- Bitwise CIO believes that Bitcoin’s long-term growth is independent of election results.

- Altcoins could see accelerated growth if Trump wins the presidency.

The clock is ticking for the US elections. With only four days to go, Bitcoins [BTC] The price is already experiencing a notable increase, just 2% away from the ATH at the time of writing.

However, the question on everyone’s mind now is: how will the election outcome impact the future of Bitcoin and the broader cryptocurrency industry?

Well, recently interview with Yahoo Finance, Matt Hougan, Chief Investment Officer at Bitwise Asset Management, summarized the forecast, noting:

“I think the most important thing for Bitcoin is that the elections happen.”

He emphasized that regardless of whether Donald Trump or Kamala Harris achieves a victory, the regulatory environment for the king coin is steadily improving – a factor likely to influence recent price movements.

The Trump advantage

The CIO acknowledged that while a Trump victory won’t completely change BTC’s prospects, it could accelerate its growth. He noted:

“In the short term, crypto prefers a Trump win to a Harris win, but Bitcoin doesn’t actually need Washington to succeed.”

The director pointed out that institutional interest, inflows of exchange-traded funds (ETFs) are increasing and rising adoption are poised to propel BTC to new heights.

Recently AMBCrypto reported that Bitcoin ETF inflows hit a five-month high. This underlined strong demand as investors become increasingly confident in the asset’s long-term potential.

Trump’s victory is a victory for altcoins

While Bitcoin seems well positioned regardless of the election, Hougan predicts a substantial altcoin rally if Trump wins.

He expressed his optimism by saying:

“We’re going above $100,000 with Bitcoin.”

Hougan said Bitcoin benefits from a defined legal status as a commodity under the SEC and CFTC. ETFs add a layer of confidence.

However, many altcoins still face ambiguous regulatory treatment. The director believes in a shift in SEC leadership under Trump.

This shift could clarify regulations, boost institutional adoption, and spur growth in the altcoin market.

In support of this view, a analysis from Galaxy Digital suggested that altcoins could perform better under Trump and could face increased regulatory risks with a Harris win.

Also a Bloomberg questionnaire also indicated that a Trump administration could favor investors and the crypto market, while a Harris administration could lean more toward housing policy reform.

Path to $200,000 for Bitcoin

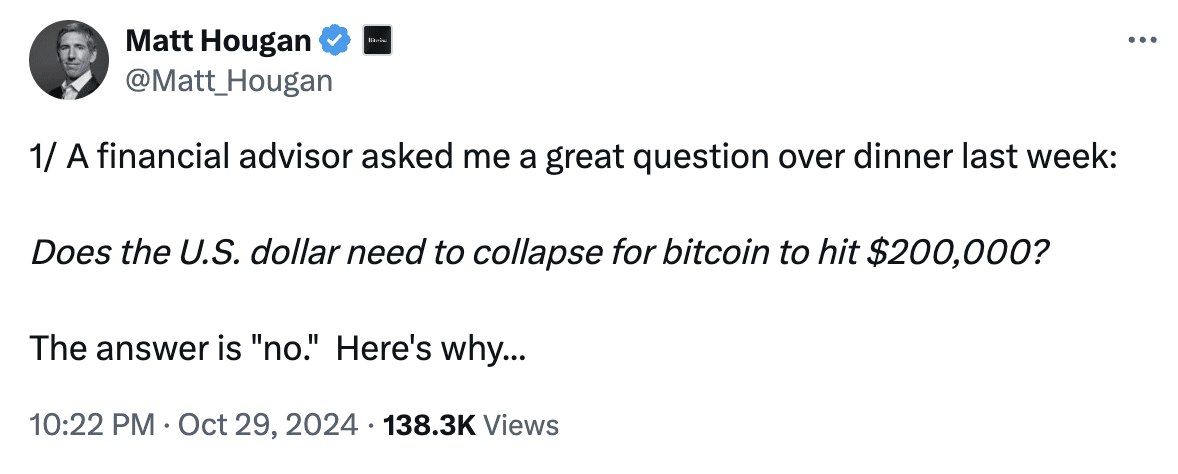

Amid the ongoing political and crypto discussions, so does Hougan addressed a critical debate on X (formerly Twitter) explaining why Bitcoin doesn’t need a dollar collapse to reach $200,000.

According to him, Bitcoin’s potential as a “store of value” and its appeal amid fiat devaluation are the main drivers of its growth.

Source: Matt Hougan/X

The executive noted that as BTC matures as an institutional asset and the store of value market grows, it could surpass a seven-figure valuation.

As the election approaches, regulatory clarity, institutional interest, and Bitcoin’s growing appeal point to a promising future for the cryptocurrency.