which has a market cap of $1.44 trillion.

As a result, the king’s coin secured its position as the ninth largest asset in the world CompaniesMarketCap.

Source: CompaniesMarketCap

The IBIT and the price milestone underlined BTC’s growing recognition as a major player in the global financial landscape.

This marked a historic moment for the cryptocurrency market as it continues to challenge traditional assets for dominance.