- Tether’s CEO clarified the company’s position on an official blockchain

- USDT reached a new high of $120 billion, strengthening its position in the stablecoin sector

Tether CEO Paolo Ardoino is in the news today after denying claims that the stablecoin publisher is building an official blockchain ‘Tether chain’.

In response to the allegations on X (formerly Twitter), Ardoino clarified that the company supports some L2s who choose USDT as payment for gas reimbursements.

“I hear few rumors about a Tether Chain again. Tether currently has no plans to build an official blockchain. There are simply several independent L2 solutions working to support $USDt for gas costs.”

He added that the company’s neutrality is crucial to avoid “everything being centralised.”

“One of the main reasons why Tether won’t be launching a chain anytime soon is that neutrality is very important.”

It should be noted that Ardoino does not rule out the possibility of a chain in the future.

Tether’s USDT growth

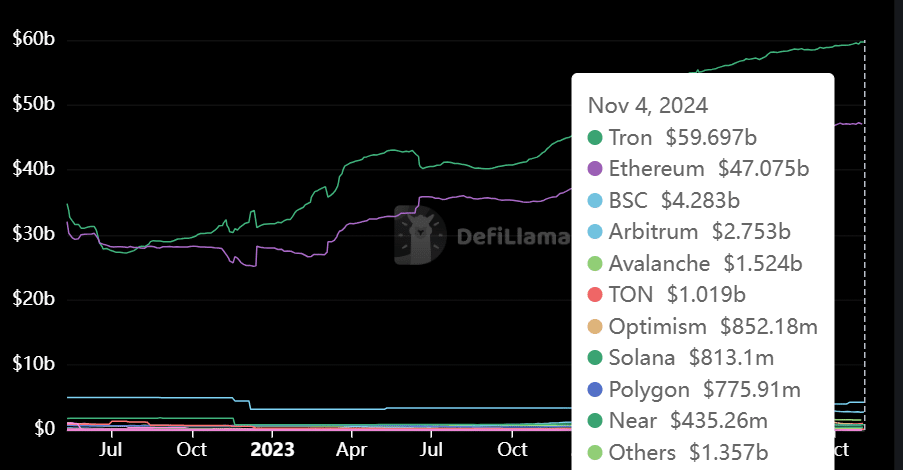

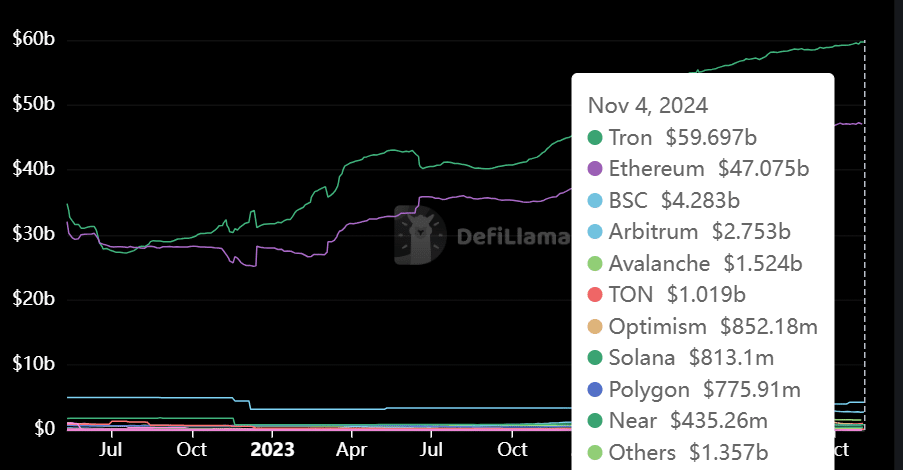

Ethereum L2s like Polygon have already adopted USDT for gas fee payments. However, Tether’s moat extends beyond just the Ethereum chain.

