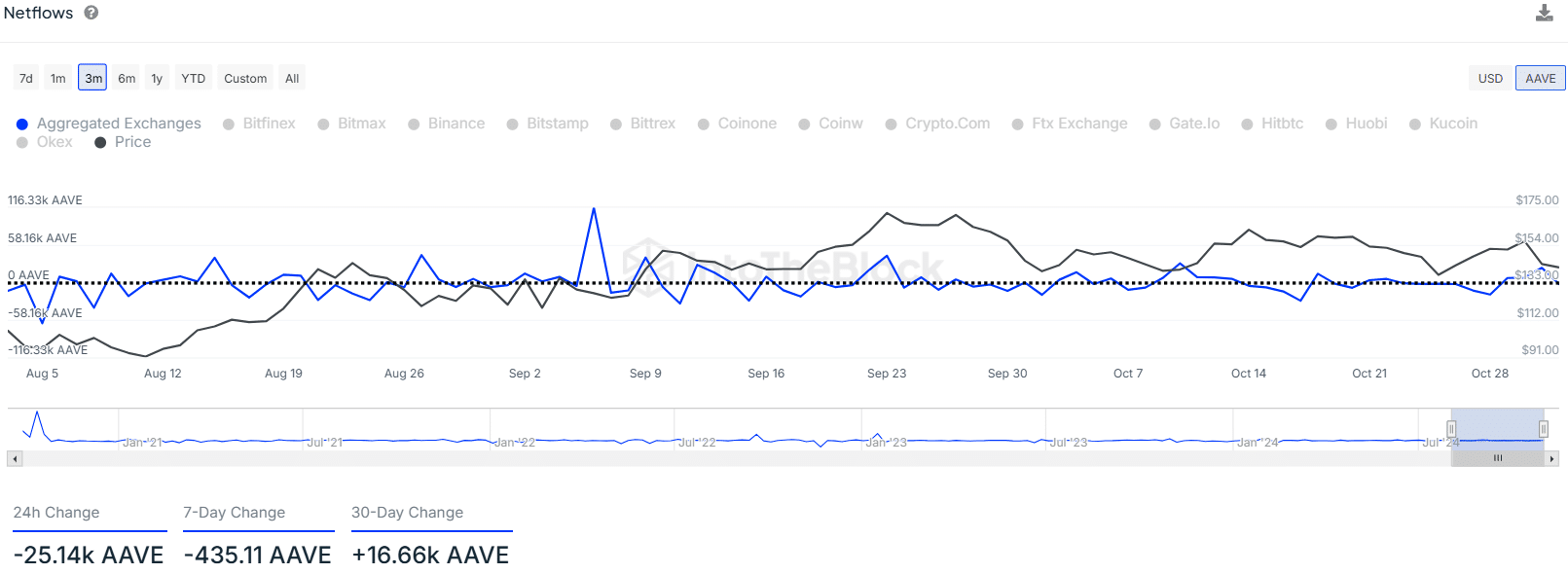

- AAVE saw moderate AC flows over the past month

- The weekly bullish market structure break was a powerful signal

Aaf [AAVE] Bulls have been stubbornly defending the $140 support level for the past two months. However, the altcoin has a target of $200 and will likely go much further based on the higher time frame price charts.

