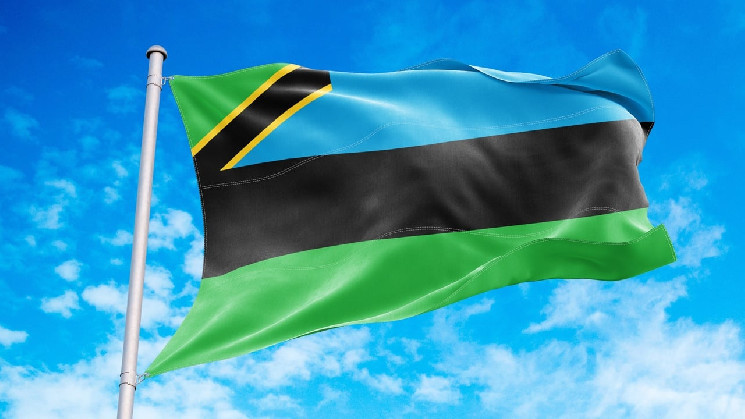

The Zanzibar government has introduced a blockchain sandbox program to encourage entrepreneurship and technological advancement. The program, powered by the Xinfin XDC Network and designed by Ledgerfi IT Solutions, allows startups to securely test their blockchain-based solutions within the National Blockchain Network. Zanzibar’s sandbox follows a similar initiative in Tanzania, which aims to streamline regulations for fintech startups. Both programs are expected to reduce risks for startups and attract investors.

Priority given to startups that promote financial inclusion

Zanzibar’s government has launched a blockchain sandbox program to encourage entrepreneurs to test their technology products and position the Tanzanian archipelago as a hub for innovation. The sandbox is powered by the Xinfin XDC Network and was designed by Ledgerfi IT Solutions to enable entrepreneurs to securely test their solutions within the National Blockchain Network.

“Our primary goal is to create a supportive environment for the development of cutting-edge technologies, including blockchain, AI and other emerging areas,” said Seif Said, Director General of Zanzibar e-Government Authority.

According to a report, the archipelago’s government is now inviting interested startups to join the sandbox. However, priority will be given to startups offering digital solutions for financial inclusion, identity verification and certification issuance. Successful innovators will have the opportunity to collaborate with experts and receive mentorship from industry leaders.

Additionally, sandbox participants with impactful solutions will receive training and participate in incubator programs to enhance their technical capabilities.

Sandbox provides a relaxed regulatory environment

Zanzibar has unveiled its fintech sandbox, which mirrors Tanzania’s framework introduced in August. The Tanzanian framework outlines the eligibility criteria, application procedures and testing guidelines for pilot innovators. The framework, which has been approved by the government, aims to boost the country’s fintech sector. It was developed in collaboration with the Tanzania Startup Association, highlighting the regulatory challenges faced by startups.

The association advocated sector-specific sandboxes to streamline regulations and promote innovation.

Similarly, Zanzibar’s National Blockchain Network will provide a soft regulatory environment, allowing startups to test ideas before entering the market. The sandbox is expected to reduce startup risks, making them more attractive to investors.