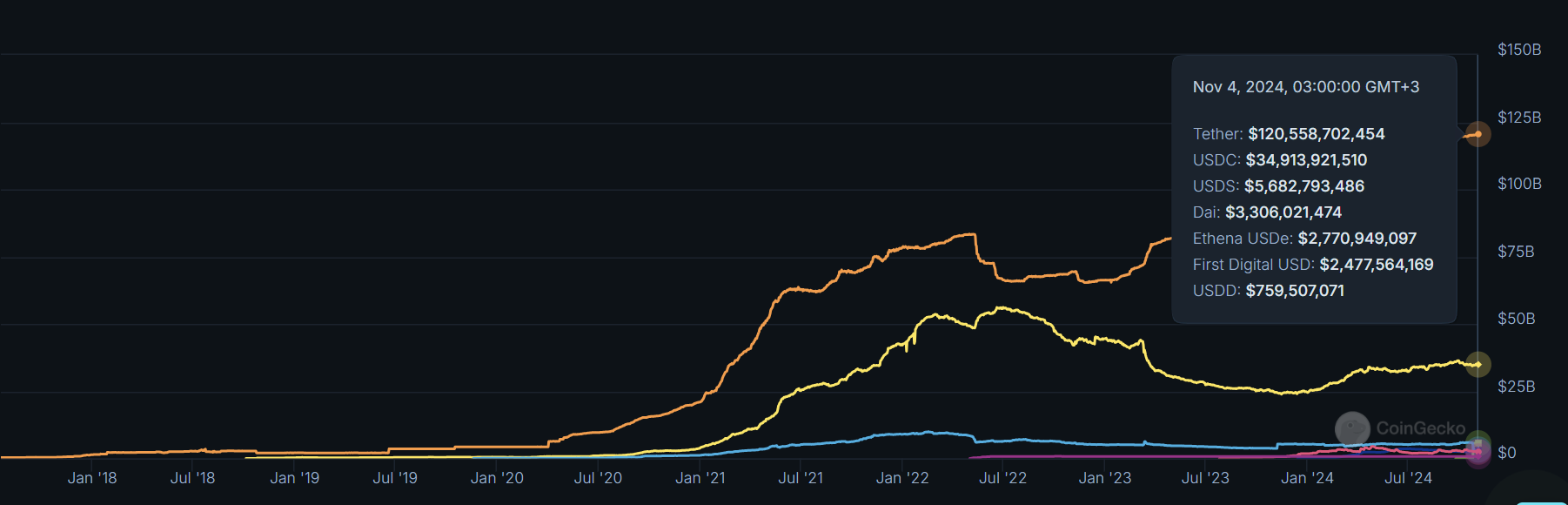

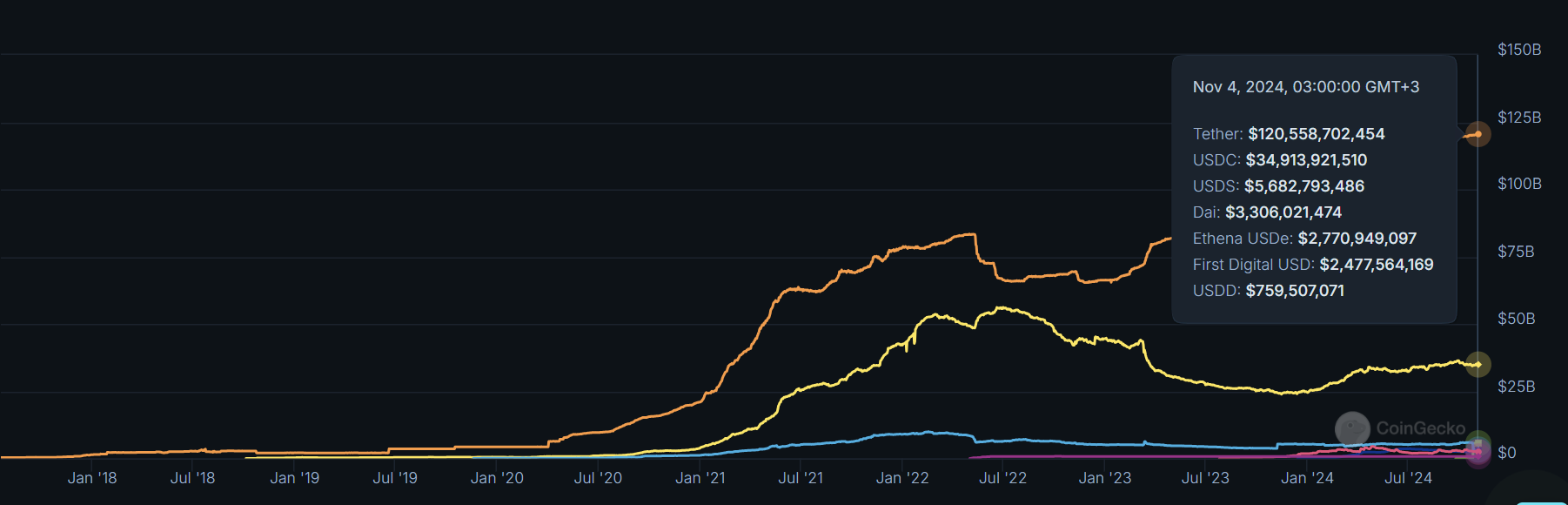

Source: Coingecko

Tether’s USDT has long been the dominant player in the stablecoin market. The market cap recently hit $120 billion, surpassing the record $83 billion set in the previous cycle. Most market trading pairs on centralized exchanges are based on USDT, which partly drives Tether’s dominance in the sector.