Source: InHetBlok

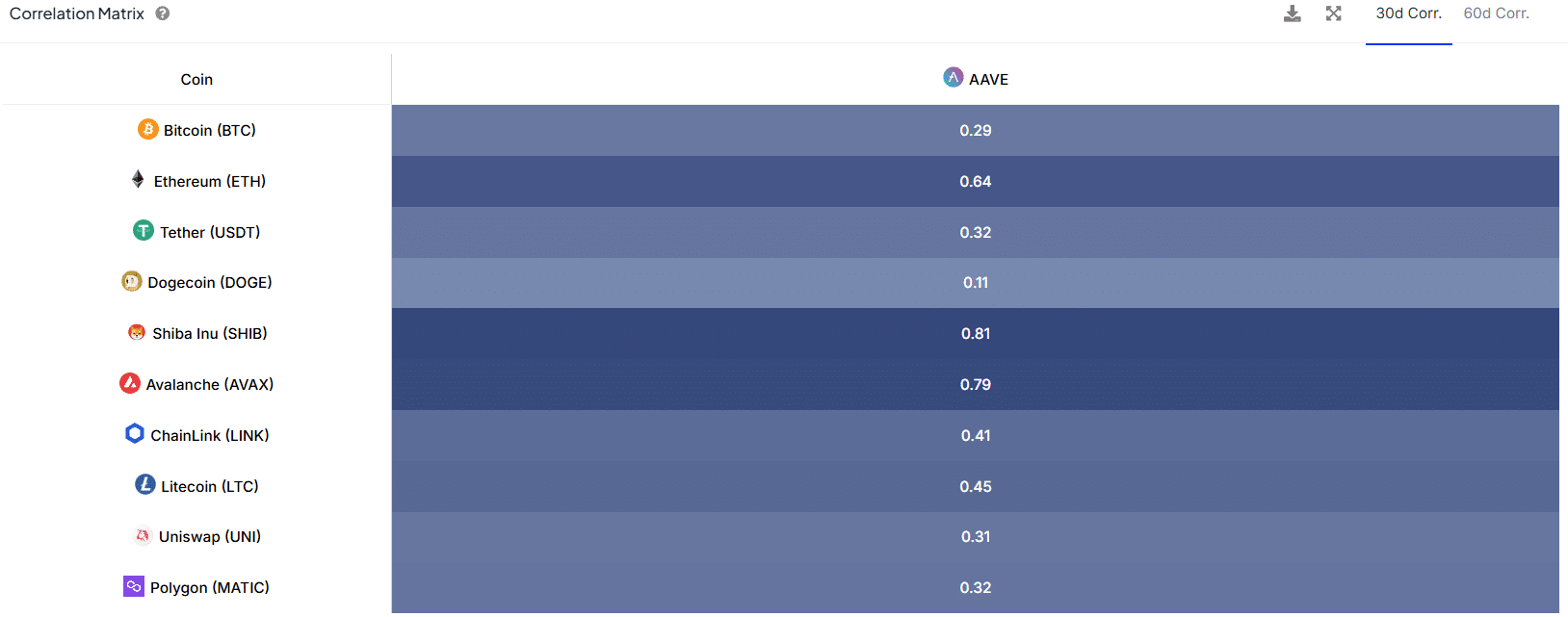

However, the low 30-day correlation of +0.29 was not surprising. As AAVE fought to defend $140 and regain $150 as support, Bitcoin has been steadily moving higher over the past six weeks.

However, long-term investors have little reason to be gloomy.

Signs of a sustained upward trend have yet to emerge

AMBCrypto found that netflow data over the past week and month was hardly encouraging. Outflows from -435 AAVE totaled just $61,000. The +16.66k AAVE change in 30 days represented a $2.3 million inflow into the exchanges.

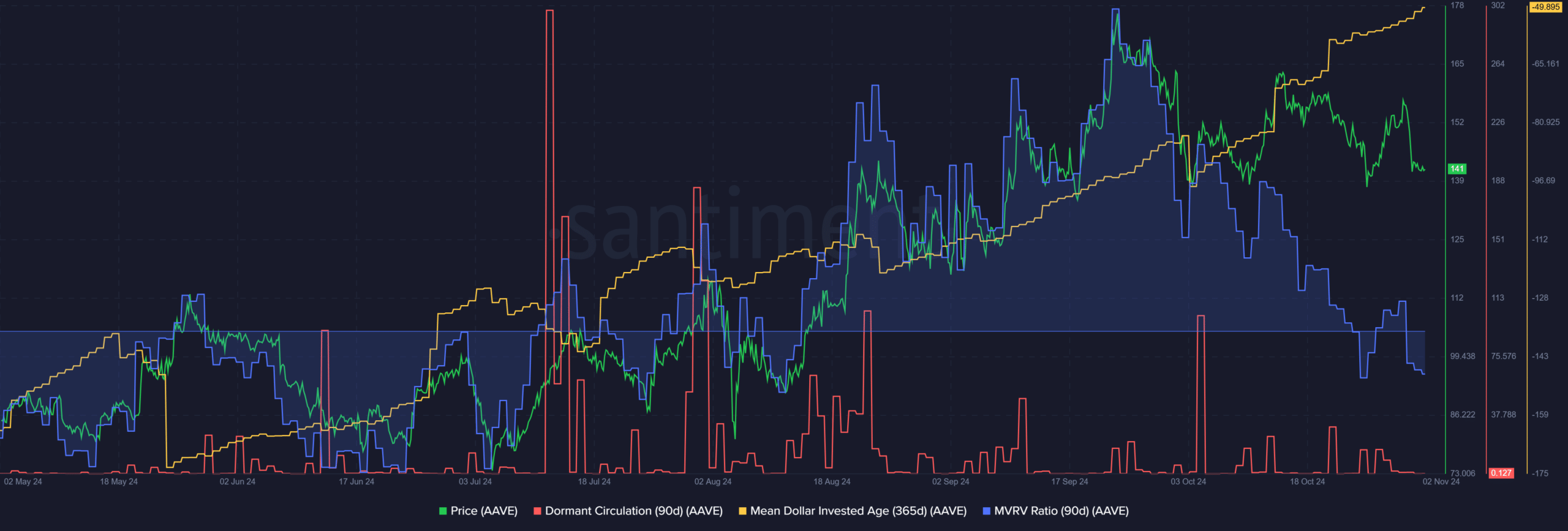

Santiment data also showed that dormant circulation was calm over the past month. This highlighted the moderate token movement between addresses, compared to the sell-off in mid-July.

So there is probably no high selling pressure in the coming days.

The declining MVRV ratio showed that 3-month holders suffered average losses. This could encourage mild selling pressure on an upswing towards $160. It also seemed an indication that profit-taking won’t stop bullish efforts.

These bullish efforts have already begun, but may be more visible on the weekly time frame. For example, the continuous upward trend in the average age invested in dollars (MDIA) meant stagnation. The drop would be a sign of more movement and new buyers, and this in turn could herald a sustainable uptrend.

AAVE provides strong evidence on the higher time frames

Source: AAVE/USDT on TradingView

The weekly chart underlined a downward trend in the second half of 2021, a trend that continued throughout 2022. The $100-$120 area formed a resistance zone that was not convincingly broken for 805 days.

Read Aave’s [AAVE] Price forecast 2024-25

This long-term consolidation was broken in mid-September when the previous high at $153 was broken with a weekly session just above it. Since then, AAVE was rejected at $180 and played defense at the $140 area.

The weekly break in the market structure six weeks ago was a sign of bullish intent. In the coming months, $290, $400 and even the all-time high of $661 would be achievable bullish targets. A slump in the MDIA would likely be an early sign that the altcoin is poised for a surge.