This article is available in Spanish.

Bitcoins consolidation under $68,000 extended this week, with bulls holding steady above the $66,000 support level. While the cryptocurrency hasn’t seen significant upside, its ability to avoid a deeper correction means it has Bitcoin remains on course to end October on a bullish note.

Related reading

In support of this outlook, a crypto analyst has highlighted an emerging trend in Bitcoin’s UTXO metric indicates an impending outbreak in the price of the crypto.

UTXO in losses reaches all-time high

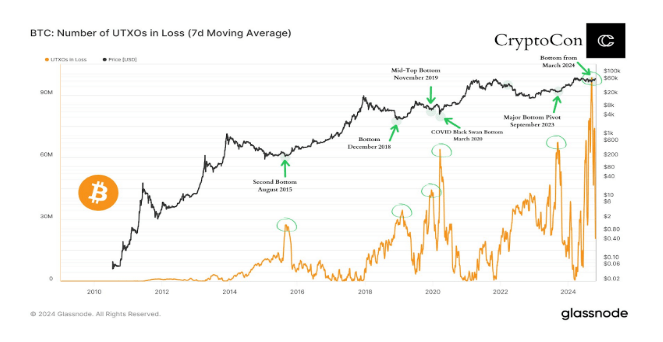

The number of Bitcoin UTXO that have suffered losses recently reached a new peak on September 11, 2024, surpassing levels last seen during the 2020 COVID-19 crash and the September 2023 market bottom.

This metric, known as Unspent Transaction Output (UTXO), refers to the amount of Bitcoin that remains unused in a Bitcoin wallet after a transaction. When UTXO is measured at a loss, it reflects the number of Bitcoin holdings that would currently be sold at a loss compared to the Bitcoin wallet’s last transaction price.

According to data from Glassnode, the number of UTXO losses soared in September, surpassing previous figures, indicating that a significant portion of active Bitcoin addresses are underwater. While this may seem like a bearish sentiment at first glance, historically it has been shown that this is not the case.

As indicated According to crypto analyst CryptoCon, big spikes in UTXO loss don’t come right before terrible price action, but usually come at the end of it. With this trend in mind, the new peak will probably be in September was a turning point for Bitcoin’s price action for the rest of the year.

What does this mean for the Bitcoin price?

Past data shows a consistent pattern: when UTXO reaches extreme highs in losses, Bitcoin’s price is often near a reversal. For example, during the COVID-19 crash in March 2020, UTXO’s losses rose significantly, followed by a strong rally that led Bitcoin to new all-time highs in the following months.

The last time UTXO spiked in losses was in September 2023, serving as a precursor to the last bull market cycle that kicked off in October 2023. This run culminated in a new all-time high for Bitcoin in March 2024, which actually saw spikes. in the UTXO with a loss as a signal of positive market momentum.

If history were to repeat itself, the spike in UTXO losses in September could also signal a market bottom, which in turn sets the stage for a rally in the remainder of the year.

Related reading

Interestingly, Bitcoin’s price action has been remarkably positive since this new UTXO spike in losses. At the time, Bitcoin was trading around $57,000. Since then, the country has seen a significant rally, getting closer to the Price point of $70,000.

At the time of writing, Bitcoin is trading at $66,720.

Featured image from Pexels, chart from TradingView