- Buyers are trying to gain ground but are facing challenges near the key EMAs

- If AVAX fails to hold above the $24 support, AVAX could face more downside risks

As predicted in our previous articleAvalanche (AVAX) has been making a sideways move lately after breaking the previous ascending channel. Recent price activity has shown mixed signals, with buyers working hard to push the price above key resistance levels.

Should AVAX holders be concerned, or is there still a chance of an outbreak?

Can AVAX bulls regain their ground?

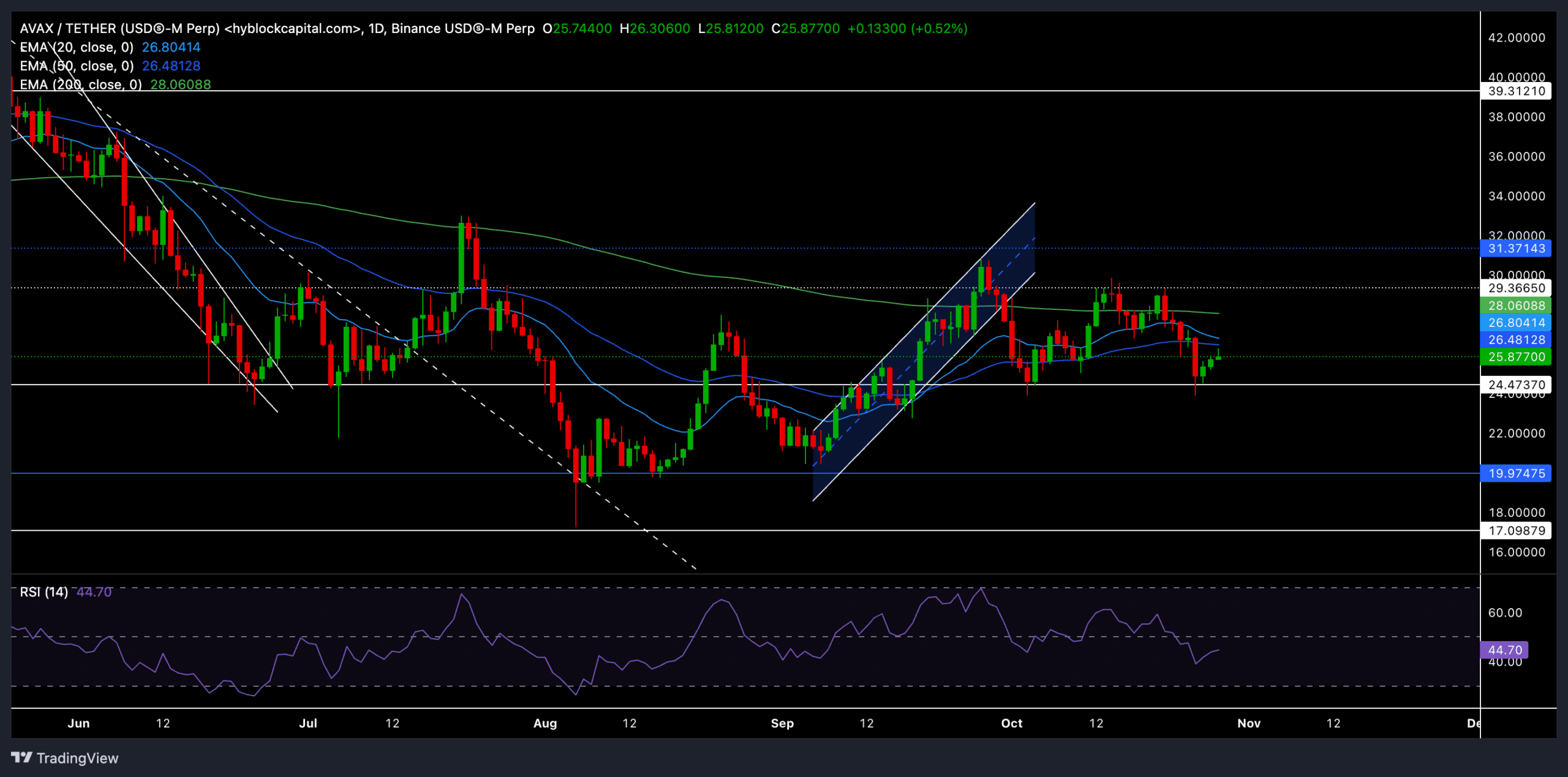

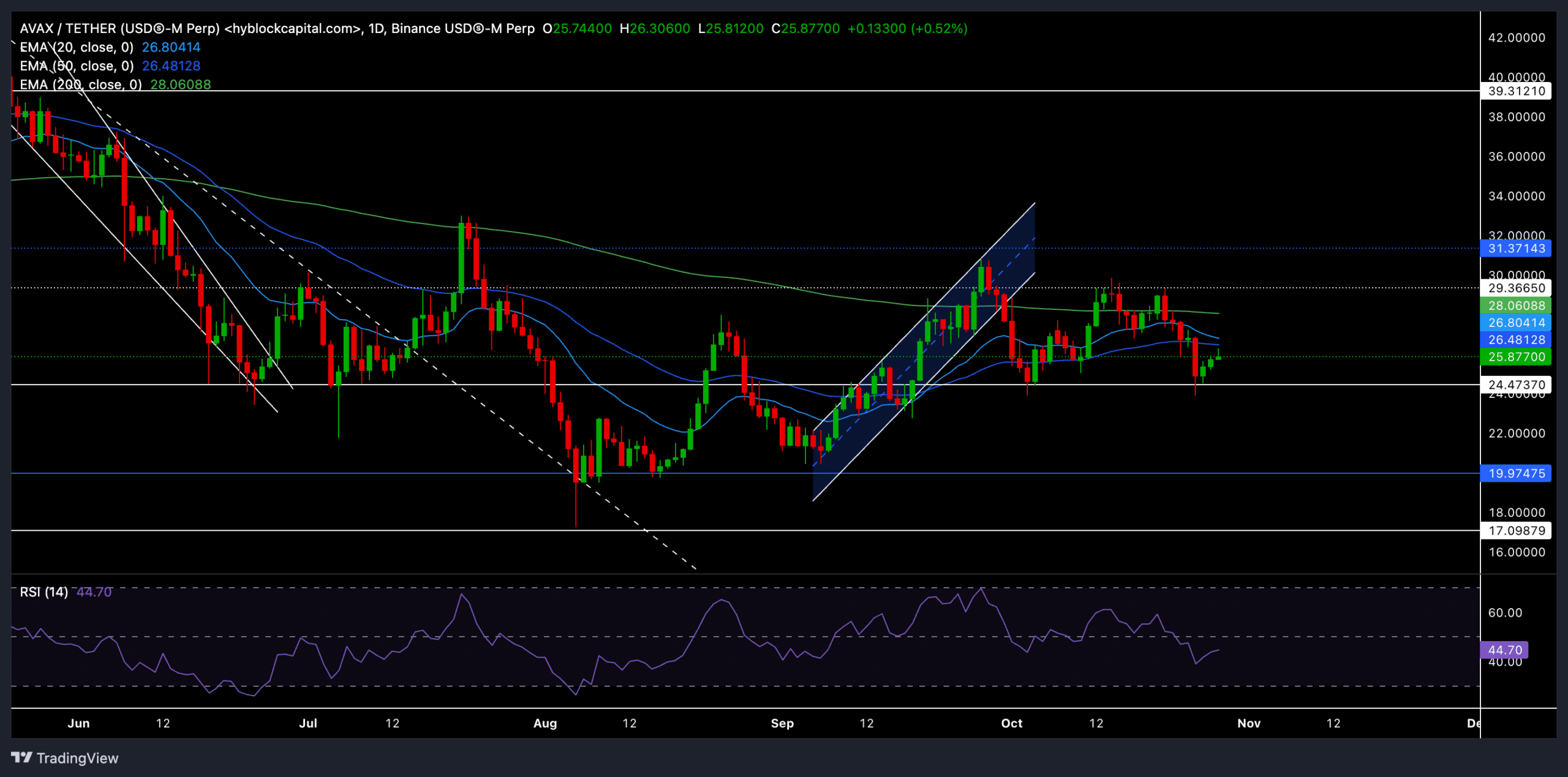

Source: TradingView, AVAX/USDT

After a steady rise earlier in September, AVAX recently broke the uptrend. Since then, the price has fluctuated between $24 and $30. AVAX was trading at $25.87 at the time of writing, just above support.

The 20-day EMA was $26.80 and the 50-day EMA was $26.48. The 20 EMA was looking south, indicating a possible bearish crossover. If AVAX cannot break and stay above these levels, this crossover could lead to more selling pressure. Furthermore, the 200-day EMA at $28.06 appeared to be a key resistance level that buyers need to overcome to gain upside momentum.

Important levels to monitor

Support: The $24.47 level is crucial. If the price falls below this, losses could go towards $20.

Resistance: Immediate resistance was at the 20-day EMA ($26.80) and the 50-day EMA ($26.48). If the price breaks above this, it could test the $28 resistance (200-day EMA) and then the $31.37 level.

The Relative Strength Index (RSI) stood at 44.7 at the time of writing, showing slightly bearish momentum as it remained below 50. A move above 50 could increase buyer confidence, while a dip below 40 could increase bearish pressure. .

