- Coinbase’s third-quarter revenue fell due to reduced trading, but posted a profit of $75 million.

- The company strengthened its crypto position with a $1 billion buyback and Fairshake PAC support.

In an unexpected twist, Coinbase revealed a decline in quarterly revenue on October 30. This indicates a decline in crypto trading activity among users during the summer months.

According to the reportthe exchange’s revenue fell to $1.2 billion in the third quarter of 2024, compared to $1.45 billion in the previous quarter. Despite this, Coinbase posted a remarkable turnaround with a profit of $75 million.

This is a marked improvement from the $2 million loss reported last year.

Coinbase Q3 revenue is a concern

Coinbase experienced a 27% drop in transaction fees compared to the previous quarter due to declining trading volumes.

The company’s shareholder letter outlined ongoing challenges in the market. The letter emphasized that sSubscription and services revenue was down 7%, bringing in $556.1 million for the quarter.

This income comes from products such as stablecoins, staking and leverage for Prime traders.

In his letter from the shareholdersthe company noted,

“We are working to drive revenue growth through products such as derivatives, international expansion, custody and deeper integration of USDC into the crypto economy.”

However, Coinbase vice president of investor relations Anil Gupta seemed positive, as evidenced in a conversation with a publication in which he marked the company’s fourth consecutive profitable quarter.

“It was a solid quarter for the company across the three priorities we laid out early this year: monetization, driving crypto utility, and driving regulatory clarity.”

