- The Altcoin season could kick off in November, which would reveal strong investment opportunities.

- However, altcoins as an asset class continue to decline.

With election results on the horizon and expected shifts in monetary policy, Bitcoin [BTC] charts a volatile price, pulling traders toward relative stability. This classic trading move – seeking refuge in Bitcoin during market uncertainty – has pushed BTC close to its all-time high of $73,000, increasing its market dominance to over 60%.

With Bitcoin in the spotlight, could this high dominance set the stage for a wave of profit-taking in altcoins, creating a potential altcoin season?

The post-election cycle could spark an altcoin season

In previous cycles, such as the run-up to Bitcoin’s all-time high of around $73,000 in March, altcoins saw significant rallies as retail investors diversified their portfolios, driven by optimism and FOMO. However, the current environment looks different.

A recent AMBCrypto report indicates that spikes in short liquidations have significantly affected Bitcoin’s recent price increases.

While this indicates a bullish near-term outlook, it could also lead to hesitation among investors concerned about volatility in the derivatives market.

This response reflects a fundamental psychological reaction to uncertainty. If this trend continues, investors could redirect their capital towards other high-capitalization tokens, potentially paving the way for an altcoin season.

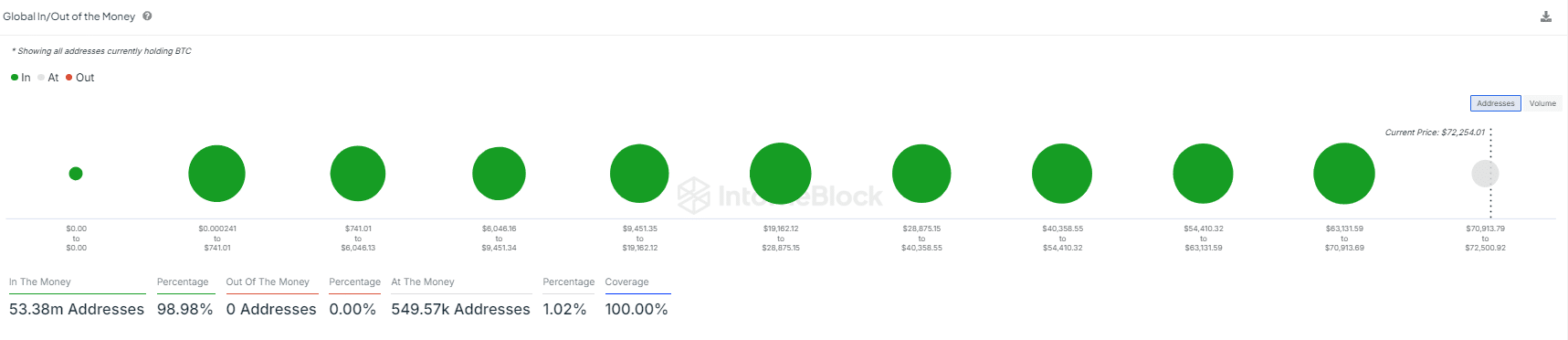

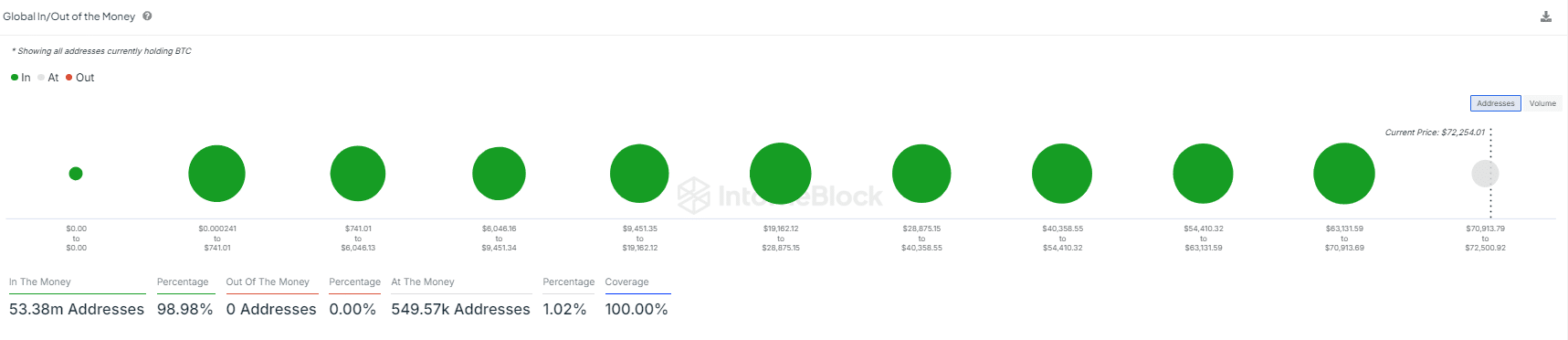

Source: IntoTheBlock

With 100% of Bitcoin cohorts currently having a net gain, there is a good chance that altcoins will see a surge in mid-November.

