Over the past 24 hours, Binance has set a new record as market sentiment shifts and Bitcoin (BTC), the world’s largest digital asset, reaches its all-time high.

Binance’s $8.3 billion open positions

Amid this bullish market sentiment, on-chain analytics firm CryptoQuant shared a post on has reached 8.3. billion.

Moreover, total derivatives exchanges have reached an all-time high of $23.3 billion. This suggests that Binance alone accounts for a significant 35% of all global futures positions. Meanwhile, monitoring just Binance’s on-chain data can provide deep insights into market trends and trader sentiment.

Open interest and market volatility risk

Despite the new performance of Binance and the general derivatives exchanges, the risk of market volatility could potentially increase. In a report about CryptoQuant one crypto analyst noted:

“A sudden increase in Open Interest (anything above 3% within 24 hours is significant) often indicates impending liquidations in the futures market.”

The analyst noted that when open interest increases, it indicates that there are many long and short positions open in the market and not yet closed. As market volatility increases, pressure on these open positions can increase as volatility turns against them, which could lead to traders closing their positions or facing liquidation to avoid further losses.

The notable positions opened in the market over the past 24 hours indicate a possible liquidation in the coming days.

Currently trading around $75,900, Bitcoin has experienced a price increase of over 9% in the last 24 hours. This remarkable increase has liquidated $393.25 million in short positions.

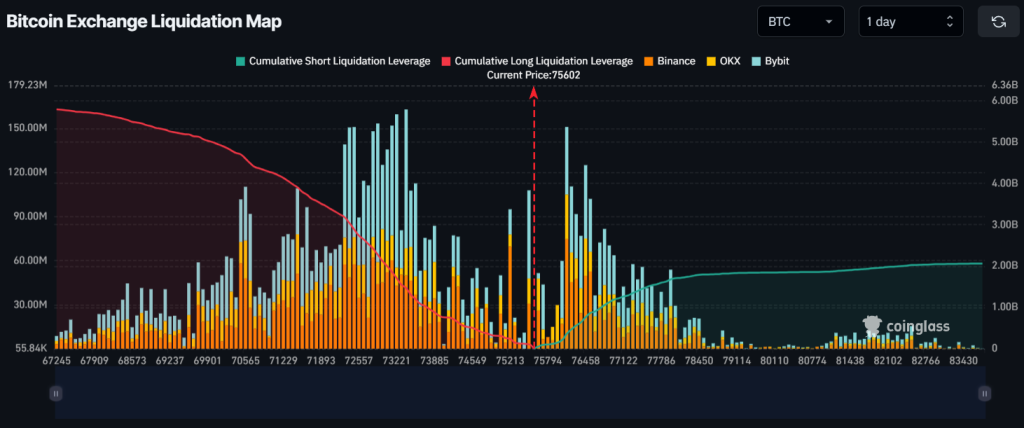

Major liquidation levels

Currently, the key liquidation levels are at $73,387 on the downside and $76,126 on the upside, with traders at these levels being over-leveraged, according to Coinglass data.

If sentiment remains unchanged and the price rises to the $76,126 level, nearly $358.73 million worth of short positions will be liquidated. Conversely, if sentiment changes and the price falls to the $73,387 level, long positions worth approximately $1.5 billion will be liquidated.

This liquidation data shows that bulls are very active right now and believe that the asset price will not fall below the $73,400 level.