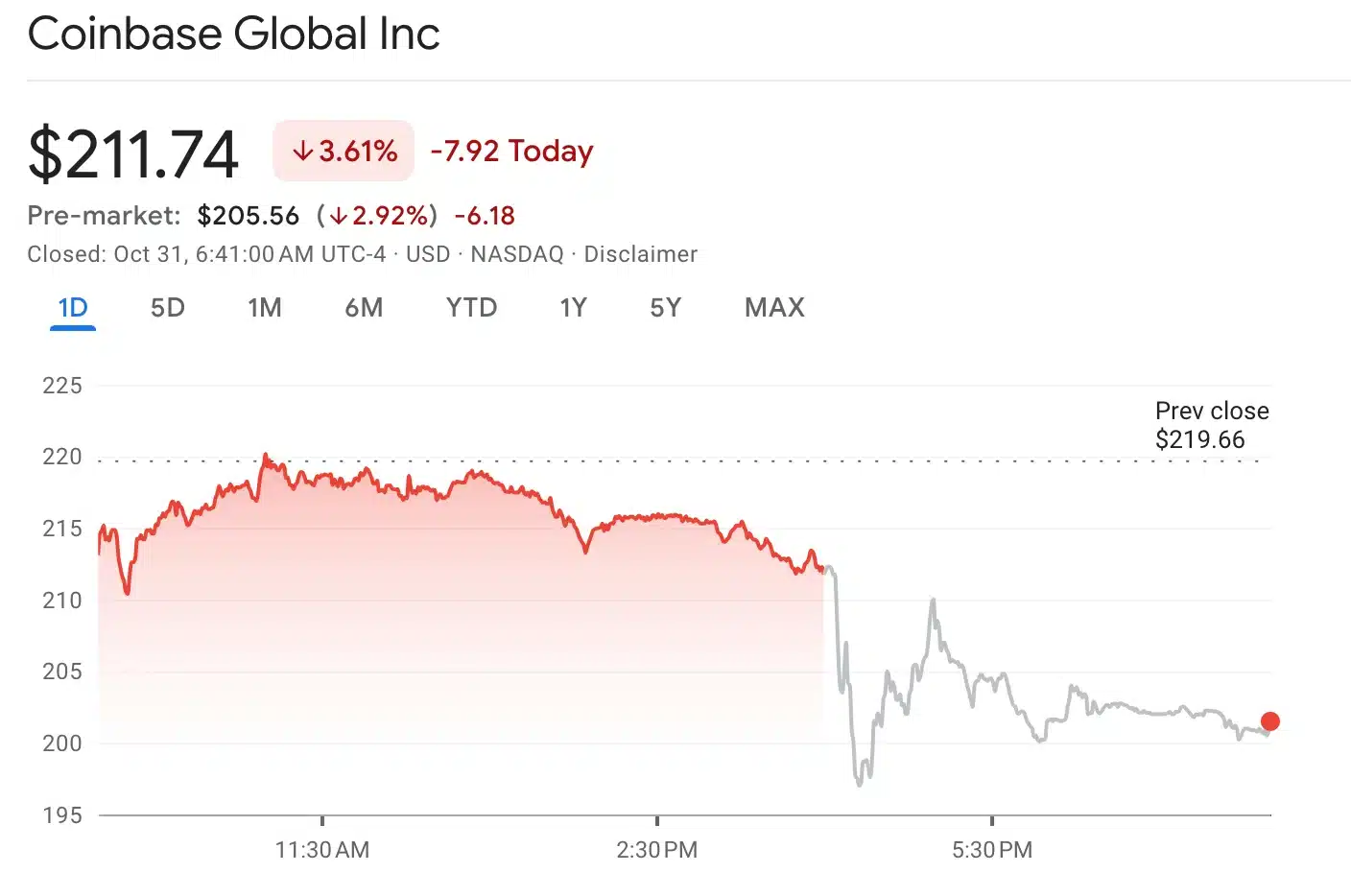

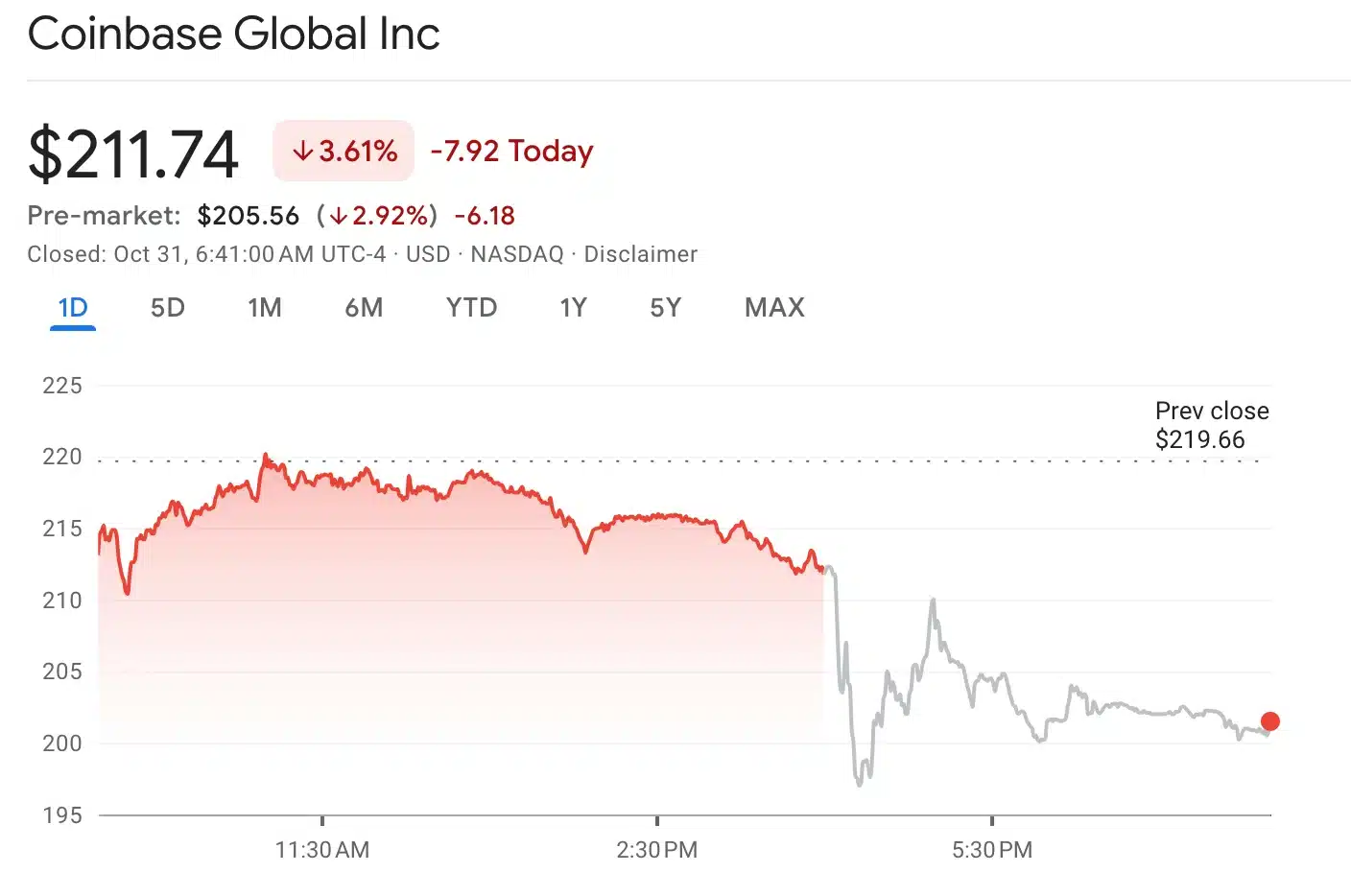

The price development of Coinbase shares

In March, Coinbase’s stock price rose to a peak of $279, fueled by Bitcoin [BTC] reaching an all-time high of almost $73,000.

Although shares have since fallen to $211 as of October 30’s close, they are still up 35% year-to-date.

However, during after-hours trading, Coinbase shares saw a further decline, falling to $202.

As of the last update Bitcoin’s price settled at $72,288.21 after a slight decline of 0.37% in the past 24 hours, while Coinbase shares traded at $211.74, down 3.61% at the time of writing.

Source: Google Finance

What awaits us?

Oppenheimer analysts predicted a decline in Coinbase trading volume due to a lack of strong market catalysts and election uncertainty.

Analysts remain cautiously optimistic, pointing to Vice President Kamala Harris’ support for a regulatory framework for digital assets.

This could boost Coinbase’s trading activity in the fourth quarter, potentially offsetting the slowdown.

The introduction of a $1 billion share buyback program underlines the company’s optimistic long-term outlook aimed at rewarding investors.

Additionally, Coinbase’s stablecoin revenue saw growth, especially at USDC, supported by platform incentives and extensive product integration.

On the political front, Coinbase is strengthening its commitment to pro-crypto policies by contributing $25 million to Fairshake PAC, a measure aimed at supporting crypto-friendly candidates in the 2026 elections.

This will strengthen its role in shaping favorable regulatory outcomes for digital assets.

Source: Brian Armstrong/X