This time frame could align with the end of the election cycle, which could prompt investors to recalibrate their strategies in response to new market trends.

Simply put, as profit-taking occurs and market sentiment changes, altcoins could benefit from increased capital flow, potentially creating an altcoin season.

But there’s a catch

The current optimism, with Ethereum posting a notable weekly gain after underperforming major rivals in the previous cycle, signals a return to previous market trends.

However, altcoins as a whole are still struggling. While a few tokens may experience a breakout, the broader trend remains clear: altcoins as an asset class continue to fade.

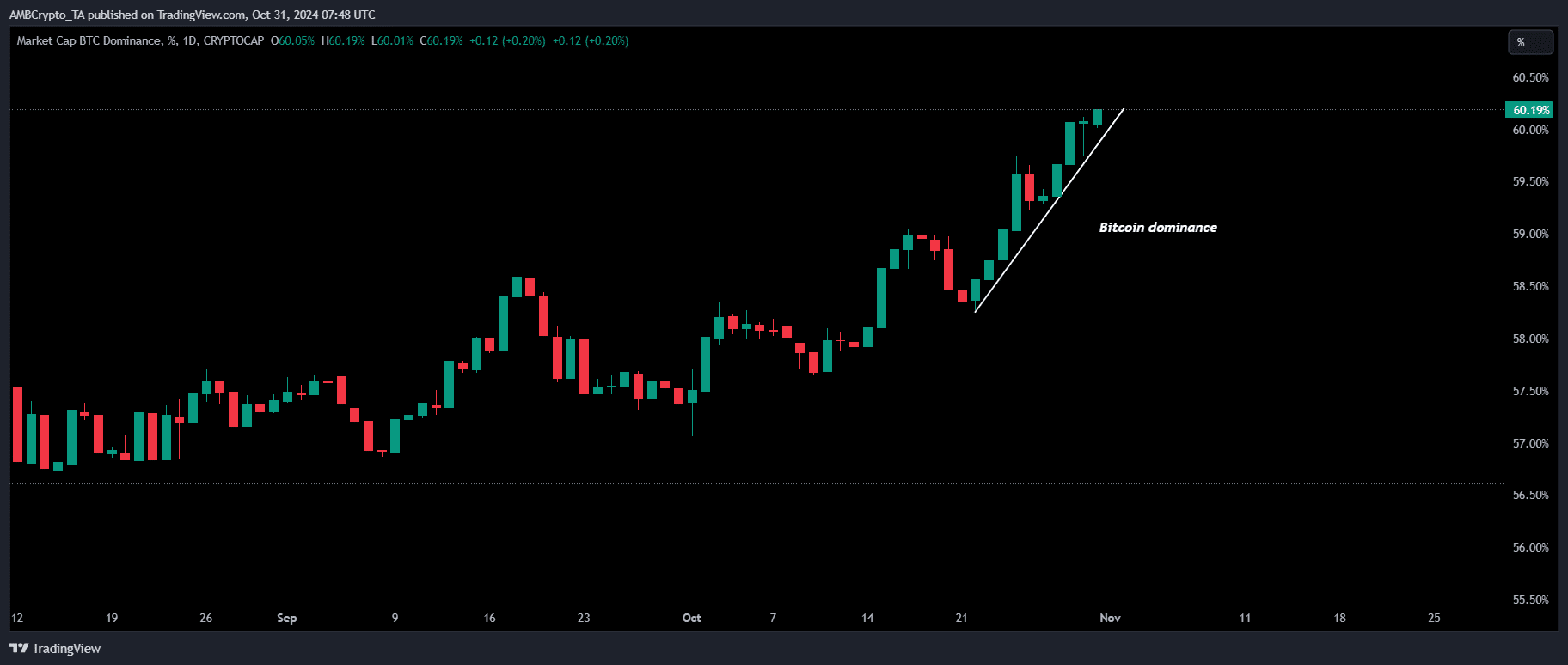

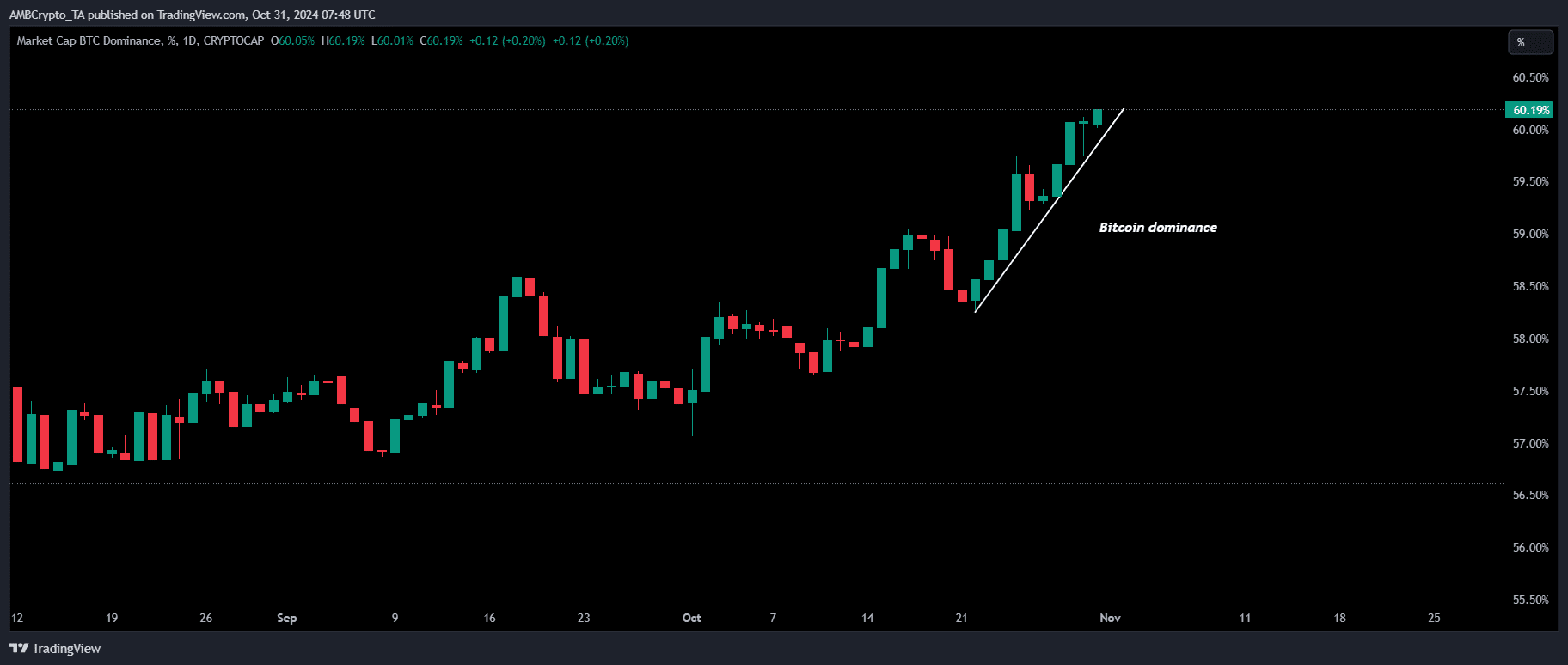

Source: TradingView

As the total market cap has risen from $2 trillion to $2.4 trillion, almost all new money has flowed into Bitcoin, draining liquidity from altcoins, evident in Bitcoin’s increasing dominance.

This indicates that Bitcoin and the rest of the market are becoming increasingly separate worlds. Currently alone 14 altcoins have managed to attract liquidity over the past 90 days.

Furthermore, they have been in a brutal downtrend against Bitcoin since early 2022. After nearly four years of underperformance, altcoins have reached levels not seen since February 2021.

Read Bitcoin’s [BTC] Price forecast 2024-25

Overall, it is clear that liquidity dynamics in crypto have changed significantly. While a few altcoins are poised for gains in the post-election cycle as Bitcoin holders look to redistribute their gains, the narrative surrounding an altcoin season remains elusive.

This trend suggests that high Bitcoin dominance may no longer be a reliable precursor for an altcoin season.