However, the dollar-pegged stablecoin has also emerged as a favorite for cross-border payments. Especially in emerging markets that are experiencing massive local fiat currency inflation.

To this end, Tron [TRX] has become a top chain for cheap USDT transfers (nearly $60 billion), surpassing Ethereum. However, other low-cost alternative chains are also emerging that allow cheaper USDT transfers. The Telegram-linked TON (The Open Network) is a good example of this.

Source: DeFiLlama

The company’s current position has made it a target of critics and regulators. In fact, Ardoino recently hit another FUD, who claimed that the company is now under investigation for illegal activities.

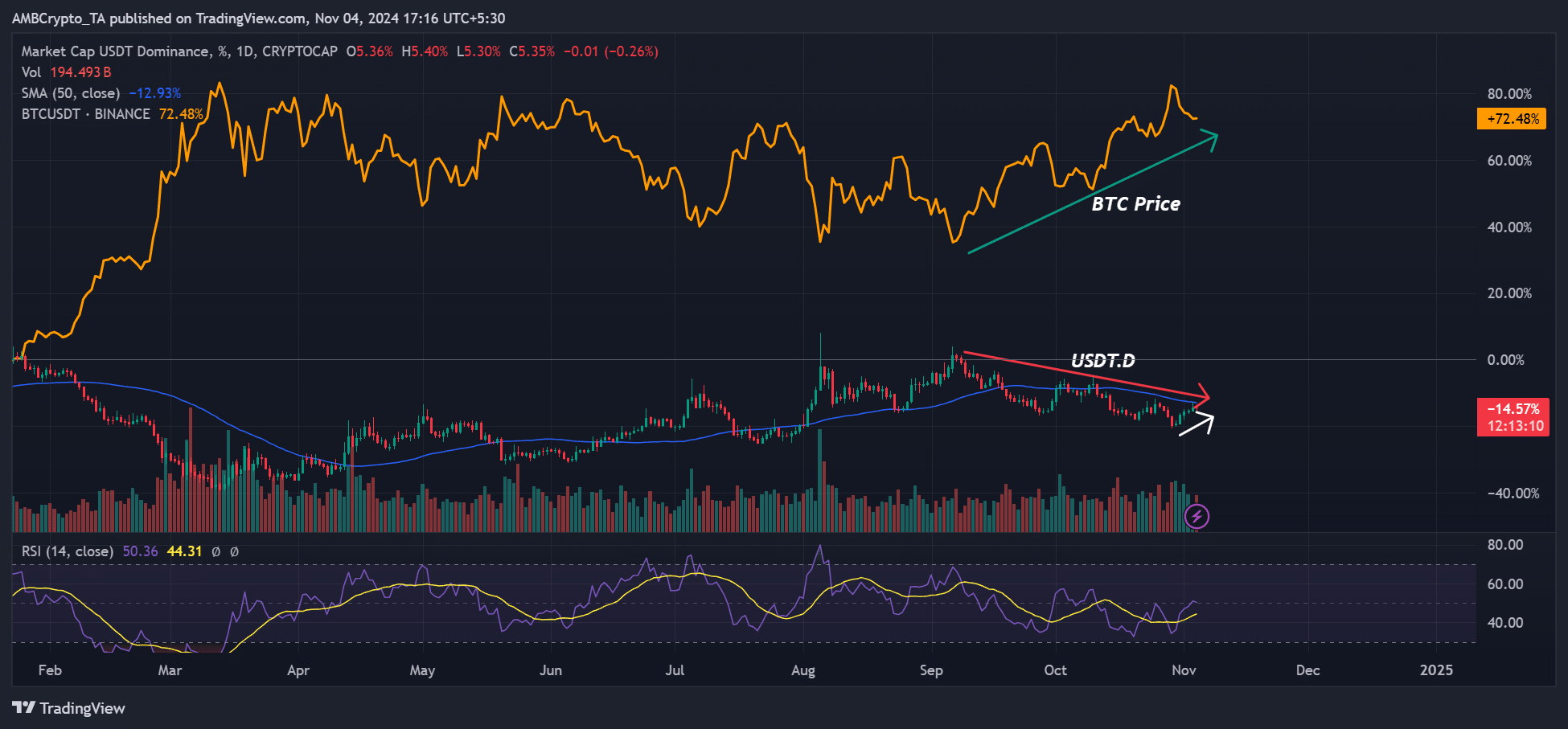

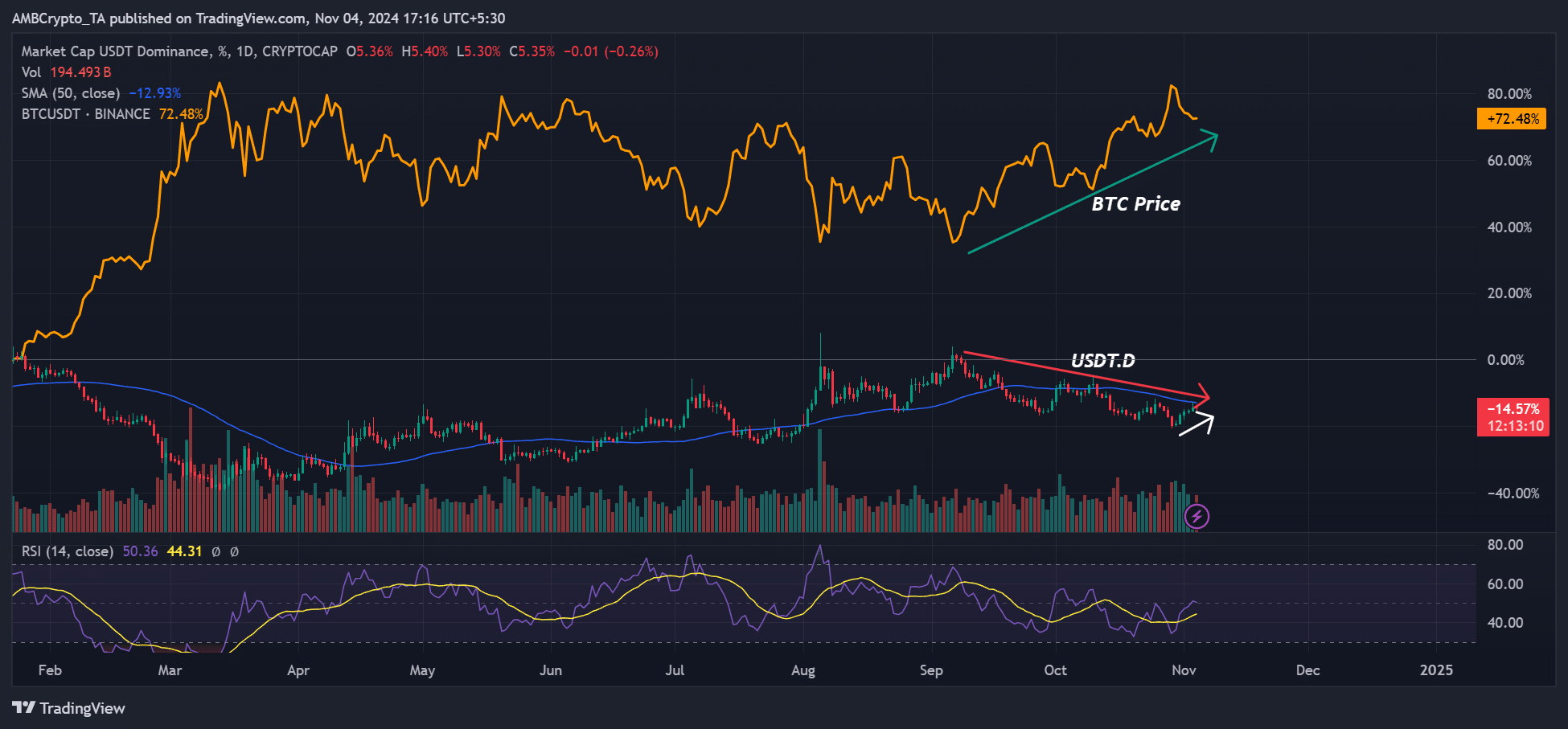

That said, USDT’s dominance also acts as a health barometer and sentiment for the sector. Although the increasing market share indicates increasing market liquidity, The dominance of USDT (USDT.D) also measures whether investors flee to the stables (risk-off) or accumulate en masse (risk-on).

At the time of writing, USDT.D appeared to be in a long-term downtrend, a trend consistent with BTC’s surge. On the contrary, a strengthening of the USDT.D would indicate a risk-off and panic in the market.

Source: USDT.D, TradingView