Derivatives data for AVAX revealed THIS

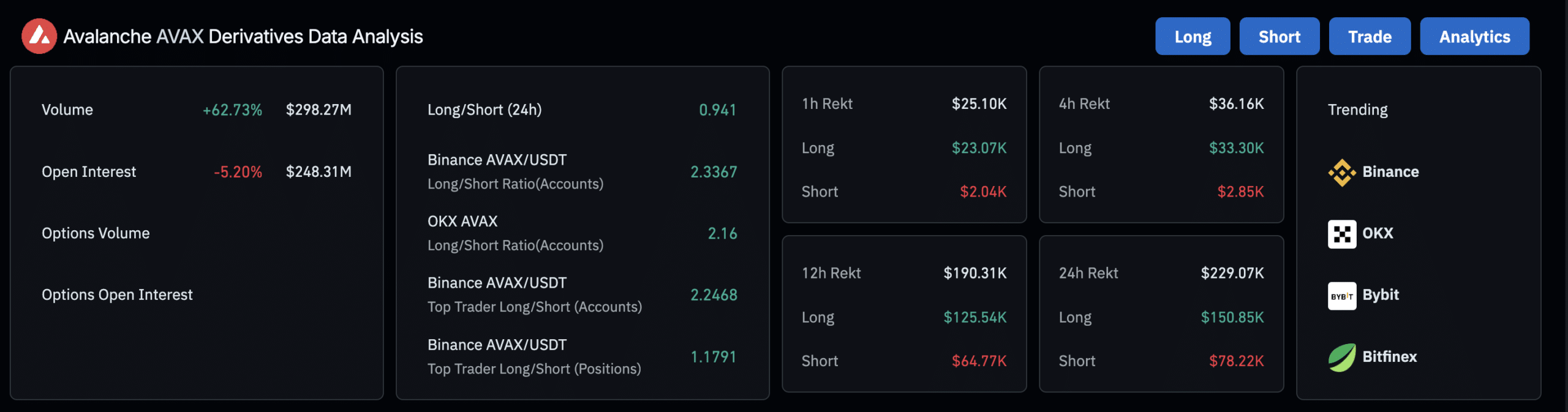

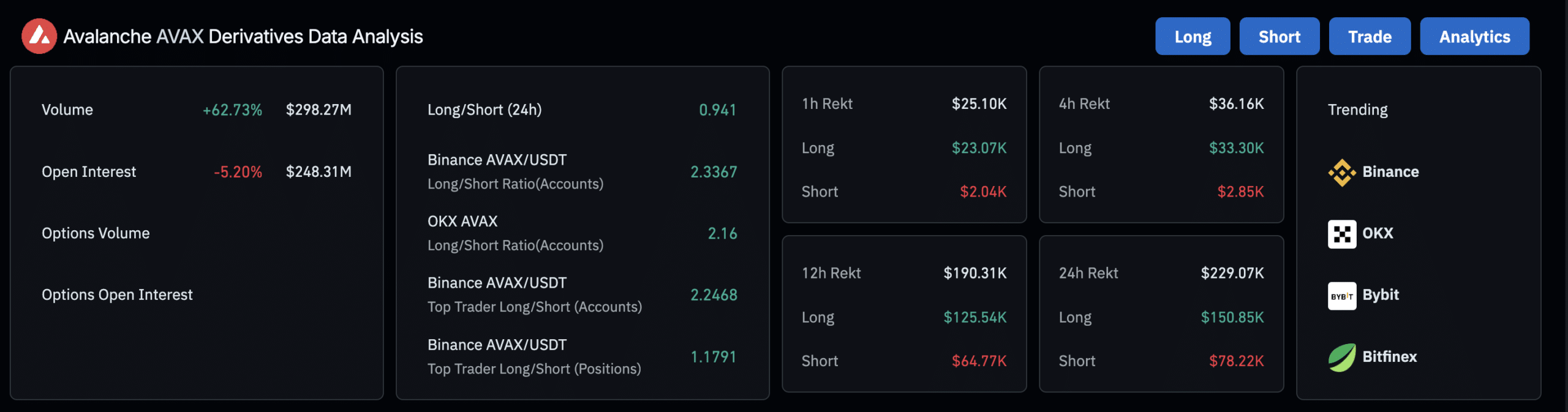

Source: Coinglass

Derivatives data revealed mixed signals for AVAX traders. Volume rose 62.73% to $298.27 million, indicating increased trading activity. However, Open Interest fell 5.20% to $248.31 million – a sign of decreased confidence among traders as many appeared to close their positions.

Interestingly, the long/short ratio on the major exchanges was 0.941, which slightly favored sellers. However, on Binance, the long/short ratio for AVAX/USDT was 2.3367, showing that many traders there are still optimistic about the coin’s potential gains.

Traders should remain cautious and pay attention to overall market sentiment and the movement of top cryptos like Bitcoin. These factors could significantly impact AVAX’s near-term trajectory. Traders should keep an eye on the 20-day and 50-day EMAs. Any bearish crossover could mean a return to the $20 zone.