- $1 billion USDT coins on TRON and Ethereum fuel liquidity and align with bullish sentiment in the market.

- Onchain data shows strong optimism with 11.83% of holders benefiting, reinforcing Tether’s role as a liquidity anchor.

The recent increase in Tether [USDT] Mining Tether has pushed Tether’s circulating supply to new highs, with a new $1 billion coin on TRON taking the stablecoin’s supply from $48.8 billion to nearly $62.8 billion.

This continued trend in TRON and Ethereum reflects a growing demand for liquidity in the market. However, these issuances have a direct impact on market dynamics, affecting trading sentiment, liquidity and price stability.

TRON has become a key driver of Tether’s growth, controlling 51% of USDT’s $120 billion supply, while Ethereum follows closely with 45%.

Therefore, these networks are essential for maintaining liquidity in the crypto ecosystem. Major coins, such as the recent $1 billion issuance on Ethereum, align with Tether’s strategy of holding reserves to meet sudden liquidity needs.

The effect of previous USDT coins on market dynamics

The recent TRON coin is not the first to catch the market’s attention. In September, Tether hit $1 billion on Ethereum, sparking speculation about future market movements. Some saw it as a bullish indicator, while others saw it as a routine stock adjustment.

Nevertheless, previous coins have often joined the bullish sentiment. Analysts note that these issuances often coincide with increased trading volumes, as traders see them as signals of rising liquidity and potential profits.

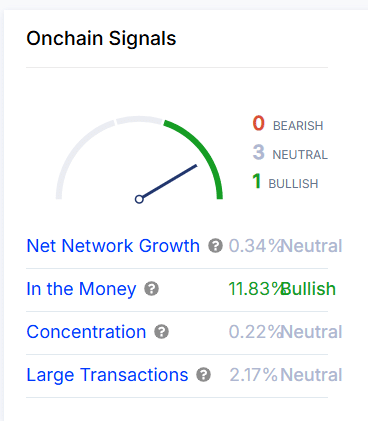

Current onchain data supports the optimism surrounding recent USDT coins. The ‘In the Money’ metric indicates that 11.83% of Tether holders are currently profiting, reflecting bullish sentiment.

Meanwhile, metrics such as net network growth, concentration and large transactions remain neutral, pointing to a stable but optimistic outlook.

As more holders remain in the money, market confidence in Tether grows, entrenching Tether’s role as a primary liquidity provider.

Source: IntoTheBlock

Can Tether‘S stability of the pin can tolerate the growing supply?

While USDT’s $1 peg provides stability, rapid supply growth could challenge this balance in volatile conditions. Tether’s market dominance, which now stands at around 5.30%, is showing signs of moving towards the 5.47% resistance level.

This rising dominance supports the peg in bullish conditions. However, a sudden downturn could test Tether’s ability to maintain its price, especially as the increased supply creates additional volatility.

Source: TradingView

Tether’s continued rise in coin count in TRON and Ethereum highlights its role as a primary liquidity provider. Each issuance strengthens market liquidity and reflects increased demand from key players.

Onchain signals support a bullish outlook, with a significant number of holders ‘in the money’.

Nevertheless, Tether’s ability to maintain peg stability amid growing supply will be essential, especially during recessions.